Resources Top 5: Pollucite fans, get happy. Burley digs in for that (and lithium) at Chubb Central

Tuesday was 'pollucite and chill' night at the Burleys'. (Pic via Getty Images)

- Canadian lithium and pollucite hunter Burley Minerals is a ressie-pack standout today

- Haranga also up there, thanks to its uranium project in Senegal

- WIN, MM1 and TG1 also winning at the time of writing

Here are some of the biggest resources winners in early trade, Tuesday December 12.

Burley Minerals (ASX:BUR)

If you’ve been feeling starved of pollucite news of late, you’re in luck, because Burley Minerals has some from its project in Quebec, Canada.

The company reports that it’s found high-value pollucite mineralisation in the spodumene-bearing Main Dyke at Chubb Central.

What’s pollucite used for? Aside from this, which is obviously very important…

… it’s a premium caesium-bearing mineral and is used in the production of biodegradable drilling fluid used in large-scale drilling (often oil well) projects. Handy stuff.

Decent lithium results were also revealed, with 5.3m at 2.3% Li2O (including 2.3m at 3.9% Li2O) intersected immediately adjacent to the pollucite zone.

Burley Minerals non-executive director David Crook said:

“To date, deposits of pollucite have not been large, but quality pollucite is a critical mineral of high value, and only three pollucite mines have operated world-wide.

“One of those mines was the Sinclair Caesium Mine near Norseman, Western Australia, which was profitably mined by Pioneer Resources Limited when I was Managing Director.

“Burley will benefit from having two of the key Sinclair team involved in the Chubb project.”

BUR share price

Haranga Resources (ASX:HAR)

Uranium is “having a moment” of late, and Haranga is right in there, gaining its slice of the yellowcake.

Where’s ‘there’? The Saraya uranium project in Senegal, where a major drilling program is in the works.

The company has just secured itself an RC drilling rig for its December drilling campaign at the Senegal site, as well as delivering an exploration update this morning.

From the latter, we can glean:

• The drilling campaign – for a minimum 4,000m and max 6,000m – is set to run until the end of February.

• Assay results are expected some time after that – February through to April.

As Stockhead’s Michael “Washy” Washbourne recently reported:

“It has been a busy few months for the relative newcomer to the niche pod of ASX-listed uranium players with an inferred resource of 12.5Mt @ 587ppm eU3O8 for 16.1Mlb defined over Saraya, $2.86 million raised for the next phase of exploration and experienced uranium executive Peter Batten joined the company as managing director, all since the beginning of September.

“Speaking to Stockhead recently about his appointment, Batten suggested his return to the yellowcake sector – he was previously managing director of Namibian uranium hopeful Bannerman Energy (ASX: BMN) in the mid-to-late 2000s – could not have be better timed, if market forecasts are to be believed.

“This next bull run in uranium has been coming since 2010,” Batten said.

“The fundamentals were building up, there was an 8-10Mlbpa shortfall, everybody was talking about the uranium cliff before Fukushima happened and all of a sudden there was 10Mlb of uranium floating in the system with no home to go to.

“There’s currently 458 operating reactors, there’s 58 under construction at the moment and there’s another 104 that are planned. So it does seem that this interest in uranium can be sustained.”

HAR share price

Widgie Nickel (ASX:WIN)

(Up on no news)

This Western Australian nickel and lithium developer/explorer is up and to the right thanks to… not too much that’s fresh this week.

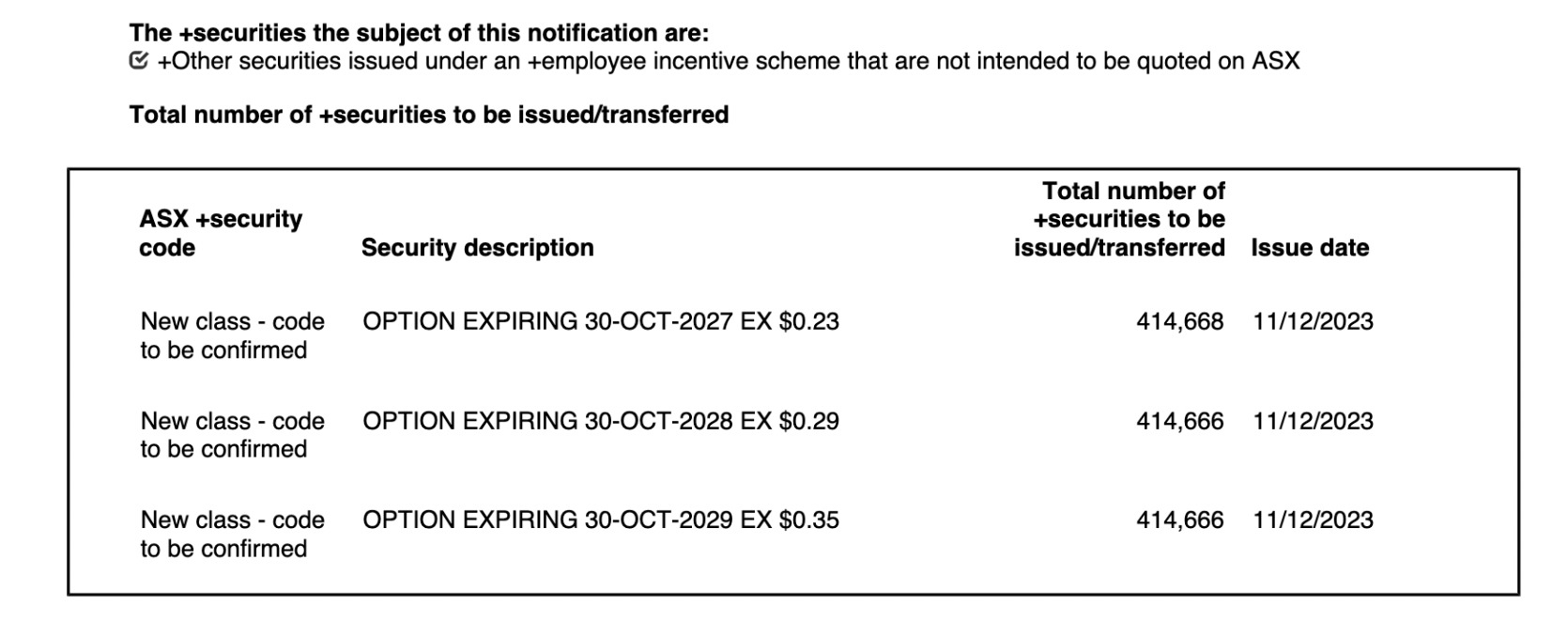

There was a notification to the ASX regarding unquoted securities yesterday…

… but other than that, let’s revert to some of its most recent positive news.

The company has been hitting high grade nickel at its 132N project of late, which is about 6km north west from the Goldfields ghost town of Widgiemooltha and roughly 100km south of Kalgoorlie.

132N forms part of the company’s expansive Mt Edwards project.

In late November, infill drilling confirmed high grade mineralisation below Widgie’s 132N open pit, with assays of up to 25.95% nickel.

“Ultra-high grade pods defined within mineralised channel flows,” said Widgie, with mineralisation remaining open at depth and the structure’s “lower channel flank unconstrained”.

An updated Mineral Resource Estimate is set to be completed in early 2024.

$WIN Widgie Townsite deposit, within the Mt Edwards #Nickel Project, offers a real opportunity for resource growth.

Significant intercepts at Widgie Townsite include 30.85m @ 1.59% Ni from 435m incl 13.43m @2.74% Ni from 449.7m.

Learn more: https://t.co/oXom6gyRwM$WIN.AX #ASX pic.twitter.com/tPDH4zhiEE

— WIN Metals (@WINMetals) December 5, 2023

WIN share price

Midas Minerals (ASX:MM1)

Gold… White… finger – he’s the man, the man with the Midas touch.

Midas Minerals has been focused on white gold (that’d be lithium) for some time now.

It is one of many small goldies that made the pivot to the great battery metal hunt near and far, in this case over in resources-rich Canada.

News?

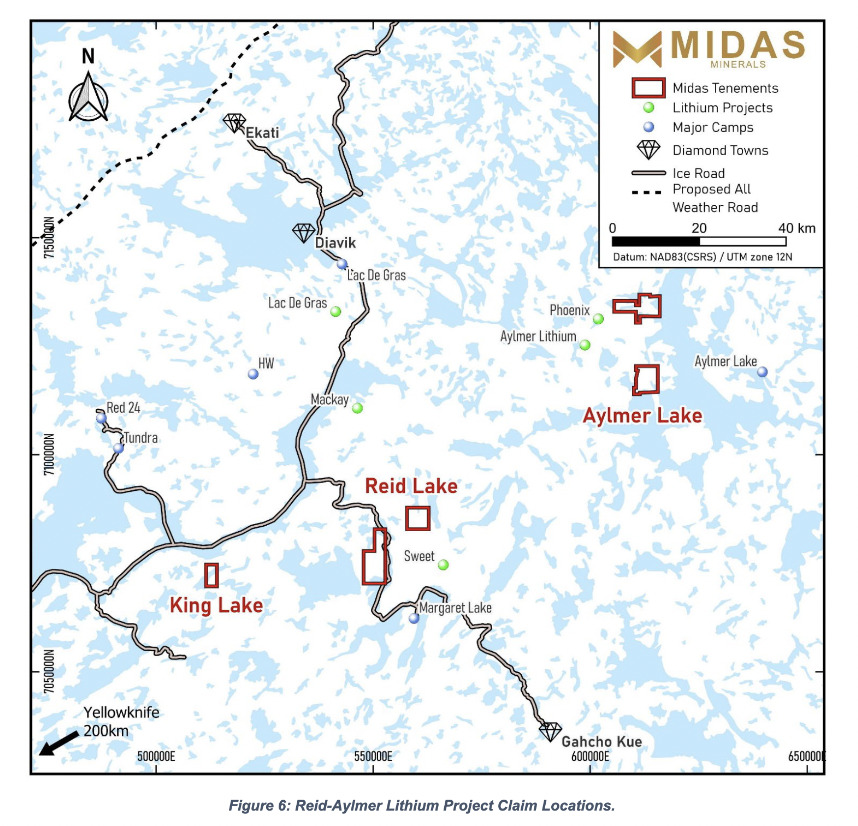

Midas’ Argus pegmatite discovery at its Reid-Aylmer project in the country’s northwest has returned up to 7.25% Li2O from rock sampling. That’s some pretty high grade stuff right there.

Argus is 30m wide and extends for at least 450m. In addition to the headlining grade, latest assay results from some 39 samples include: 5.55% Li2O, 5.12% Li2O and 3.97% Li2O.

Numerous pegmatite targets are apparently yet to be inspected over 157km2 project area, and with new claims granted, Midas notes it will get be seeking a drill permit application immediately.

We've discovered a new #pegmatite at our Reid-Aylmer #Lithium Project in Northwest Territories, #Canada. Argus is up to 30m wide and at least 450m long, returning up to 𝟳.𝟮𝟱% 𝗟𝗶𝟮𝗢 from sampling: https://t.co/W1BQGhnL3G

Application for drill permitting is underway #MM1 pic.twitter.com/YyMDCPSJRr

— Midas Minerals (@MidasMinerals) December 11, 2023

Midas MD Mark Calderwood said: “Our recent discovery of the large Argus pegmatite at Reid-Aylmer represents an excellent, potentially high-grade, lithium drill target.

“The pegmatite is metasediment hosted and contains abundant coarse white to grey spodumene. We are itching to get back on the ground to see how many other pegmatites in the various swarms located on the Reid-Aylmer claims might contain spodumene, and mapping will commence after the snow melt.”

MM1 share price

TechGen Metals (ASX:TG1)

Self described as “the only junior explorer with 100% ownership of 3 gold & copper areas in Western Australia”, TG1 (not to be confused with TG Metals (ASX:TG6)) is up a very handy 46% over the past month and another 14% today.

News? Some, yeah. The company has provided an exploration update regarding its Ida Valley lithium project, which is some 50km north along strike from Delta Lithium’s (ASX:DLI) impressive Mt Ida Lithium deposit and 100km south of Liontown Resources’ (ASX:LTR) headline-hogging Kathleen Valley deposit in Western Australia.

The Ida Valley project comprises two granted exploration licences and lies within the northern sector of the renowned Norseman-Wiluna Greenstone Belt.

Priority lithium targets have now been identified by the company after some 1,219 soil samples were completed to assess the project’s prospectivity for LCT style pegmatite action.

“Soil anomaly peaks of 144.5ppm Lithium and 49.8ppm Caesium,” highlighted TechGen.

ASX Announcement: Ida Valley Priority Lithium Geochemical Targets. Read full announcement here https://t.co/BhwIFDYgjM#lithium #pegmatites #caesium #gold #Exploration #MiningStocks #Mining #stockmarket #ASX $TG1 pic.twitter.com/uO2a8k3SUk

— TechGen Metals (@TechGenMetals) December 11, 2023

The company’s MD Ashley Hood commented:

“We are thrilled to have another stage of the rapid lithium search at our 100% owned Ida Valley Lithium Project completed with a quick turnaround on the historic soils…

“The soil sample modelling has identified 16 separate lithium targets. Two Priority 1 targets are a standout for Lithium, Caesium and Tantalum being complimented by additional pathfinder elements pointing to the same areas as internal modelling had earlier suggested.”

TG1 share price

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.