Resources Top 5: Sabre more than rattles, boosting lithium hunt; Auric rakes in $5m gold sales; GDM hits ASX

Pic via Getty Images

- Sabre Resources “more than doubles” its lithium tenement footprint in the Pilbara, WA

- Auric Mining celebrates a golden $5m payday

- Lion One uncovers a bonanza-grade mineralised structure in Fiji

- And another goldie, newcomer Great Divide Mining hits the ground running on the ASX

Here are the biggest small cap resources winners in early trade, Friday August 25.

SABRE RESOURCES (ASX:SBR)

Peak Asset Management recently nominated Sabre Resources as one of its top lithium plays. It’s beginning to seem like a pretty good shout.

SBR, an explorer focused on a hunt for nickel sulphide, lithium and gold assets in Western Australia along with uranium and base metal prospects in the Northern Territory, is up today on big news regarding the lithium aspect of its portfolio.

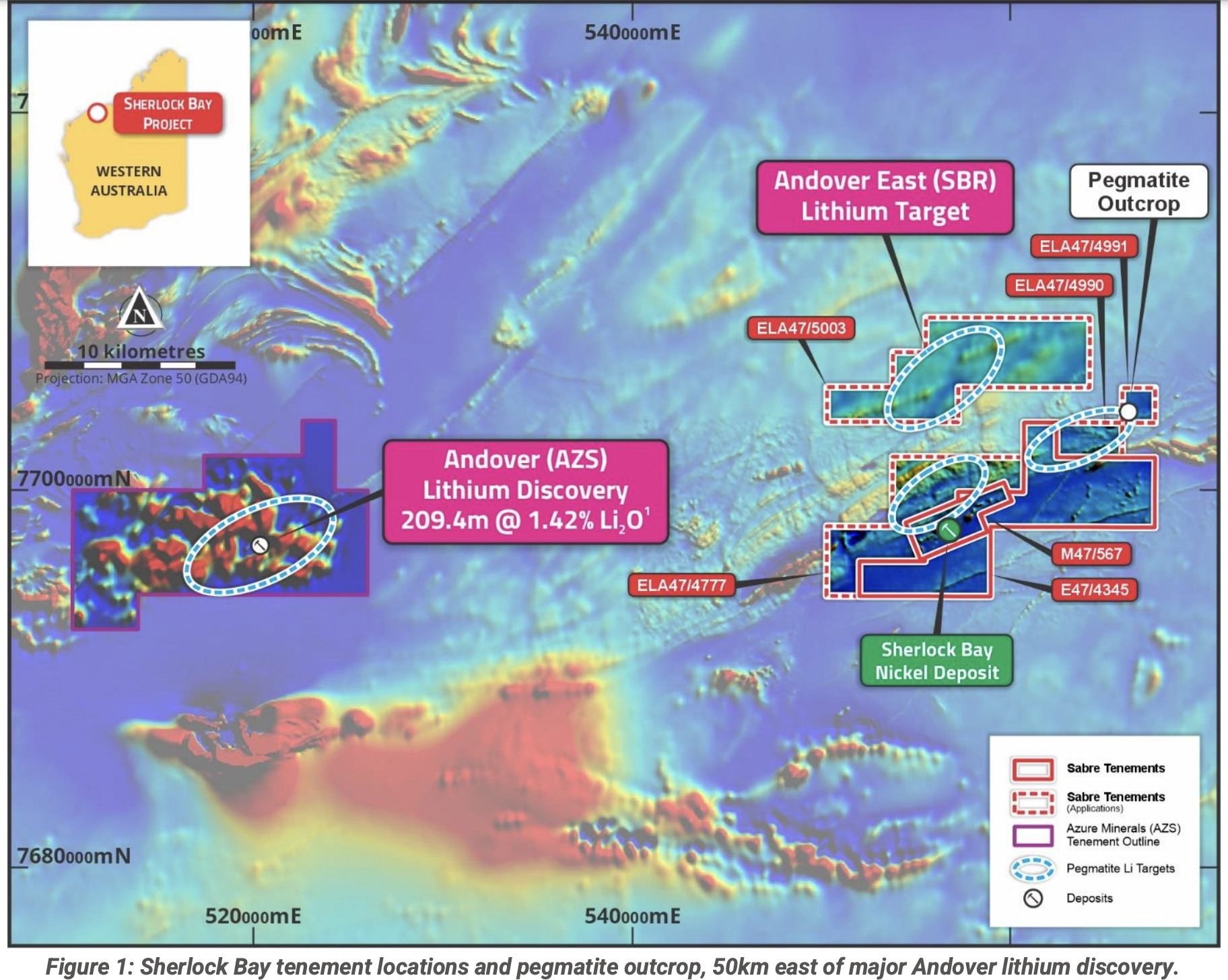

The company has announced this morning it’s “more than doubled” its tenement footprint at its nickel-copper-cobalt and lithium-hunting Sherlock Bay project at Andover East in the Pilbara in WA.

It now represents a “very large, more than 210 square kilometre tenement holding” notes the company.

And yep, it’s another project that’s just down the road (directly to the east) from the big-hitting Mark Creasy-backed Azure Minerals (ASX:AZS) Andover discoveries – within the same structural-intrusive corridor.

Our #tenement footprint at the #SherlockBay Project has more than doubled, including a major new tenement application.

Full #ASX announcement here 👉 https://t.co/71LwghzoyJ$SBR #SBR #lithium #lithiummining #mining #WesternAustralia #asxnews #MiningStocks@SabreResources pic.twitter.com/El0mjQbfEY

— Sabre Resources Ltd (@SabreResources) August 24, 2023

The tenement increase includes a major new application at Andover East that represents a new major lithium target for the company. Sabre says the location covers “Andover Lithium Project “look-a-like” targets on a “northeast trending magnetic low”.

Azure Minerals recently produced intersections of up to 209.4m @ 1.42% Li2O1 from pegmatites (lithium-bearing rocks) in similar conditions.

Sabre notes that its Andover East targets lie under soil cover. East of these target areas outcropping pegmatites (see above) have been located across a 140m wide zone.

“Sampling of the outcropping pegmatites, as well as those intersected by recent drilling at the Sherlock Bay nickel deposit, produced anomalous lithium, cesium and rubidium as well as gallium results,” reads today’s announcement.

Sabre Resources CEO, Jon Dugdale said that its expanded area “supports the high prospectivity of the Company’s Sherlock Bay tenements for the location of major lithium discoveries.

“Following grant of the new tenement applications, the next steps will include detailed geophysical programs including gravity measurements to locate buried pegmatites that will then be tested with bedrock aircore drilling.

“The drilling will test for buried lithium bearing pegmatites within this highly prospective tenement package within what is now recognised as a world class lithium pegmatite region.”

SBR share price

AURIC MINING (ASX:AWJ)

Auric Mining, which anyone who grew up partly on a diet of Saturday-evening James Bond flicks surely can’t help but imagine being run by Bond villain Auric Goldfinger, is well up today on the news of some you-beaut gold sales that’ve boosted the company’s revenue.

And it’s talking more than $5 million in revenue. Midas touch-tastic, or what?

It comes from the company’s first toll milling campaign on gold-bearing ore from its Jeffreys Find mine, which has yielded 1,721 ounces of gold – sold from the first 36,180 tonne ore parcel.

It was sold at an average price per ounce of AUD$2,939, generating a total gross revenue of $5,057,527.

The firm also notes that the mining of the Stage 1 pit has been completed, with ore haulage to the Greenfields Mill ongoing.

Approximately 145,000 tonnes will be processed in the next toll milling program, and that will kick off in early September.

“This is a tremendous result for Auric,” said Auric’s managing director Mark English.

“Nevertheless, it’s just the start. The second parcel of approximately 145,000 tonnes will be processed by the Greenfields Mill commencing early September 2023 in one batch, which is also terrific news.

“We now have confirmation of grade and plant recovery. With a gold price at around AUD$2,950/ounce, Auric will soon receive a substantial cash flow injection.”

We expected you talk, Auric… and you didn’t disappoint.

📣It’s what every explorer dreams of!

Wow!🤩 This 6.6kg gold doré bar is worth more than half a million dollars! Just part of the $5 million worth of gold sold from Jeffreys Find Gold Mine at Norseman. Serious cash flow to follow shortly for @AuricMining as its JV partner, BML… pic.twitter.com/jqrO38EgLt

— Auric Mining Limited (ASX:AWJ) (@AuricMining) August 25, 2023

AWJ share price

LION ONE METALS (ASX:LLO)

Small Canadian gold hunter Lion One Metals has this morning announced the discovery of a new mineralised structure carrying bonanza grade gold 1km to the north of the company’s 100% owned Tuvatu Alkaline Gold Project in Fiji.

Surface sampling has returned multiple high-grade results up to 92.55 g/t gold.

The find has been dubbed “The Lumuni occurrence”, and reportedly shows “a width at surface of approximately 0.5m to over 1m, and is manifested as two mapped zones of what may be a single continuous feature”.

More specifically, sampling of the structure has offered up the following results: 66.83g/t Au over 0.7m in Hole CH3850, 48.45g/t Au over 0.7m (including 92.55g/t Au over 0.3m) in Hole CH3851, and 15.18g/t Au over 1.1m (including 31.25g/t Au over 0.3m) in Hole CH3849.

TSX rebounds from 2-month low as the index rallied on Wednesday, led by #mining shares.

Is this emerging gold player on your radar? @liononemetals recently announced the discovery of New Bonanza Grade #Gold Lode 1 KM North of Tuvatu.

Learn More: https://t.co/S25h2CrqZ3… pic.twitter.com/Z3cmrfnOu7

— BTV & CEO Clips (@BTVCeoClips) August 24, 2023

As you’d expect, Lion One’s chairman and CEO Walter Berukoff is a bit chuffed.

“We’re very pleased with the discovery of the Lumuni occurrence,” he noted, adding that it was made as part of the company’s ongoing regional mapping and sampling program throughout the Navilawa Caldera location.

“What makes this discovery so outstanding is the continuity of the high-grade material,” he explained.

“It is not a single bonanza-grade sample, but rather a traceable lode of high to very-high grade material that can be followed along at surface.

“The fact that these high-grade samples coincide with a steeply dipping resistivity low is even more compelling as it provides us with immediate drill targets to pursue. We can now add Lumuni to our growing list of high-priority regional exploration targets.”

LLO share price

GREAT DIVIDE MINING (ASX:GDM)

This Brisbane-based mining outfit is a brand-new entrant to the local bourse and has made an immediate impression on investors following a $5 million public offering.

The company is focusing on a high-potential portfolio of gold and critical metals assets with initial emphasis on its Yellow Jack gold project in Greenvale, Queensland.

That’s a shallow, open-resource site that, the company notes, has close proximity to existing heap leach and Carbon-in-Pulp process plants enabling project development with limited capital expenditure.

GDM has today confirmed the engagement of a number of consultants it’s brought in to support the development of its mineral resource estimation (MRE), and that process has already kicked off.

The firm’s CEO, Justin Haines: “With our listing today we have hit the ground running by confirming engagement of consultants to work on our maiden JORC 2012 compliant mineral resource estimate at Yellow Jack – which we expect to be completed within the coming weeks.

“We have also commenced seeking tenders for drone-based LIDAR surveys over priority targets as well as further drilling to be conducted at the Yellow Jack Gold project following release of the MRE.”

ASX welcomes Great Divide Mining Ltd. Great Divide Mining focuses on the responsible development of Australian resources. We wish you every success in the future! https://t.co/Exp9VhEyXO#ASXListing #ASXBell pic.twitter.com/BlSts9sIp8

— ASX 🏛 The heart of Australia's financial markets (@ASX) August 25, 2023

GDM share price

AUSTRALIAN MINES (ASX:AUZ)

Up on not much news)

Is battery metals stock Australian Mines re-capturing some long-lost form? It was a right stonker back in 2017, but recent years unfortunately saw it fall away dramatically.

“It’s been in the doghouse over the past few years,” Stockhead’s Reuben Adams succinctly put it recently.

That said… sweeping aside sweeping judgments, are investors finally seeing some value in AUZ again, though? The share price is, for some reason we’re trying hard (again) to fathom this morning, up about 19%.

There’s no news we’re seeing to support this, so we’ll revert back to the last piece of major news the company released via the ASX.

A couple of weeks ago, Australian Mines noted that its CEO Michael Holmes is exiting the company to “pursue other interests” at the end of October.

“Michael will continue as CEO until his departure date as the company explores the market for a new CEO,” read the firm’s last ASX release.

AUZ’s main focus is the Sconi lithium project in North Queensland, which has a binding offtake agreement in place with LG.

Sconi is a big deal for AUZ, but investment decisions surrounding it have been met with hefty delays that have frustrated shareholders in recent years.

Still, it has massive potential, and perhaps another regime shift at the company can get it all moving further in the right direction.

The project is expected to produce 46,800tpa nickel sulphate and 7000tpa cobalt sulphate over a 30-year life. It would, however, cost more than $1.5bn to build.

AUZ share price

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.