Resources Top 5: Westar laps up ‘outstanding’ silver and gold results

Pic via Getty Images

- ‘If you want a way out, silver and gold’ sang Bono. What’s that got to do with anything?

- Westar, that’s what. It’s well up today on its latest silver and gold-related assay results

- Also shining on the bourse, earlier: G50, AAU, M4M, WCN

Here are some of the biggest resources winners in early trade, Tuesday May 7.

Westar Resources (ASX:WSR)

Perth-based junior (tiny-tot, really) explorer Westar is on the hunt for gold, silver and other future-facing metals in WA, focused on its projects in the Pilbara, Yilgarn Murchison regions.

It’s the latter that comes into sharp focus today, as the company has just announced “outstanding” gold and silver assays at its Mindoolah Mining Centre – part of the Mindoolah project in the Murchison minerals field.

How outstanding? It’s talking up to 40.7g/t gold and 214g/t silver from stockpile grab samples, with other samples testing at 13.6, 12.3, 9.4, 6.9, 5.8g/t gold.

The company is also reporting a 1.7g/t gold and 16.1g/t silver rock chip sample from a quartz vein in the Mindoolah Main Reef open pit, and notes that a systematic stockpile and open pit sampling program is planned for the site.

The project and its mining centre is located within 100km of a processing plant operated by major gold producer Ramelius Resources (ASX:RMS), which is also Westar’s current JV partner in the Mt Finnerty gold project.

Gold-rich quartz veins are reported to have been mined from numerous old workings at the Mindoolah site, dating back to the early 1900s and 1940s.

We've received outstanding #gold and #silver results of up to 40.7g/t Au (over an oz/t Au) and 214g/t Ag (nearly 7oz/t Au) from recently returned 14 grab samples of mined stockpiles located at the historic Mindoolah Mining Centre. In addition, up to 1.7g/t Au and 16.1g/t Ag rock… pic.twitter.com/jGLuthzs45

— Westar Resources (@Westar_Res) May 6, 2024

Westar’s executive director Lindsay Franker said:

“We are very encouraged by these excellent initial results and, coupled with numerous yet to be tested historic workings and open pits, highlight the potential at the Mindoolah Mining Centre.”

Next up, the company plans to evaluate the stockpiles and open pits, focusing on the potential for an open pit cutback and possibly toll treating ore at nearby processing plants.

WSR share price

Gold 50 (ASX:G50)

Emerging precious metals exploration company Gold 50 is progressing its high-potential projects in America’s southwest, particularly in Arizona at its Golconda Project and in Nevada at its White Caps project.

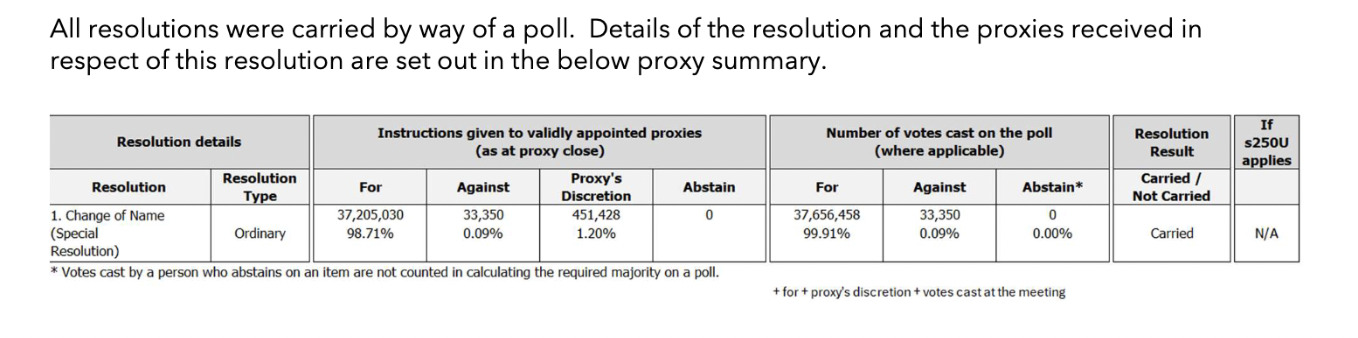

It was well up earlier today after announcing an extraordinary general meeting. We’ll let you be the judge of that, by way of examining the following summary of the meeting’s results:

There appears to be a company change of name underway. Erm… extraordinary stuff. Guess you’d best stay tuned for that one.

G50 share price

Antilles Gold (ASX:AAU)

Copper-gold explorer Antilles Gold moved up solidly this morning on news that results of the Scoping Study for the first stage of the proposed Nueva Sabana gold-copper mine in Cuba are now in.

Details from that reveal that the deposit has a small 3g/t gold cap, an underlying copper-gold zone, and a deeper sulphide copper zone open at depth at 150m, and could potentially transition into the El Pilar porphyry copper deposit which is offset to the south.

The study was prepared by the 50:50 Cuban joint venture company, Minera La Victoria, which is undertaking the project.

Antilles says it intends to subscribe the final US$2m of its US$15m earn-in for a 50% shareholding in Minera La Victoria within the next few months. The company’s cash burn will then be substantially reduced going forward, it notes.

Chairman of Antilles Gold, Brian Johnson, noted that “even though the first stage of the Nueva Sabana project is quite small, it is fortunate that it will be development-ready within a short period of time”.

This, he says, is “economically advantageous considering the joint venture’s flagship development, the La Demajagua gold-silver-antimony mine, had to be delayed after being expanded to allow the production of a gold doré when the market for its gold-arsenopyrite concentrate became an issue in August 2023.”

AAU share price

Macro Metals (ASX:M4M)

(Up no no news)

Macro Metals continues its stupendous rise, up about 30% intraday, 58% this week and remaining in the YTD stratosphere with a +800% gain at time of writing.

Aside from a positive quarterly activities and cashflow report from about a week ago, we’re not seeing anything as yet that substantiates today’s fresh burst from M4M.

We're pleased to release our March 2024 Quarterly Activities Report – read it here 👉https://t.co/DOSGbCF5oz pic.twitter.com/1D1MAGgK5D

— MacroMetals (@MacroMetals) April 30, 2024

In March, as you might recall, this iron ore junior made some high-profile boardroom appointments.

Namely, two highly successful small caps mining investors – Tolga Kumova and Evan Cranston, bringing big bucks (subscribing for $1.22m out of a total placement of $1.35m) and big experience and an agenda to help develop Macro’s Pilbara iron ore portfolio.

Macro, formerly known as Kogi Iron, is hoping to “become a multi mine producer” and its assets now include W5, 5km along strike from Fenix Resources’ (ASX:FEX) Iron Ridge mine in the Mid West, and Deepdale, next door to Rio Tinto’s Robe Valley operations and CZR Resources’ (ASX:CZR) Robe Mesa project in the Pilbara.

M4M share price

White Cliff Minerals (ASX:WCN)

White Cliff was busting up the bourse earlier this morning (since pulled back a fair bit), after being granted all federal licences for its Radium Point uranium-copper-gold-silver project.

The project is situated on Great Bear Lake in the Canada’s Northwest Territories.

WCN also said that exploratory drilling has been wrapped up at White Cliff’s 100%-owned Reedy South gold project in the Cue Goldfields region of Western Australia.

White Cliff MD Troy Whittaker said:

“Having these final federal licences granted at Radium Point is the last phase of our application process and the milestone where we now fully transform from applications under assessment to exploration-ready at our multi-metal project in Canada.

“Our initial focus at Radium Point and Nunavut projects in Canada will be infield rock chip sampling, reconnaissance, and the airborne MobileMT geophysical survey which will then be followed up by our maiden drilling campaign.”

WCN share price

At Stockhead we tell it like it is. While Antilles Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.