Resources Top 5: Surefire Resources strikes deal with Saudi Arabia; Loyal Lithium makes ‘significant’ find

Getty Images sent its smallest photographer to cover the SRN/Saudi deal. Possibly.

- Surefire Resources has inked an eye-catching MoU with the Kingdom of Saudi Arabia.

- Loyal Lithium is going hard for the battery metal in James Bay, making a ‘significant breakthrough’.

- Evolution Energy Minerals has hopped into bed with China’s BTR New Material Group.

Here are the biggest small cap resources winners in early trade, Wednesday August 16.

SUREFIRE RESOURCES (ASX:SRN)

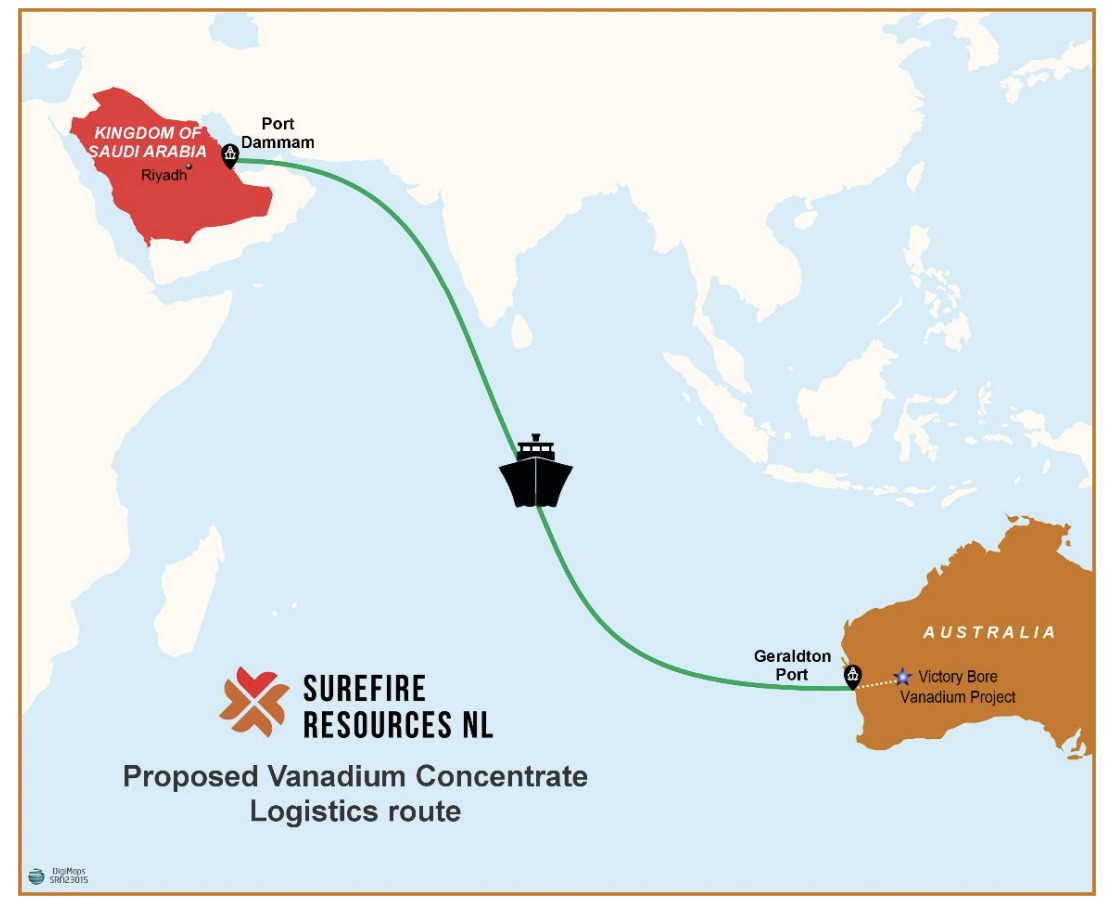

Surefire has “executed an MoU” with the Kingdom of Saudi Arabia’s Ministry of Investment – for vanadium and High Purity Alumina (HPA) processing opportunities originating in Western Australia.

The MoU is the positive result of a development proposal from the company to the Saudi ministry regarding Surefire’s Victory Bore vanadium and HPA project, about 560km north-east of Perth.

Vanadium-bearing magnetite concentrate will then be processed in the Kingdom of Saudi Arabia for a variety of products.

The company notes that the Saudi Ministry of Investment will assist Surefire to “identify suitable process plant locations, introduce potential partners, and secure binding agreements for funding and development”.

The Kingdom of Saudi Arabia is a significant user of vanadium products, notably in its steel sector where demand is estimated at 10,000-12,000tpa and growing at 4-5% year on year.

Additionally, notes Surefire, the HPA feedstock from Victory Bore could also be processed in the kingdom, where demand is increasing, or for export over to Europe.

Surefire Resources Managing Director Paul Burton said “This is a very significant milestone and achievement for the company and provides a clear development pathway for the Victory Bore Project as we progress the Pre-Feasibility Study.”

SRN share price

LOYAL LITHIUM (ASX:LLI)

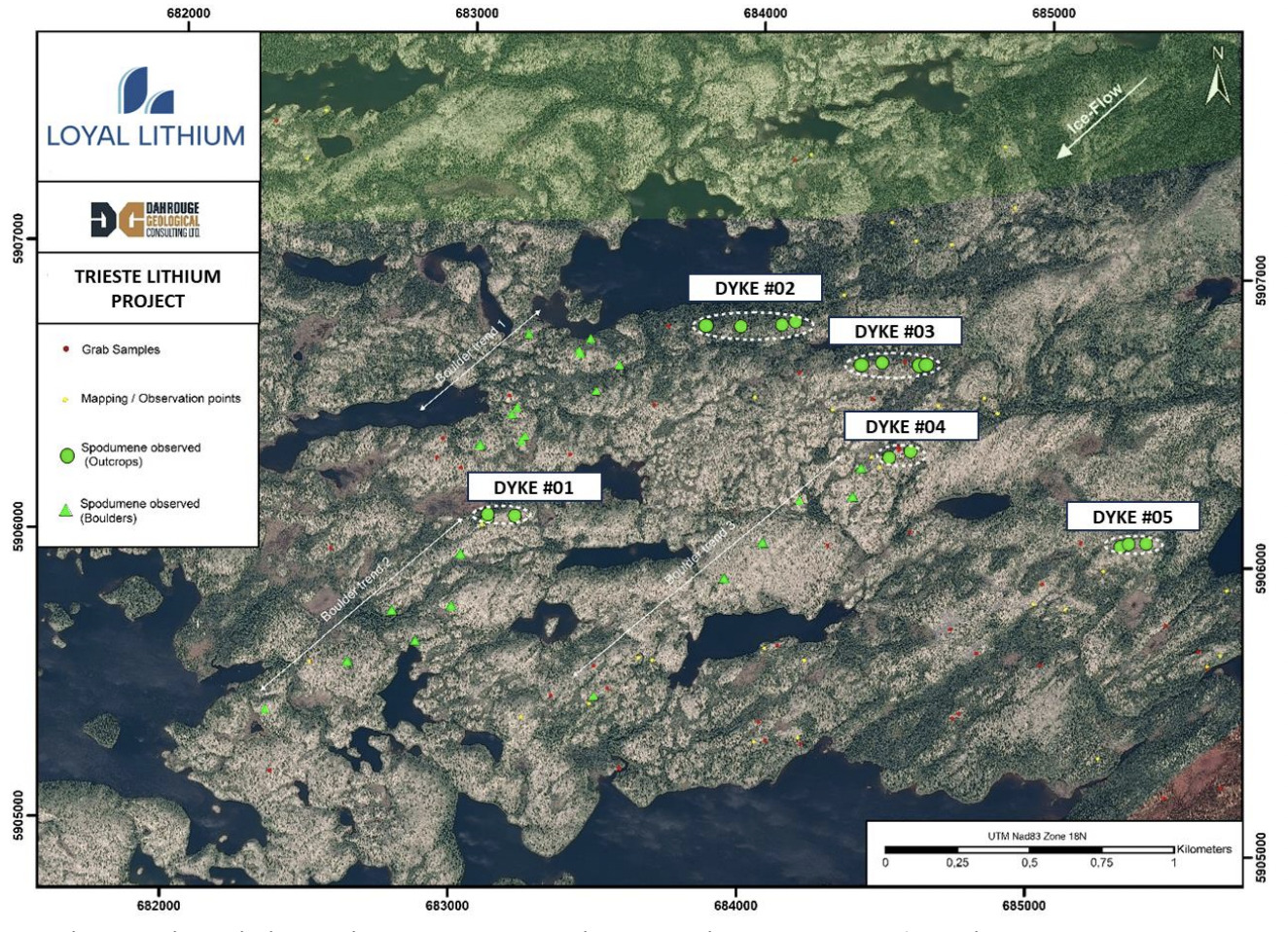

Up-and-coming lithium hunter Loyal Lithium has this morning announced the discovery of five spodumene-bearing pegmatite dykes at the Trieste Lithium Project in the battery metal’s new hotspot – James Bay, Canada.

The Quebec explorer is describing the find as “a significant breakthrough” in its ongoing campaign in the region.

The five dykes, with aligned implied continuous outcrops, have been identified within a 6km2 area to the south of the Trieste Greenstone Belt, “situated in a metasediment host – leaving several high value greenstone targets yet to be explored”.

Preparation for drilling activities at these locations is set to commence imminently, and the exisiting in-field team from Dahrouge Geological Consulting (DGC) will be engaged in the campaign, increasing its team to 19 operatives.

The team will also be taking on channel sampling, LiDAR surveys, and high-resolution geophysics tasks.

Loyal Lithium’s MD, Adam Ritchie, said: “Although still very early, we are excited by the potential of this fertile area south of the Trieste greenstone.

“The discovery of five spodumene rich dykes gives us great confidence as we accelerate our exploration activities and prepare for drilling.”

LLI share price

EVOLUTION ENERGY MINERALS (ASX:EV1)

The graphite-focused exploration company has today announced it’s inked a strategic investment agreement, binding offtake agreement and transformational MoU for “downstream collaboration” with none other than the world’s leading battery anode producer, China’s BTR New Material Group.

Seems like a big deal, that, and investors are liking it this morning.

EV1 reckons the benefits of this agreement will manifest in the following key ways:

• Ensuring ~90% of Evolution’s graphite is under offtake with globally leading customers, which supports project economics and is expected to enhance project financing proposals.

• The provision of strategic financial support, with potential for further BTR funding contributions.

• The partnering with BTR’s anode processing technology is expected to provide an “accelerated yet de-risked solution to becoming a vertically integrated supplier of battery anode materials”.

It apparently all amounts Evolution’s, er, evolution towards becoming a vertically integrated producer of lithium-ion battery anode materials.

Evolution MD Phil Hoskins called the agreement a “transformational opportunity” for the company, adding that it provides “further validation of the Chilalo project’s quality, including the significant value-added potential into battery anodes”.

Evolution’s Chilalo Graphite Project is in southern Tanzania with a focus on downstream processing into value-added graphite products.

EV1 share price

AMERICAN WEST METALS (ASX:AW1)

(Up on no news)

AW1 continues to be a copper-toned success story, gaining again nicely so far today, and up a whopping 500%+ since announcing two big hits at its Canadian Storm copper project on June 6.

But don’t take our word for it (actually do) – the chart tells the story, with Bitcoin-of-yore-like gainz, fanging up hard from about 5c to where it sits at about 31c, at the time of writing.

To refresh your memory, the diamond drilling back in June uncovered a new near-surface zone of mineralisation and a deeper sediment-hosted copper system in an underexplored area of the Storm project in Canada’s remote Nunavut territory.

Over 76m of near surface breccia copper sulphides with zones of massive sulphide were intersected in hole ST23-03.

And then there was 2m of visual breccia and dense vein style copper sulphide (chalcocite, bornite and chalcopyrite) between 273m and 275m downhole.

Notably, the deeper intersection was interpreted to correlate with the prospective sediment hosted copper horizon intersected earlier this season.

“The new near surface copper zone has been named Thunder, which highlights the strength and significance of the discovery,” MD Dave O’Neill said at the time.

The company has no fresh news today, but it’s announced it’s holding a general meeting of major shareholders in Perth next month.

AW1 share price

BALLYMORE RESOURCES (ASX:BMR)

(Up on no news)

Gold-hunting junior Ballymore Resources is part of a crop of Queensland explorers hoping to make the Sunshine State a golden state once more.

“Queensland was once one of Australia’s true golden gooses,” wrote Stockhead’s Josh Chiat late last month.

“Known for its copper riches and bounty of steelmaking coal, which after a major royalty hike last year is making the State Government billions, Queensland is by no means resource poor.

“But its rich legacy of gold production has been overshadowed as investment has flowed to other jurisdictions and commodities.”

Ballymore has been showing promising signs in the Queensland gold-production push, however, noting in a recent quarterly activities report that it has “four highly prospective projects in prolific Queensland mineral belts which have produced 40Moz gold as well as significant copper, lead, zinc and other critical minerals”.

Recently, the company announced plans to reopen and reignite the Dittmer gold mine in north Queensland, renowned for producing some 54k ounces of the “prettiest commodity” of them all.

“New bonanza gold grades validate the planned Dittmer Mine reopening study,” noted Ballymore, adding that “new drill results and visible gold further confirm the historic Dittmer Gold Mine lode extension”.

BMR share price

At Stockhead we tell it like it is. While American West Metals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.