Resources Top 5: West Africa ASX goldies go galactic

Pic via Getty Images

- African Gold shares go galactic on massive 65m thick high-grade gold intercept

- West African neighbour Many Peaks Minerals a passenger on the rocket

- Eclipse reads REE mineralisation in Greenland

Here are the biggest small cap resources winners in morning trade, Tuesday, October 15. Prices accurate at time of writing.

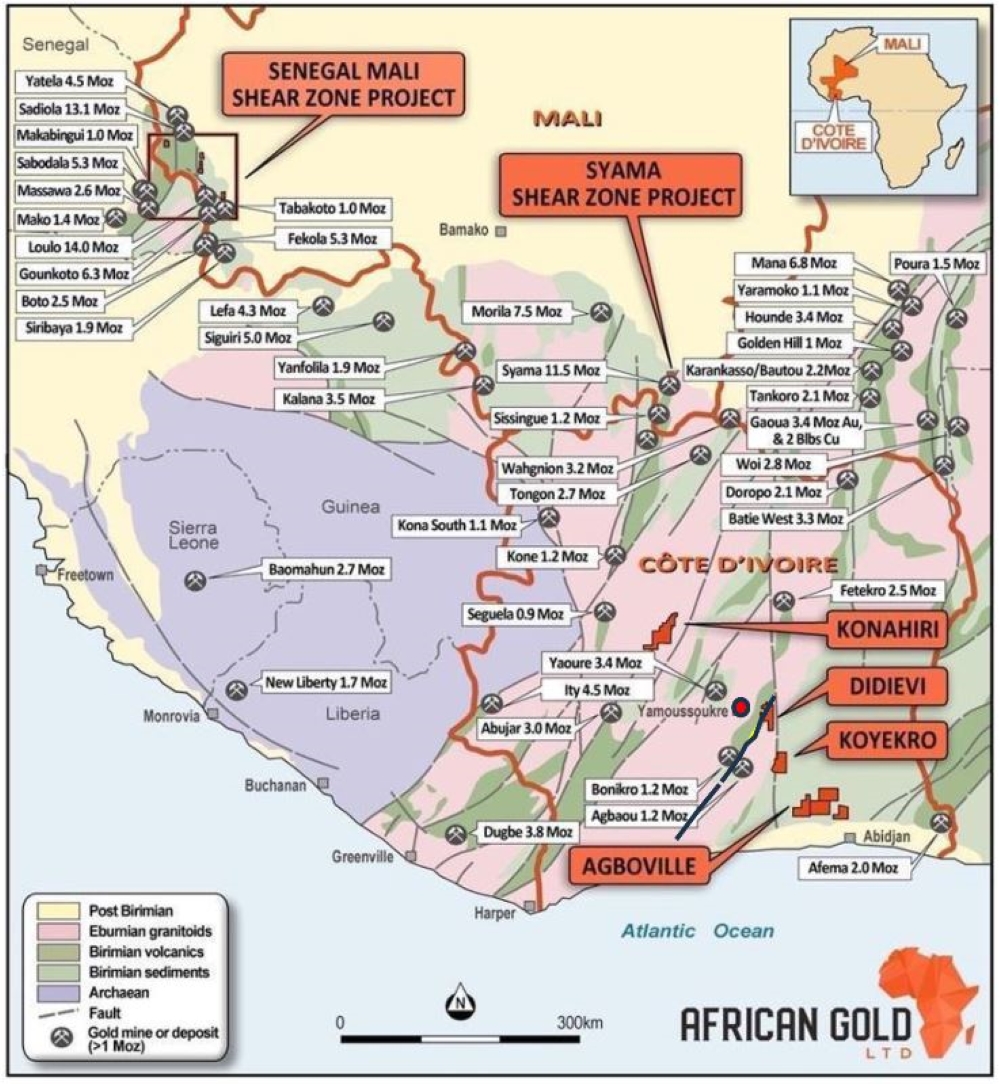

African Gold (ASX:A1G) and Many Peaks Minerals (ASX:MPK)

A spectacular, wide, high-grade gold vein of an eye-whopping 65m at 5.6g/t has been intercepted at A1G’s Blaffo Guetto prospect at the Didievi project in Cote d’Ivoire, along with shallow intercepts of 9m at 1.7g/t of gold from 23m and 28m at 1.1g/t from 77m.

Not one for grandiosity, A1G said the results will go towards a ‘positive’ update to Didievi’s existing 4.93Mt for 452,000oz gold at 2.9g/t resource (with a 1g/t cut-off grade).

There have also been changes to the company’s board announced this morning, with Adam Oehlman stepping in as CEO and Phillip Gallagher set to step down as managing director.

“65.m at 5.6g/t gold from 177m is a spectacular result from the recent diamond drilling program on the Blaffo Guetto prospect,” A1G MD Phillip Gallagher said.

“Excitingly, it is an extension of previous mineralisation and remains open at depth, plus it has extended our target area which this diamond drilling was designed to test.

“This is a fantastic result that has shown that the resource modelling that the design of this diamond drilling program was based on is proving to be accurate.”

Didievi has other exciting prospects that remain substantially untested, says the explorer, including the Kouassi and Akissi prospects to the north of Blaffo Guetto and the 11km-long Poku gold trend located to the south-west.

“These fantastic drilling results today strengthen our belief that the Didievi Project has the potential to be a multi-million-ounce deposit,” Gallagher said.

Shares have gone up a whopping 110% at time of writing.

West Africa is heating up for bullion

M&A activity is accelerating around bullion hunters in the West African nation, where production has grown more than five-fold since 2010.

Canada’s Thor Exploration snapped up Endeavour Mining’s Guitry project last month for US$100,000 and a 2% net smelter royalty, targeting a 500,000-1Moz gold resource.

That’s on top of an earn in agreement to grab an 80% interest in Goldridge Resources’ early-stage Boundiali project in the country’s northwest.

“Côte d’Ivoire hosts over 30% of West Africa’s greenstone belts and is proving to be an emerging region for world-class gold discoveries,” Thor Exploration CEO Segun Lawson said.

And while there’s no news from Many Peaks Minerals (ASX:MPK), its stock is perhaps riding up on the news of today’s heavily traded neighbour A1G.

MPK has projects in the same region, near Didievi, and recently increased its footprint in the country by 50% with the acquisition of the Baga gold project.

It’s currently planning to drill high-priority targets at its Odienne project this quarter, which is on the same shear corridor as Predictive Discovery’s (ASX:PDI) Bankan discovery along with several other gold occurrences that straddle over the border into neighbouring Guinea.

Bankan recently drew in West African ASX gold beast Perseus Mining (ASX:PRU) as a major shareholder in PDI.

MPK shares are up 12.5%, adding to a 73% YTD rise in stock price and currently trading at 22c.

Eclipse Metals (ASX:EPM)

Historical drill core assessments from HyperXRF handheld readers have shown early signs of REE potential at the Grønnedal prospect within the Ivigtût project in southwest Greenland.

While still early doors with exploration, the explorer says there’s high magnetic REE ratios of neodymium that warrant further investigation over the Grønnedal carbonatite.

The project already has a resource estimate of 1.18Mt at an impressive 6859ppm total rare earth oxide (TREO) for >8000t of TREO.

Further analysis of historical diamond drill cores suggests that REE concentrations are much deeper than previously mapped 500m deep mineralisation.

Shares in the penny stock rose 16.6% today to trade at 0.7c.

Adelong Gold (ASX:ADG)

Second-stage soil sampling at ADG’s namesake gold project in NSW has identified further drill targets in the area northwest of the Adelong Mill and along strike from the Currajong deposit.

The company says 30% of the samples contained over 0.1g/t gold, which indicates proximity to the gold sources while peak results of 3.03g/t and 1.39g/t were also received.

Some elevated gold in soil samples are at the end of traverses, which requires follow-up sampling.

It added that this appeared to delineate target zones and a drilling program is being planned to upgrade and extend resources within the scoping study area (Challenger, Currajong and Caledonian) to support an upgraded study.

Shares in the minnow have made a 25% gain on the bourse today to trade at half a penny (0.5c).

Volt Resources (ASX:VRC)

VRC successfully rebooted the Zavalievsky graphite project in Tanzania yesterday and has plans to produce various graphite grades starting with high quality graphite ore via multi shift operation.

The junior acquired a 70% stake in the project in 2021 which has a processing plant, mining equipment and power substation and a revised feasibility study for a Stage 1 development will see an annual run rate of 400,000tpa to produce 24,7800tpa of graphite.

Interestingly, Volt has a subsidiary materials company with a warehouse type deal that provides lab storage for wet chemistry, chemical hoods, a clean room and refrigeration within a 1200sqft two story facility for pilot-scale clean tech in New Jersey. Go figure.

At Stockhead we tell it like it is. While Many Peaks Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.