Resources Top 5: Thick lithium with a side of high-grade gold, please

Pic: Minerva Studio, iStock / Getty Images Plus

- Red Dirt hits thick lithium (with a side of gold AND copper) at Mt Ida project

- Resolution inks another farm-in deal with mid-tier miner Oz Minerals

- OzAurum says Mulgabbie North could be “a significant gold discovery”

Here are the biggest small cap resources winners in early trade, Friday May 13.

RED DIRT METALS (ASX:RDT)

The WA explorer intersected 34.17m at 1.32% lithium from 332m at ‘Sister Sam’ — part of the ‘Mt Ida’ project — which includes a 12.43m chunk grading 2.13%.

Ore grade at hard rock lithium mines is generally around 1%, so this is good stuff.

A bunch of other holes returned similar hits. “Exceptional grades of Li2O over significant thicknesses” at Sister Sam have now been logged over 600m, RDT says.

The nearby ‘Timoni’ pegmatite, where shallower high grade intervals have been reported, is nearing 500m.

RDT is ramping up resource drilling, with a third rig (Diamond) now having arrived at site, and further two rigs (1 Aircore and 1 RC) planned to arrive by the end of the May.

The explorer plans to drill a total 60,000m by September.

“These first diamond results have confirmed that the Sister Sam pegmatite grades and widths are continuing some 600m down plunge from the surface expression of the pegmatite, and show no signs of grade dropping off or significant variations in mineralogy across the intrusive,” RDT managing director Matthew Boyes said.

“The presence of large widths of greater than 2% Li2O contained within all the assayed holes demonstrates the high grades present within these pegmatites and the potential to add a significant amount of lithium metal over a small vertical distance.

“I look forward to the next round of assays and to advancing with follow-up metallurgical testwork and the commencement of our maiden resource estimate.”

Here’s bonus for RDT holders. Mt Ida was originally a gold project and RDT, although currently not focusing any of its exploration efforts on targeting gold, continues to intersect the precious metal in its hunt for lithium.

The most recent hit was 4m @ 12.52g/t gold and 1.46% copper from 62m downhole (~50m below surface) in a fresh semi-massive, sulphide rich, quartz bearing lode. Which is fantastic.

The explorer has kicked off a full review of the existing gold mineralisation with a view to update a revised and JORC 2012 compliant resource estimate over Mt Ida.

“RDT firmly believes that significant potential exists for further exploration success and a material increase in the existing gold endowment at Mt Ida and budgeted 14,800m of RC and diamond drilling into the near-term evaluation of this mineralisation,” it says.

The $140m market cap stock is down 32% year-to-date. It had $25m in the bank at the end of March.

OZAURUM RESOURCES (ASX:OZM)

The explorer says a new diamond drill hole has hit gold-hosting rock at ‘Mulgabbie North’, “further validating the potential of Mulgabbie to be a significant gold discovery”.

Late last month OZM hit 1.31g/t over 56m — including 18m @ 2.07g/t — in drilling at the ‘Mulgabbie North’ project, next door to Northern Star’s (ASX:NST) tier 1 Carosue Dam operations in WA.

The results, which include significant hits from three holes spaced 100m apart, come from a recently launched 7,500m reverse circulation (RC) drilling campaign.

It’s early days, but this virgin discovery at the so-called ‘Demag Zone’ remains ‘open’ all over the joint, OZM says.

The new diamond drilling aimed to chase this gold mineralisation even furthur out, as well as provide valuable information on lithology, mineralisation, alteration and structure.

“The Mulgabbie North Gold Project is shaping up to be a significant gold discovery situated right alongside the Northern Star Carosue Dam Mill,” OZM boss Andrew Pumphrey says.

“The first diamond drill hole completed at the new discovery Demag Zone has intersected mineralisation that closely correlates with adjacent RC holes MNORC 176 and 177, further validating the potential of Mulgabbie to be a significant gold discovery.”

After listing in 2021, OZM punched in a mammoth 82,000m of combined RC and AC for the year in the hunt for WA’s next big gold mine.

It is planning an initial 7,500m of RC, 2,000m of diamond and 5,000m of AC for the first six months of 2022. RC drilling of the Discovery Demag Zone will commence in three weeks’ time.

The $11m market cap stock is up 46% year-to-date. It had ~$3.3m in the bank at the end of March.

RESOLUTION MINERALS (ASX:RML)

$7.16bn-capped Oz Minerals (ASX:OZL) will spend $4m over five years to earn 51% in RML’s ‘Benmara’ project in the Northern Territory.

RML is free-carried until year six of the deal, when it can contribute toward exploration to retain its 49% interest.

If RML elects not to participate, OZL has the option to earn a 75% interest, by sole-funding and delivering a Final Investment Decision to Mine.

It’s the second RML project in the NT to catch OZL’s eye. The mid-tier copper producer is also spending $5m on exploration to earn a 51% interest in the ‘Wollogorang’ copper-cobalt-uranium project.

This development should excite RML shareholders, CEO Christine Lawley says.

“The agreement makes it possible for Resolution to advance three major projects simultaneously; two having external funding from copper producer OZ Minerals at both Wollogorang & Benmara Projects,” she says.

“This minimises dilution for Resolution shareholders and creates three major opportunities for shareholder upside.

“While all eyes will be on drilling activities in June on our flagship 64North gold project in Alaska, do not underestimate the value creation being undertaken in Australia with significant drilling activities planned closer to home on our Northern Territory projects in 2022.”

ADMIRALTY RESOURCES (ASX:ADY)

(Up on no news)

This iron ore-nickel-cobalt explorer/project developer has been largely MIA in 2022.

In February last year, ADY signed a deal to hopefully commercialise its Mariposa iron ore project in Chile.

Under the contract, Chinese company Hainan fully funds mining and construction “with all capital contributions, security, legal costs, risks and potential losses borne by Hainan solely”.

The deal covers the first 2 million tonnes of iron ore. Admiralty will get a ‘laddered’ royalty rate up to 7 per cent per tonne of iron ore produced if the price stays above US$90/t.

In its Dec quarterly the company said it was “now progressing to settling a final Joint Venture Agreement between the Company and Hainan”.

Start of construction was pencilled in for end of May 2022.

“The Company notes that delays in settling the Joint Venture Agreement and enabling commencement of activities at Mariposa were largely due to COVID-19 related travel disruption, particularly given Hainan’s operations team have previously been unable to apply for visas to enter Chile, however this process is now underway,” it says.

The $16m market cap stock is up 60% year-to-date. It had $1.1m in the bank at the end of December.

GALILEO MINING (ASX:GAL)

(Up on no news)

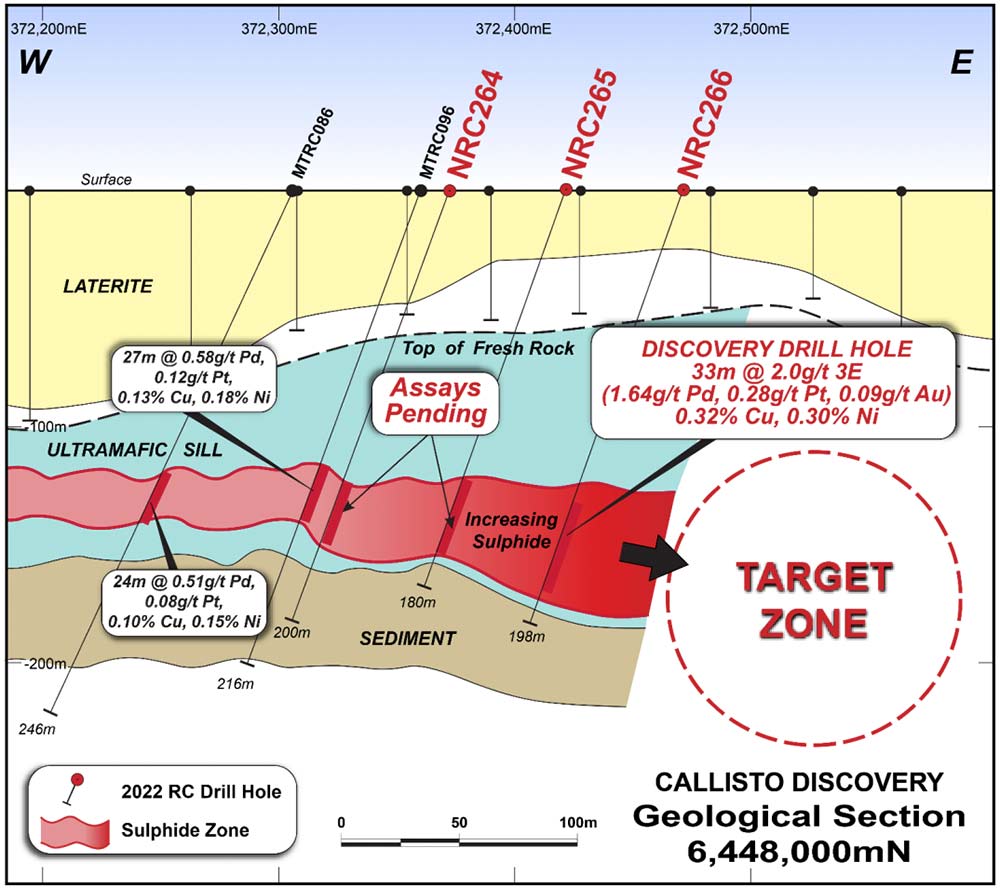

After taking a breather yesterday, GAL is again flying on the back of a major palladium-platinum discovery announced Wednesday at the ‘Norseman’ project in WA.

The discovery hole at the ‘Callisto’ prospect returned a 33m-long intersection grading 2g/t 3E (1.64g/t palladium, 0.28g/t platinum, 0.09g/t gold), 0.32% copper & 0.30% nickel from 144m.

This 33m assayed intersection occurs within a wider 55m disseminated sulphide zone (126–181m) “indicating the potential for a large mineralised system”, GAL says.

Assays from a further five drill holes are pending, but GAL has already flagged strong geological continuity “with all drill holes intersecting disseminated sulphides”.

And as you can see in the image below, GAL hasn’t even hit the juicy target zone yet:

All up, there is 5km of untested prospective strike length.

Being on a granted mining lease also means the explorer could potentially accelerate development at Callisto if resource drilling is successful.

There are already geological similarities to South Africa’s colossal ‘Platreef’ palladium-platinum-gold-rhodium-copper-nickel deposits, GAL MD Brad Underwood says.

In addition to Callisto, GAL also has multiple PGE-nickel-copper targets at the ‘Jimberlana’ and ‘Mission Sill’ prospects to the south “that offer new opportunities for further discoveries”, Underwood says.

This is the latest in string of successes for famed prospector Mark Creasy, who owns 24.6% of GAL and is now several million dollars richer on paper following this re-rate.

The $92m market cap stock is up 140% year-to-date. It is well funded for exploration with $8.7m in the bank at the end of March.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.