Resources Top 5: Royal ASX small caps lead the way with copper and gold

Pic via Getty Images

- Lord bets on below-surface copper

- Saudi Arabian gold lights up investor eyes to AuKing

- Rock chip grades up to 24.2g/t gold erupt Red Mountain shares

Here are the biggest small cap resources winners in morning trade, Wednesday, November 6. Prices accurate at time of writing.

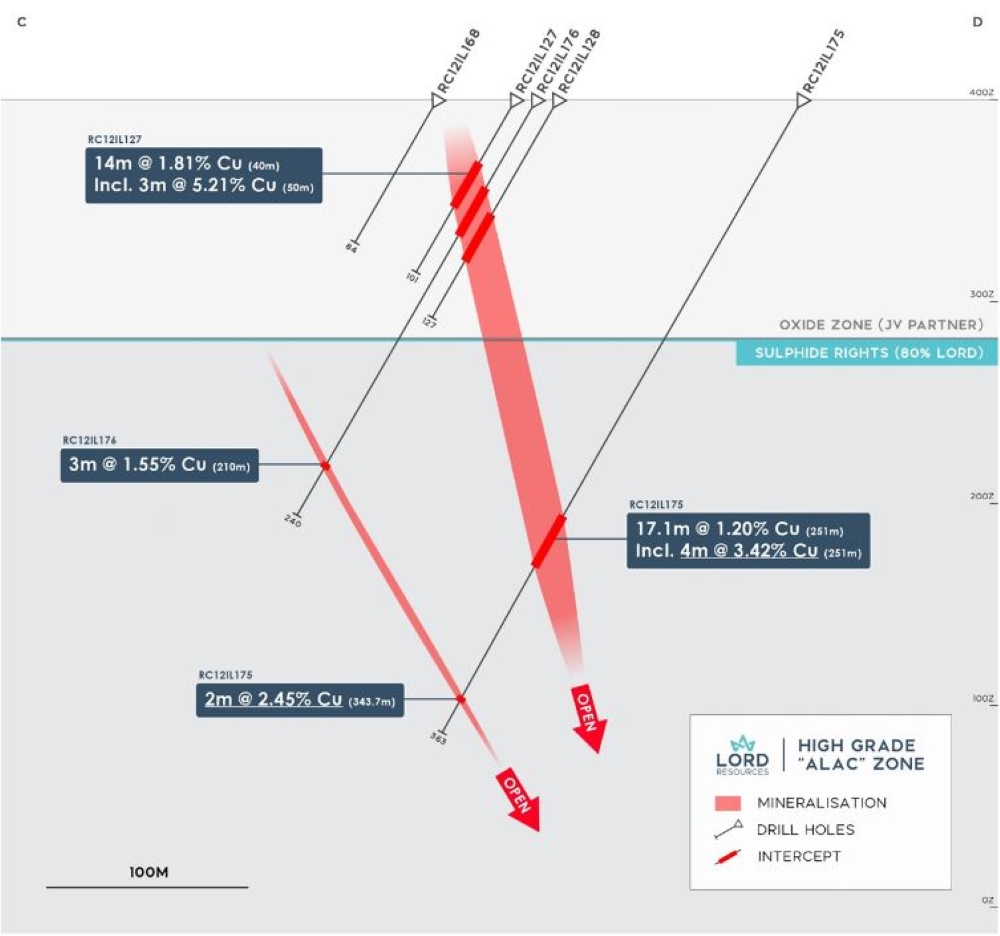

Lord Resources (ASX:LRD)

LRD has snapped up an 80% interest in the sulphides within the Ilgarari copper project from Blackrock Resources – with a stipulation that it has rights to minerals 120m below and further from the natural surface.

The acquisition presents a low-cost entry into a highly prospective copper project for LRD, where historical drilling at depth returned high-grade copper of up to 6.62% and had defined mineralisation of >4km across steeply dipping NE-trending structures.

LRD CEO Andrew Taylor says the acquisition represents a unique opportunity to secure a JV in a highly prospective copper project in a Tier-1 jurisdiction north along the Great Northern Highway from Sandfire Resources’ (ASX:SFR) DeGrussa copper-gold mine.

“Prior exploration has defined mineralisation over 4 km along the Ilgarari Fault and with numerous high-grade hits around both the “Main” and “Alac” workings,” Taylor says.

“The Lord team looks forward to undertaking a systematic exploration program for the extensions and source of this mineralisation in conjunction with Blackrock Resources.”

Auking Mining (ASX:AKN)

Probably the only ASX small cap to ply its trade in the Kingdom, AKN shares have shot up after it announced it had secured the Shaib Marqan exploration license in a government bid process.

Shaib Marwan is a tenement area that’s considered highly prospective for orogenic vein-hosted mineralisation and is said to be significantly underexplored and right near the Al Amar gold mine 100km to the northwest, producing 30,000oz in 2022.

At least 22 ancient workings over quartz veins have been noted in the area, with 50 vein and wall-rock samples averaging ~5.8g/t gold, with a maximum hit of 40g/t.

The quartz veins have lengths of up to 300m, with widths of up to 10m being reported.

“AuKing is very pleased to have secured the Shaib Marqan exploration licence with its local partner BSMC,” the company’s MD Paul Williams says.

Shaib Marqan is situated in a highly mineralised area within the famous Arabian-Nubian Shield geological region within close proximity to various established deposits.

The explorer says systematic exploration across the licence area could lead to the rapid identification of a significant mineral deposit within the Ar Rayn terrane.

Nex Metals Exploration (ASX:NME)

More outstanding gold hits have cropped up from Arika Resources’ (ASX:ARI) now-completed RC drill campaign at the Landed at Last prospect at Yundamindra, of which NME has a 20% stake.

Landed at Last is part of a ~2.5km-long gold mineralised corridor with multiple gold-bearing structures, with less than half of the structures drill tested, and historical drilling of structures restricted to sub-50m depth.

Arika’s drilling has confirmed thick, high-grade gold mineralisation extending from surface and remaining open at depth and along strike.

Results of the final batch of assays from an RC drill campaign cropped up a standout 30m at 2.26g/t gold from 26m at hole YMRC050, including 4m at 11.72g/t from 40m, with a high-grade 1m at 24.10g/t from 43m.

Whether NME shares shot up 28% on the news is a bit of a mystery, since 80% shareholder ARI was down 7% at time of writing.

Red Mountain Mining (ASX:RMX)

RML has soared on high gold grades confirmed in 91 rock chip sample results obtained from Vein #2 and Vein #3 of the Flicka Zone at RMX’s Flicka Lake prospect in Ontario with peak values of:

- 24.2g/t gold and 19.4g/t from Vein #2

- 9.35g/t gold from Vein #3

Soil ands rock sampling has been completed at the early doors project near Lake Superior and within the underexplored Archaean Meen-Dempster Greenstone Belt.

Those types of sample results are taken from surface and may indicate mineralisation below, but it’s not a given at all those grades will be replicated in the orebody.

The Superior Province is laden with gold projects, including historical production from the Golden Patricia, Pickle Crow and Dona mines.

Ionic Rare Earths (ASX:IXR)

IXR shares are up as its Viridion JV with fellow ionic REE hunter Viridis Mining and Minerals (ASX:VMM), has inked an MoU with the SENAI FIEMG tech centre in Minas Gerais State, Brazil, which owns Lab Fab, the first REE magnet lab in South America.

VMM, with IXR, is going to launch studies for its REO refinery and magnet recycling facilities early next year after completing production from VMM’s Southern concessions at the Colossus project.

Pilot plant locations are under review for the magnet recycling, which looks to fill projected supply deficits in the REE market in the future.

“This latest agreement is a major step forward for the Viridion JV, helping to unlock magnet recycling’s significant role in the development of initial REE supply chains in new markets such as Brazil,” IXR MD Tim Harrison says.

“The production of magnet REOs within Brazil will enable the ramp up of magnet production capability at CIT SENAI’s LabFab facility, which is targeting a ramp up in NdFeB production to 100 tonnes per annum by the end of 2026. We see the JV as the natural partner to help deliver this within the timeframe via recycling.

“By working with LabFab, we will also be able to recycle waste streams produced in the ramp up of activities, which will enable the development of a truly insulated, secure NdFeB supply chain in Brazil that can support significant advanced manufacturing activities underway in that market.”

At Stockhead we tell it like it is. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.