Resources Top 5: Trek hits visible gold and picks up the pace at Christmas Creek

Trek Metals believes the Christmas Creek project has major discovery potential. Pic: Getty Images

- Visible gold has spiked interest in Trek Metals’ Christmas Creek project as it seeks a large orogenic gold system

- Waratah Minerals is on the march as it enhances copper-gold prospects in the prolific Lachlan Fold Belt of NSW

- EcoGraf applauded for implementing environmental and social programs at Epanko Graphite Project in Tanzania

Your standout small cap resources stocks for Tuesday, March 18, 2025.

Trek Metals (ASX:TKM)

Trek Metals is on the hunt for a deposit of major scale at Christmas Creek in the Kimberley, not far south of Halls Creek.

The northern WA town counts as the birthplace of the famously rich state’s gold rush in 1885, but its remote location and the success of miners further south in WA’s Goldfields region has seen it go underexplored in the more than century since.

Host rocks are also obscured by cover, but the latest news out of the Trek camp suggests previous explorers would have done well to be more vigilant.

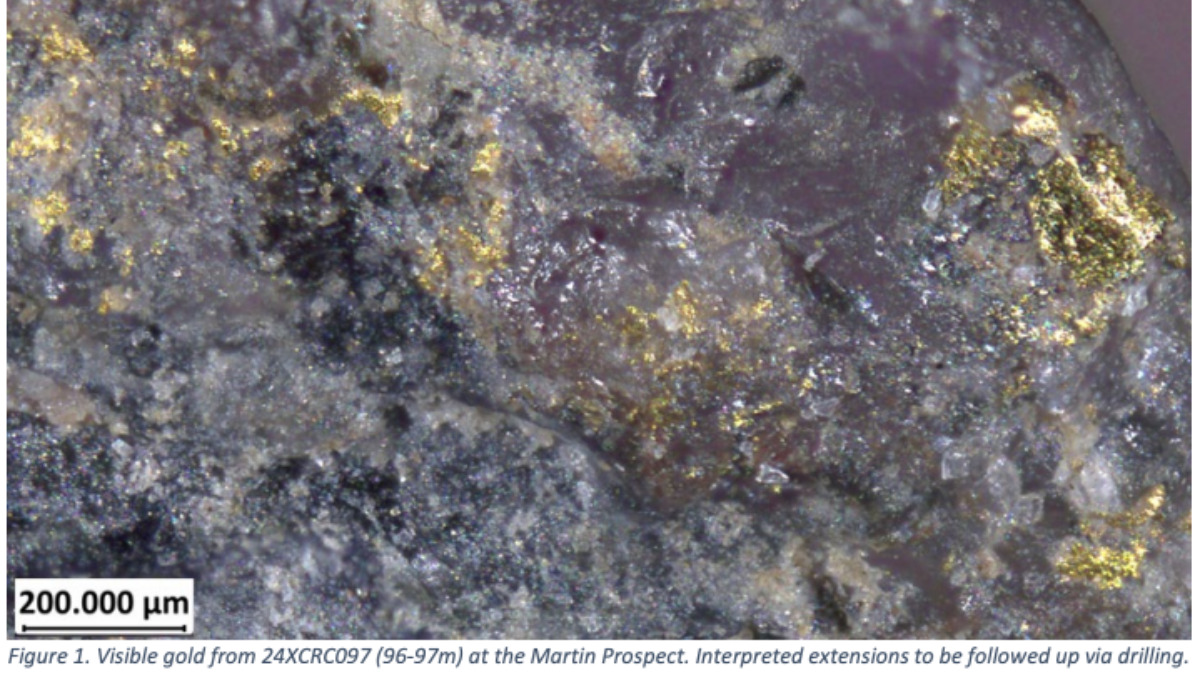

The newest find is a small cap punter’s favourite type – visible gold, the sort of drill intercept which often evades a geologist across their entire career.

Importantly the holes from which the VG comes have already been assayed. It was identified in drill chips from reverse circulation hole 24XCRC097, which delivered standout high-grade strikes of 10m at 12.66g/t from 59m and 10m at 7.34g/t from 94m.

Trek says the occurrence is a positive indication in terms of its geological and processing potential – high-grade gold accumulations tend to be liberated easily in gravity circuits – BUT of course proper met testwork will be required to make any real assumptions.

Drilling will be fast tracked at the Martin prospect, with a field crew to be mobilised in the coming weeks to establish a camp and commence site prep for upcoming drilling.

“In our view, the Christmas Creek Project represents a major discovery opportunity as part of the upcoming drill season, with the potential for a large-scale orogenic gold find of considerable scale that we believe could quickly re-rate Trek,” TKM managing director Derek Marshall said.

“Thanks to the initial drilling completed last year and the work we have completed over the past few months, this opportunity has now been significantly de-risked as we move towards the next phase of drilling.”

Christmas Creek was previously held by another company in a JV with Newmont, the world’s largest gold producer, which spent $6m on the ground searching for an analogue of its Tanami project and 20Moz Callie mine across the NT border.

“The next round of major gold discoveries in Australia are likely to come from areas such as this, where the gold-bearing host rocks are obscured by recent sand cover – meaning this is a completely new search space,” Marshall said.

“We see strong geological analogies in this district to the Tanami region of the NT, which is what attracted the world’s largest gold company, Newmont, to enter into a joint venture and spend $6 million working up early-stage targets.

“We have been the beneficiaries of this work and, with a significant breakthrough already achieved at the Martin prospect, we are looking forward to seeing what our next round of drilling can deliver. Orogenic gold systems offer the potential for large, high-grade and long-life gold deposits. They are the most economically important gold deposit type globally.”

Drilling is expected in May.

Waratah Minerals (ASX:WTM)

(Up on no news)

Joining the growing list of explorers seeking copper-gold in the well-endowed Lachlan Fold Belt of NSW is Waratah Minerals, whose Spur project is just 5km west of Newmont’s massive Cadia Valley project.

As well as Cadia Valley’s 50Moz gold and 9.5Mt tonnes copper, this region near Orange also hosts the Northparkes copper-gold operations and Cowal gold mine of Evolution Mining (ASX:EVN), and the Tomingley operations and Boda exploration play of Alkane Resources (ASX:ALK).

Waratah is undertaking around 1000m of oriented diamond core at the Breccia West prospect to test the nature, downdip continuity and structural controls on epithermal gold mineralisation.

The work program is also investigating a potential link with a gold-copper porphyry system.

Eyes were turned on the Spur project with an intersection last July of 57m at 2.50g/t gold and 0.11% copper from 115 metres.

With both minerals in demand and commanding strong prices, shares in the company increased 31% to 19c.

Ecograf (ASX:EGR)

Getting it right with ESG principles is vital for all mining companies and particularly those operating in Africa, where they can make a significant difference for local communities at and near exploration, development and operational sites.

EcoGraf is kicking goals with its environmental and social programs for the Epanko graphite project in Tanzania.

These programs have been completed in accordance with Equator Principles, Global Industry Standard on Tailings Management and relevant Tanzanian legislation as a key requirement of the financing process for Epanko.

More than $3.5m has been invested by EcoGraf in the last two years on programs undertaken by leading international and in-country environmental and social experts to ensure the project is developed in accordance with the highest sustainability standards.

Key environmental programs include biodiversity surveys and critical habitat assessments; surface and hydrogeological modelling; tailings storage facility evaluation, design and expansion planning; development of a conceptual mine closure plan.

Social and commodity programs include: surveying of households and landholdings to generate updated social data and compensation arrangements; establishment of resettlement working groups; confirmation and valuation of potential resettlement areas proposed by villagers; and community health, human rights, social and labour planning assessments.

A highly experienced manager has been appointed to oversee the Resettlement Action Plan alongside the company’s manager of environment and communities.

The Epanko medical dispensary has been completed and will be handed over to the community as part of EcoGraf’s social development program.

EcoGraf shares hit a new 12-month high intraday at 20.5c, closing at 19c, an increase of 18.8% on Monday’s close.

Renergen (ASX:RLT)

(Up on no news)

Renergen may have no news out today but as of March 14, the company had transformed itself into a commercial producer of liquid helium.

It noted that after facing challenges cooling large iso-containers to the extreme temperatures needed for liquid helium storage, it was successful in implementing an alternative solution.

The company now regularly fills smaller Dewars, which have capacity of 250-500 litres, with liquid helium. These are then collected by the customer.

This approach will continue until its plant reaches closer to nameplate capacity.

RLT adds the quality of its LNG and liquid helium produced from its Virginia gas project in South Africa now exceeds minimum design specifications.

“This achievement represents a concrete step toward rebuilding the trust placed in us — a commitment we take seriously,” chief executive officer Stefano Marani said.

“Successfully managing cryogenic liquid at -269 degrees Celsius is a remarkable accomplishment achieved by very few companies worldwide.”

Helium is a rare gas that typically commands a price of between US$400 and US$500 per thousand cubic feet of gas (Mcf) for longer-term contracts due to its irreplaceable use in semiconductor manufacturing, nuclear energy production, solar panels, optic fibre and the cooling of superconducting magnets in MRI scanning machines.

Shares have jumped almost 37% to 75,5c.

Nimy Resources (ASX:NIM)

Gallium is listed as a critical mineral across Australia, the EU, the UK, the US, India, Japan and South Korea due to its unique properties and essential role in semiconductors, optoelectronics, renewable energy technologies and defence systems.

According to The Business Research Company, the global market for gallium is projected to reach US$22bn by 2034 with a compound annual growth rate (CAGR) of 24.3%.

One company working towards supplying gallium to the rapidly expanding global gallium market is Nimy Resources with its Mons Belt project in Western Australia.

In a key step, Nimy has signed a non-binding memorandum of understanding with Curtin University to collaborate on advancing gallium-related research, development and production.

This establishes a framework for cooperation between Nimy and Curtin to strengthen Australia’s position in the critical minerals sector, specifically focusing on gallium.

The non-binding agreement reflects a shared commitment to leveraging Nimy’s high-grade gallium discovery and Curtin’s world-class research expertise to support secure, allied-controlled supply chains, including for the Australian national security community and US Department of Defense (DoD).

“This MoU with Curtin University marks a significant step forward in our strategy to establish Nimy as a key player in the gallium market,” said Nimy Resources technical director Christian Price.

”By combining our high-grade gallium discoveries with Curtin’s world-leading research capabilities, we are well-positioned to deliver a secure source of this critical mineral for high-tech and defence applications.

“We look forward to collaborating closely with Curtin and our U.S. partners to unlock the full potential of this initiative.”

The MoU has seen NIM shares as much as 30.24% higher to 5.6c.

Recent drilling results from Mons Belt have identified Australia’s highest-grade gallium intervals, including 72m at 117ppm Ga2O3 and a peak value of 1m at 495ppm Ga2O3. A conceptual exploration target has been defined of between 9.6Mt and 14.3Mt at 39ppm to 78ppm gallium.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Trek Metals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.