Resources Top 5: This $180m coal stock expects to book an eye-watering $80m profit for Q4

Pic: Flashpop/ Getty Images

- Lode hits ‘significant sulphides’ at Webbs Consol silver project

- Coal producer Terracom predicts $81m EBITDA for the December quarter

- Cannindah hits monster 282m @ 1.28% copper equivalent intersection at namesake project

Here are the biggest small cap resources winners in early trade, Tuesday, October 19.

LODE RESOURCES (ASX:LDR)

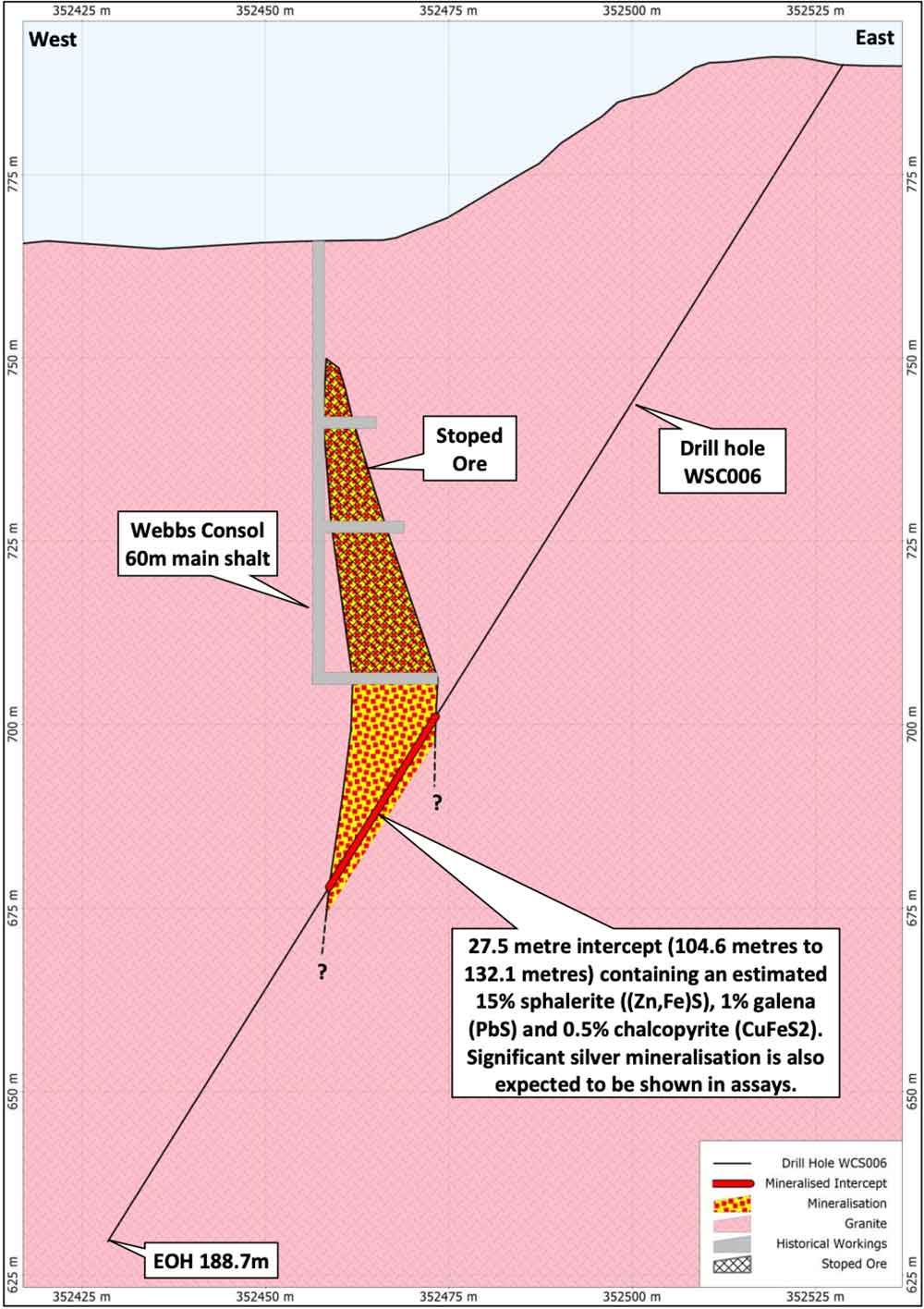

The newly listed explorer hit “significant sulphides” — including 27.5m at ~15% sphalerite (zinc ore), 1% galena (lead ore) and 0.5% chalcopyrite (copper ore) – in maiden drilling at the ‘Webbs Consol’ silver project in NSW.

This intercept — directly below the Webbs Consol main shaft where historical mining was recorded to a vertical depth of 60m – indicates the orebody continues at depth:

Significant silver mineralisation is also expected to be shown in assays, which are anticipated in 3-4 weeks.

The $11.7m market cap junior is up 50% on its IPO price of 20c per share.

TERRACOM (ASX:TER)

Coal miners are raking in the cash.

The latest to report results is Terracom, which made $17.2m EBITDA (earnings before interest, tax, depreciation, and amortisation) in September from the ‘Blair Athol’ mine.

This was from revenue of $177 per tonne of coal sold (margin: a hefty $101 per tonne).

More importantly, TER says forecast revenue for the entire December quarter will be $230/t – which would give it a cash margin of more than $140/t.

At forecast production of ~575,000t, that equates to EBITDA of over $81m for the quarter. Merry Christmas, shareholders.

The $180m market cap stock is up 53% over the past month.

VALOR RESOURCES (ASX:VAL)

(Up on no news)

On October 11, VAL announced that rock sampling returned thick, high-grade copper at the ‘Cobremani’ and ‘Maricate’ targets, part of the Picha project in Peru.

Results include a 35.6m long channel sample averaging 1.3% copper and 22.85g/t silver at Cobremani, as well as several samples up to 13.4% copper at the 1km-long Maricate target area.

Over 150 assay results from the Maricate and ‘Cumbre Coya’ targets are expected imminently.

Geophysics and drill planning will kick off once the current field program is complete, VAL says.

This Tolga Kumova favourite also has uranium projects in Canada’s Athabasca Basin.

The $45m market cap stock is down 5% over the past month, but up 90% year-to-date.

CANNINDAH (ASX:CAE)

Looks like CAE has grasped the tail of a monster at its namesake project in QLD, with new assays returning a further 92m at 1.2% copper from the bottom half of hole 21CAEDD002.

All up, this monstrous intersection totals 282m @ 0.94% copper, 0.3 g/t gold, and 19 g/t silver — which translates to 282m @ 1.28% copper equivalent.

The next hole, (21CAEDD003) still has assay results pending, with the hole ending at 762.6m (versus a planned 250m). CAE is expecting these “in the short term”.

The brownfields ‘Mt Cannindah’ copper-gold-silver project has an existing resource of 5.5 million tonnes @ 0.93% copper.

The company is currently undertaking a 1,450m drilling program to explore both new and existing areas.

The $116m market cap stock is up 130% over the past month, and 666% year-to-date.

TIGERS REALM COAL (ASX:TIG)

The Russian coal producer has been experiencing exceptionally strong demand for its met and thermal coal, particularly in China, it said on October 15.

“The Chinese spot metcoal market has been very strong for US, Canadian and Russian coal producers, with CFR prices for hard coking coal (HCC) rising from $300/t in Q2 to around $400/t at this moment,” TIG says.

“Occasional cargoes are rumoured to have been secured at prices approaching $600/t.”

And when it comes to thermal coal, the current QHD marker price is RMB 1,461/mt, which is up by 46% since the start of Q2 and is providing strong support to Russian import prices, TIG says.

“Newcastle 6,000 NAR and 5,500 NAR coals are trading at $203/t and $115/t respectively, according to trade publications,” it says.

“Whilst prices are expected to moderate eventually, supply is so tight at present that significant retracing is not likely before the end of the Chinese winter season.”

“Given our mining and port performance for the first nine months, TIG raises its full‐year 2021 sales guidance from 700 – 800kt to 800 – 850kt.”

TIG’s costs of production were US$32.96 per tonne for the six months to June 2021.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.