Resources Top 5: This copper-gold stock is +375% after unearthing two discoveries in 2 months

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Sunstone Metals pulls up an incredible 111m long intersection grading 2.3g/t gold at brand-new target

- Project generator Ausquest upgrades potential of Julimar-like ‘Morrisey’ nickel-copper-PGE project

- Volt Resources acquires lithium project next to Rio’s Jadar deposit

Here are the biggest small cap resources movers in early trade, Thursday November 18.

SUNSTONE METALS (ASX:STM)

A maiden drill hole has pulled up an incredible 111m long intersection grading 2.3g/t – including 7.2m at 26.9g/t – at the brand new ‘Alba’ target, part of STM’s ‘Bramaderos’ project in southern Ecuador.

The mineralisation was intersected at a relatively shallow depth of ~65m from surface and remains ‘open’ in multiple directions, the company says.

The drill rig on site at Bramaderos is currently completing a hole at the advanced ‘Brama’ porphyry target where drilling is nearly complete, leading to a mineral resource estimate in 2022.

The rig will be moved back to Alba next week.

“The intersection at Alba is clearly an exceptional result which we will follow-up immediately,” Sunstone managing director Malcolm Norris says.

“The broader Alba target opens up a number of areas for drill testing.”

This could be STM’s second major discovery in as many months, after it hit a monster 480m-long copper-gold intersection from 11m depth at the ‘El Palmar’ project, also in Ecuador.

This sparked a re-rate, which has been compounded by today’s announcement. The $209m market cap stock is now up 375% since early October.

The company has ~$20m in cash and investments.

AUSQUEST (ASX:AQD)

Project generator AQD has a longstanding strategic exploration alliance (since Feb 2017) with major miner South32, which was recently extended for a further two years.

AQD basically acts as S32’s informal exploration division — it finds projects, does the early work, and if S32 likes them an earn-in agreement is formed.

Under the agreed joint venture terms, S32 must contribute $US4.5m to earn a 70% joint venture interest in each project. It can earn an 80% interest in each project by completing a pre-feasibility study.

Six of AusQuest’s projects are currently exploration opportunities under the alliance (three in Australia and three in Peru), with three of these projects (‘Hamilton’, ‘Balladonia’ and ‘Los Otros’) to be drilled very soon.

AQD has now upgraded the potential of its Julimar-like ‘Morrisey’ nickel-copper-PGE project in WA — held under the Strategic Alliance Agreement (SAA) with S32 — after receiving highly encouraging results from soil geochemical programs.

Ground EM surveys to optimise drill sites at three prospects have been planned and are expected to be completed within the next six weeks.

The $15m market cap stock had $4.7m in the bank at the end of September.

VOLT RESOURCES (ASX:VRC)

Another lithium acquisition, this time from Europe focused graphite stock VRC.

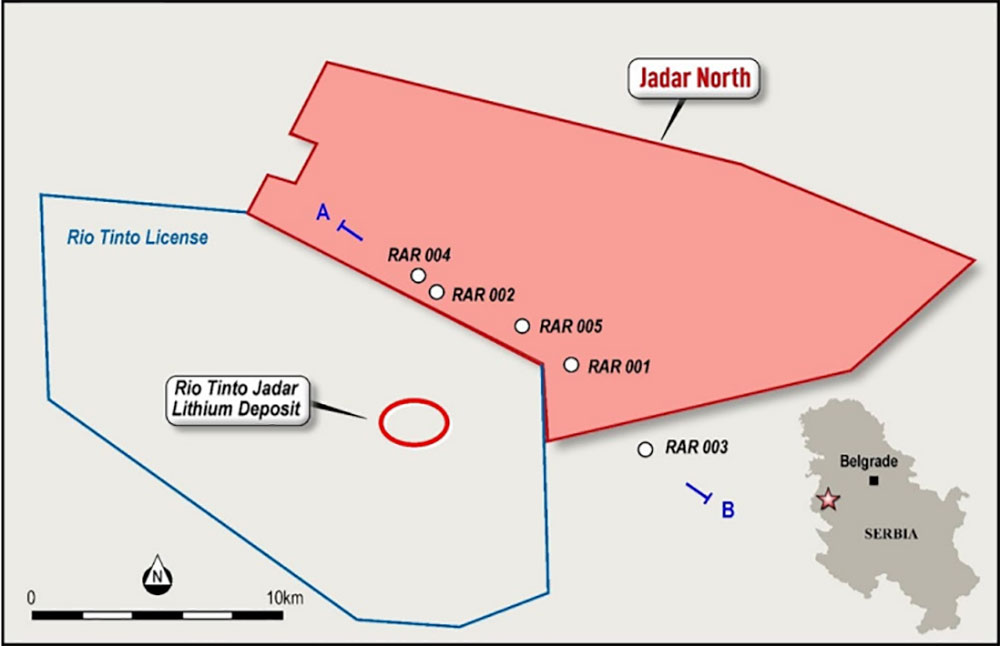

The ‘Jadar North’ licence application in Serbia neighbours Rio Tinto’s (ASX:RIO) large world class Jadar lithium-borate project:

Limited exploration has already identified the presence of lithium and borate, managing director Trevor Matthews says.

“Volt looks forward to the licence applications being granted and to completing phase one exploration drilling on the three licences to test the lithium and borate mineralisation potential during the course of 2022,” he says.

VRC recently acquired of a 70% controlling interest in the Ukraine graphite producer ZG Group, which help “deliver on its strategy to become a key supplier of natural flake graphite products and battery anode material to the growing EV and other graphite markets”.

As long as the Russians stay on their side of the line.

The $66.5m market cap stock is down 3% over the past month. It had about $3m in the bank at the end of September.

RESOURCE MINING CORP (ASX:RMI)

A soil/rock chip sampling program has defined a 2km long nickel-cobalt anomaly at the ‘Kabulanywele’ project in Tanzania, acquired by the explorer in February this year.

High grades up to 1.27% nickel in a rock sample and up to 0.85% nickel in soil were returned, the company says.

RMI is now planning a follow-up drilling program to test the identified anomaly.

The $4.7m market cap tiddler had just $48,000 in the bank at the end of September but has access to an additional $4.8m in loan facilities.

PACGOLD (ASX:PGO)

(Up on no news)

Last week, the recently listed explorer pulled up thick, high-grade gold in maiden drilling at the ‘Alice River’ project in north QLD.

The highlight intercept was 26m at 3.6g/t gold from 104m, including 3m at 21g/t from 126m.

This was an exceptional outcome from the first holes into a new, large-scale target, PGO managing director Tony Schreck says.

“High-resolution IP geophysics data highlights the new target zone extending over 800m south from beneath the open pit and these initial two drill holes confirm our interpretation that the system significantly widens only 50m to 100m below surface and is open in all directions,” he says.

This new target represents just one of numerous new large-scale targets being tested in the current drill program.

The red-hot $18m market cap stock is up 123% on its IPO price of 25c per share.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.