Resources Top 5: This cashed up, $30m cap junior could have hands on a golden colossus

Pic: tampatra, iStock / Getty Images Plus

- Algerian mining regulator issued a mining permit for Terramin’s 49%-owned Tala Hamza zinc-lead project

- Los Cerros hits 52m grading 3.65g/t gold in maiden drilling at Kusi, part of the Ono project in PNG

- Fin Resources has identified possible outcropping lithium at Cancet West project in Quebec’s James Bay region

Here are the biggest small cap resources winners in early trade, Thursday May 18.

TERRAMIN (ASX:TZN)

TZN is closer to developing one of the largest zinc and lead orebodies in the world after the Algerian mining regulator issued a mining permit for the 49%-owned Tala Hamza project.

This was the final regulatory, financial and environmental hoop TZN had to jump though prior to development, the company says.

The permit allows for the processing of 2Mtpa of ore, instead of the 1.3Mtpa envisaged in the 2018 mining study “indicating that project returns will be enhanced over the anticipated 20+ year mine life”.

Tala Hamza contains 53Mt at 6.6% zinc, plus lead for 3.5Mt of contained metal.

That 2018 study, which is probably well and truly out of date, envisages a $450m start-up cost. Operating costs would be in the second quartile globally (first quartile being the cheapest).

Some good news for the junior, which was refused a mining licence for the super high grade Bird in Hand gold project (BIHGP) in South Australia in February.

South Australia’s Minister for Energy and Mining Tom Koutsantonis crushed the development due to its potential impact on local wineries.

A feasibility study showed that the BIHGP could’ve generated a post-tax NPV of $14m with an IRR of 80.5% (that’s high) over ~4 years of production.

The project’s base case projection was to produce ~44,700oz a year at a low all-in sustaining cost of $959/oz.

The $75m capped stock has bounced back strongly in early trade to be up ~20% year-to-date.

LOS CERROS (ASX:LCL)

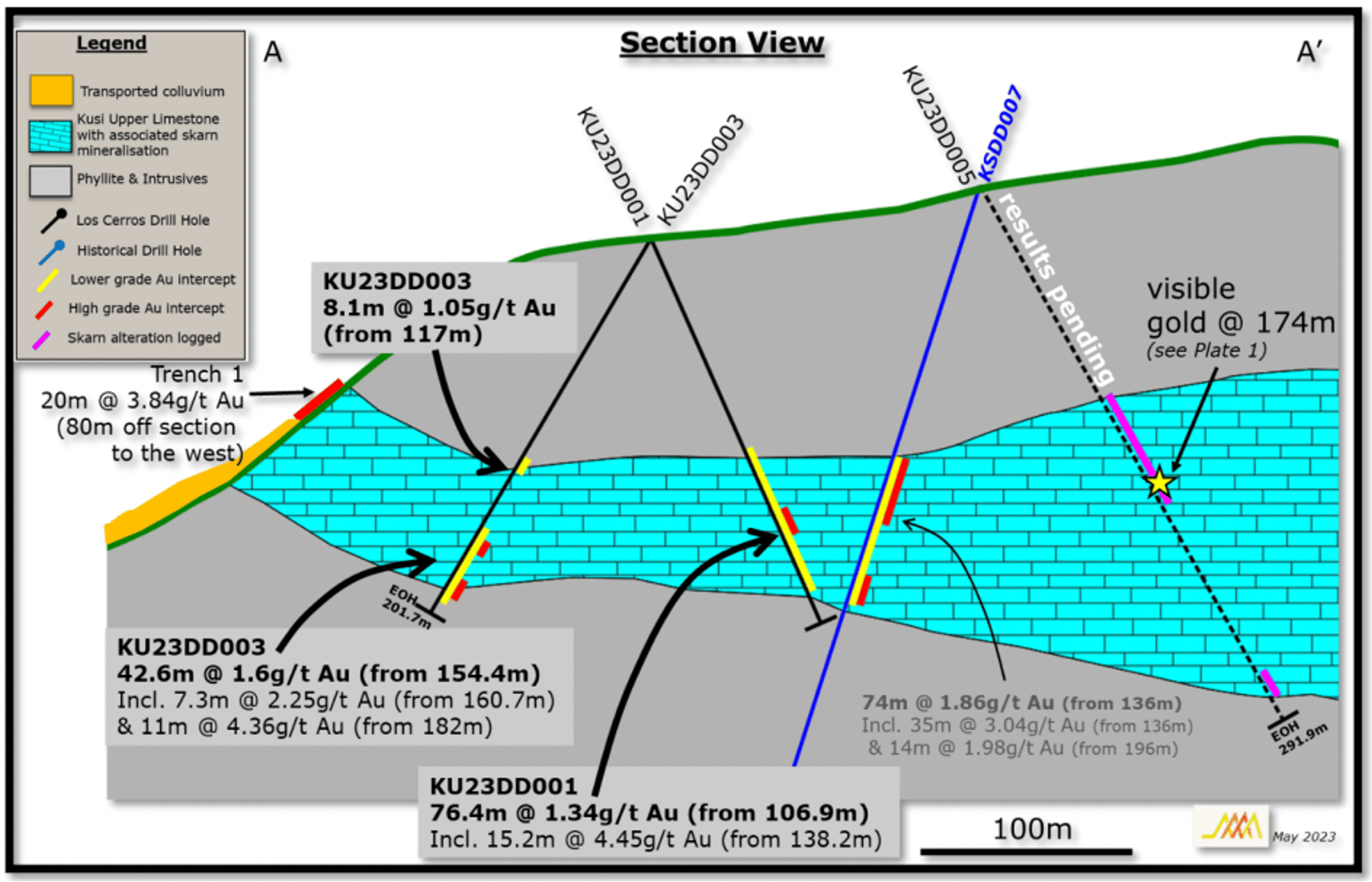

LCL has pulled up an incredible 52m grading 3.65g/t gold from 160m in maiden drilling at Kusi, part of the Ono project in Papua New Guinea.

Drill results received thus far have exceeded grade expectations, says the company, which is only five holes into an 18-hole, 3000m program.

That hit included a couple of high grade chunks: 6.68m @ 10.91g/t from 171.75m, and 7.5m @ 14.87g/t from 191.7m.

Assays are pending for hole 5, which intersected the widest zone of upper limestone skarn thus far, including visible gold and chalcopyrite, 165m away from of the above drill hole.

In (and around) the upper limestone skarn is where the good stuff is:

It’s getting better to the north, the company says.

The advanced South American gold stock recently diversified as it waits for “greater clarity on new government mine development policies” in Colombia, inking a deal to buy five large projects in PNG from private company Footprint Resources.

The $30m capped stock is down 30% year-to-date. It had $8.7m in the bank at the end of March.

GOLDEN MILE RESOURCES (ASX:G88)

The junior explorer has uncovered three “exciting untested high priority gold targets” for drilling at the Yuinmery project in WA’s Murchison region.

Yuinmery Trend, Happy Camper and Pirates Patch join the Elephant Reef, Ladies Patch and Hammerhead gold prospects which were upgraded by shallow aircore drilling last year.

These targets are within a large ~5.8km long x 1.1km wide area of gold-in-soil enrichment, 12km from the high grade 3.2Moz Youanmi deposit being redeveloped by Rox Resources (ASX:RXL).

It is also down the road from Ramelius Resources’ (ASX:RMS) super high grade Penny West mine.

G88’s WA exploration portfolio also includes Quicksilver (nickel, cobalt) and Yarrambee (nickel, copper, gold).

Much of the action is taking place at Quicksilver, where G88 has established a 26.3Mt resource grading 0.64% Ni & 0.04% Co (168,000t of nickel and 11,300t of cobalt), plus rare earths and scandium.

It has now completed a small metallurgical drilling program to de-risk the process flowsheet and provide confidence to proceed to a Scoping Study, the first proper look at the economics of building a project.

$5.5m capped G88 is up 10% year-to-date. It had $709,000 in the bank at the end of March.

FIN RESOURCES (ASX:FIN)

FIN has identified possible outcropping pegmatites at the Cancet West lithium project, down the road from high profile players like Winsome Resources and Patriot Battery Metals in Quebec’s James Bay region.

The junior has subsequently staked an additional 510ha of prospective open ground directly west of the project, part of the recently acquired Mt Tremblant tenements.

Detailed field mapping, outcrop sampling and geochemical sampling is expected to be completed during the upcoming Canadian summer field season.

This field work will allow FIN to evaluate and rank areas of highest prospectivity and verify interpreted pegmatite outcrops with the aim of generating drill ready targets.

Also joining the company as exploration manager is former MinRes (ASX:MIN) head rock kicker Tom Ridges.

FIN was previously focused on a ‘zero carbon’ multi-commodity operation at the 905sqkm Sol Mar project in northern WA but pivoted earlier this year, probably due to a lack of investor interest.

The $15m capped stock is down 15% year-to-date. It had $2.3m in the bank at the end of March.

WILDCAT RESOURCES (ASX:WC8)

WC8 is still jumping around on volume following yesterday’s lithium acquisition announcement.

The historical Tabba Tabba tantalum mine and lithium-tantalum project in the Pilbara includes a bunch of mining leases – important if you want to get into production quickly — large areas of outcropping pegmatites, and a high-grade 318,000t at 950ppm Ta2O5 tantalum deposit.

The project, briefly explored by Pilbara Minerals (ASX:PLS) in 2015, was historically a tanty asset so assays for lithium are limited.

However, there are some nice hits like 8m at 1.42% Li2O from 4m for WC8 to follow up.

The deal will cost WC8 up to 250m shares worth $14.5m at current prices, which makes vendor GAM a major shareholder in WC8.

“Tabba Tabba is a proven LCT pegmatite system that was within Pancontinental’s tantalum portfolio in the 1980s, along with Pilgangoora (Pilbara Minerals), Wodgina (Mineral Resources) and Yinnetharra (Delta Lithium),” WC8 exec Matthew Banks says.

“Our technical team believes there is significant exploration upside at Tabba Tabba, it is located within granted mining leases and we have approval for a 200-hole drill program.

“On deal completion we will welcome a range of major shareholders to the company and look forward to following through with discovery-focussed drill programs earmarked for 2023.”

There are also various net smelter royalties payable to GAM should the project enter production.

The $37m capped stock is up 185% year-to-date. It had $4.9m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.