Resources Top 5: Paynes spotting pushes GSM higher after finding peggies with lithium potential

Pic via Getty Images

- Golden State Mining spots beaut pegmatite dykes at its Paynes Find project, WA

- Boab Metals intersects zinc-lead sulphide up in the Kimberley

- NWC, WML and OZM are also making moves on the bourse today

Here are the biggest resources winners in early trade, Wednesday November 8.

Golden State Mining (ASX:GSM)

Small market-capped explorer GSM has been placing a fair amount of its recent focus on the highly prospective Yule project in the Pilbara where it’s hunting for Tier 1 gold and lithium not far from De Grey Mining’s (ASX:DEG) world class Hemi gold discovery.

However, it’s up on news today from its Paynes Find lithium project further to the south in the Murchison region of WA.

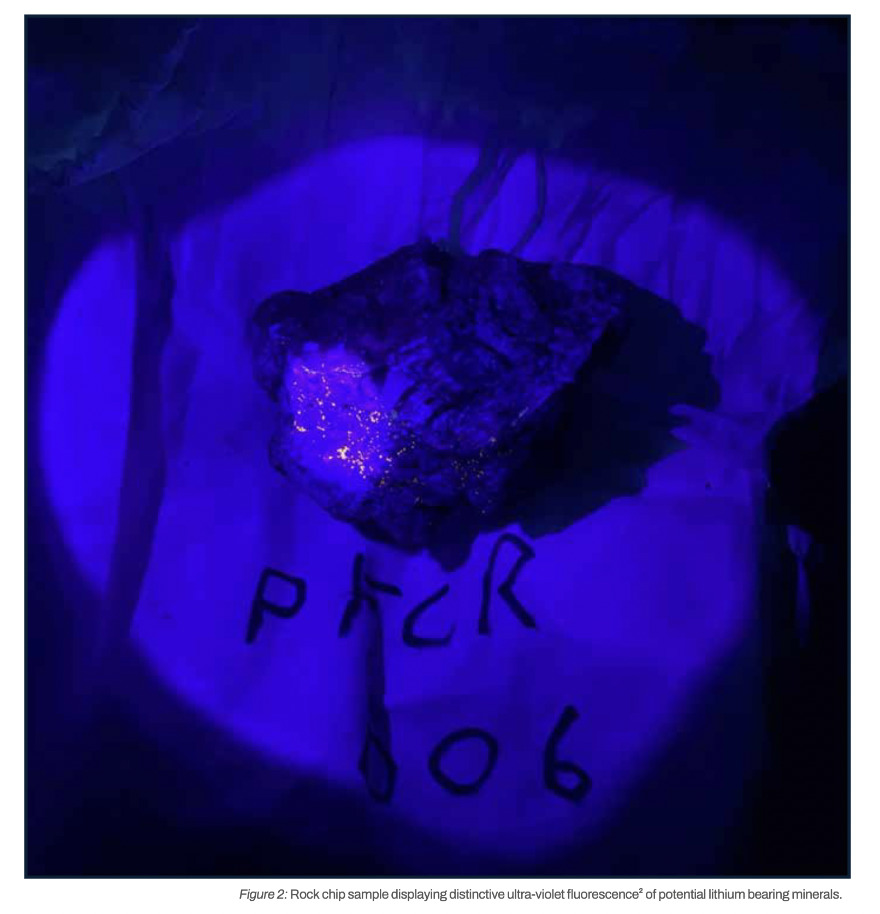

Essentially, numerous outcropping pegmatite dykes have been identified from field observation work at the site, “within elevated to anomalous lithium-caesium-tantalum (LCT) geochemistry envelopes”.

The company notes that rock chip assay results from 19 samples are expected in early December and that drill planning is underway for up to 8000 metres of AC and RC action.

$GSM notes the presence of pegmatite intrusives at its Paynes Find (Li) Project in #WA:

☀️Pegmatite outcrops within elevated to anomalous #LCT geochemistry envelopes. Assay results ~ early Dec

☀️AC/RC drill planning underway up to 8000m#ASX report ➡️ https://t.co/EC5QNAashz pic.twitter.com/apKZA8BvRa

— Golden State Mining (@MiningState) November 7, 2023

Golden State’s MD, Michael Moore said:

“The GSM team’s latest field trip to our Paynes Find lithium project was following up on previously reported anomalous lithium, caesium and rubidium assay results from recent soil sampling programs.

“The Paynes Find project was pegged by GSM after a high-level targeting exercise identified it as having the right geological attributes to host lithium mineralisation. We now look forward to finalising drill target areas and undertaking drilling in early 2024.”

GSM share price

Boab Metals (ASX:BML)

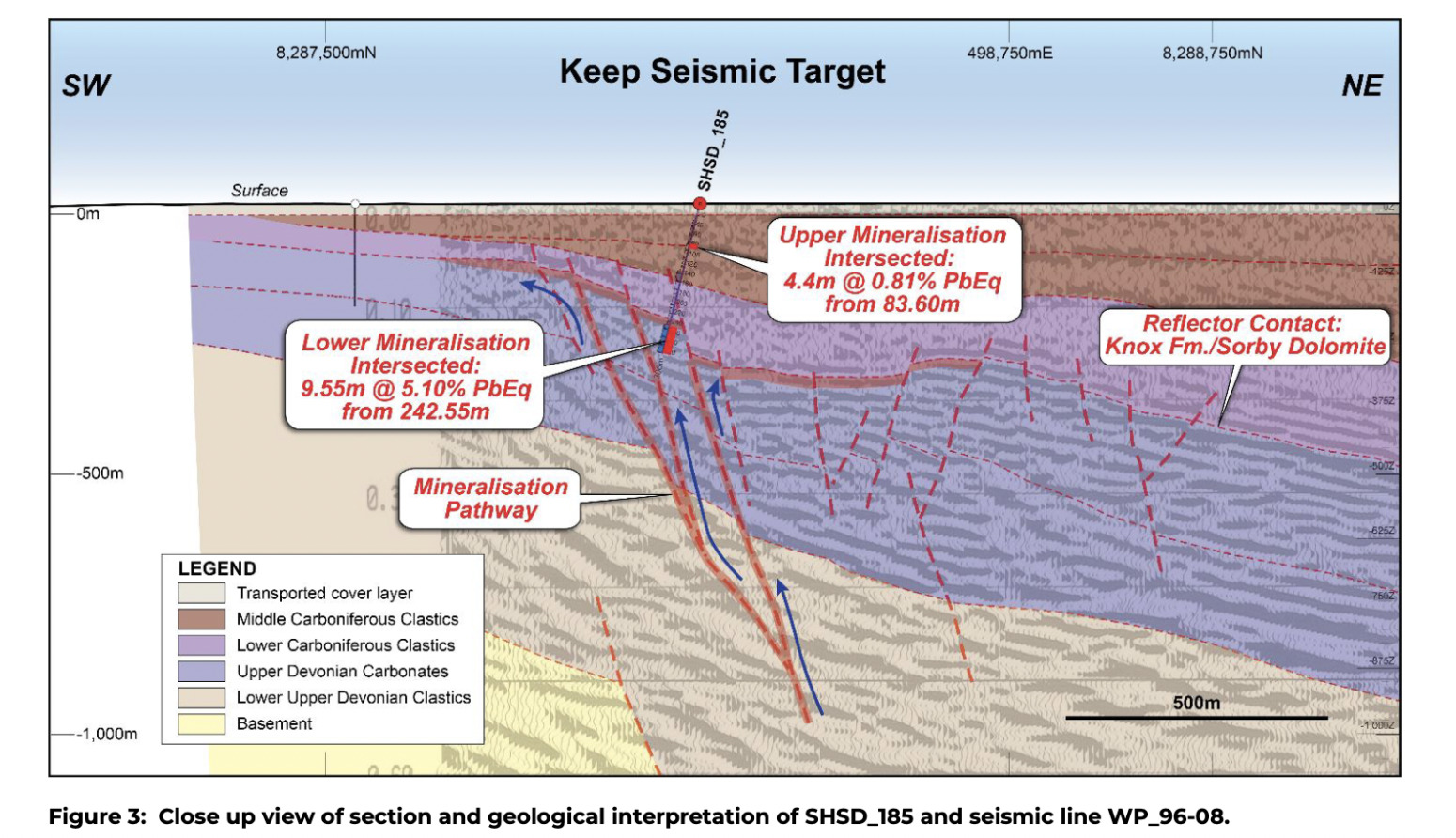

Base and precious metals explorer Boab is up and to the right today on news it’s made significant intercepts at the Keep Seismic prospect within its 75% owned Sorby Hills lead-silver-zinc project in the Kimberley region of WA.

That’s a project about 50km north east of Kununurra and 150km from Wyndham Port. It’s beautifully remote up there.

Headlining base metal highlights as follows:

• Hole SHSD_185 – 9.55m at 5.10% PbEq (2.59%Pb& 2.26% Zn) and 17.6 g/t Ag from 242.55m.

• This includes – 3.12m at 13.43% PbEq (6.37% Pb & 6.36% Zn) and 26.5 g/t Ag from 245.36m.

Boab’s MD and CEO, Simon Noon expressed excitement over the zinc-lead sulphide intersections, adding:

“This is an outstanding success given the conceptual nature of the target and its location in an area, and at a depth where no mineralisation has been intersected before.

“The location of the drill hole sits around 2km away from the closest ore reserves at Sorby Hills and will be a catalyst for further exploration within our mining tenements. It is clear there is more to be discovered at Sorby Hills.”

BML share price

New World Resources (ASX:NWC)

NWC, a $70m market capped explorer hunting for minerals in North America, is up on the news it’s entered into a binding agreement with Trident Royalties Plc, which will provide $11 million in exchange for a 0.9% NSR royalty over its high-grade Antler Copper Project in Arizona.

New World says it will retain the right to buy-back 0.3% of the royalty and the funding will be used to:

• accelerate resource expansion and discovery drilling, and,

• expedite the development of copper mining operations at Antler.

New World’s MD Mike Haynes grabbed the mic, or at least the keyboard:

“We are very pleased to have secured $11 million of funding, which will enable New World to continue to expand the resource base while also expediting development activities at the high-grade Antler Copper Project, without diluting our shareholders.

“Trident’s royalty funding follows a competitive process. Trident has undertaken extensive due diligence on the project, so this represents another strong endorsement of New World’s expansion and development strategy to become a significant North American copper producer.”

NWC share price

OzAurum Resources (ASX:OZM)

Goldie/lithium play OzAurum has copped a “please explain” from the ASX regarding recent trading activity of its share price, which is up a whopping +52% this week.

OzAurum dead-batted the queries back up the pitch. It’s not very exciting stuff, but you can read those responses in its reply to the ASX here.

What’s more exciting, though, is the fairly recent news regarding OZM’s Linopolis Jaime hard rock lithium project acquisition in the State of Minas Gerais, Brazil.

As Stockhead ressie expert Reuben Adams put it:

“A sniff of Sigma-like success has early-stage lithium explorers flooding Minas Gerais and other mining-friendly Brazilian hotspots.

“OZM’s deal announced last month was a game changer, with the stock soaring 130% on volume thanks to “a +7m wide spodumene zone with an average grade of spodumene crystals of 6.94% LiO2” at the Jaime Linopolos project.”

This is the kind of action that sends a stock stonking. As for this week’s movement, a bit like OZM, we’ll keep ears to the ground.

And… because we kinda love this pic here at Stockhead, here’s a reprise, in all its spod-tastic, high-helmet-riding glory:

OZM share price

Woomera Mining (ASX:WML)

This Adelaide-based small-capped explorer (gold, PGEs, nickel, copper, cobalt and… yep, lithium) makes the ressie-gainers grade today with a +20% move so far.

News? Yes, of the shares-placement variety:

Woomera notes it has “issued 237,500,004 ordinary shares to professional and sophisticated investors pursuant to the share placement announced on 1 November 2023.”

The company issued a total of 237,500,004 ordinary shares at $0.009per share to raise $2.1m, with 142,058,029 shares “issued pursuant to the company’s 15% placement capacity” per ASX rulings.

Woomera’s chief focus for now is on battery metals (lithium nickel, copper + PGEs) and gold in the Yilgarn and Pilbara regions of Western Australia, plus the Musgrave Province in South Australia along with copper-gold mineralisation in the Gawler region of South Australia.

WML share price

At Stockhead we tell it like it is. While Golden State Mining is a Stockhead advertiser, it did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.