Resources Top 5: Record gold prices send juniors flying into development mode

Dig, Baby, Dig. Pic: Getty Images

- Flynn Gold rises as investors prospect Tassie gold exploration target

- Great Divide rises then falls on Adelong Gold JV

- Nagambie refreshes resource with new gold and antimony price deck

Your standout small cap resources stocks for Monday, November 11.

FLYNN GOLD (ASX:FG1)

Flynn Gold rose over 30% today, surging off the back of a presentation on its Tasmania gold assets.

Well, there’s some other stuff in the portfolio, but the thing that’s engaging the imagination of investors right now is the Golden Ridge project, where the explorer thinks it could have a continuation of Victorian gold field trends on the other side of the Bass Strait.

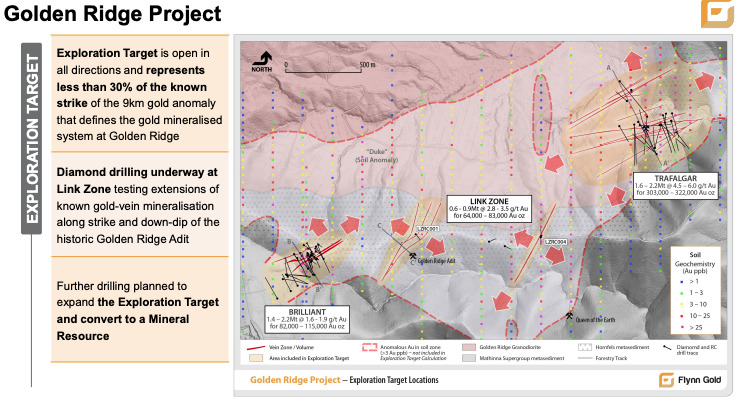

A maiden exploration target was floated last week, putting a 449,000-520,000oz target range on the project, consisting of 3.5-5.4Mt at 3-4g/t gold.

There could be more precious metal beyond that. The target, Flynn says, covers less than 30% of the known 9km gold anomaly at Golden Ridge.

While Flynn is on a road less travelled for Aussie explorers, Neil Marston’s company has garnered plenty of interest from commentators around the traps, notably our own “Garimpeiro” columnist Barry FitzGerald over the weekend.

READ: Barry FitzGerald: Garimpeiro weighs in like Errol Flynn on Tassie gold prospect

Also moving north as investors digested news from last week was Equinox Resources (ASX:EQN), which led our ressie gainers last Friday after reporting super high grades among historic results at its newly acquired Alturas project in British Columbia, Canada.

ADELONG GOLD (ASX:ADG) and GREAT DIVIDE MINING (ASX:GDM)

It’s hit some turbulence over the last week but with the gold price upwards of $4000/oz it’s little wonder ASX small caps are looking for a way to swing from explorer to producer in short order.

The best way to do that is to make a deal and a handshake, and that had ASX duo Great Divide Mining and Adelong Gold moving up in lockstep on Monday.

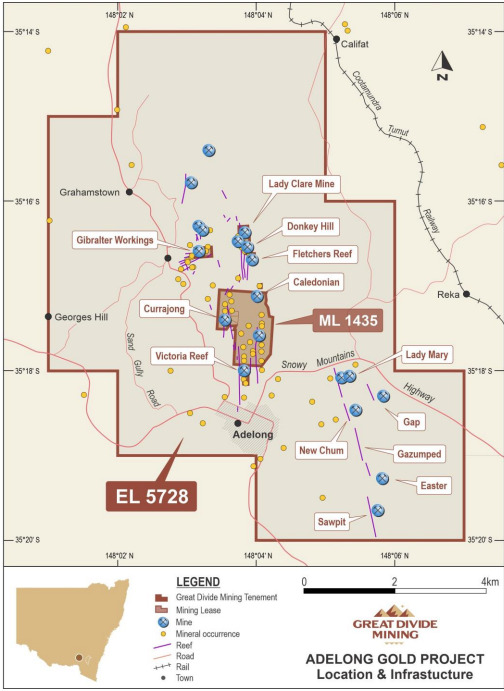

The corporate marriage has an unusual structure to it. Adelong owns a subsidiary called Challenger Mines Pty Ltd, which boasts the Adelong gold mine tucked away in the south of New South Wales, 20km from the town of Tumut and a short drive from the Victorian border.

GDM will spend $300,000 on the ground in exchange for 15% of Challenger with another 36% to vend once gold production starts. All up the ground includes a mining lease and exploration lease covering 68km2 of turf, 1.5km2 of it where mining has been permitted.

Forgotten but not gone, the Adelong field once produced some 800,000oz of gold before it fell into obscurity. But gold prices have been extraordinary this year and anything that can be ramped up quickly holds allure.

Permitting has gotten harder in recent years, with approvals timelines becoming more convoluted, costly and time consuming.

Adelong already contains a processing plant, the Challenger mine and Currajong prospect, development consent for an open cut and underground mine alongside a licence to operate the mill and use cyanide, a key processing chemical, an EPA licence, water extractive licence and approval for a planned tailings dam.

ADG’s last inferred resource update came up to 188,000oz at 3.21g/t.

Commissioning and testing works are expected to begin in the March quarter at the plant, though there is a caveat – due diligence still needs to take place before GDM can confirm when and what it needs to do for production to start.

“Our strategy has always been to control each step of the gold production process, from exploration through to production. We’ve done it,” GDM CEO Justin Haines said in a statement. The company listed in mid-2023 in a $5m IPO with less advanced prospects in Queensland.

“Our strategy of targeting historical workings has delivered the de-risking, conservation of capital and speed to market as we said it would.”

“We might not become the biggest gold producer, but in a little over a year GDM have proved that we not only talk the talk, along with every other gold exploring hopeful, but at GDM there’s a difference, at GDM we also walk the walk … and we’ve proven it.”

There’s still plenty of water to run under the bridge there, but it’s a story worth watching.

~$7m capped GDM was up in the order of 14% at midday on thin volumes before tanking in the afternoon session to close down 14.3%, while ~$4m capped Adelong, which also approved the sale of its Cosmo project in WA to Sarama Resources (ASX:SRR) last week, was up 25%.

NAGAMBIE RESOURCES (ASX:NAG)

Back to Stockhead’s now highly regular antimony watch and today’s mover is an explorer already on the antimony train.

Victorian gold explorer Nagambie has loaded a new resource up for its eponymous gold mine, boosting its gold equivalent resource by 110% to 322,000oz of gold equivalent and its grade by 61% to 18.6g/t AuEq.

There’s some accounting behind all this. We don’t have lots of additional drill results on top of a resource dropped in May.

But the market has moved a lot since then. Gold prices have surged, while antimony, a critical metal in solar panels, defence tech and munitions, has risen to all time highs upwards of US$35,000/t due to Chinese export restrictions.

The lower cut-off grade has brought more material into the resource model, with 20,800t of antimony now estimated in the ground alongside 58,000oz of gold. Resource tonnes have lifted 30% to 539,000/t, with grades of 4g/t AuEq and above considered economic.

In raw metal terms the gold grade is 3.3g/t with an antimony grade of 3.9% Sb.

“The 18.6 g/t or 0.6 oz/t AuEq grade is very high by industry standards and exceeds the 4.0 g/t AuEq economic cut-off grade by 14.6 g/t AuEq or 78% of the grade,” NAG chair Kevin Perrin said.

“The follow-up drilling program is now due to commence in several days. The highest priority, initial target is the western end of the N1 lode.

“This is a large un-estimated area, with good geological continuity, where the first five intersections are planned. With the increased JORC Resource figures, I am of the view that the share price for the company is now significantly undervalued.”

Aren’t they all. Nagambie was mined back in the day, with Perseverance Mining getting stuck into oxide gold mined from two pits between 1989 and 1994. The inferred resource NAG has posted sits in the sulphide material beneath this surface oxide zone in the West pit area.

It’s considered open to the east, west and at depth, with Nagambie suggesting in the ground metal content could average over 2000oz AuEq per vertical metre, hoping the resource continues to the 1000m depths seen at Victoria’s Fosterville and Costerfield mines.

GBM RESOURCES (ASX:GBZ)

(Up on no news)

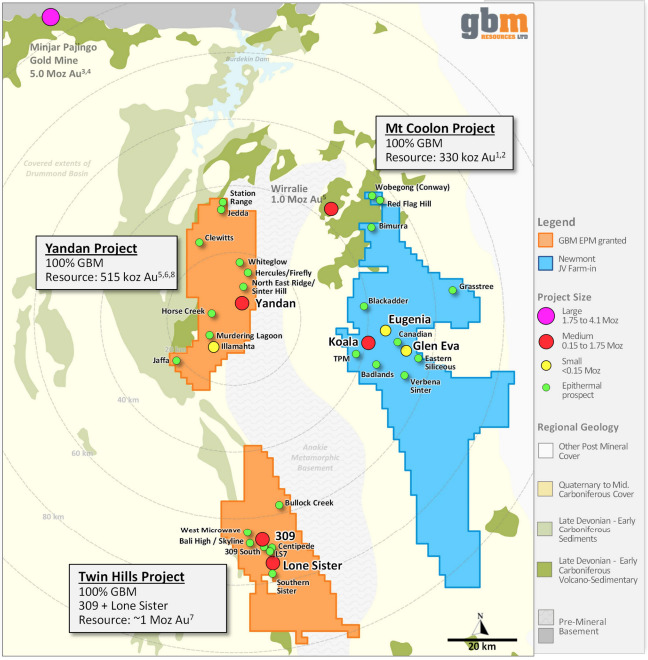

$10m capped GBM’s sailing higher on no news today, but it’s got some decent backing with the world’s biggest gold miner Newmont on the case at the Drummond Basin project in Queensland.

Last we heard the Denver based behemoth punched two diamond holes for over 1000m of core, hitting epithermal veining 500m south-east of an existing pit and 400m below the surface.

Newmont has also churned through 5499m of aircore drilling at the Mt Coolon prospect.

If it hits 10,000m of drilling (6500m done so far) Newmont has the right to claim a 51% majority share in the JV.

The Glen Eva Pit at Mt Coolon contains a modest 78,300oz, but with Newmont on board the JV’s sights are obviously set higher. The major doesn’t want anything below tier-1 – say 500,000ozpa over more than a decade.

GBZ has 1.84Moz of gold resources across the Drummond Basin.

Separately, a private shareholder called Wise Walkers – which holds 9.6% of GBM’s shares – entered into a $12 million farm in over the Twin Hills gold project. This could cede a 70% stake to Wise Walkers but bring the ~1Moz Twin Hills closer to production, with drilling funded through a $6m commitment from the purchaser due to start early in 2025.

GBZ’s management focus will turn to the Yandan project, with partners committing to spend up to $37m on its other Drummond Basin assets.

At Stockhead we tell it like it is. While Equinox Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.