Resources Top 5: We have a new contender for copper-gold hit of the year

(Photo by Roy Rochlin/Getty Images for MTV)

- Emmerson pulls up “stunning” 117m at 3.38% copper from 75m at the ‘Hermitage Project’

- KGL announces record assay of 61.4% copper at the ‘Rockface’ target

- Krakatoa unearths ionic type rare earths at the ‘Rand’ gold project in NSW

Here are the biggest small cap resources winners in early trade, Wednesday December 8.

EMMERSON RESOURCES (ASX:ERM)

Is this one of the best drill hits of the year?

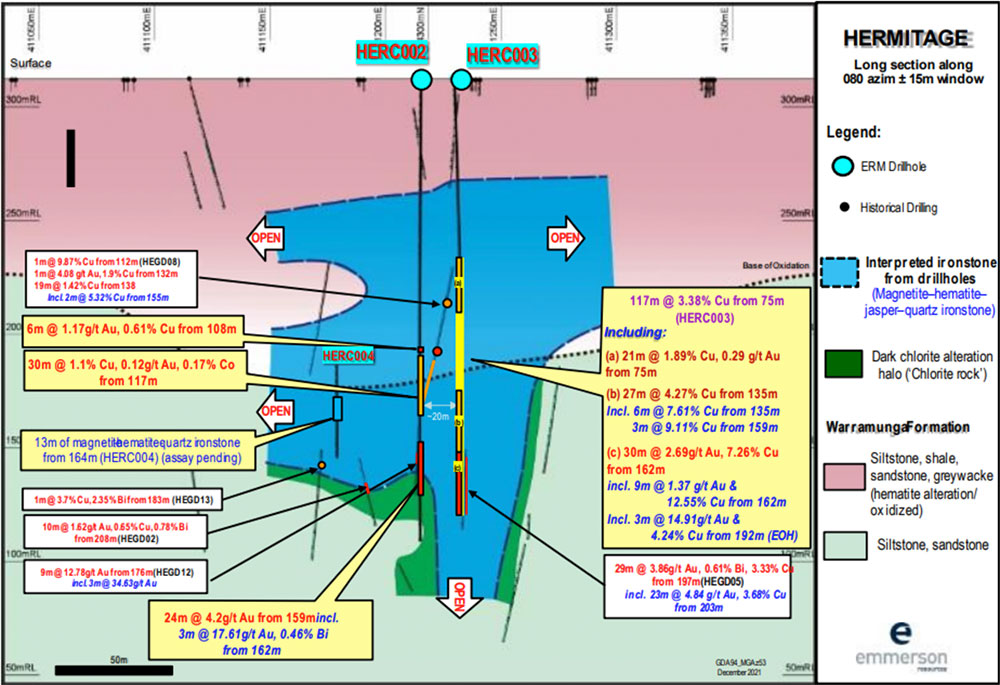

ERM has pulled up a “stunning” 117m at 3.38% copper from 75m in drilling at the ‘Hermitage Project’ in the NT.

Due to drilling difficulties the vertical hole (HERC003) was abandoned in high grade mineralisation –3m at 14.91g/t gold and 4.24% copper, to be exact. Amazing stuff.

This drill hole will be continued with a diamond ‘tail’ in 2022, ERM says.

Four RC holes were drilled by ERM in this program, testing an area ~200m east-west but focussed on the theory of high-grade mineralisation hosted in almost vertical ‘pipes’:

An adjacent vertical hole (HERC002) also returned impressive numbers, including:

- 18m at 1.40% copper and 0.23% cobalt from 117m, and

- 24m at 4.2g/t gold from 159m (including 3m at 17.61g/t).

Hole HERC001 encountered no significant mineralisation, while results from HERC004 are pending.

“Whilst it is still early days, the metal zonation and mineralisation in drill hole HERC003 displays increasing gold and copper grades with depth – the subject of future diamond drilling,” ERM managing director Rob Bills says.

“Although based on limited data (i.e. rock chips), it appears that HERC003 intersected a subvertical, brecciated, high grade metal rich feeder zone which has channelled and concentrated the copper and gold and remains open at depth.”

This was a re-rating event for $84m market cap ERM, which is up 125% over the past month. The explorer had $4.5m in the bank at the end of September.

KGL RESOURCES (ASX:KGL)

Another standout drilling intercept.

KGL’s main game is the 426,200 tonne (and growing) Jervois copper project in NT, where the plan is to produce 30,000 tonnes of copper per year, plus silver and gold.

A final feasibility study is now underway, as well as drilling to extend mine life to a minimum 10 years.

KGL has just announced a new record assay of 61.4% copper at the ‘Rockface’ target, part of a total intercept of 20.5% copper and 302g/t silver over 4.21m from 698.80m downhole:

This is extraordinary, KGL managing director Simon Finnis says.

“Mineralogically, it represents 97% pure bornite [high grade copper mineralisation] and confirms the previous visual estimate,” he says.

“More importantly, together with previous results and the new visual mineral intersections announced here, they demonstrate that the high-grade shoot of massive sulphides has significant dimensions and grades that bode well for the future.

“Equally exciting are the indications from the DHEM geophysics that the Rockface deposit remain open for significant extensions at depth.”

Drilling continues with two drill rigs on site, and this will continue into calendar 2022, “focusing on a strong portfolio of exploration targets and brownfield potential to extend existing deposits”.

The feasibility study is targeted for completion in early 2022.

The $233m market cap stock is flat over the past month, and up 120% year-to-date. It had $18.1m in the bank at the end of September.

EMPIRE RESOURCES (ASX:ERL)

(Up on no news)

$14.5m market cap ERL has been bouncing around like a yoyo over the past few trading days on no news.

The busy polymetallic explorer has already drilled 13,000m so far in 2021 at the ‘Penny’s and Yuinmery’ projects in WA, with diamond drilling of some juicy gold, copper, and nickel-copper-PGE targets at Yuinmery due to kick off sometime this month.

ERL would’ve drilled even more if not for issues getting hold of a rig, something the company intends to fix in 2022.

“Our exploration plans for 2022 include the lock-in of a core drilling rig and driller for exclusive use by Empire,” chairman Michael Ruane says.

“This should assist in accelerating at least the drilling component of our exploration programs for the forthcoming period. The rig will be particularly useful for the deep drilling required for the promising Yuinmery targets (eg Smiths Well/YT01).”

The rig should be ready for commissioning this month, he says. ERL had ~$3.5m in the bank at the end of November.

KRAKATOA RESOURCES (ASX:KTA)

KTA has unearthed ionic type rare earth (IAC) elements at the ‘Rand’ project in NSW, which the company is mainly exploring for gold.

IAC projects are in demand right now. Typically found in southern China, they are commonly considered to be some of the cheapest and most accessible sources of heavy rare earths.

In June, KTA reported “encouraging” gold assay results from the maiden aircore (AC) drilling program at the Rand ‘Bullseye’ magnetic target.

This drilling was re-assayed for REEs, which returned a highlight 11m @ 1,223ppm TREO from 43m.

“We are still very early in this investigation and can only speculate on the origins of the rare earths, but it is clear they have concentrated in the clay rich saprolite zones above the intrusives as well as within the metasediments surrounding these,” KTA CEO Mark Major says.

“This is the first discovery of clay hosted REE within this area of NSW.

“The company has significantly expanded its land holding over the already large area via applications of additional tenure with similar geophysical signatures and underlying geology.”

KTA also says the Rand area is considered prospective for tin–tungsten deposits and copper–gold porphyries.

The $17m market cap stock is down 3% over the past month. It had $2.5m in the bank at the end of September.

FORRESTANIA RESOURCES (ASX:FRS)

(Up on no news)

The freshly listed stock has uncovered new lithium targets at its namesake project in WA, including one neighbouring the world class Wesfarmers/SQM ‘Mt Holland’ lithium mine called ‘Cohn’.

Cohn, ~6km southeast of Mt Holland, covers a previously defined lithium and caesium soil anomaly that is ~14km long. It is one of many walk-up lithium and gold drill targets emerging, FRS says.

“Given the Forrestania Project’s proximity to a world-class lithium mine, a plus one-million-ounce gold camp and several outstanding nickel mines, the exciting challenge for the company’s exploration team was always going to be ‘where to start?’” FRS chief executive officer Melanie Sutterby says.

Gold and lithium drilling is due to kick off before the end of the year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.