Resources Top 5: Rio just started drilling a WA lithium project for its $35m cap JV partner

Get the popcorn out. Pic: master1305, iStock / Getty Images Plus

- RIO is due to kick off a seven-hole, 1400m drill program this week over the North Rover JV with Everest Metals

- Brazil lithium hunter Gold Mountain now up 60% over the past week on no news

- Also up on no news: Equinox (lithium, iron ore), Australian Mines (nickel, cobalt), Lepidico (lithium)

Here are the biggest small cap resources winners in early trade, Tuesday 11 July.

EQUINOX RESOURCES (ASX:EQN)

(Up on no news)

EQN listed on the ASX last year looking to develop its Hamersley iron ore project, nestled between major mines owned by Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) in the Pilbara.

After a fairly quiet 2022 on that front, it joined the Canadian lithium rush in December, staking a claim over the Dome Lake and Larder Lake projects in Ontario.

Preliminary exploration programs for both projects are expected to commence in the second half of 2023, EQN said late June.

The company also has the early stage Auxesia project, immediately south of the Mt Marion lithium mine in WA.

The $6m capped stock is flat year-to-date. It had $4.9m in the bank at the end of March.

GOLD MOUNTAIN (ASX:GMN)

(Up on no news)

Similarly, the former porphyry hunter has found new life as a lithium explorer in Brazil, which also hosts other high profile stocks Latin Resources (ASX:LRS), Solis Minerals (ASX:SLM) and freshly minted miner Sigma Lithium (TSX.V:SGML).

Sigma Lithium’s (TSX.V:SGML) success at its new 270,000tpa Grota do Cirilo hard rock mine has sparked a torrent of interest in the country’s lithium.

GMN’s Salinas II and the Salinas South lithium projects are adjacent to LRS and within the proven ‘Lithium Valley’ area hosting Grota do Cirilo.

GMN is proposing to spend ~$1.25m on staged exploration over the next 12 months on both its JV and 100%-owned tenements in Brazil, consisting of initial desktop reviews and targeted reconnaissance trips to collect samples.

Depending upon exploration progress, the company intends to drill selected targets.

The $33m capped stock is up almost 60% over the past week on no news.

EVEREST METALS (ASX:EMC)

The stock formerly known as Twenty Seven Co rebranded as EMC in late 2022 with a focus on lithium, gold and base metals in Australia.

Complementing its wholly owned Mt Edon (lithium) and Revere (gold) projects are a couple of lithium JVs with Rio Tinto (ASX:RIO) and Stelar Metals (ASX:SLB).

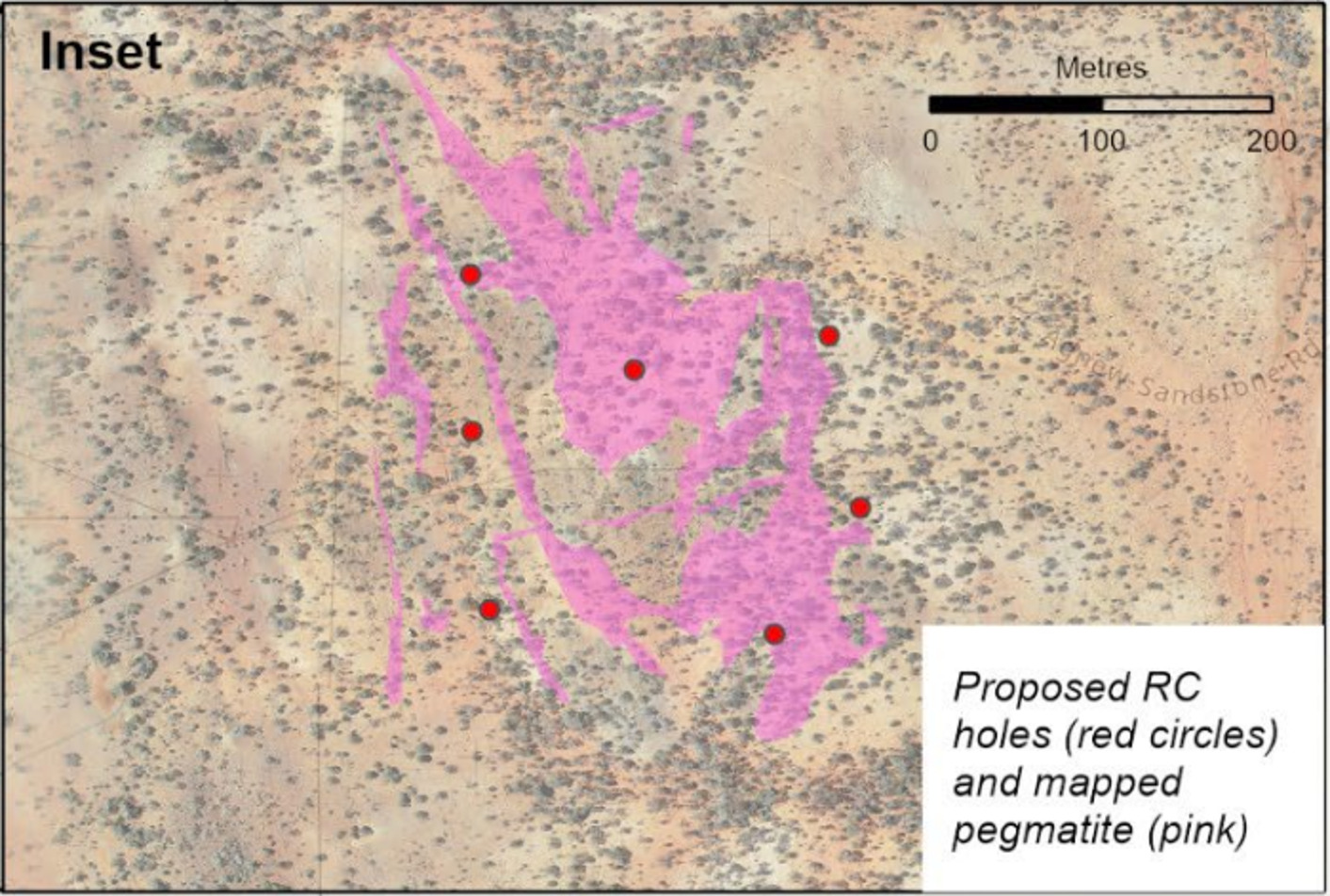

RIO is due to kick off a seven-hole, 1400m drill program over the North Rover JV this week.

The target is potential pegmatite hosted lithium mineralisation beneath weathered pegmatite outcrop, EMC says.

“EMC is pleased Rio Tinto Exploration has decided to progress to the next stage of the North Rover earn-in with commencement of this drilling program,” CEO Simon Phillips says.

“It’s exciting to have a major earn-in partner in exploring this relatively underexplored part of the EMC portfolio.”

The program will take ~10 days to complete.

Rio can earn 80% in the non-gold mineral rights on North Rover by sole funding A$5m of non-gold exploration.

$35m capped EMC is up 230% year-to-date. It had $2.9m in the bank at the end of March.

AUSTRALIAN MINES (ASX:AUZ)

(Up on no news)

One of the most popular battery metals stocks of 2018 has been in the doghouse over the past few years.

Now targeting a final investment decision on the massive Sconi nickel-cobalt project late 2025, AUZ has seen the value of its shares drop almost 97% over the past five years amid constant delays and a recently settled civil complaint from ASIC over disclosures made about offtake agreements in 2017 and 2018.

In 2021, it inked a binding offtake with a subsidiary of battery maker LG Chem, but this deal will have to be amended following the strategic shift to develop Sconi as a nickel sulphate, cobalt sulphate, and scandium oxide project.

The project is expected to produce 46,800tpa nickel sulphate and 7000tpa cobalt sulphate over a 30-year life. It would cost almost US$1bn to build.

Last week the last of the mining leases over Sconi were granted for an initial 25-year term.

“The approval of the Greenvale mining lease is another step closer to realizing the Sconi Battery Minerals project as we progress towards a final investment decision, expected by the end of 2025,” it says.

LEPIDICO (ASX:LPD)

(Up on no news)

LPD wants to build a lepidolite lithium mine and concentrator in Namibia, and a 5600tpa chemical conversion plant in Abu Dhabi.

The integrated Phase 1 project has a base case NPV8% of US$530m and IRR of 42% at a long-term lithium hydroxide price of US$22,840/t.

Some fairly conservative lithium price sensitivity analysis sees the NPV8% range from a downside scenario of US$452m ($675m) based on a US$16,800/t lithium hydroxide price to an upside figure of US$703m ($1,050m) based on a lithium hydroxide price of US$32,350/t.

The capital cost estimate including contingency for the chemical plant is US$203m and for the concentrator US$63m for a combined US$266m.

The next step is for LPD is to lock in financing and offtake ahead of first production in 2025.

The $110m capped project developer is struggling for traction in 2023, down 35% year-to-date. It had $15.3m in the bank at the end of March.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.