Resources Top 5: Three ASX copper discoveries in three days? That’s unheard of

Pic: Getty

- Culpeo Resources is third ASX stock to announce a big copper hit this week, surges +200%

- Tesoro Resources drills incredible 63.93m @ 7.61g/t gold

- More high-grade lithium from Brazil for Latin Resources, peaking at 3.22%

Here are the biggest small cap resources winners in early trade, Wednesday March 30.

CULPEO MINERALS (ASX:CPO)

What are the chances of three copper discoveries on the ASX in three days? Slim-to-none, and yet here we are.

On Monday, Tempest Minerals (ASX:TEM) surged 265% after making a big copper discovery in its very first hole at ‘Orion’, part of the flagship ‘Meleya’ project in WA.

On Tuesday, newly listed Recharge Metals (ASX:REC) hit 300m of copper mineralisation in drilling at the flagship ‘Brandy Hill South’ project, also in WA.

It gained 238% for the day.

Today, Culpeo Minerals (ASX:CPO) is making similar gains in early trade after hitting the copper motherlode in its very first drillhole at the historical ‘Lana Corina’ project in Chile.

This explorer listed on the ASX September 10 with a couple of porphyry projects in Chile — ‘Las Petacas’ and ‘Quelon’ — and only entered into an agreement to acquire 80% of Lana Corina earlier this month.

The highlight hit includes 200m of visible sulphide copper from 50m to 250m depth. Just look at this beautiful core:

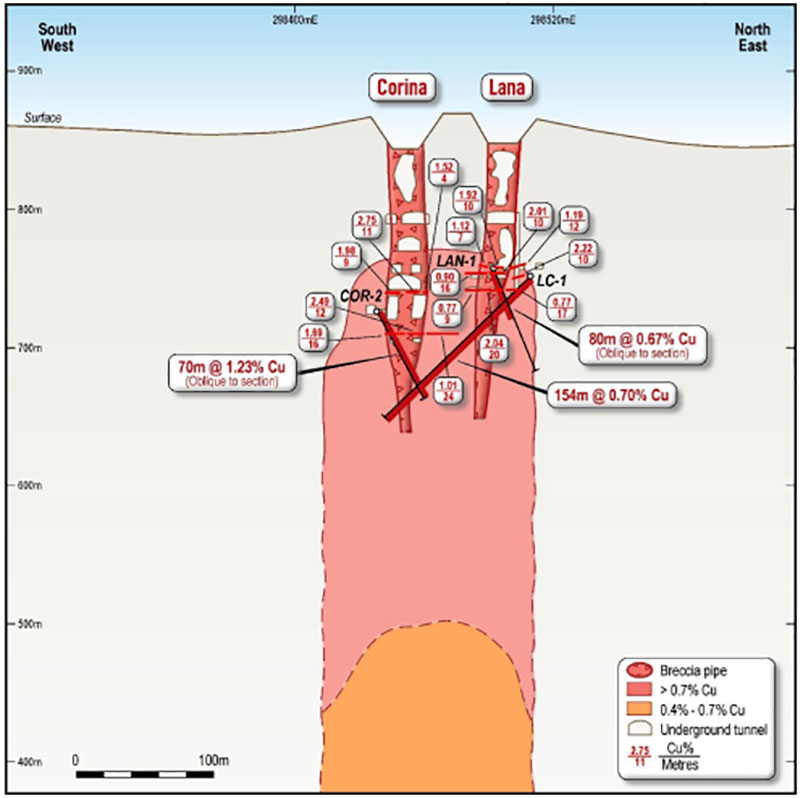

The high-grade copper at Lana Corina is associated with three known ‘breccia pipes’ occurring in the upper levels of a large copper bearing porphyry system.

These breccia pipes, which outcrop at surface and extend to a vertical depth of +200m, have already returned high copper grades from drilling and historic underground sampling.

CPO’s 4,000m drill program is ongoing, with first assays expected in about six weeks.

“We are excited about the intersection of significant amounts of copper sulphides in this first hole,” managing director Max Tuesley says.

“This provides further confidence in the prospectivity of Lana Corina and its potential to host a significant copper deposit.

“We look forward to reporting assay results from the drilling program in due course and view Lana Corina as a key component of our high quality copper portfolio in Chile.”

The junior explorer is up about 180% in early trade.

CPO share price chart

COSMO METALS (ASX:CMO)

A 3,000m drilling program has kicked off at CMO’s neighbouring ‘Mt Venn’ and ‘Eastern Mafic’ copper-nickel projects in WA.

The drilling program is expected to take ~3 weeks to complete.

The main aim is to support resource studies at the more advanced Mt Venn, with mining consultant Entech also engaged to deliver an initial Exploration Target for the project during the June quarter.

A prebious drill program completed in late 2021 returned several wide, higher-grade copper intersections including:

- 46m @ 0.80% Cu from 141m including;

o 12m @ 1.26% Cu from 155m and 13m @ 1.06% Cu from 170m.

“We have the great advantage of previous exploration activity which has identified a substantial, sulphide hosted base metals system in the Yamarna project which substantially improves Cosmo’s chances of making a meaningful discovery,” CMO managing director James Merrillees says.

Cosmo Metals, a spin-out of gold explorer Great Boulder Resources (ASX:GBR), listed earlier this year after raising ~$7m at 20c per share.

CMO share price chart

TESORO RESOURCES (ASX:TSO)

Another monster hit in Chile.

TSO has pulled up some remarkable gold hits at the 661,000oz ‘Ternera’ deposit, part of the ‘El Zorro’ project, including:

- 93m @ 7.61g/t including 7m @ 66.10g/t, and

- 60m @ 2.89g/t including 10.60m @ 14.34g/t.

These thick, high-grade results compensate for their depth (between 250m and 350m).

All seven drill holes reported so far have returned multiple wide gold intercepts from high grade gold zones within Ternera, “providing significant scope for additional gold resources to be added with further drilling”, TSO says.

Assays remain outstanding for five drill holes.

Ternera and El Zorro get better with every hole, managing director Zeff Reeves says.

“These seven holes are amongst the best results we have ever seen from Ternera, with hole ZDDH0288 returning a 486 g/m intercept and hole ZDDH0290 returning 184 g/m.

“Importantly these holes have delineated consistent, wide and strike extensive mineralisation which remains open to the south and at depth.

“We’re assessing these zones as we believe that additional drilling could significantly increase the size of the Ternera Mineral Resource and make a material difference to the scale of the project.

“The widths and grades encountered provide multiple options for the project as they could support exploitation by either open pit or underground mining in the future.”

The $63m market cap stock is up 25% year to date. It had $5.6m in the bank at the end of December.

TSO share price chart

LATIN RESOURCES (ASX:LRS)

More high-grade lithium from Brazil for LRS, peaking at 3.22%.

Ore grade is usually around 1%, so this is good stuff.

First assay results from the initial two drill holes at the ‘Southern Target’ area of the ‘Salinas’ project “have confirmed a potential new high-grade lithium discovery”, LRS says.

Highlights include 4.31m at 2.22% Li2O from 83.82m and 8.13m at 2.00% Li2O from 111.3m.

These results continue to give us confidence that we may be onto a potentially major new lithium discovery in one of the best mining jurisdictions in the world,” managing director Chris Gale says.

“Lithium grades over two per cent are not common, with most operations in Australia running between one to one and a half per cent lithium.

“Our pegmatite ‘Peg_2’ is running grades of around two per cent lithium, with a peak of over three per cent over one meter, which are very high.”

LRS will now focus the drilling on the much thicker pegmatites to the south, where the pegmatites remain open.

“These assay results are only for the first two holes, we have another four holes that had thicker intersections with abundant spodumene as well,” Gale says.

“We are eagerly awaiting further assay results for these holes, which we expect to come through over the next few weeks.”

The high-flying stock is up ~230% year-to-date. It has $4.2m in cash and investments.

LRS share price chart

MC MINING (ASX:MCM)

(Up on no news)

This tiny South African coal miner and project developer squeezed out an $US800,000 loss for the December half, still better than the $2.7m loss from the prior corresponding period.

In fact, all the important numbers improved due to higher prices except sales, which fell from 127,534t to 107,953t of high quality coking and thermal coal.

“The higher global demand for coal post the COVID-19 pandemic resulted in a significant increase in international prices with an average API4 coal price of $151/t for the Period (H1 FY2021: $64/t),” MCM says.

So, how’s the company’s outlook?

Pretty good, if MCM can lock in the funds to develop the flagship ‘Makhado’ hard coking coal project.

Makhado would position the company as South Africa’s pre-eminent hard coking coal producer, MCM says.

“A number of parties are continuing their due diligence review for providing the balance of the funding required by the company to develop Makhado,” the company says.

“MC Mining remains confident that the parties taking part in the process will commit the necessary funds to complete the funding package, anticipated to be finalised during H1 CY2022.”

The $20m market cap minnow is up 30% year-to-date. It had $3.1m cash at the end of December.

MCM share price chart

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.