Resources Top 5: Who just acquired a project next to one of the biggest lithium mine developments in the world?

Pic: iStock / Getty Images Plus

- Chase Mining is granted part of Barkly North project in the NT, prospective for clay rare earths and uranium

- Riversgold acquires porject neighbouring Covalent Lithium’s Mt Holland lithium mine

- White Cliff (rare earths, lithium), Barton (gold) and Athena (iron ore) up on no news

Here are the biggest small cap resources winners in early trade, Friday August 26.

CHASE MINING (ASX:CML)

The former shell company is now ‘chasing’ some of 2022’s hottest future facing commodities: graphite, rare earths, and uranium.

Following the recent “transformational acquisition” (one of the most overused phases in the explorer’s lexicon) of its advanced McIntosh graphite project, CML has today been granted part of its Barkly North project in the NT.

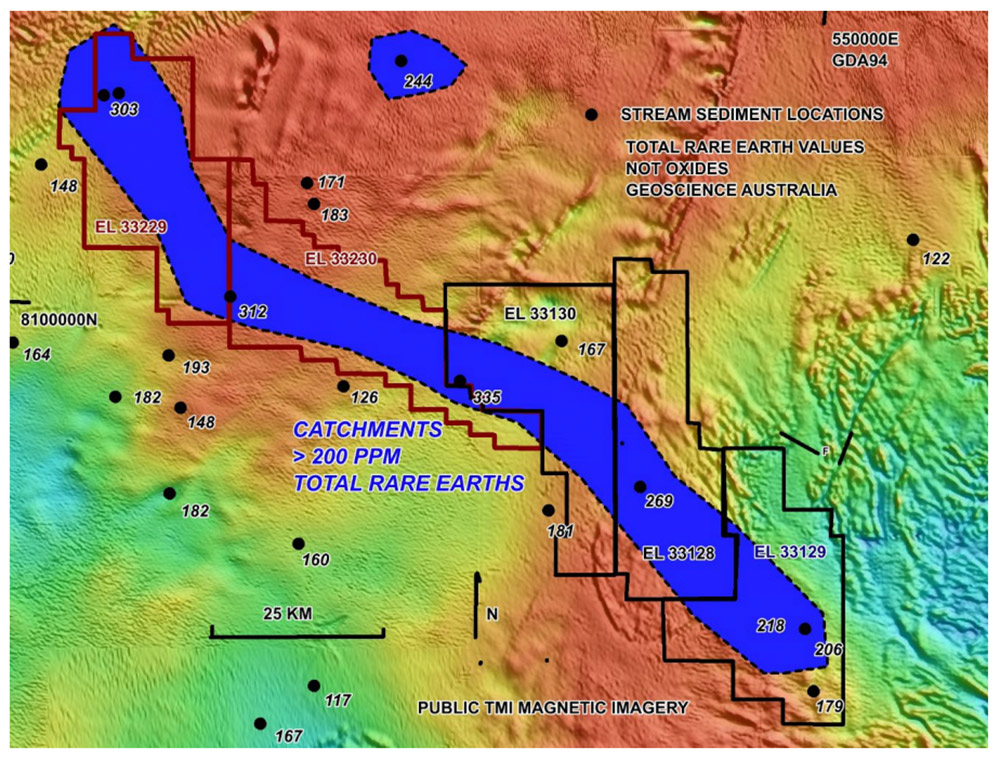

These licences cover the eastern half of a 160km long rare earths trend with accompanying high values of niobium, chrome and uranium:

CML believes that this “extraordinary” trend in stream sediment anomalism is caused by a previously unrecognised ionic clay hosted rare earths deposit.

Ionic clay rare earths deposits have advantages over hard rock rare earth deposits, CML says.

“They are cheaper to mine and process, and the waste material does not present problems with toxic elements,” it says.

“Much of the world supply is from clay hosted deposits.”

A surface sampling program is due to kick off in the next three months, prior to a shallow drilling program in the drier months of 2023.

The $12m market cap stock is up 80% year-to-date. It had $2.4m in the bank at the end of June.

RIVERSGOLD (ASX:RGL)

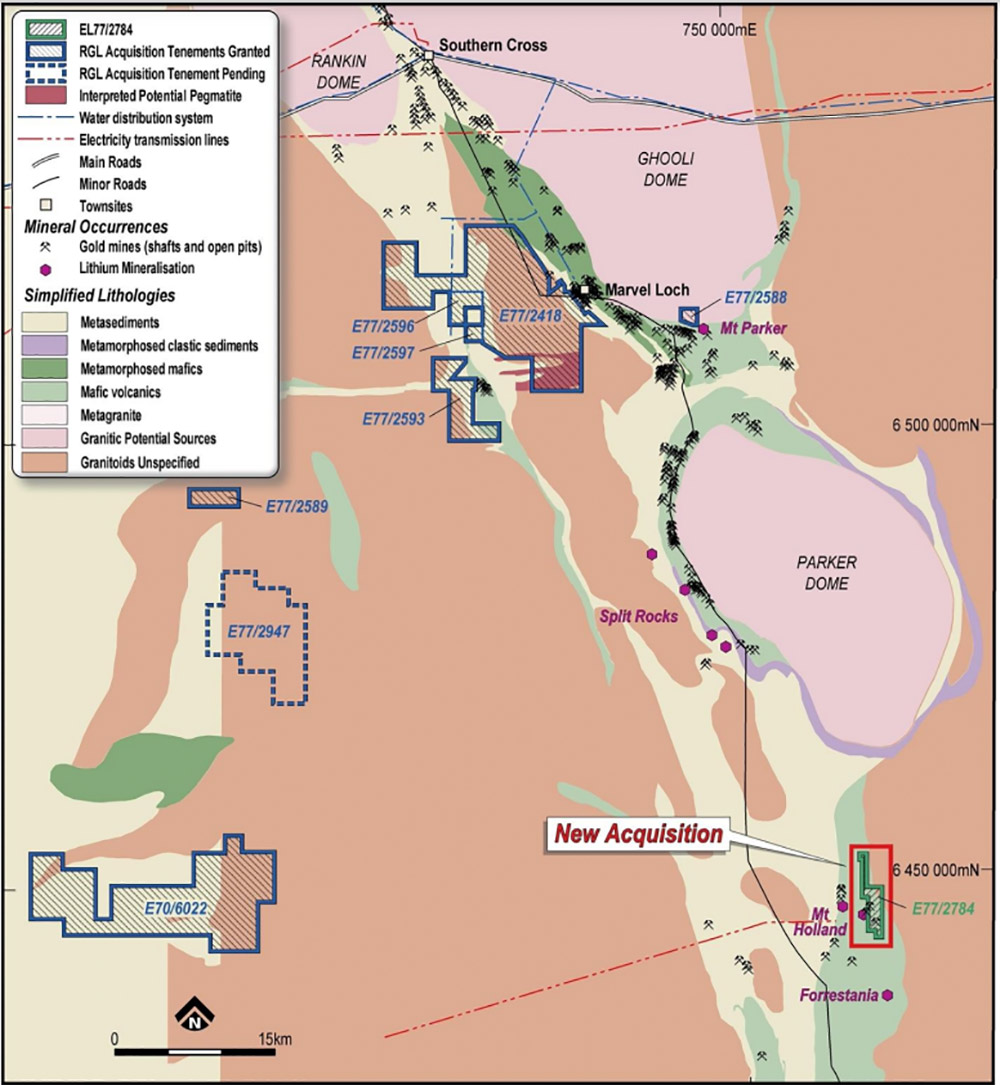

RGL has acquired a modestly sized 9.2sqkm of ground immediately to the east of Covalent Lithium’s globally significant Mt Holland lithium mine in WA.

Covalent is a joint venture between $55bn market cap Wesfarmers (ASX:WES) and major global lithium producer SQM.

Being right next door to one of the biggest lithium deposits in the world is exciting stuff, RGL CEO Julian Ford says.

“The new ground directly abuts Covalent Lithium’s Mt Holland Project, where they are actively developing their Earl Grey deposit which contains a resource of 189Mt at 1.5% lithium oxide (Li2O),” he says.

“We believe there is great potential for the Earl Grey and Bounty systems to continue into the E77/2784 tenement.”

RGL will pay private co Cacique Resources $850,000 cash and ~4m shares for 80% of the project.

The former goldie has pivoted to lithium exploration in a big way this year.

This latest acquisition adds to RGL’s 292sqkm of lithium ground in the surrounding Southern Cross-Marvel Loch district announced in early August, and lithium tenements in the Pilbara announced early May.

The $33m market cap stock is up 400% year-to-date. It had $2.8m in the bank at the end of June.

WHITE CLIFF MINERALS (ASX:WCN)

(Up on no news)

The minnow — which has spiked +100% this week — is now on the ground at the early stage Yinnetharra rare earths and lithium project in WA.

Here, a new batch of “expedited” rock chip samples returned results up to 780ppm rare earths, it said yesterday.

That’s positive, the company says, as it works to dial in on the primary source of mineralisation.

More sample results are on their way.

“Our knowledge of Yinnetharra is growing at an exponential rate, with a small batch of positive rock chip results returned for REEs, and with regional success from pairs for Thorium anomalies adding to our exploration model, we are starting to grasp the exploration potential from a project area that has had in essence, no exploration,” technical director Ed Mead says.

“With positive REEs responses in assays from strongly altered rocks, on the periphery of thorium responses from recently reprocessed coarse data, our understanding and targeting is improving.”

WCN also has an NT uranium project in the portfolio called Garder Range.

The $19m market cap stock is up 25% year to date. It had ~$1m in the bank at the end of June.

BARTON GOLD (ASX:BGD)

(Up on no news)

The hard-drilling South Australian explorer listed in June 2021 following a $15m IPO.

In June, it completed drilling at its Tunkillia (965,000oz) and Tarcoola (no resource, yet) targets. Significant assays from Tarcoola include 2m @ 7.07g/t Au from 52m, including 1m @ 11.8g/t Au from 52m.

Assay results from Area 51 discovery target (Tunkillia Project) are expected shortly.

Tarcoola is a brownfields site within trucking distance of BDG’s processing plant, while Tunkillia sits on a host structure extending 7km north and 7km south of the existing resource.

Over 15,000m of drilling is expected over the second half of the year to grow BDG’s Tarcoola and Tunkillia project footprints, making new regional discoveries, and building on the current ~1.1Moz resource.

The $16m market cap stock is down 12% year to date. It had a hefty $11.2m in the bank at the end of June.

ATHENA RESOURCES (ASX:AHN)

(Up on no news)

Another morning of gains on no news for this quiet explorer.

AHN is focused on the ‘Byro’ project in WA, which includes iron ore, copper, PGE, and graphite targets.

In late May, resource drilling kicked off to upgrade the old ‘FE1’ magnetite iron ore resource to JORC 2012 standards – a must-have for ASX listed explorers.

Assays are pending.

The $15m market cap stock – which relisted on the ASX November last year following a period in bourse purgatory — is up 40% in 2022.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.