Resources Top 5: Santa Fe jumps five-fold on Côte d’Ivoire gold acquisition

Santa Fe Minerals jumped impressively on Thursday. (Pic: Nicola Olyslagers of Team Australia, winner of the Diamond League event in Stockholm in June 2025. Getty Images)

- Santa Fe Minerals is acquiring the Eburnea gold project in Côte d’Ivoire

- Bendigo-style mineralisation has been confirmed in the first diamond hole at Blue Moon prospect in Victoria

- Drilling is about to start in Sipa Resources’ maiden campaign at Tunkillia North and Nuckulla Hill gold projects

Your standout small cap resources stocks for Thursday, July 3, 2025

Santa Fe Minerals (ASX:SFM)

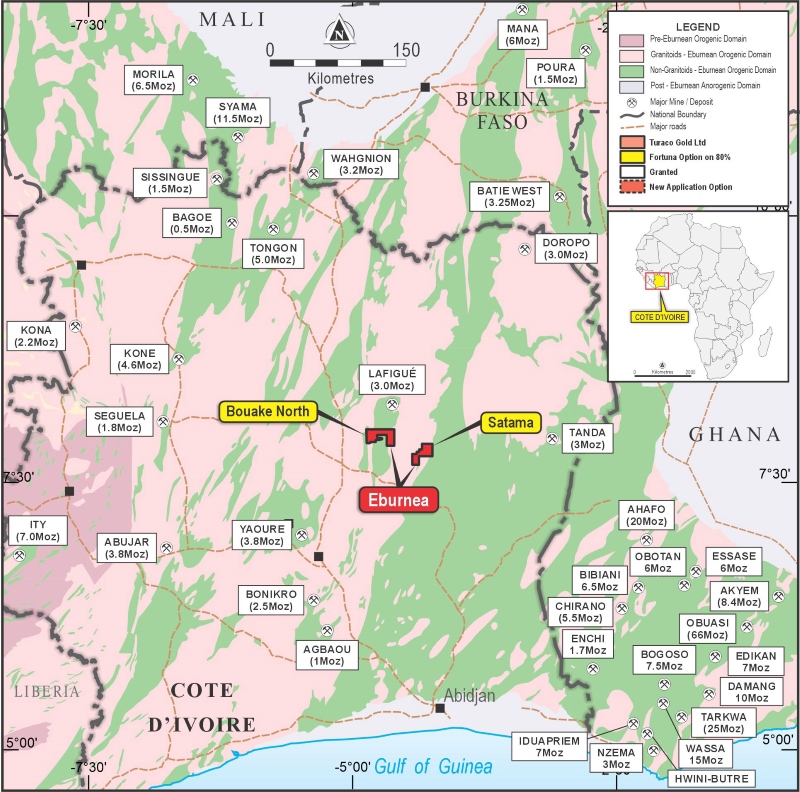

Santa Fe Minerals (ASX:SFM) jumped more than five-fold to a three-year high of 16c after executing a deal to acquire the Eburnea project in Côte d’Ivoire from Turaco Gold (ASX:TCG).

Binding share purchase agreements will give SFM 100% of the Satama permit covering 168.7km2 and up to 90% of the Bouake North application covering 380.8km2 once granted.

Satama has shown promise, with hits like 26m at 4.82g/t gold, and sits on a 2km-long mineralised zone with plenty of room to grow as geophysical surveys and historical results suggest there are multiple repeat parallel zones.

The deal for the under-application Bouake prospect, which lies 35km from Endeavour’s 3Moz Lafigue mine (3Moz at 2.0 g/t), will see SFM acquire 65%, with the right to increase to 80% upon granting and an option to further increase to 90%.

Satama and Bouake North have been explored for gold via soil and auger geochemistry, geophysics and several phases of aircore and RC drilling.

Drilling has identified multiple gold mineralised zones that have good potential to define significant resources with additional exploration.

At Satama, most of the drilling in the Main Zone has been within the shallow oxide zone, however, some deeper holes show good continuation of mineralisation into fresh rock.

West of the Main Zone geophysics and geochemistry identified several sub-parallel mineralised zones with strike lengths of up to 3km. These have only been lightly drilled and are confirmed by strong shallow intersections in aircore drilling and remain priority targets.

Exploration at Bouake North comprising auger drilling has defined collectively 6km strike of +100ppb gold.

To fund the move, Santa Fe has secured $1.2 million at 5c a share, a 61.3% premium to the last closing price, all subject to shareholder and ASX sign-off.

The sale is consistent with Turaco’s focus on the development of the Afema gold project in southern Cote d’Ivoire and follows divestments of other non-core permits to Many Peaks Minerals, Aurum Resources, Awale Resources and Fortuna Mines.

Falcon Metals (ASX:FAL)

Falcon Metals is parked at the doorstep of the world-class 22Moz Bendigo Goldfield with the Blue Moon prospect in central Victoria and is revving up its engine after confirming Bendigo-style mineralisation in the first diamond hole.

The hole intersected several narrow high-grade gold-bearing quartz lodes and returned 2.2m at 6.5g/t gold from 41.2m, including 0.3m at 39.2g/t from 41.2m; and 2.4m at 8.4g/t from 600m, including 0.3m at 48.7g/t from 600m and 0.3m at 18.2g/t from 602.1m.

There may be more to come as FAL has only received partial results.

Investors welcome the early success with shares reaching 21.5c, an increase of 38.71% on the pre-trading halt close on June 30.

The hole targeted the interpreted northern down-plunge continuation of the Garden Gully anticline trend, at the previously undrilled Blue Moon target area.

Garden Gully anticline was the most productive in the Bendigo Goldfield and is estimated to have produced 5.2Moz at 15g/t from areas where the more prospective parts of the sequence outcropped or were close to the surface.

The new results and the presence of visible gold from the first hole have confirmed the conceptual target and provide good vectors for wedge holes to test for wider zones of mineralisation closer to the fold hinge.

“This is an exciting start to the drill program, intersecting high-grade veins in our first hole in the east limb of the anticline,” Falcon Metals’ managing director Tim Markwell said.

“The recognition of Bendigo-style mineralisation with visible gold proves our concept that the high-grade Bendigo lodes plunge into Falcon tenure and provides encouragement to drill wedge holes, in order to track these zones closer towards the fold hinge, where they are usually thickest.”

Remaining assays for the hole are expected to be received in the coming weeks and given results from thus far, the rig has started a wedge hole to test targets T552, T600 and T643 closer to the fold hinge.

Shallower targets will be tested by a new hole from surface.

SIPA Resources (ASX:SRI)

Drilling is about to start in Sipa Resources’ maiden campaign at the new Tunkillia North and Nuckulla Hill gold projects in South Australia and shares reached 1.7c, a lift of 21.43%.

RC drilling will start next week and the initial aim is to infill and extend previously identified gold mineralisation at Bimba and Sheoak prospects within Nuckulla Hill, which is in the same shear zone that hosts Barton Gold’s (ASX:BGD) 1.6Moz Tunkillia deposit.

The two projects were acquired in December 2024, host multiple advanced and large-scale prospects and cover ~40km of the Yarlbrinda shear zone – a 150km long and 12km wide structure analogous to the major Kalgoorlie Shear Zone in WA.

While exploration is still in its early phases, evidence has emerged that the Yarlbrinda Shear Zone extends from Barton’s Tunkillia deposit into Nuckulla Hill.

Both projects also host rock types similar to those at Barton’s deposit.

WIA Gold (ASX:WIA)

Positive results have been fielded from 33 RC drill holes and 11 diamond holes in a 11,192m campaign by Wia Gold (ASX:WIA) to upgrade and expand the 2.12Moz Kokoseb Gold Project in Namibia.

In Southern Zone RC drilling returned up to 50m at 12g/t Au from 188m, including 1m at 528g/t, and this is the most significant gold intercept returned to date at Kokoseb.

Other results were 24m at 2.42g/t Au from 100m, 23m at 2.36 g/t from 92m and 27m at 2.34 g/t from 123m.

At Central Zone drilling extended the high-grade shoot with an unconstrained intercept of 118.3m at 1.46g/t Au while infill drilling returned 28m at 1.57g/t from 9m and 33m at 1.47g/t from 87m.

Diamond drilling at Central extended the high-grade shoot a further 200m down plunge and returned 9.7m at 4.66g/t Au from 477.9m, including 5.1m at 7.40g/t, and 5.7m at 5.82 g/t from 493.2m.

All zones remain open at depth and along strike with all new assays to be included in an MRE update which remains on track to be released in July.

Coronado Global Resources (ASX:CRN)

Despite volatile met coal prices and markets, Coronado Global Resources is moving ahead, being 29.63% higher to a daily high of 17.5c.

A number of moves have been made in the past month to support liquidity including a refinanced debt facility with private equity firm Oaktree Capital Management and up to US$150m in additional liquidity from Stanwell Corporation in exchange for thermal coal supply of up to 800,000tpa over five years from 2027.

On July 3 in response to media speculation suggesting that it is in discussions with certain parties about a sale of assets or the business, CRN confirmed to the ASX:

“The company has engaged in discussions with certain counterparties about a potential sale of a minority interest in certain assets but has not received any binding proposal from any party and has not made any decision as to whether it will proceed with a sale or any other form of transaction.”

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Sipa Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.