Resources Top 5: Rising ASX juniors in the know, know niobium

Pic: Getty Images.

- Summit kicks on further niobium discoveries at Ecuador project (in Brazil)

- Power Minerals decides it wants in on the action, too – stocks rise over 30%

- Waratah rockets after drilling into more high-grade gold at Spur

Here are the biggest small cap resources winners in morning trade, Wednesday, July 3.

Summit Minerals (ASX:SUM)

(Up on yesterday’s news)

Surface sample assays showing some pretty hefty grades of hot commodity niobium out of the Ecuador project in… Brazil? (yep, sure is) have put a rocket under SUM’s share price today.

Other ASX niobium hunters have also been going gangbusters lately, as 80% comes out of just one mine (also in Brazil) and countries want to diversify supply chains, as fellow Stockhead Jess Cummins reported earlier in the week.

Multiple additional pegmatites were discovered and mapped across the niobium-tantalum Ecuador tenure and partial rare earth oxide grades from rock chip samples showed hits of:

- 19.95% Nb2O5, 38.70% Ta2O5 and 4090ppm PREO

- 21.22% Nb2O5, 39.15% Ta2O5 and 4120ppm PREO

Expanded magnetic and LIDAR surveys are being planned to cover the remaining tenement area to assist with mapping of prospective pegmatites in the lead up to drilling.

“Our Ecuador project appears to be the gift that keeps on giving, as we possibly have a multi-commodity project on our hands,” SUM MD Gower He says.

“Not only do we have amazing niobium assay results, but we also have extraordinarily high tantalum and REE results.”

The $18.5m market-capped junior’s trading is up 11%, rising 3c to 30c per share at time of writing.

Niobium has superconducting applications industrially and is used as a crucial alloying element in nickel-based superalloys and also in high-strength, low-alloy steels.

Power Minerals (ASX:PNN)

The latest ASX junior to join the niobium choo-choo train, PNN has announced an option to snap up three exploration permits immediately adjacent to SUM’s Ecuador.

The Lĺtio project covers 27km2 and its geology is interpreted to run into Ecuador after PNN conducted a recon site visit to confirm.

PNN has agreed to pay $30,000 up front and a cash and shares consideration of $570,000 to Ita Iron Mineracao after due diligence of the project.

Initial sampling results will be used to define exploration targets for a planned maiden drilling program, subject to results.

The explorer is currently developing its Salta lithium project in Argentina and the move increases its presence in South America.

“Brazil is growing in stature as a sought-after location for minerals exploration and discovery and we are delighted to have secured this project, in an emerging exploration district,” PNN MD Mena Habib says.

Investors are liking the move into niobium prospectivity as shares are up +30% on trade today so far to 17c.

Waratah Minerals (ASX:WTM)

Gold explorer WTM has sprung the market with more high-grade results from ongoing drilling at its Spur project, with up to 9.33g/t gold.

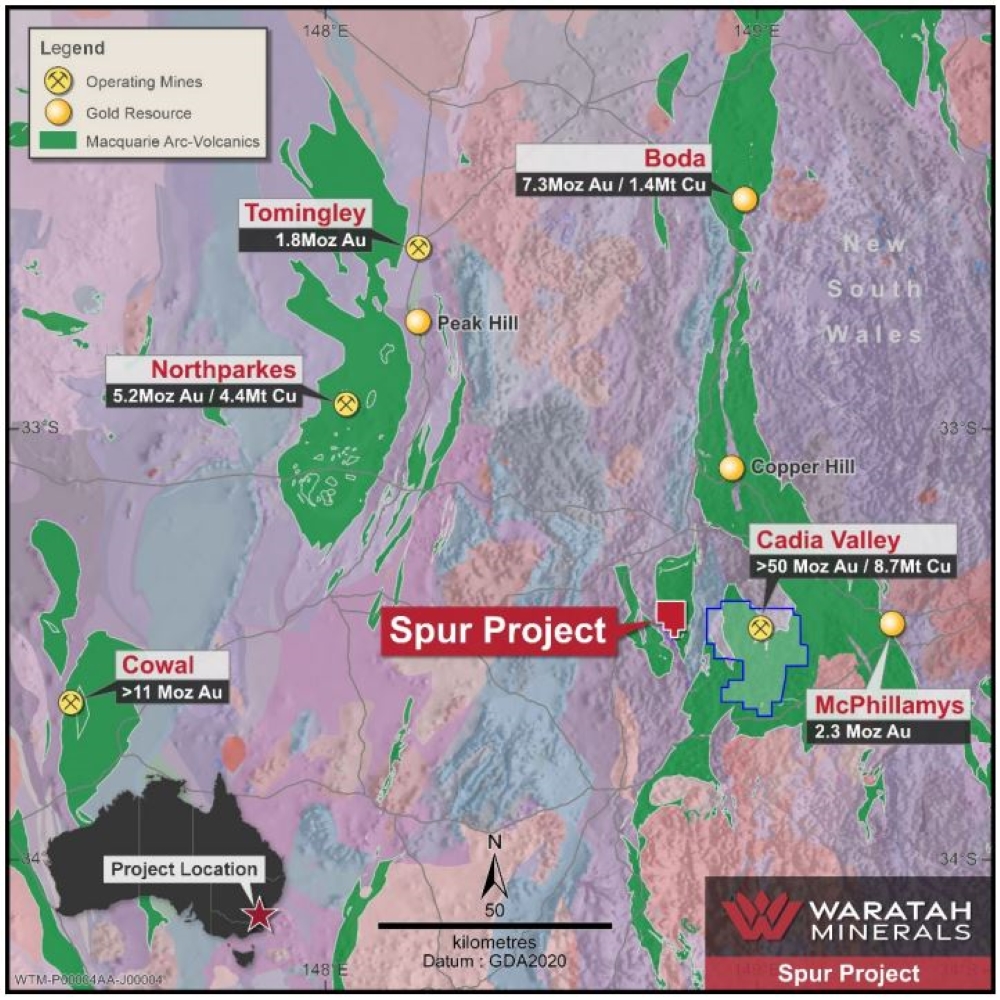

The explorer is betting there’s a sizeable gold deposit on its tenure since the tenements are just 5km from Newmont’s +50Moz gold Cadia Valley and near the multi-million ounce Cowal and Boda deposits in NSW’s prolific Lachlan Ford Belt.

Results from the extra six RC drill holes are on top of assays from the first two holes, which showed a best interception of 11m at 10.82g/t at the Spur East target zone last month.

WTM reckons the early figures confirm the potential for significant shallow gold resources with grades increasing at depth.

“Each drillhole is increasing our confidence in the exploration strategy and we look forward to updating our shareholders with further RC results in the near term,” WTM MD Peter Duerden says.

More drilling is being planned to follow up and expand the exploration program.

Shares have punched up 52% in early trade today.

BPM Minerals (ASX:BPM)

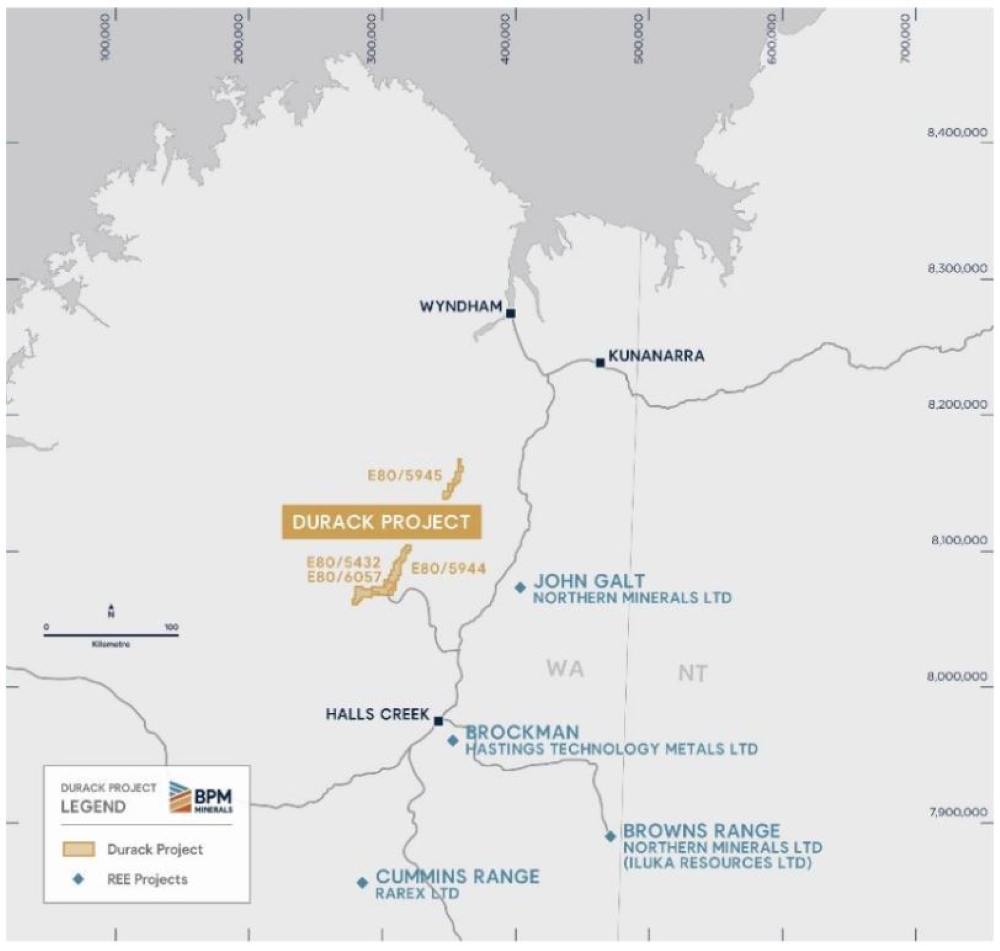

Gold and base metals hunter BPM is now foraying into rare earths after snapping up interest in the 494km2 Durack project in the WA Kimberley region.

The area is home to advanced REE projects such as Hasting’s Brockman, RareX’s Cummins Range and Northern Minerals’ Browns Range.

Recent rock chipping at Durack returned highly encouraging assay results where over 20% of the TREO consists of high-value magnetic REEs neodymium and praseodymium (NdPr).

The project area contains over 100km of underexplored outcropping prospective strike and data has highlighted several compelling radiometric anomalies to explore.

Shares in BPM popped on the news rising over 30% to 7.2c per share.

Pantera Minerals (ASX:PFE)

(Up on no news)

While not sure quite what has sparked a 20% rise in shares today, we do know PFE recently increased its landholding in the prolific Smackover Formation, a region in Arkansas rich in lithium brines.

Majors such as ExxonMobil and Albemarle are pouring in billions of dollars into developing a world-class lithium-brine mining jurisdiction.

Surrounding PFE’s acreage to the east, north and northwest and contiguous with the project, Exxon Mobil (US$419 billion market cap) continues to conduct drilling operations on their leased acres.

Exxon’s strategic plan includes the construction of a sizeable lithium brine processing facility, aimed at advancing their project into full-scale production.

Shares in PFE rose 20% to 3.6c per share in trade today.

At Stockhead we tell it like it is. While Pantera Minerals, BPM Minerals, Summit Minerals and Power Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.