Resources Top 5: Osmond stocks initiate warp speed on Orion buy

Pic: Getty Images.

- Osmond sees massive gain on Orion critical minerals acquisition

- North Stawell to apply Machine Learning (ML) and AI to advance geological interpretation of prospective land

- Maiden met test work at Devlin Creek shows copper concentrate can be produced

Here are the biggest small cap resources winners in morning trade, Friday, September 6. Prices accurate at time of writing.

Osmond Resources (ASX:OSM)

The clear winner for Friday’s early trade is OSM as it came out of a trading halt and announced the acquisition of the behemoth Orion EU critical minerals project in southern Spain.

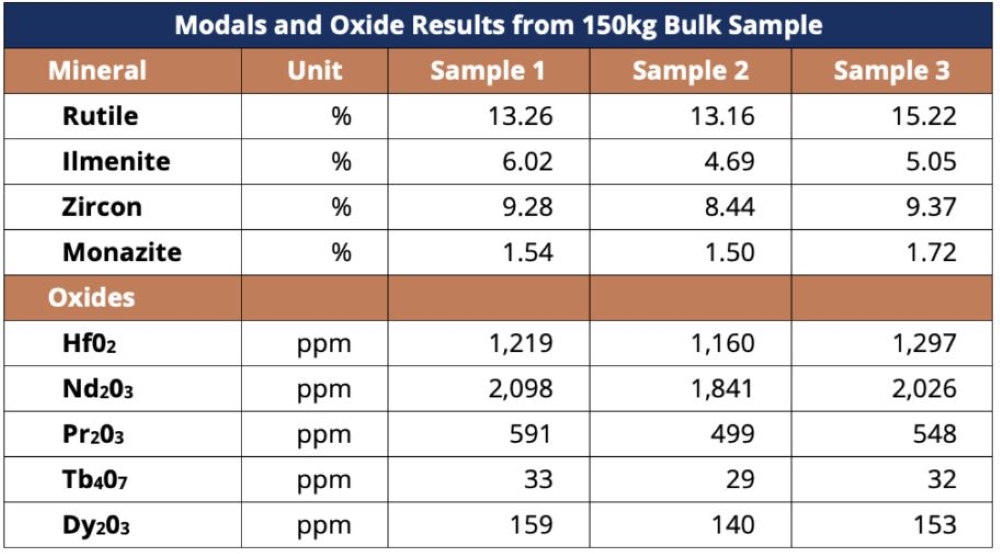

Very decent grades were identified across rutile, zircon and rare earths.

The EU currently extracts no titanium, no light or heavy rare earths and less than 20% of its annual consumption of zircon.

The explorer has penned an agreement to acquire up to an 80% interest in the capital of Iberian Critical Minerals (ICM) via a three-tranche staged acquisition.

The deal machinations read like a year 7 maths problem. ICM currently holds a 100% interest in the capital of Omnis Mineria SL (Omnis) which in turn holds a 51% interest in the capital of Green Mineral Resources SL (GMR).

Omnis has the right to increase its interest in GMR to at least 90% upon completion of a scoping study and GMR holds a 100% interest in the rights and title to the Orion EU critical minerals project.

The landholding includes 288 Spanish mining units (cuadrículas mineras) covering an area of 86.4km2 and has identified layers of rich critical minerals including rutile (titanium), zircon, hafnium, and light and heavy rare earths.

Exploration activities have focused on mapping and sampling the titanium-zirconium-REE rich layers across a wide area of the >2km-long Avellanar target to fast-track into drilling and a mineral resource estimate.

Director change and cap raise

OSM has appointed Anthony Hall as MD effective September 9, replacing founding exec director Andrew Shearer. Hall lived in Spain and was CEO of Highfield Resources and its potash development.

The company has also rattled the tin for $700,000 in a share placement and appointed renowned resources entrepreneur Tolga Kumova as a strategic advisor.

Shares in the junior went gangbusters on the news, rising 171% to trade at 19c at time of writing.

Energy Resources of Australia (ASX:ERA)

On the back of ERA announcing an $880m raise to fund the rehabilitation of the Ranger uranium mine in the NT.

Rio Tinto (ASX:RIO), its 80% shareholder, was to subscribe to the raise and up its voting power to 99.2%. However, Zentree Investments and Packer & Co are using their combined almost 12% votes to allege that the mining giant is “taking advantage” of its position to takeover ERA.

ERA ceased production at the Ranger uranium mine after a 40-year mine life that produced over 132,000 tonnes of U3O8, yet since the rebound in prices of yellowcake, the high-grade mine is being considered for a re-opening.

Shares in ERA bounced on news of the minority stakeholders’ application, rising 40% to trade at 0.7c.

North Stawell Minerals (ASX:NSM)

(Up on no news)

In a collaborative research project with CSIRO, NSM will apply Machine Learning (ML) and Artificial Intelligence (AI) to advance geological interpretation and assess prospectivity across its Victorian gold assets.

It’s going to apply the tech to its Wildwood and Darlington prospects with over 4500m of diamond drilling and more than 40,000m of AC drilling to be conducted in phases.

Extensions to the 87.3koz gold at 2.4g/t Wildwood resource will be conducted and exploration at is to kick off at Darlington – which has similar characteristics to the multi million-ounce gold deposit at Stawell 6km to the south and is entirely untested at depth.

Shares bounced up 30% on the news to trade at 1.7c.

Blackstone Minerals (ASX:BSX)

(Up on no news… again)

There seems to be some market ructions around BSX, yet still all quiet on the current financial year front.

Backed by 15.5% shareholder Corazon Mining (ASX:CZN) and there’s rumours it’s securing a JV partner for developing its Ta Khoa nickel refinery in Vietnam.

The company has a unique strategy to convert nickel concentrate blends into precursor cathode active material for the growing batteries industry.

Shares in the junior are up 58% over the last month, including 19.5% on trade today.

QMines (ASX:QML)

Maiden metallurgical test work at QMines’ Develin Creek project near Rockhampton, QLD, has successfully produced saleable copper and pyrite concentrates.

The company had in late 2023 engaged Como Engineers to supervise a test work program on drill core sourced from the project to define the metallurgical response of the Develin Creek deposit with respect to the process flowsheet for the proposed Mount Chalmers flotation plant.

This work successfully produced a copper concentrate containing 20% copper, which is higher than the targeted 15%, and a pyrite concentrate with 51% sulphur.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.