Resources Top 5: Silver hits and lithium permits

Pic via Getty Images

- Mithril surges on massive high-grade gold and silver hit as it looks to double resource at Mexican project

- Ioneer closing in on permits for Rhyolite Ridge lithium and boron mine in Nevada

- Trigg Minerals up on NSW antimony buy

MITHRIL SILVER AND GOLD (ASX:MTH)

$31 million capped Mithril is up ~120% over the past month, with all of that gain coming in an extraordinary week that has seen it run hot on exploration announcements from the Copalquin project in Mexico.

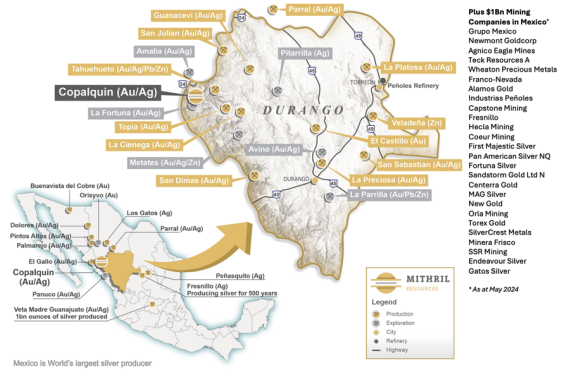

Its conviction is that the district under MTH’s future control, once an option to acquire the project is exercised, can mirror others along Mexico’s plentiful Sierra Madre trend.

Mexico doesn’t have the biggest profile in the ASX mining world, but it is the world’s dominant silver producer.

Mithril’s El Refugio contains a resource of 529,000oz at 6.81g/t gold equivalent. Its newest hit at the Target 1 (El Cometa) area shows that will almost certainly grow.

The headline strike in hole CDH-159 marks Mithril’s best intercept at the property to date, striking 33m at 31.8g/t gold and 274g/t from surface.

From 18m downhole there’s a 7m section at an even higher 144g/t gold and 1162g/t silver, with 2m from 20m deep grading 495g/t gold and 3765g/t silver.

The news comes after a modern LiDAR survey, which doubled the number of historic workings in the Copalquin district for Mithril to follow up.

MD John Skeet is hoping to double the size of the El Refugio resource by early next year.

“Hole CDH-159 is a globally significant >1,000 g/t AuEq1 x metre drill hole at the maiden resource Target 1 area where we aim to 2X the (529koz @6.81 g/t AuEq1 ) resource in Q1 2025,” he said.

“The intercept includes a zone of lower grade material from surface plus a very high-grade zone from 16 metres down hole, including the typical bonanza gold and silver grades that are a hallmark of this important mining district.

“With the exceptional dill results combined with our recent LiDAR survey, district access road upgrade works and development of the district geologic model, Copalquin continues to progress as another significant gold-silver district in Mexico’s prolific Sierra Madre Trend.”

Cue a ~48% lift in MTH shares.

IONEER (ASX:INR)

In spite of weak lithium prices, US-focused Ioneer has set its sights on a potential 2028 start date for commercial production and December 2024 date for FID on its Rhyolite Ridge lithium and boron mine in the USA.

The company published its final environmental impact statement today for the project, which has the potential to quadruple domestic production of lithium in the United States, where carmakers are finding it tough to find material that complies with rules to garner tax incentives in the Inflation Reduction Act.

Currently the only commercial source of lithium domestically in the USA is Albemarle’s Silver Peak brine operation.

At 5000t LCE, that’s a fraction of the output of the giant hard rock lithium mines in Australia.

Importantly, the release of the final EIS includes an opinion from the US Fish and Wildlife Service that it won’t jeopardise the future existence of the Tiehm’s Buckwheat, a flowering plant in the Silver Peak region of Esmeralda County, Nevada.

“Since Ioneer’s work at Rhyolite Ridge began in 2016, we have listened to members of the community and adapted our plans to maximise the project’s many economic benefits while minimising indirect impacts to the community and environment. Rhyolite Ridge is stronger because of the extensive collaboration and input from all involved stakeholders,” Ioneer MD Bernard Rowe exclaimed.

“Today’s issuance not only advances the Rhyolite Ridge project but brings the United States closer to a more secure and sustainable source of domestic critical minerals.”

Exec chair James Calaway added: “We look forward to the conclusion of the 30-day statutory waiting period and timely issuance of the Record of Decision to advance Rhyolite Ridge into construction. We are eager to get to work in contributing to the domestic supply of critical materials essential for the transition to a clean energy future.”

Ioneer signed a deal with Sibanye-Stillwater all the way back in September 2021 to bring the project to fruition, with Sibanye pledging a conditional US$490 million commitment to take a 50% interest in Rhyolite Ridge.

It also has US$700m in conditional loan funding tom the US Department of Energy. The project will produce 22,000tpa of lithium carbonate and 174,400tpa of boric acid at a lithium carbonate equivalent cost of US$2510/t, according to the latest numbers from Ioneer at a US$785m capital cost.

However, its DFS was completed over four years ago in April, 2020. While it’s down 12% in the past 12 months, Ioneer is one of the few lithium stocks sitting on YTD gains in 2024, up ~35%.

TRIGG MINERALS (ASX:TMG)

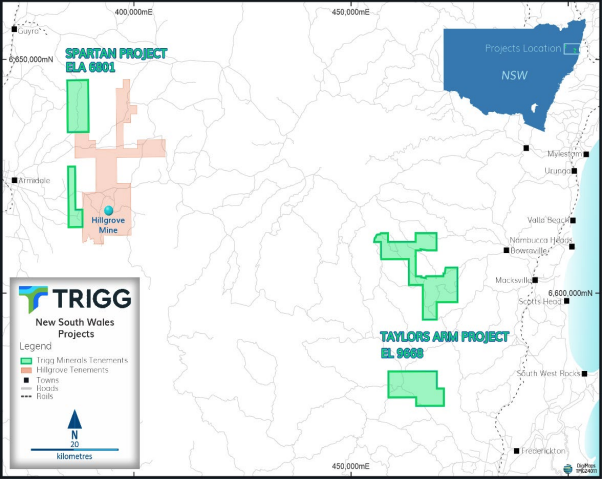

Reborn after originally listing in WA’s short-lived wave of potash proponents, Trigg has two major exploration fronts at hand now after securing a project where the company says some of Australia’s highest grade antimony has been found.

It started drilling earlier this week at the Drummond project in Queensland, where the explorer is searching for an analogue of the 3.6Moz Pajingo mine.

But the company has today acquired the Taylors Arm and Spartan assets in the New England Orogen of New South Wales.

The latter is next to Hillgrove, Australia’s largest known deposit of the critical mineral, which has doubled in value this year and surged in investor interest since China initiated export controls in August.

Taylors Arm, though, has the historic antimony chops. Its 71 historic workings include Testers, where grades from massive stibnite veins clocked 63% Sb, regarded by TMG as the highest in Oz.

Also in the package, the Swallows Nest mine started during World War 2 and delivered a 40% Sb concentrate from 1940-1955 along with a 30% product when it reopened in 1972, with recent rock samples showing the grade could still be there (29.8% Sb and 31.4% Sb).

The Purgatory mine produced 1229t of antimony at a grade of 42.27% Sb from 1935-1954, while prospectors have uncovered further significant mineralisation at the Bradleys mine in more recent times.

“Trigg’s acquisition of ultra-high-grade antimony assets in NSW represents a transformative transaction for the Company, significantly enhancing its strategic resource portfolio,” TMG executive chairman Timothy Morrison said.

“The move into the antimony space positions Trigg to capitalise on growing demand for the critical mineral and strengthens our market presence. With successful exploration, we can achieve a strong foundation for future growth and profitability.”

PINNACLE MINERALS (ASX:PIM)

(Up on no news)

Pinnacle Minerals is running higher a day after the resignation of its CEO and managing director Nic Matich, amid a ‘strategic review’ looking at cutting costs, streamlining exploration activities and assessing acquisitions.

“On behalf of the Board, we thank Nic for his significant contributions to the Company throughout his time with Pinnacle and wish him every success in his future endeavours,” chair Chub Witham said.

Matich was originally appointed back in September 2022, with the company exploring for lithium in Quebec, Canada, mineral sands near Iluka’s operations at Capel in WA and rare earths in South Australia.

It had roughly $1.5m in the bank at June 30.

SOUTHERN HEMISPHERE MINING (ASX:SUH)

(Up on no news)

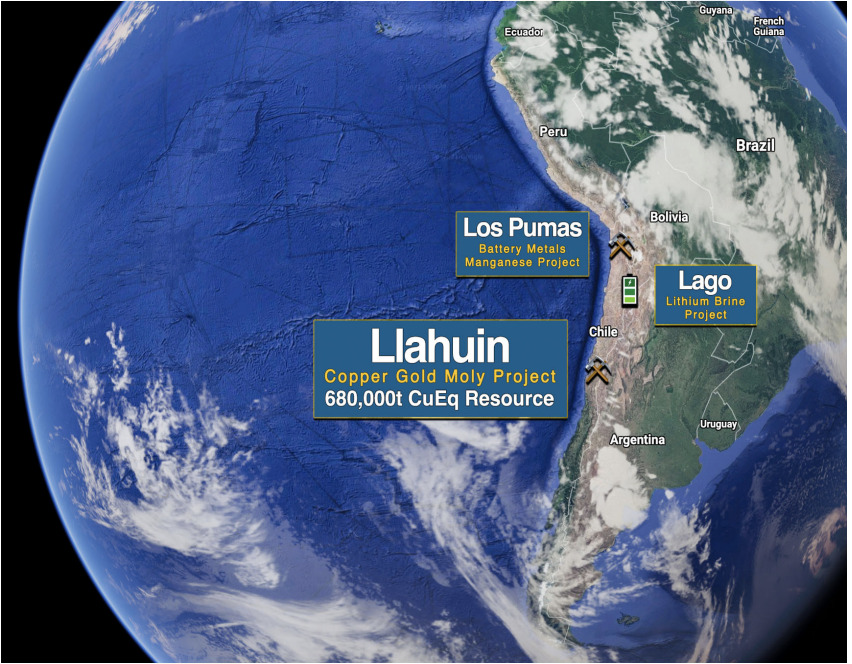

Southern Hemisphere Mining had nothing to report today, but investors could be punting after digesting news from yesterday that drilling would be starting at the Llahuin copper, gold and moly project in Chile.

Drilling will start next month, with the $12.5m explorer chasing a resource upgrade by the second half of 2025 to up its 680,000t copper equivalent resource.

Up to 5000m of RC and diamond drilling will be completed by local contractor R Munoz Drilling, with a key target hole aiming to extend a hole drilled to a depth of 644m in 2013, giving a low cost entry to the secrets of a target zone north of the Cerro-Ferro porphyry deposits to a depth of 1200m.

Drilling will also be undertaken into the promising Curiosity copper-gold porphyry target, where samples of outcrops reported grades of up to 0.69% copper, 7.38g/t gold, 8.3g/t silver and 459ppm molybdenum.

“Regular updates will be provided during the drilling and as assay results are received from the ALS laboratory in Santiago with first results expected mid-November,” SUH said.

At Stockhead, we tell it like it is. While Mithril Silver and Gold and Trigg Mining were Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.