Resources Top 5: Russian gold boss flies into Ironbark

Ironbark says former Nordgold CEO Nikolai Zelinski will be its exec chair elect. Pic: Getty Images

- Ironbark Zinc brings former CEO of Russia’s Nordgold on board as future chair

- Black Dragon Gold soars on much ado about nothing, with some updates on the EIA process for its Salave gold project in Spain

- ASQ hits shallow, high grade coarse gold at Koolyanobbing

Here are the biggest small cap resources winners in morning trade, Friday, November 1, 2024. Prices accurate at time of writing.

IRONBARK ZINC (ASX:IBG)

Two years ago then CEO Nikolai Zelenski left Russia’s Nordgold citing the desire to pursue personal investment opportunities.

The timing seemed hardly coincidental. Less than a year on from an aborted attempt to seek legitimacy in the west with a London listing the gold miner, backed by Russian oligarch Alexei Mordashov, was sanctioned after Putin’s war in Ukraine began.

Now Zelenski has re-emerged as the executive chair elect at Ironbark Zinc in an intriguing appointment that comes alongside a $10 million placement led by Argonaut, Taylor Collison and advised on by Bacchus Capital.

The changes are substantial but feature the continuation of Michael Jardine as MD. He called the appointment of Zelenski a ‘transformational moment for Ironbark’. The board continues to boast some interesting names, notably former Australian Foreign Minister and US ambassador Alexander Downer.

Dr Fred Hess will transition to a non-executive director role, while two ex-Nordgold execs will take key roles at Ironbark, Evgeny Tulubenskiy and Igor Klimanov.

Danny Segman, Ironbark’s biggest shareholder, will become a non-executive director while Bacchus Capital founder and former Morgan Stanley global head of metals and mining Peter Bacchus will become an adviser to the IBG board.

Up 75% today, the firm’s shares are set for a 1 for 125 consolidation in line with a raising at 20c, a 20% discount to its 25c per share price (on a post-consolidation basis).

Segman and Zelenski has pledged to apply for $700,000 of shares in the raising, with the bulk of the changes to come into force if shareholders vote it up at an upcoming EGM to be held in mid-December. Others will take place at the AGM on November 28.

What is Ironbark actually doing with the cash?

It’s got a strategic review ongoing on what has been its key asset, the “Tier-1” Citronen zinc project in Greenland. That’s a euphemism for a sale. The company today said it was in discussions concerning Citronen’s potential sale, having in September said it would consider options including an outright project sale, majority sell-down, co-ownership or a spinout.

It’s aiming to make new copper, gold and critical mineral discoveries in Australia and Brazil around Mt Isa and Perseverance (Minas Gerais) with ground also in regional New South Wales.

“With Nikolai joining the team, IBG’s ongoing evolution away from a single asset company to one with a portfolio of growth projects will be greatly accelerated. We are now particularly well placed to consider adding further gold exposure to our existing copper, gold, base and battery metals focused asset suite,” Jardine said.

“It was pleasing to see this strategic evolution so well supported by our existing shareholders, many of whom took the opportunity to increase their holding in the Company, as well as welcoming some significant new shareholders including some very well-known junior resource funds.”

Zelenski’s comments, meanwhile, put acquisitions front and centre:

‘“I am delighted to join Ironbark at this pivotal time and very much look forward to meaningfully contributing to its continued evolution. With our team’s deep operational and strategic experience in the gold sector, we are distinctively positioned to execute on our vision for acquisition-led growth.

“The Ironbark portfolio has already undergone an incredible transformation, providing a diversified exposure across various stages of project development, multiple jurisdictions, and a mix of commodities.”

BLACK DRAGON GOLD (ASX:BDG)

(Up on no news)

Black Dragon Gold’s done little more than release a quarterly report yesterday but the company is climbing today as it delivered a string of sort of updates in its quarterly report on the 1.5Moz Salave gold project in Asturias in Northern Spain.

There wasn’t much in the way of actual updates, aside from commentary about support from pro-mining stakeholders, who “expressed frustration at the slow process relating to the Environmental Impact Assessment progressing”.

“At a local level, the Tapia de Casariego Town Council (“Council”) continued to consider the application to change the land designation use at Salave from agricultural to industrial to allow mining activity,” the explorer said.

“Consideration by Council will cover planning aspects, while an environmental assessment will be conducted by the Principality of Asturias. Spain-based General Manager Jose Dominguez continues to lead collaborative discussions on the ground with a range of key local stakeholders.

“As previously reported, Company representatives remain in regular communication with local (Tapia) and regional (Asturias) levels of government to progress EIA approval and relevant zoning changes for Salave Gold.”

The company’s shares are up a fairly crazy 81% today.

BDG recently made a placement to Spanish investors in a bid, it said to align them with its Salave permitting programme.

“We are delighted to have attracted key new Spanish investors to the Company’s register. We look forward to working with our Spanish investors and aligning our immediate corporate objectives to advance the Company’s Salave Gold permitting programme,” exec chair Dominic Roberts said on Wednesday.

The company’s Spanish subsidiary had first initiated the EIA procedure for Salave in 2019, submitting a dossier on public comments in 2022.

AUSTRALIAN SILICA QUARTZ (ASX:ASQ)

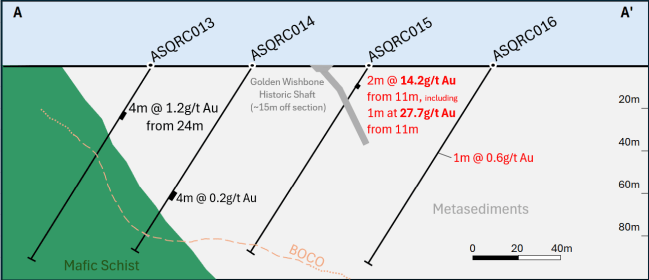

Finally, some drilling results to sink your teeth into. ASQ lifted ~30% on some ‘high grade’ gold hits at the Koolyanobbing metals project, located near Southern Cross in WA, in a region best known for its long-running iron ore mine.

Hits were indeed high grade though relatively narrow. A 2m section of 14.2g/t from 11m (the first metre at 27.7g/t) came in a re-assay of a hole that struck 4m at 4.44g/t from 8m at the Golden Wishbone prospect, identifying coarse gold greater than 100µm.

Over at Emu a hit of 2m at 2.9g/t from 63m with 1m at 3.8g/t from 64m was an upgrade on a previously reported 8m at 0.7g/t from 60m.

There’s also a freshly reported 1m at 0.6g/t which didn’t make the list of highlights.

This is all early doors stuff. Aircore drilling is planned for Golden Wishbone in late 2024 following the 16 hole, 1479m reverse circulation program that delivered today’s assays.

Golden Wishbone is a 650m-long gold in soil anomaly at the top of what ASQ says it an 8km gold trend, including an abandoned 1930s shaft which produced a reported 204oz at 18g/t from a lone vein.

“Whilst several historic surface prospecting trenches have been constructed in the area, the public record suggests no modern exploration has been undertaken. During September 2024 a four hole, 413m RC program was completed testing the central part of the gold target,” ASQ said.

RTG MINING (ASX:RTG)

(Up on no news)

Another gainer moving on an end-of-month quarterly report, RTG says it’s nearing completion on financing for a first direct shipping ore stage for its Mabilo copper and gold project in the Philippines, which it says will deliver net cashflow in excess of US$50m.

TSX and ASX-listed RTG owns 40% of Mt Labo Exploration and Development Corporation, the holding company for Mabilo.

It stands to receive a 2% net smelter royalty and will be repaid a loan of US$27m from cash flows from the first stage of the project, RTG says.

Its cash flow will assist in financing internally its stage 2 equity contribution on the project, which will require the construction of a 1.35Mtpa plant.

A feasibility study on this development is pretty dusty, having been announced in March 2016. But RTG says Stage 1 will deliver 27,800t of copper and 7600t of gold from a 104,000t supergene chalcocite zone with an average reserve grade of 20.7% Cu.

“We continued to make important progress during the quarter towards the start-up of our Stage 1 DSO activities at Mabilo and I am pleased to report that financing and offtake negotiations with the relevant parties are expected to be finalised imminently,” president and CEO Justine Magee said.

“The finalisation of the Stage 1 financing and offtake term sheet will trigger an exciting phase of activity for RTG and its in-country JV partner, highlighted by a high-grade DSO that will mine, amongst other products, approximately 100,000t of supergene chalcocite material which runs in the order of 21% reserve grade copper.

“Mabilo represents a world-class copper and gold asset underpinned by robust commodity prices and strong project economics that include very attractive early cashflows from Stage 1.

“We would like to thank shareholders and investors for their patience over recent months while we work to finalise these important agreements, and we look forward to further updates as we move toward operational startup.”

ARK MINES (ASX:AHK)

(Up on no news)

The owner of the Sandy Mitchell monazite project in Queensland, an agglomeration of industrial mineral sands and rare earth metals, AHK released its quarterly report on Wednesday.

AHK updated its mineral resource and exploration target during the September quarter, also submitting a mining lease application for Sandy Mitchell post quarter’s end.

A scoping study is upcoming, with a pre-feasibility study to follow, as detailed in our round up of quarterly reporting from a host of Queensland explorers this morning.

READ: Queensland’s new era turns focus to rare earths, silver, gold and energy developers

“Sandy Mitchell is not only a unique Rare Earth and Heavy Mineral gravity beneficiated sand project, but it has the potential for world class scale,” AHK exec chair Roger Jackson said in the Wednesday’s September results update.

At Stockhead, we tell it like it is. While Ark Mines is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.