Resources Top 5: PLG, SUM and ASX newbie RAU make rare earths gains common today

Pic via Getty Images

- The local bourse is emitting loud “REE!” sounds on Friday at lunch

- New rare earths hopeful Resouro makes a solid entrance

- While Pearl Gull Iron and Summit are also making strong moves

Here are some of the biggest resources winners in early trade, Friday June 14.

Resouro Strategic Metals (ASX:RAU)

We have a new rare earths hopeful on the bourse as of this morning, with Resouro Strategic Metals commencing trading.

It’s made a fine entrance so far, getting off the mark with a 26% gain at the time of key tapping.

Resouro is a truly international player – a Canadian-based REE explorer and development company focused on projects in Brazil, including the REE and titanium Tiros Project (90% ownership) and the Novo Mundo and Santa Angela gold projects.

It’s also listed on the TSX V and the Frankfurt Stock Exchange.

It launches on the ASX today following a successful $8 million IPO, which was priced at $0.50 per CHESS Depositary Interests (CDI), with 16 million CDIs issued. The IPO resulted in an initial $46.1 million market capitalisation for Resouro.

In any case, shareholders are off to a decent start, with RAU changing hands for $0.63 at last check (see below for latest).

The Tiros REE and titanium project is the company’s main focus and covers an area of roughly 450km2 in the Minas Gerais State, one of the leading mining jurisdictions in Brazil.

IPO funds will be used to progress a targeted drill program at Tiros, with a significant JORC-compliant mineral resource the ambition.

Pearl Gull Iron (ASX:PLG)

Tiny, sub $5m market capped explorer Pearl Gull was soaring a little earlier with a more than 60% gain. It’s since pulled back but is still double-digit flying.

This morning it announced it’s farming into an an early stage clay rare earths project in Chile, having made strategic acquisition of Huemul Holdings.

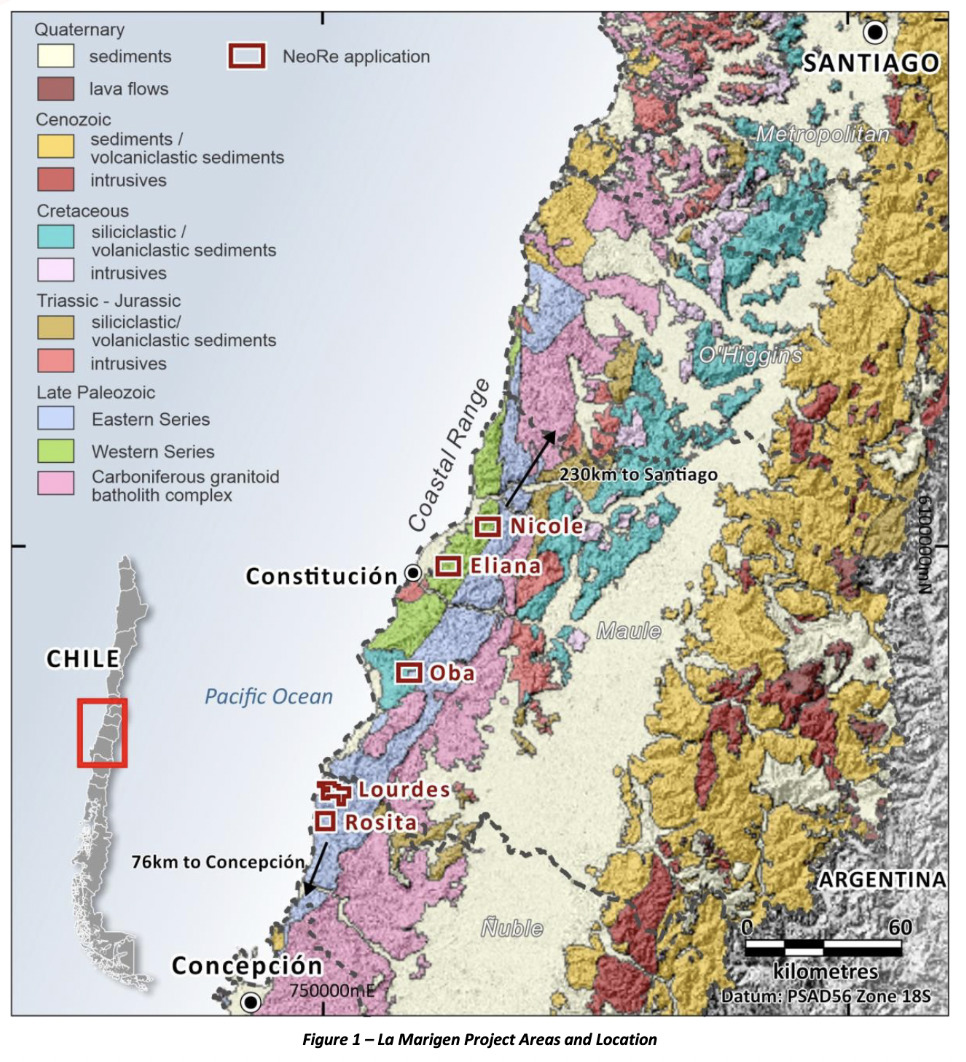

This will see the company earn up to an 80% interest in NeoRe SpA’s La Marigen project, which is located in a highly prospective area for ionic adsorption clay REE in Chile.

The project covers five tenements across a vast area – some 228km2 – and is situated in an underexplored mineralisation belt.

Pearl Gull considers the acquisition and proposed farm-in to the La Marigen project a strong way to strengthen its asset portfolio, while still maintaining plenty of focus on its existing Cockatoo Island iron ore project off the NW coast of Western Australia.

Chairman Russell Clark said:

“The farm-in to the La Marigen Project provides the company with an opportunity to potentially acquire an interest in an emerging ionic adsorption clay rare earth elements region, known to host high grades.

“Importantly the project area is located in close proximity to Concepción, which is a major industrial city on the coast of Chile.”

Tempus Resources (ASX:TMR)

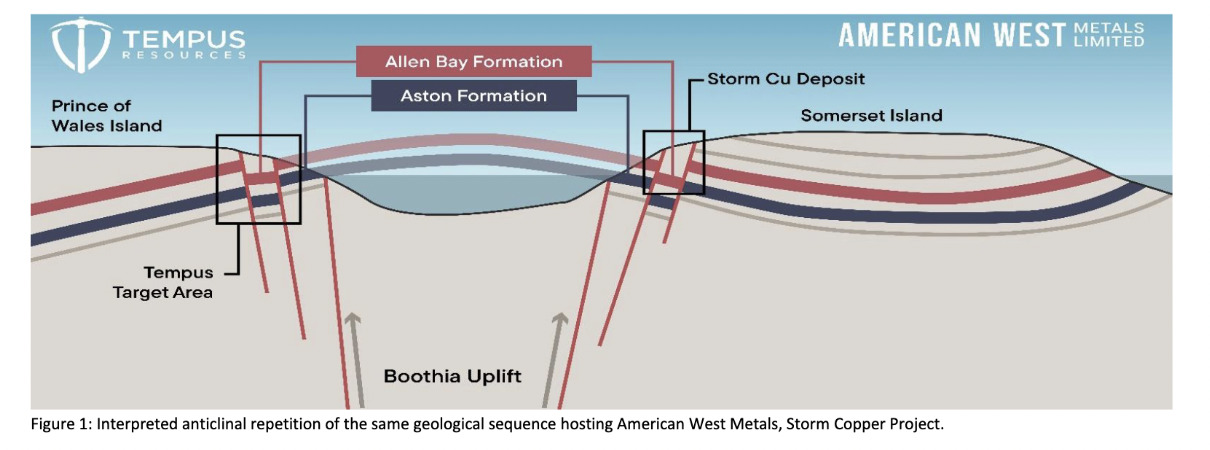

Another minnow explorer, Tempus has completed the acquisition of the Prescott copper and base metals project, ~100km from American West Metals’ (ASX:AW1) Storm project (17.5 Mt @ 1.2% copper and 3.4g/t silver) in Canada.

Investors/shareholders rate this news, to the tune of 25% intraday, and counting.

A large airborne geophysical survey is reportedly already underway at the Prescott op, which is scheduled to wrap up in mid-July. And this will be followed by a detailed geochemical mapping program, notes the company.

The Prescott project area covers some 240km of apparent strike, and Tempus has reasons to believe it has strong potential to host a sedimentary hosted copper deposit or Mississippi Valley-type deposit (zinc-lead).

The entire project consists of 49 licences that are predominantly located on Prince of Wales and Somerset Island and are interpreted to host an “anticlinal repetition of the same geological formation hosting American West Metals’ Storm Copper Project”.

Sun Silver (ASX:SS1)

Silver explorer SS1 is a recent entrant to the ASX and has been chopping around since mid May. It’s double digits up today, though, thanks to some fresh news.

A drilling contract has been awarded for the company’s prime focus, which is the Maverick Springs silver project in Elko County, Nevada. That’s a highly prospective project with an inferred mineral resource of 292,000,000 oz AgEq at 72.4gt Ag.

Alford Drilling, a well-experienced contractor based in Elko, has been hand-passed the work and the first drilling program at Maverick Springs is set to start in the upcoming weeks.

Mineral deposits at Maverick Springs are still open in all directions and at deeper levels, offering several drilling opportunities to expand the resource base.

What next? “Mobilisation”, naturally.

Sun Silver executive director Gerard O’Donovan enthused:

“Award of our inaugural drilling contract marks a significant milestone for the company. We look forward to mobilising to site in the next few weeks and commencement of drilling.”

Summit Minerals (ASX:SUM)

SUM is still counting the share price gains coming as it continues an impressive run of late. The stock is now up about 164% over roughly the past month and 233% YTD.

As we reported earlier in the week, first assay results from the company’s Equador project in Brazil have confirmed high-grade niobium and tantalum over a 1.2km strike length.

Equador represents just one project within a wider niobium-rare earth tenement package covering 107.47km2 in Brazil’s Borborema Pegmatitic Province (BPP), Paraiba state, a region regarded as one of the world’s most important sources of tantalum, REEs and beryllium.

Due diligence on historical results have turned up standout samples containing 303,400ppm Nb205 (30.34%) and 15,130ppm partial rare earth oxide (1.513%) while multiple pegmatite bodies and many historical workings have been identified during multispectral analysis work.

Read more > here.

At Stockhead we tell it like it is. While Summit Minerals, Sun Silver and Resouro Strategic Resources are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.