Resources Top 5: Loyal Lithium spots bulk James Bay spod; and is Mr Lithium Joe Lowry’s ‘tethered goat’ a winner?

Pic via Getty Images

- It’s spod-spotting a-go-go once again in James Bay as Loyal Lithium makes some big, thick finds

- TG “Tethered Goat” Metals is keeping its own recent lithium finds in the spodlight

- And Magnum is up on a zero-carbon green pig iron deal with Saudi company Midmetal

Here are the biggest resources winners in early trade, Wednesday November 1.

Loyal Lithium (ASX:LLI)

Loyal Lithium, one of several Aussie explorers in the thick of the spod-hunting action over in the battery metal hotspot of Quebec’s James Bay, is making a lunchtime (+35%) burst up the ASX on the back of an interception of the big, beautiful and thick variety.

We’re (actually it’s) talking “thick intercepts of spodumene-bearing pegmatite” at LLI’s highly prospective Trieste project.

This is exactly what you want to see in Cores 👀 @LoyalLithium

Another Quebec Lithium Deposit being uncovered ⛏️

All drill holes to date have intercepted spodumene bearing pegmatite at Dyke #01 which remains open in all directions

74.77m of spodumene bearing pegmatite… pic.twitter.com/uWSgNEg5yK

— Pilbara☀️Wanderer ⛏🚶🏻 (@PilbaraWandy) October 31, 2023

The company’s drilling program is targeting Dyke #01, which it notes is a “large, prominent weather-resistant outcrop ridge”, with all drill holes to date successfully intercepting spodumene-bearing pegmatite.

Fourteen drill holes have been completed to date and Dyke #01 remains open in all directions with drill core displaying large and abundant spodumene crystals from surface.

Other highlighted company notes include:

Notable drilling pegmatite cumulative intercepts (apparent widths) of:

– 74.77m of spodumene-bearing pegmatite: DIS23-014

– 30.44m of spod-bearing peggie: DIS23-011

– 27.96m of spod-bearing peggie: DIS23-004

– 26.74m of spod-bearing peggie: DIS23-006

– 24.22m of spod-bearing peggie: DIS23-005

The company adds that samples are now being selected for assaying and those results are expected by January 2024.

Loyal Lithium’s MD, Adam Ritchie, said:

“We are delighted to have been able to commence this maiden drilling program just 6 weeks after the discovery at the Trieste Lithium Project.

“The geological understanding gained by this program has confirmed extensions of the spodumene bearing dyke beyond the exposed outcrop, which in turn has confirmed the possibilities of concealed extensions across the entire project.

“The visual spodumene crystals within the core are large and abundant – in line with what we’ve seen at surface across the project.”

Also well up today at the time of writing, by the way – perhaps on a bit of LLI-related nearology action – is Pinnacle Minerals (ASX:PIM).

PIM, an absolute minnow with a $4.6m market cap recently announced it has joined the crowded James Bay lithium party, acquiring a 75% interest in the Adina East lithium project, which is adjacent to LLI’s Treiste in the famed Trieste Greenstone Belt. It’s also just some 24km from Winsome Resources’ (ASX:WR1) Adina project, which has recorded 1.34% Li2O over 107.6m and grades up to 4.89% Li2O.

LLI share price

TG Metals (ASX:TG6)

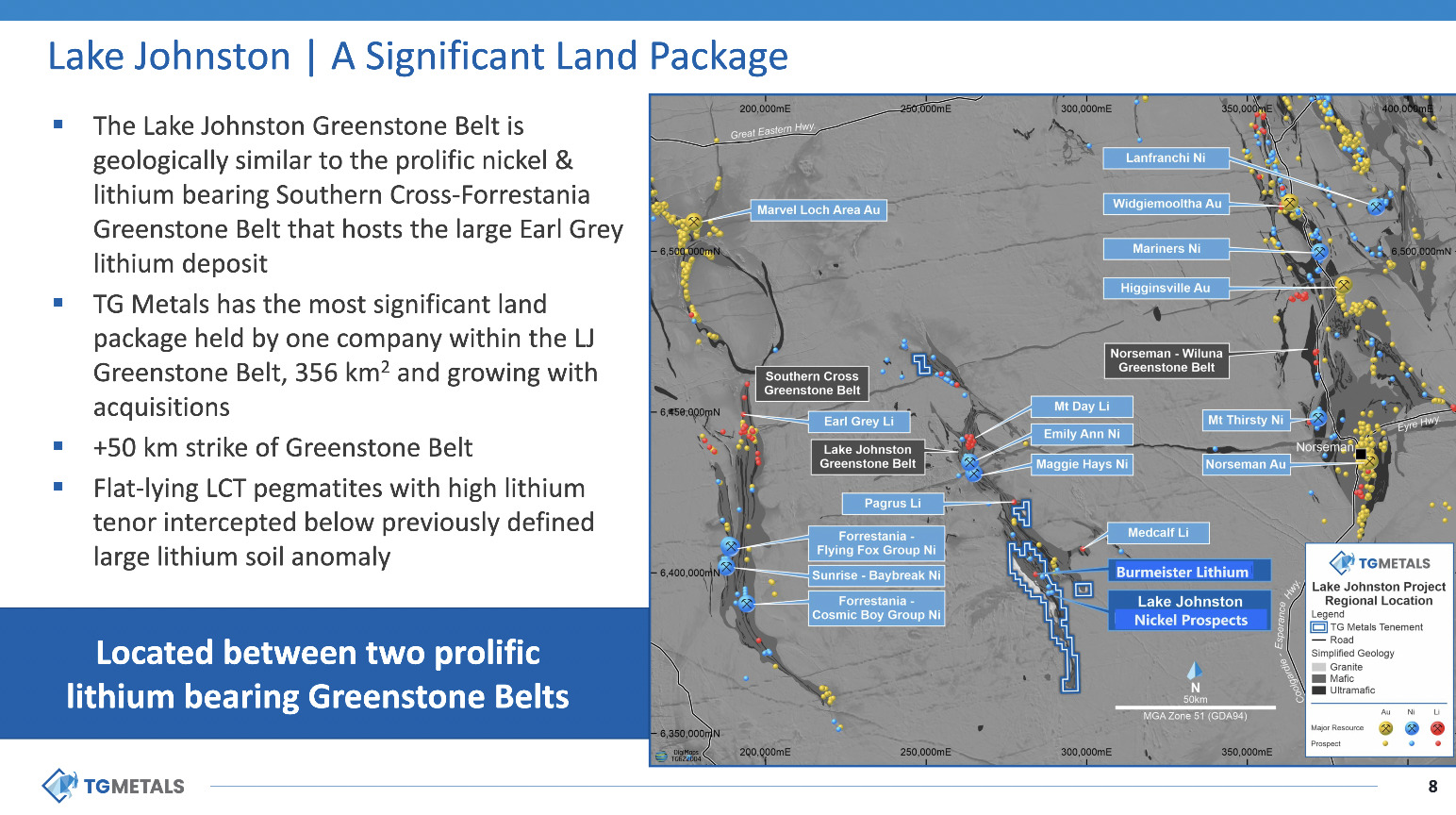

Lithium, nickel and gold exploration junior TG Metals made waves earlier this week when it surged up the ASX after announcing an interception of high-grade lithium at its Lake Johnston Li-Ni-Au project in the Lake Johnston Greenstone Belt of WA.

Today, the “Tethered Goat” – as Joe “Mr Lithium” Lowry recently dubbed the company – is continuing the good vibes from this recent find, with an investor presentation drilling further into the details for shareholders and other interested parties.

I have often received criticism from “Down Under” for never discussing early stage explorers. Let me right that perceived wrong by giving a shout out to my pals at “Tethered Goat” aka TG Metals. 頑張って下さい #TG6 #DYOR pic.twitter.com/lL20scV3rj

— Joe Lowry (@globallithium) October 30, 2023

Earlier this week the company noted that initial drilling of the 4.5km by 1.7km Burmeister lithium soil anomaly within the project has found a spodumene-bearing pegmatite with grades up to 2.28% Li2O.

Here are some further deets from the presso…

TG6 share price

Magnum Mining (ASX:MGU)

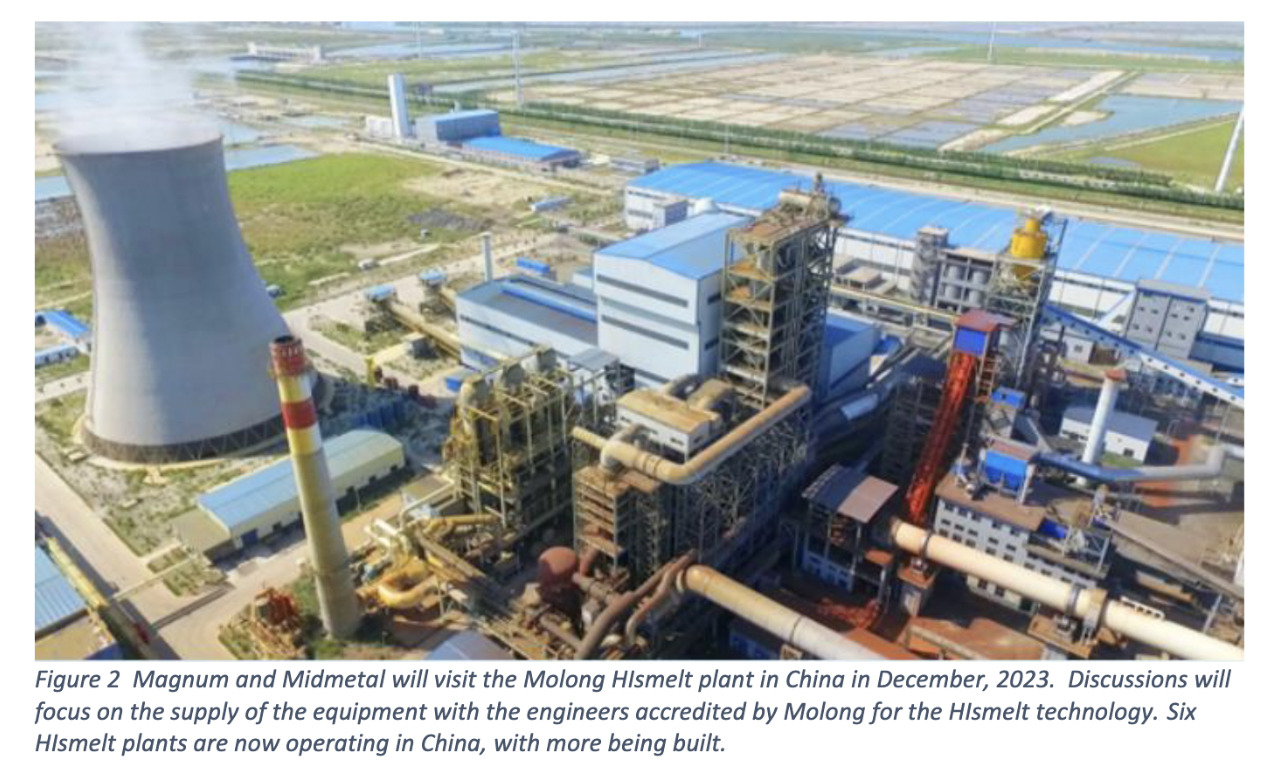

Minerals exploration and mining company Magnum came off a trading halt this morning after announcing it’s inked a deal with Midmetal of Saudi Arabia to 50/50 jointly fund a feasibility study on producing zero-carbon “green” pig iron.

It’s been a mixed year for the magnetite/iron ore-focused company – that said, it’s so far up about 24% YTD.

The study will focus on the development of a HIsmelt facility in Saudi Arabia, operating on a net zero-carbon basis to produce green, high quality pig iron.

HIsmelt is an air-based direct smelting technology originally developed by Rio Tinto in 1982 to smelt high phosphorous iron ore fines with non-coking coals.

The tech can reportedly “deliver high purity pig iron now, without awaiting the development of technically challenging and economically burdensome hydrogen reduction techniques”.

In this instance, the process will be be fed by Buena Vista magnetite concentrate augmented with steel mill waste. (Buena Vista is the company’s iron ore project located in Nevada, USA.)

Magnum and Midmetal will reportedly jointly develop agreements for project funding and pig iron offtake and the study is expected to be completed by the end of this year.

MGU share price

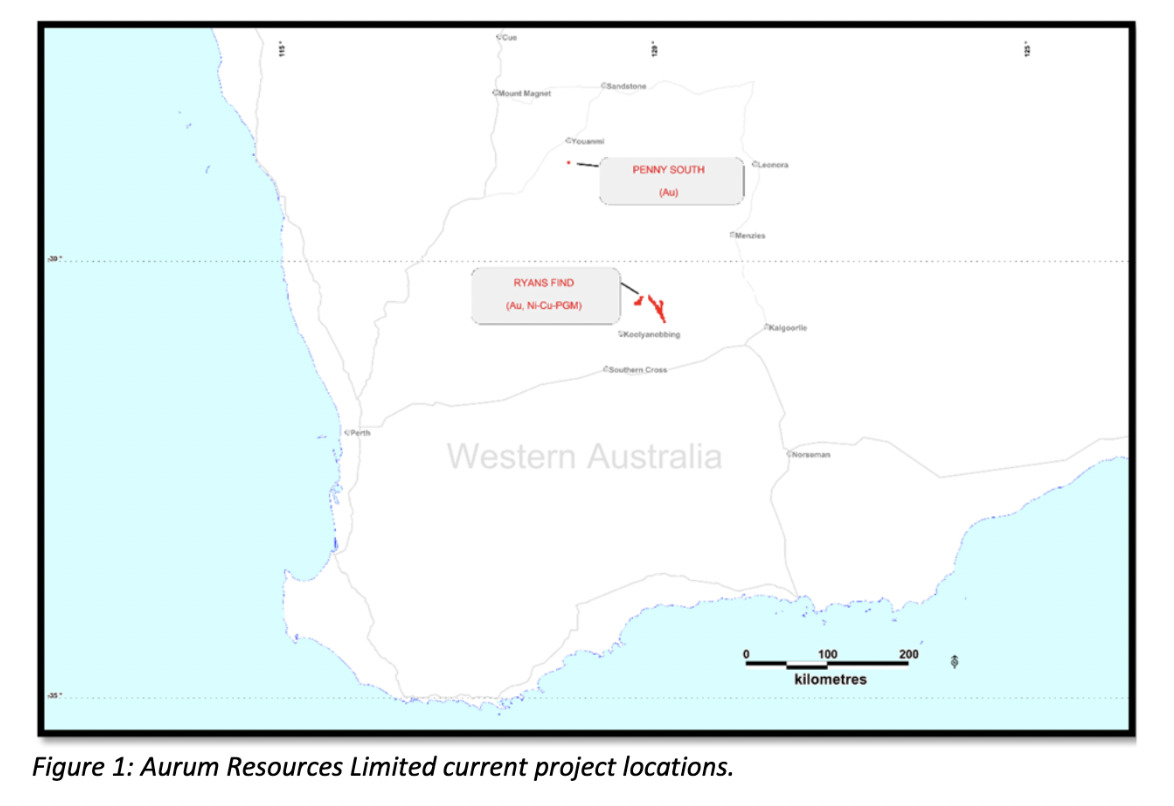

Aurum Resources (ASX:AUE)

Gold-hunting minnow Aurum is near 20% up at the time of writing. Quarterly reporting? You bet.

Highlights? We got ’em. Actually, the company’s ASX announcement does, but instead of heading there, you can read them here:

• For the quarter ending September 30, the company notes its aircore drilling has been successfully completed at its flagship Ryans Find gold project, which is north-east of Koolyanobbing in Western Australia.

• All 74 planned drill holes were drilled down to fresh rock/refusal, with a maximum hole depth of 69m. The program’s drilling total was 2,634m.

• A total of 731 composite samples were delivered to Intertek Laboratories for assaying.

• Also, some $705,000 of capital raising was completed in the quarter. A handy sum. The company also notes it has cash on hand, as of September 30, 2023 of $2.548 million. Even handier.

AUE share price

Alchemy Resources (ASX:ALY)

Small gold and battery metals hunter Alchemy is double digits up today (roughly 20% at time of beginning this article, although sagging a handful of % since). Yesterday it, too, released its Quarterly Activities and Cashflow Reports into the wilds via the ASX.

Some highlights:

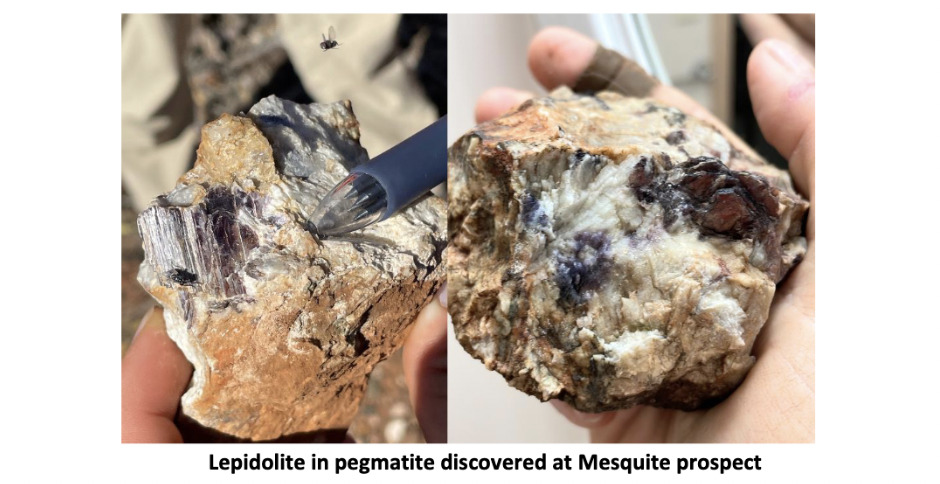

• Its gold/lithium Karonie project in WA delivered the completion of a lithium-focused RC program on Hickory, Mesquite, Pecan and Taupo North Prospect areas, with 28 holes drilled for 3,732m.

• That drilling was successful in identifying new zones of pegmatites at Mesquite and Taupo North, confirming Alchemy’s interpretation of a system developing at depth and within proximity to the Cardunia granite “Goldilocks Zone”.

• Ground mapping anomalies discovered additional lepidolite and spodumene at new target areas at Mesquite with assays up to 0.45% Li20, while numerous additional targets were identified in the project areas.

• A maiden Mineral Resource Estimate (MRE) for the Overflow deposit at the 80% owned Lachlan gold project in New South Wales, was also delivered in the quarter.

• The estimate, prepared and verified by external consultants, came in at a JORC-compliant 342koz at 1.30g/t AuEq (Inferred, 0.7g/t AuEq cut-off) from surface.

• Meanwhile, cash at hand on September 30 (end of quarter) 2023 was $4.4m. Exploration expenditure for the reporting period was $577,000.

ALY share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.