Resources Top 5: Metallurgical wins, another Robe River and Achilles won’t heel

Pic: Getty Images.

- Resouro jumps on metallurgical grades

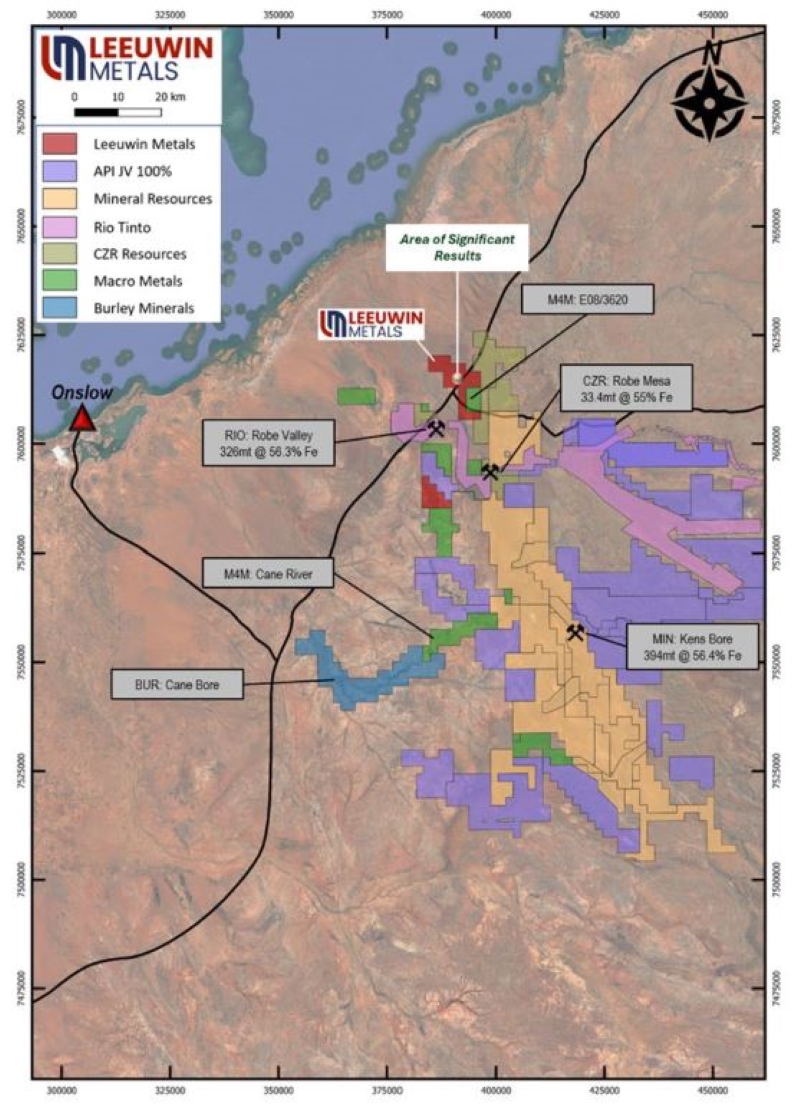

- Leeuwin opens strong with channel iron deposit prospectivity at West Pilbara

- Australian Gold and Copper maintains recovery after RC drilling hits high grades

Here are the biggest small cap resources winners in morning trade, Tuesday, August 13. Prices accurate at time of writing.

Leeuwin Metals (ASX:LM1)

Rock chip sampling of LM1’s West Pilbara iron ore project has has shown values of >50-55% iron along a 1.7km strike.

Satellite imagery and mapping turned up the prospectivity for lucrative channel iron deposits (CID), with multiple target areas present within the project area.

CID’s are a major source of cheap iron ore that is close to the surface and can be calcined into 63%+ iron, mined nearby at Rio Tinto (ASX:RIO) 326Mt at 56.3% iron Mesa A and CZR Resources (ASX:CZR) 33.4Mt at 55% iron Robe Valley in the Pilbara’s Robe River region.

Further ground exploration is about to commence at West Pilbara to try and prove up the CID targets, which could turn the project into another Robe River iron ore mining operation.

LM1 is also running its finger over its Root Lake lithium project and has kicked off a summer field program where it has identified a 4.7km-long mineralised trend with over 20 spodumene-bearing pegmatites.

Shares in LM1 shot up 24.6% on open today, yet settled up 10.9% at time of writing.

Resouro Strategic Metals (ASX:RAU)

After listing on the aussie bourse in June, Canadian miner RAU has been exploring the development potential of the massive 1.7 BILLION tonne rare earths resource it estimated at its Tiros project in Minas Gerais, Brazil.

Along with scale, the project also averages an impressive 3900 parts per million (ppm) TREO, with 1100ppm of them the high-value magnetic rare earths such as neodymium, praseodymium, dysprosium and terbium – elements used in tech that are ever-growing in demand.

Its also got a titanium dioxide content of 12% within over half the combined measured and indicated 1Bt at 4050ppm inventory.

RAU has been busy conducting metallurgical wizardry to see if those grades can translate into economically lucrative production.

READ MORE: REE Survival Guide Part 2 – How metallurgical wizardry can make or break a project

“Outstanding” metallurgical test results with its partner Altilium have just been released, showing that the consistent, thick and near surface material has strong potential to produce excellent recoveries of up to 96.2% magnetic rare earths.

Test work is ongoing to optimise REE extraction and titanium oxide recoveries and will add to an upcoming preliminary economic assessment of Tiros.

Shares in the explorer jumped 12.3% on news to trade at 41c per share.

Australian Silica Quartz (ASX:ASQ)

(Up on no news)

Rising up the charts today, ASQ’s 2000m reverse circulation (RC) drilling program at its Quartz Hill MSGi project in QLD that it completed last year ended up proving an MRE of 17.3Mt at a whopping 99.04% silica (SiO2).

Since then, it’s started work on a scoping study that’s looking at suppling 300,000tpa of silicon metal feedstock lump to offtake partner Quinbrook, which is proposing develop a multi-billion dollar polysilicon manufacturing facility powered by large-scale solar near Townsville.

A diamond drill hole has been completed to a depth of 64.5m to validate an RC hole and will provide samples for metallurgical testing for the progressing study.

Shares in the $8.4m market-capped silica hunter are up 36.4%, trading at 3c.

Australian Gold and Copper (ASX:AGC)

(Up on no news)

AGC is still on the rise after its Achilles discovery in Cobar, NSW.

The stock was worth 7.9c by ANZAC day this year, before shooting up to 56c per share in May on the back of revealing exceptional grades of up to 45g/t and 3000g/t silver – with a whopping 38% lead and zinc content from drilling.

The discovery is unusual, and what AGS says is a “true greenfields discovery”.

While there was a sell-off after an $11m cap raise, it’s been back on the rise since last week, after revealing some high grade assay results from a follow-up RC drill campaign.

Drill intercepts up to 5m at 16.9g/t gold, 1,667g/t silver, 0.4% copper and 15% lead+zinc were unearthed late last month.

Shares in AGC are up 15.91%, trading at 25.5c per share.

Nova Minerals (ASX:NVA)

(Up on no news)

NVA has kicked off resource drilling at its 500km2 flagship Estelle gold project in the prolific Tintin Gold Belt in Alaska, where another ASX junior Felix Gold (ASX:FXG) is also currently looking to prove up a resource nearby.

A PFS is on the way for the high-grade RPM deposit, part of the explorer’s global 9.9Moz resource across four deposits, as it continues efforts to become a Tier 1 gold producer.

It wants to establish an initial low-capex smaller scale operation at RPM so it can get some early cashflow and high margins, as it has an idea to self-fund expansion plans or develop a higher capex mining operation with increased gold production.

Assays from drilling are expected soon and will go towards increasing resource confidence and provide data for the upcoming PFS.

Shares in the $34m market-capped gold hunter are up 15.4% to be swapping at 15c per share at time of writing.

At Stockhead we tell it like it is. While Leeuwin Metals and Resouro are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.