Resources Top 5: Notable small cap investors Tolga Kumova and Evan Cranston get behind Macro Metals

Pic via Getty

- Macro Metals up on new boardroom appointments, including high-profile backers Tolga Kumova and Evan Cranston

- Nex Metals surges on Yundamindra gold project drilling approvals, even if JV partner Metalicity doesn’t

- Also having a good day: ARV, AAJ , ODY

Here are some of the biggest resources winners in early trade, Wednesday March 6.

Macro Metals (ASX:M4M)

Of late, iron ore junior and lithium explorer Macro Metals has largely been focused on acquisition of 85% rights to the Aurora Energy Metals Project (AEMP) in the McDermitt Caldera, the USA’s largest lithium province.

But the M4M share price is bursting up today on news of a new boardroom appointment and tenement acquisition with iron ore focus.

The company has announced the appointment of a “highly regarded board with the dedicated focus of developing Macro’s Pilbara iron ore portfolio”.

The incoming board (or nominees) have subscribed for $1.22M out of the total placement of $1.35 million “as a reflection of their commitment towards capturing shareholder value and delivering upon their strategy”.

Board members include: Simon Rushton – MD (co-founder and inaugural MD of Hedland Mining, a Port Hedland iron ore junior); along with, notably, famous small cap investors Tolga Komova and Evan Cranston as non-exec directors.

Macro Metals – you might remember it as Kogi Iron pre-2023 – has entered into a tenement acquisition agreement to acquire a total of six exploration licence applications from Mining Equities for a cash reimbursement amount of $54,420 and a 2% royalty on all minerals sold from each project.

Those projects include:

• the W5 Iron Ore Project located in midwest WA, 5km along strike from Fenix Resources’ (ASX:FEX) Iron Ridge Mine.

• the Deepdale Iron Ore Project, adjacent to Rio Tinto’s Robe Valley iron ore operations and CZR Resources’ (ASX:CZR) Robe Mesa Project in the West Pilbara.

• as well as the Bellary Springs, and Turner iron ore projects

As far as the Aurora Energy Metals (ASX:1AE) lithium project acquisition is concerned, Macro Metals is currently doing its due diligence.

$M4M has mutually agreed with @Aurora_1AE to extend the exclusivity period by 3-mths in relation to the proposed #acquisition of an 85% interest in the #lithium rights over the Aurora Energy Metals Project, as announced on 14/11/23.

Read more here: https://t.co/U1favStpko pic.twitter.com/FGvfpkfvVu

— MacroMetals (@MacroMetals) February 11, 2024

M4M share price

Nex Metals Exploration (ASX:NME)

WA-focused gold, copper and nickel hunter is up on “outstanding” gold prospectivity at the Yundamindra gold project, of which it owns 20% in a JV with Metalicity (80%).

Curiously, MCT is now currently 25% down after also bursting up on the news earlier. Profit taking? Probs.

In any case, NME is doing well off the news, surging 30%.

Drilling approvals for the maiden drilling program at Yundamindra have now been lodged for the first drill program in over 10 years at the project.

Drilling will target the highly prospective Western Line, including the Landed at Last prospect.

The Landed at Last prospect has historically returned very good shallow, high grade results including:

• 11m at 5.85g/t Au from 40m in LW32

• 10m at 9.99g/t Au from 10m in LW34

• 9m at 8.56g/t Au from 36m in LW33

Yundamindra is located ~65km southeast of Leonora, within trucking distance of a number of mills. Prospects remain open at depth and along strike.

NME share price

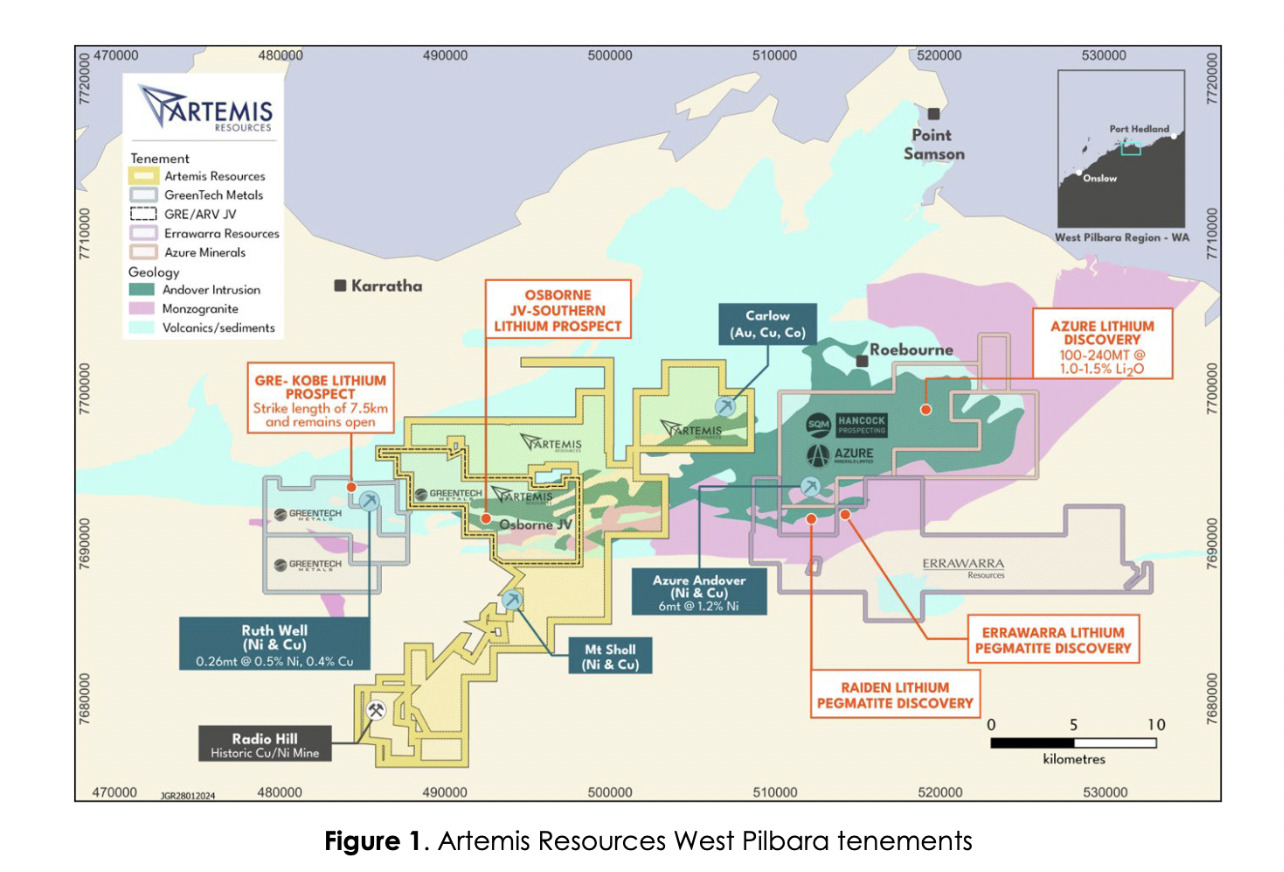

Artemis Resources (ASX:ARV)

Gold, copper and lithium focused company Artemis, on the hunt in WA’s Pilbara region, is on the up today thanks to high-grade samples returned at its Mt Marie lithium prospect.

The company has more than 150km2 of 100% owned tenure and only around 25km2 covered in its ground reconnaissance program to date.

This coarse spodumene crystals up to 30cm in length.

Additionally, multiple rock chip assays of >0.50% Li2O have come in from a new zone identified at the Osborne East prospect.

Further reconnaissance and follow-up sampling will now be undertaken across the E47/1746 tenement.

Artemis’ executive director George Ventouras said, “This second round of rock chip assay results provides further evidence of the potential scale and grade of the Artemis lithium discovery.

“These results from the Mt Marie prospect and the new zone identified at Osborne East, are opening up the lithium mineralised region considerably and suggests that a greater portion of the tenement area is now prospective for lithium mineralisation.

“We are confident that we have only just scratched the surface of lithium mineralisation potential across the tenement portfolio.”

ARV share price

Aruma Resources (ASX:AAJ)

Gold, lithium and REE explorer Aruma’s share price is up about 25% so far today, on the back of high-grade rare earths discovered at its Salmon Gums project in the Eastern Gold Fields of Western Australia.

Maiden REE-focused drilling there has returned multiple high-grade clay rare earths of “significant thickness”, including: 11m at 904ppm TREO from 18m; 6m at 770pmm TREO from 24m; 18m at 638ppm TREO from 12m and more.

Additionally, the company notes that surface sampling of exposed ionic clays in the emerging greater Esperance-Salmon Gums ionic clay REE region has returned the highest REE result in the area to date; 8,700ppm TREO with high-value Nd + Pr oxides representing 22.5% of TREO grade.

The REE drilling also confirms a northern extension of recent REE discoveries by Meeka Metals (ASX:MEK) and OD6 Metals (ASX:OD6) in the region.

Aruma managing director Glenn Grayson said:

“The high-grade results returned from our first-pass REE-focused drilling at the Salmon Gums Project is exciting for Aruma. It appears that the higher grade mineralisation extends further onto our Project area, which enhances the potential for it to host extensive REE mineralisation.

“The exceptional grades and thicknesses reported in this maiden drilling program, along with the highest grade ionic clay REE reported in the region to date – in surface sample AR33002 – highlights the largely untested REE potential of Salmon Gums and our team’s skill in identifying and advancing high-value mineral prospects.”

AAJ share price

Odyssey Gold (ASX:ODY)

WA gold-exploring junior Odyssey is focused on its high-grade gold projects in the Murchison Goldfields.

It’s up today on… not much. It did deliver a half-year report (to end of December 2023) yesterday, however.

That included a note about the company’s flagship Tuckanarra Gold Project, part of the prolific Murchison Goldfields.

Odyssey has announced an updated mineral resource estimate (MRE) for Tuckanarra totalling 5.14 million tonnes at 2.5g/t Au for a total 407,000 ounces of gold.

Odyssey’s tenement package covers an area of ~170km2. It holds an 80% interest in the Tuckanarra (Odyssey 80%/Monument Mining 20%) and Stakewell (Odyssey 80%/Diversified Asset Holdings 20%) gold projects, which together make up the Tuckanarra Project.

⛏️ Odyssey Increases Mineral Resources to 407koz at 2.5g/t Au at Tuckanarra Gold Project

Represents a significant 12% increase in the MRE gold grade to 2.5g/t Au, compared to August 2023 MRE grade of 2.2g/t Au

More: https://t.co/RtqdOeN1pw $ODY $ODY.ax #gold #ASX #ASXnews pic.twitter.com/bx2tq71xwz

— Odyssey Gold (@odyssey_gold) February 15, 2024

ODY share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.