Resources Top 5: Thick, shallow AND high grade – First Lithium strikes in Mali

Pic via Getty Images

- FL1 has made an impressive lithium hit in Mali, surging it +70%

- Bastion Minerals gains lithium, REE and gold projects in WA

- Godolphin Resources is selling two NSW projects to concentrate on REE

- Enova and MetalsTech also among the gainers

Here are some of the biggest resources winners in early trade, Wednesday December 20.

First Lithium (ASX:FL1)

Recently we reported that “the true scale potential of First Lithium’s Blakala lithium prospect in Mali is starting to emerge”. Well, today, it has very much become highly emergent, with FL1 sporting the loudest voice on the ASX this morning after coming off a brief trading halt.

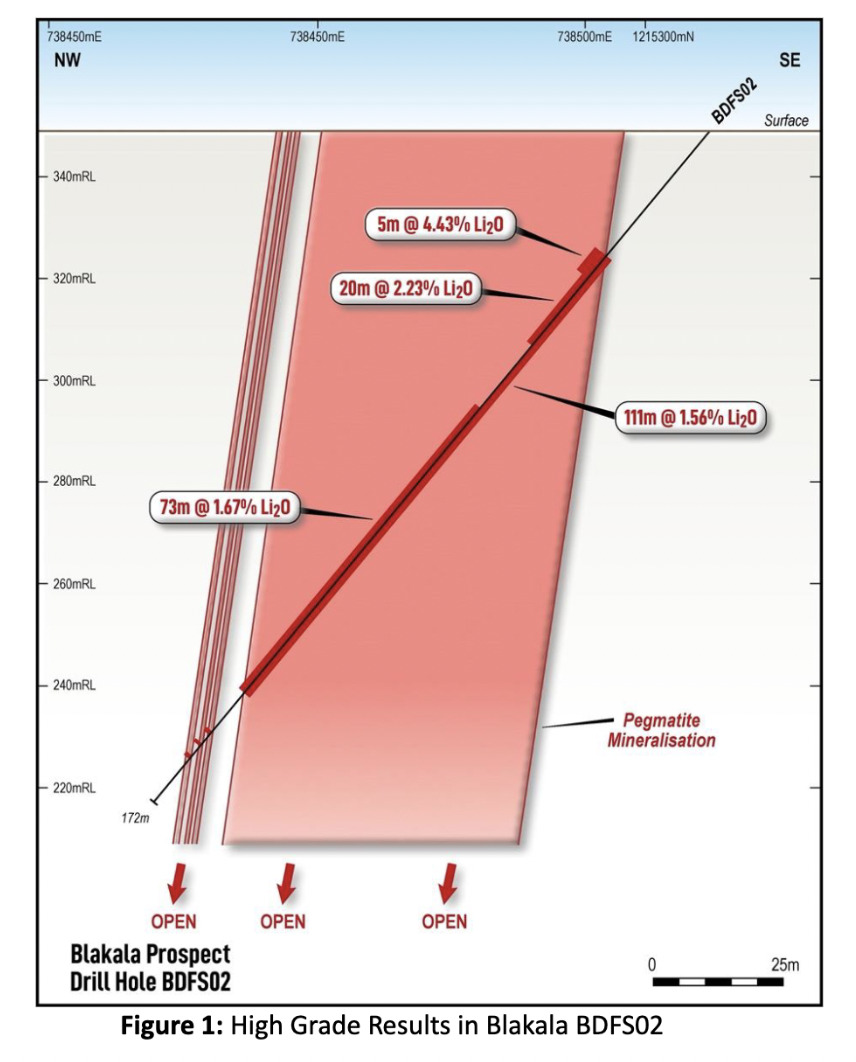

It’s currently up +70% on the back of a big find at Tier 1 priority target Blakala, part of the Gouna project, including – in the first three holes – a 111m intersection at 1.57% Li2O.

And that result there also included a 10m chunk grading 3.39% Li2O from 33m depth.

Stockhead’s Reuben Adams was overheard earlier saying something like: “That’s high grade! It’s also exceptionally thick and shallow.”

Another hole brought similar results: 60m intersection at 1.59% Li2O (from 39m), including 38m at 1.76% Li2O (from 51m).

First Lithium #FL1 is pleased to announce a Significant Discovery confirmed at #Blakala including 111m @ 1.57% Li2O

Spodumene mineralisation is high grade, outcrops at surface, and is open at depth and along strike pic.twitter.com/J2oLGKfmne

— First Lithium Ltd (@FirstLithiumLtd) December 19, 2023

FL1 says that the results back up the visual estimates of the spodumene percentages in the core samples, with the spod mineralisation deemed high grade, outcropping at surface, and open at depth and along strike.

Further core samples – 726 of them – are being assessed with results expected in early January.

It’s fair to say that these results further justify why Blakala was one of only two Tier 1 priority targets in Mali ranked by CSA Global in 2008, the other being Leo Lithium’s (ASX:LLL) 211Mt Goulamina project – the fifth largest hard rock deposit in the world.

FL1 MD Venkat Padala said: “The laboratory results have delivered the outstanding grades we were all anticipating based on the previous visual estimates.

“The grades and depth of the discovery in this region provide further confidence the Blakala prospect could deliver a significant high grade mineral resource in 2024 as the grades and depth of results to date at Blakala provide great confidence for the project.”

Drilling is set to continue and a maiden resource is pencilled in for 2024.

FL1 share price

Bastion Minerals (ASX:BMO)

This small copper, lithium and green metals hunter is committed to decarbonisation for a sustainable fut… etc etc. In other words, it’s part of possibly the biggest narrative that’s shaping the mining sector – certainly if you believe Elon Musk when he says that “lithium batteries are the new oil”.

Why’s BMO up more than 20% at the time of key tapping, though? We’ll tell you.

The company has just signed two agreements to acquire two highly prospective lithium, REE and gold projects in Western Australia.

The lithium and REE operation is in the Gascoyne region and is known as the Morrissey lithium project and comprises 15.58km2 of ground within the “Volta Corridor” – an 80km long WNW trend that’s prospective for LCT lithium-bearing pegmatites.

The other site – the Split Rock Dam project – is in the Mt Ida Goldfields area, and is 38.54km2 of ground prospective for lithium and gold.

The company notes that Split Rock Dam abuts and is immediately adjacent to tenure involved in the most recent major transaction in the area, a subsidiary of Wesfarmers (ASX:WES) executing a $26 million transaction on lithium and gold rights held by Ora Banda (ASX:OBM) announced on October 30.

Also, these are both popular areas of focus, following Delta Lithium’s (ASX:DLI) recent drilling success out there.

The total cost of both acquisitions is $1 million… (cue Dr Evil meme, someone), which will be realised by Bastion via the issue of 71,428,571 fully paid ordinary shares in the company to Critical Minerals Morrissey (and its shareholders) and Syndicate Metals.

And that’ll be “at a deemed issue price of AUD$0.014 per share (subject to shareholder approval), in addition to a net smelter royalty of 1.5% payable to the vendors”.

Management’s delight spotted in tweet below:

#ASXNews$BMO.AX is pleased to announce the execution of two agreements to acquire two highly prospective #lithium, #REE and #gold projects, the Morrissey Project & Split Rock Dam Project, in WA, which expand the Company’s portfolio of tenements.https://t.co/ShOvlS6m8a pic.twitter.com/6KlfMHgMha

— Bastion Minerals Limited (@BastionLimited) December 19, 2023

BMO share price

Godolphin Resources (ASX:GRL)

This small NSW-focused minerals explorer is up and to the right to the tune of about 28% at the time of writing, with its share price reaching its highest mark since July 10.

The company has announced it’s selling the Lewis Ponds and Mt Bulga projects (gold and base metals) for $11 million in cold, hard cash. Or at least a bank transfer, presumably.

This, notes the company, will provide GRL with a good chunk of funding to “rapidly advance its flagship Narraburra Rare Earths project in central west NSW, along with its other advanced stage exploration projects.”

Battery metals focused explorer Minerals Pty Ltd is the buyer, according to GRL’s announcement.

GRL MD Jeneta Owens described the sale as “a transformative transaction for Godolphin”.

And in other recent Godolphin news, this…

Yeoval Copper-Gold Project RC Drilling Completed and New Targets Identified at Vaughans Ridge

Drilling targeted multiple structural zones w/ the potential to host high-grade #copper mineralisation – program completed on time and under budgethttps://t.co/MRmuRAqVid $GRL $GRL.ax pic.twitter.com/nsfL1dvLMp

— Godolphin Resources Limited (@GodolphinASX) December 18, 2023

GRL share price

MetalsTech (ASX:MTC)

MetalsTech, a long-time gold project developer which joined the lithium hunt this year, is up after it announced this morning it’s brought Hong Kong-based financial services firm Minmetals Securities on board as a strategic advisor.

And that’s to essentially coordinate a strategic process and provide corporate and investor relations advice with regards to a potential transaction involving MTC’s Sturec gold Mine in Slovakia.

The plot thickens, possibly.

Apparently Minmetals has been engaged to oversee “a process involving eight potential strategic parties from China and four potential strategic parties of Western origin” with discussions at various advanced stages.

A lot of potentials and possibles going on there. In any case, shareholders seem to like the news.

Recently, MTC released a “robust” scoping study regarding the Sturec mine.

The study highlighted “highly encouraging economics and technical viability” for the mine, emphasising its potential to become a low-cost gold and silver concentrate producer”.

MTC share price

Enova Mining (ASX:ENV)

(Up on… news from Dec 18?)

Earlier this week, this sub-$10m market capped critical minerals hunter announced it’s all set to acquire highly prospective Caldeira REE and Brazilian Lithium Valley tenements.

There’s been no news in the couple of days since, so let’s assume ENV’s +30% bump has something or everything to do with that.

The company has entered into a binding option agreement to acquire 100% of the Poços, Juquia, Resplendor, Carai, Santo Antonio and Salinas East prospects – all in Brazil comprising some 675.79km2 of land.

The majority of the tenements are located in Brazil’s renowned Poços deCaldas/Caldeira Rare Earth complex and “Lithium Valley” in the mining state of Minas Gerais.

Importantly for shareholders, the tenements are close to several world class deposits, including Sigma Lithium’s Grota do Cirilo Resource (77Mt at 1.43% Li2O + 8.5Mt at 1.43% Li2O Inferred) and Latin Resources’ (ASX:LRS) Salinas Project (45.2Mt at 1.32% Li2O).

ENV share price

At Stockhead we tell it like it is. While First Lithium is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.