Resources Top 5: TechGen Metals in starring role after finding high-grade copper target

TG1 was a star performer among ASX small cap stocks after identifying a high-grade copper target at Blue Devil project. Pic: Getty Images

- TG1 identifies high-grade copper target at the Blue Devil project near Halls Creek in WA

- Investors have welcomed a new partnership to advance the Cabora Bassa oil and gas asset in Zimbabwe

- It’s full steam ahead for CAE at Mt Cannindah copper-gold deposit in Central Queensland

Your standout small cap resources stocks for Thursday, August 28, 2025

TechGen Metals (ASX:TG1)

Playing the starring role among ASX juniors on Thursday was TechGen Metals (ASX:TG1), reaching a 12-month high of 5.3c, an increase of 165% on the previous close.

TG1 closed at 3.6c, which was 80% higher, and more than 108 million shares were exchanged valued at more than $4.47 million.

This came after a new high-grade copper target was identified at the 195km2 Blue Devil project 40km northeast of Halls Creek in WA.

Blue Devil presents an attractive, first-mover opportunity focused on the exploration of copper, gold and silver within the Halls Creek Orogen, a proven mineralised region.

TG1 has completed a heritage survey and a final report is expected in the coming weeks, following approval from the board of the Jaru People.

With a Heritage Protection Agreement in place, the tenements are now pending government granting of tenure, a procedure which is now just a formality process.

Two new parallel structurally controlled high-grade copper gossans and iron quartz gold zones about 80m apart were identified during the survey.

Twelve rock chip samples were collected along an east-west quartz structural corridor over about 2km with copper samples returning up to 52.3%, 22.6% and 21%, and gold samples of up to 5.35g/t and 1.84g/t.

Given the gossanous style of mineralisation and exceptional grades having high levels of copper/gold +/-silver elements including sulphur and phosphorus, an IP survey is being planned.

This is expected to provide additional drill targets to support and add to the already large 2.75km Blue Devil intrusion-related copper gold target identified by EM conductor and magnetics.

As the Blue Devil Cu/Au/Ag target area has never been drill tested, TechGen has a rare greenfield opportunity to deliver a potential new discovery.

“We are delighted with the on-country heritage survey that was recently completed with the assistance of the traditional owners from the Jaru People managed by the Jaru Board that strongly supports our recently signed Heritage Protection agreement, we look forward to ongoing relationships working together on the completion of the survey report in due course,” TechGen’s MD Ashley Hood said.

Invictus Energy (ASX:IVZ)

A new partnership, to advance the Cabora Bassa oil and gas asset in Zimbabwe and establish an Africa-focused upstream company, has been welcomed by Invictus Energy (ASX:IVZ) investors.

A 145% increase on Wednesday after the partnership with Al Mansour Holdings (AMH) was announced was followed by a jump of 42.31% to 18.5c, a 12-month high, with more than 122m shares changing hands.

The partnership includes a binding MoU and share subscription agreement giving AMH a 19.9% stake in Invictus.

AMH, which is led by His Highness Sheikh Mansour bin Jabor bin Jassim Al Thani of Qatar, will provide up to US$500m in conditional finance to advance Cabora Bassa to commercial production.

Through the partnership, it is intended to establish a new Africa-focused upstream company, Al Mansour Oil & Gas (AMOG), in a JV between Invictus and AMH.

AMOG will focus on acquiring producing and near-term development oil and gas assets as well as strategic corporate M&A across key African countries.

Invictus will lead technical, commercial and operational management and AMH will fund acquisitions and development through its Qatar-based investors.

“The strategic investment by Al Mansour Holdings and formation of Al Mansour Oil & Gas with the backing of His Highness Sheikh Mansour is a transformational milestone for Invictus,” managing director Scott Macmillan said.

“It significantly enhances the growth trajectory for our Cabora Bassa project and opens the door to strategic upstream opportunities across the African continent.

“Through our role in AMOG and the strategic investment by AMH in Invictus, our shareholders will gain exposure to a diversified portfolio of development and producing assets, backed by world-class partners and capital strength.”

“We’re proud to launch Al Mansour Oil & Gas in partnership with Invictus Energy, a company that shares our vision for responsible and impactful energy development across the African continent,” Sheikh Mansour said.

“Our investment in Invictus and our new AMOG joint venture reflects our long-term commitment to Africa’s growth, energy security and economic transformation.

“Our goal with AMOG is to unlock the immense potential of Africa’s oil and gas sector in a way that benefits all stakeholders – host governments, communities and investors alike.

“We look forward to building a world-class African upstream portfolio and working closely with our partners to deliver energy for progress.”

Cannindah Resources (ASX:CAE)

It’s full steam ahead for Cannindah Resources (ASX:CAE) at the Mt Cannindah copper-gold deposit in Central Queensland after securing $4.5 million in an underwritten entitlement offer.

The funds will power up a reverse circulation drill campaign as the company hunts for Australia’s next major porphyry copper discovery.

Drilling is set to focus on northern and southern extensions to the 14.5Mt at 1.09% copper equivalent resource, which the company believes reflects only a small and shallow component of what could be a much larger porphyry discovery.

Those tonnes – 159,000t CuEq in metal equivalent – have been added at a discovery cost of just 3.5c per pound, with major targets across 95% of the mineralised system at the project near Gladstone.

A new target called Little Wonder at the southern end of a 700m stretch untested by drilling will be included in the campaign.

Rubix Resources (ASX:RB6)

(Up on no news)

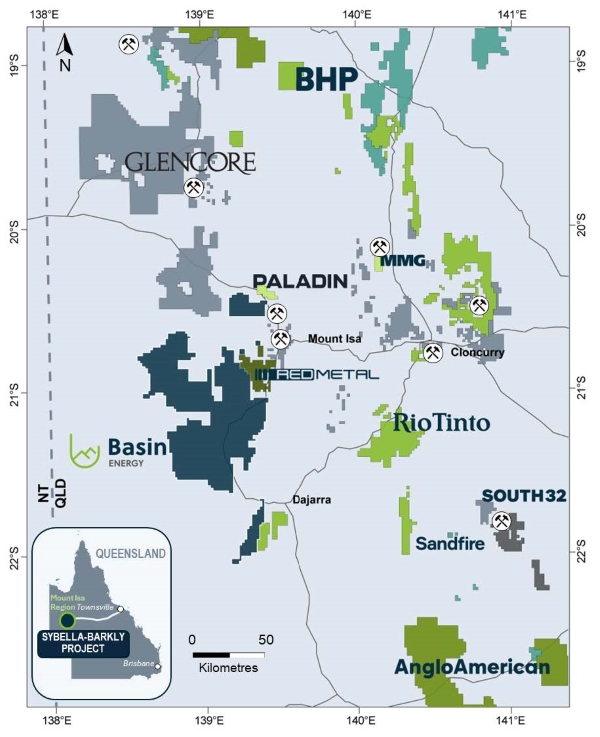

With a diversified project base of four prospective projects in North Queensland and Western Australia supported by the Ceiling lithium project in James Bay, Quebec, Rubix Resources (ASX:RB6) lifted 38.1% to a 12-month high of 14.5c before a trading halt.

The halt is in place pending a response from the company to a price query from the ASX which followed the share price rise.

RB6’s primary focus is Queensland Collaborative Exploration Initiative co-funded drilling at the Paperbark project.

Chargeability targets are the focus of drilling, associated with surface mineralisation at Grunter North and lead-zinc mineralisation at the JB Zone with assays expected in late September or October.

The company is also assessing the mineralisation potential at the Etheridge Gold Project in Queensland while also reviewing strategic projects for potential acquisition.

Finder Energy Holdings (ASX:FDR)

(Up on no news)

Through an alliance with subsurface technology company SLB (formerly, Schlumberger), Finder Energy Holdings (ASX:FDR) is pursuing a strategy to bring forward first oil at the Kuda Tasi and Jahal projects in Timor Leste.

The alliance is untertaking an integrated single-source solution beginning with a commitment to undertake a FEED (front-end engineering and design) process. And that will deliver project costings and a timeline (including procurement of critical path long-lead items) to the level of accuracy required to achieve a final investment decision.

Further support will come from the project having access to SLB’s global procurement and stocking programs.

Under a Development Alliance Agreement and Accelerated FEED Project Agreement, the two parties will complete the key drilling and subsea components within six to nine months, about 12 months ahead of schedule.

“This alliance with SLB brings enormous resources and development capability to the project not only accelerating FEED but establishing a pathway through to FID, the construction phase and beyond,” FDR’s CEO Damon Neaves said.

FDR reached a two-year high of 12c, a lift of 23.71% on the previous close.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Cannindah Resources is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.