Resources Top 5: Minnow Pinnacle Minerals joins increasingly crowded James Bay lithium party

Pic via Getty Images

- Move over, several ASX lithium explorers, because Pinnacle Minerals is joining the fray in James Bay

- Meanwhile Battery Minerals is going for… erm, gold… over in central western NSW after making a new acquisition of its own

Here are the biggest resources winners in early trade, Tuesday October 17.

Pinnacle Minerals (ASX:PIM)

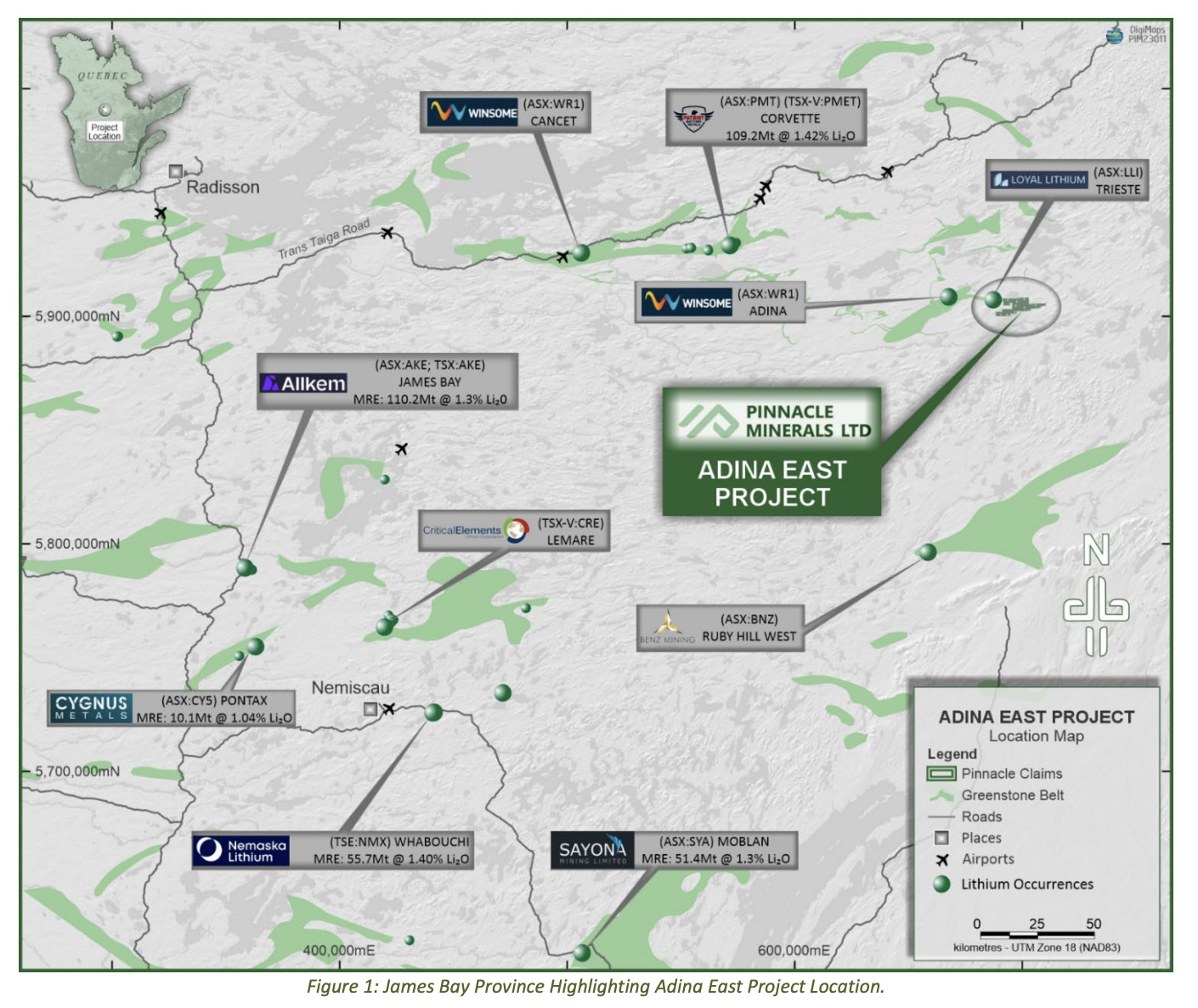

In clear price-moving news explorer Pinnacle Minerals has announced it’s joining the crowded party looking for battery metal love over in the (we pray) prolific region of James Bay in Quebec, Canada.

PIM, an absolute minnow with a $3.2m market cap, was atop the ressie gains summit this morning and is still near the top at the time of writing, with a 44% gain.

Earlier, it had entered into a trading halt pending an acquisition announcement, which it’s now released into the wild.

The company has confirmed it’s made a conditional agreement with a subsidiary of Waratah’s Electrification and Decarbonization AIE LP fund, to acquire a 75% interest in the Adina East Lithium project in James Bay.

We are pleased to announce that the company has entered into a conditional agreement with a subsidiary of Waratah’s Electrification and Decarbonization AIE LP fund, to acquire a 75% interest in the Adina East Lithium Project.https://t.co/ZlymgsJrSb$PIM pic.twitter.com/DW9g8evA4x

— Pinnacle Minerals (ASX:PIM) (@PinnacleMineral) October 16, 2023

The project claims cover 72.7km2 and border an “interpreted extension” of the Trieste Greenstone Belt just 24km from Winsome Resources’ (ASX:WR1) Adina project, which has recorded 1.34% Li2O over 107.6m and grades up to up to 4.89% Li2O. Did someone say nearology? Someone probably has by now, yes.

The project is also adjacent to the Loyal Lithium (ASX:LLI) Trieste Project and one of Winsome’s other ventures in the region, its Tilly project.

As part of the acquisition, Pinnacle has agreed to grant the vendor (which is Waratah) the right to purchase 25% of all minerals extracted from Adina East “in consideration for a US$500,000 offtake prepayment”.

And that would essentially fund the transaction and initial exploration of the project, which is expected to get cracking this month.

Lithium Royalty Corp (TSE:LIRC) retains a 2.0% gross revenue royalty on the Adina East project. That’s a company that also has a stake in notable projects at various stages of development, including Allkem’s (ASX:AKE) Mt. Cattlin Project, Sigma Lithium’s Grota do Cirilo project, Core Lithium’s (ASX:CXO) Finniss Project, and the aforementioned Winsome Resources’ Adina project.

Pinnacle Minerals Managing Director Nic Matich said: “This partnership is anticipated to allow Pinnacle to expand and grow the company’s critical mineral portfolio further.

“Preselling a 25% offtake for US $500,000 shows the ‘offtakers’ confidence in the Project and bolsters our cash reserves in a climate where the dilutive effect of raising capital is destructive to junior explorers. Lithium Royalty Corp. has royalties in 32 projects globally highlighting its global expertise in the sector.”

PIM share price

Battery Minerals (ASX:BAT)

Another tiny battery metals (and gold as it turns out) hunter, the does-more-than-what-says-on-tin named Battery Minerals, also moved up quickly today in the first ASX session and is currently boasting a +40% gain.

Like a BAT out of price-sinking hell?

The one time Mozambique graphite hopeful has fresh acquisition news, releasing an announcement it’s acquiring the advanced Spur gold project, in the heart of the highly prospective Lachlan Fold Belt in central western NSW.

We're is pleased to announce entry into a binding agreement to acquire 100% of the issued share capital of Deep Ore Discovery Pty Ltd, which holds EL5238 comprising the Spur Project in the heart of the highly prospective Lachlan Fold Belt.#ASX🔗https://t.co/Kh3OsaZWKY$BAT #gold pic.twitter.com/grNFamuhEv

— Waratah Minerals (@MineralsWaratah) October 16, 2023

The company reports that multiple epithermal gold targets have been reported at the Spur project, including near-term, high-impact drill targets down dip from open historic drill intercepts, as previously reported by Golden Cross Resources (ASX:GCR).

BAT says it is well funded with a current cash position of $1.2m and the drills are set to start spinning in December, pending full completion of acquisition.

Battery Minerals MD Peter Duerden was enthused, noting in the BAT’s ASX release: “This deal represents a transformative opportunity for the company.”

BAT share price

Ballymore Resources (ASX:BMR)

(Up on yesterday’s news)

Gold-hunting Queensland junior explorer Ballymore Resources is still glinting in the afterglow of yesterday’s news.

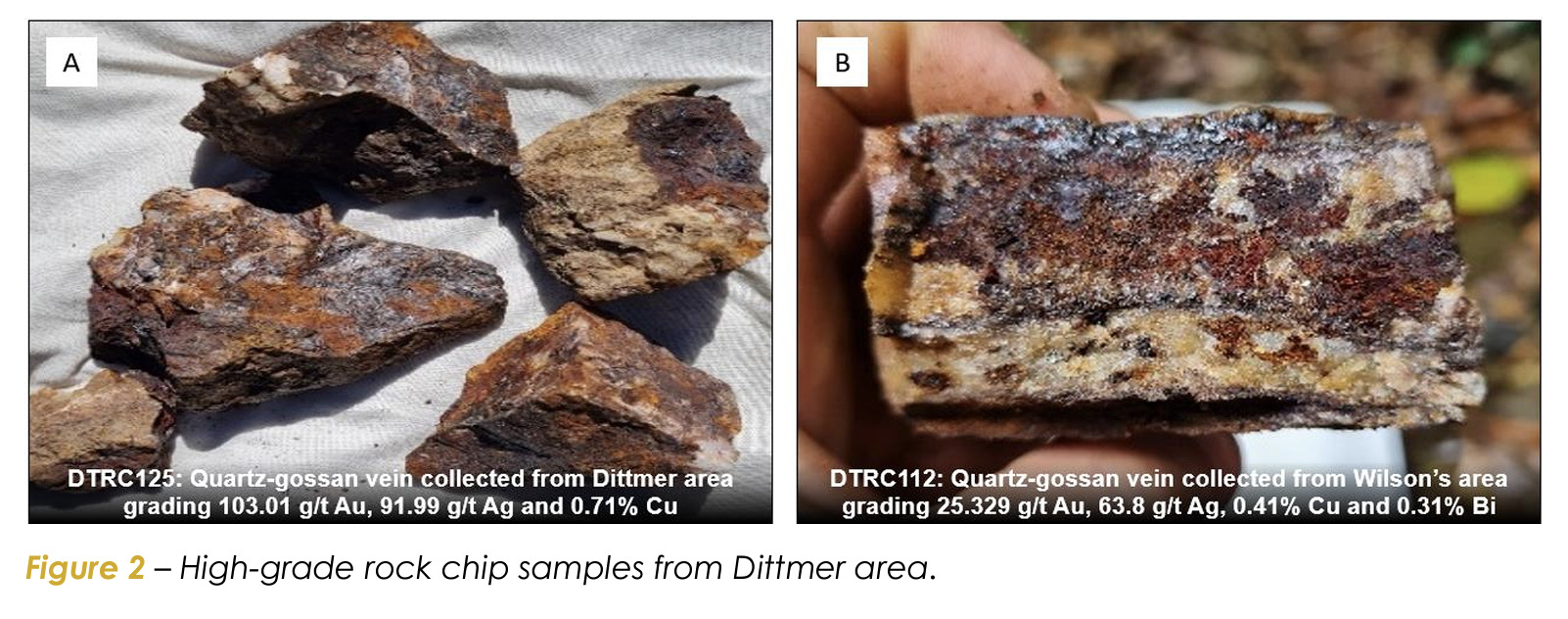

It announced “extremely high-grade gold results” with individual assays up to 2206 ppb Au (2.2 g/t) returned from soil sampling program over its Dittmer prospect, some 30-odd kilometres south-west of Prosperine in central Qld.

The prospect includes the historic Dittmer mine and numerous unexplored, historic workings in local area and the company believes the find confirms Dittmer as a major mineralised system defined by broad anomalies.

Want some pictorial evidence? Here you go, courtesy of Ballymore’s October 16 ASX announcement…

Ballymore’s technical director David A-Izzeddin, said:

“Dittmer, our flagship project, continues to yield exciting results, returning new soil results which demonstrate its potential to host a major mineralised system similar in style to Queensland’s largest gold mine at Ravenswood.”

BMR share price

Yandal Resources (ASX:YRL)

(Up on no news)

Like yesterday (which saw Dacian Gold (ASX:DCN) rise on its huge news of a takeover bid by Genesis Minerals (ASX:GMD)) it’s not a bad day for small goldies so far by the looks of things.

Here’s another one, Yandal Resources, which is “looking for the Mother Lode!” in WA.

Why’s YRL up 18% at the time of writing? Can’t say we’re seeing much, or anything at all, in terms of news on that.

With not much to go on, then, we refer you to the company’s progress report from earlier this month, in which it noted it’s defined initial mineral resource estimates for its HMS Sulphur and Gilmore deposits within its 100%-owned Mt McClure Gold project.

This sees an increase of the 17km-long project’s total gold inventory by 34% to 182,200 ounces at 1.7 g/t. The company’s combined mineral resource inventory across all its projects now comes to 470,200oz at 1.4 g/t Au.

Yandal Resources’ Managing Director Tim Kennedy said of the mineral resource increase at Mt McClure:

“Importantly, this was added for less than $20 per ounce, demonstrating the potential for low-cost brownfield discoveries across the Mt McClure Gold Project.

“Having a combined Resource Inventory of some 182,000oz on granted mining leases nearby to haulage infrastructure is a good starting point for the project, and we look forward to progressing other opportunities to increase this further.”

YRL share price

Southern Gold (ASX:SAU)

(Up on no news)

Annnnd another small gold explorer in the… no-news share price climb club.

The $7.29m market capped Southern Gold is hunting gold-silver and other critical minerals at its exploration projects in under-explored regions of South Korea.

These are largely greenfield epithermal gold-silver targets in the south-west of the country, although it’s (surprise, surprise, given its South Korean connection and the large size of the Asian powerhouse’s EV market) also recently moved into hunting for lithium/battery metals/rare earths.

The company has a strong connection to the lithium battery industry, with a battery tech commercialisation component comprising a key part of its business.

No fresh news today for SAU, but per a recent announcement, the company has appointed one reportedly highly experienced Dr Ebbe Dommisse as interim CEO of its for its subsidiary, Iondrive Technology.

And that’s to lead a prefeasibility study of IDT’s DES battery recycling technology through to the end of this year.

IonDrive Technologies (IDT) a wholly-owned subsidiary of $SAU, has appointed Dr. Ebbe Dommisse as its Interim CEO to lead the prefeasibility study of IDT’s DES #battery #recycling technology through to 31 December 2023: https://t.co/cljFtwRvHH pic.twitter.com/klSL615b3a

— Iondrive Limited (@IondriveASX) October 10, 2023

SAU share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.