Resources Top 5: Lithium standouts, tin discoveries, and superstar mine builders join cashed-up goldie

(Photo by Jeff Spicer/Jeff Spicer/Getty Images)

- Former Saracen boss Raleigh Finlayson will cornerstone a $20.8m funding package for Genesis, will join as MD mid 2022

- blending brines from Pepininni’s ‘Rincon’ and ‘Incahuasi’ salares in Argentina creates very high lithium concentrations

- Sky makes tin discovery in NSW

Here are the biggest small cap resources winners in early trade, Wednesday September 22.

GENESIS MINERALS (ASX:GMD)

Former Saracen/ Northern Star (ASX:NST) boss Raleigh Finlayson will cornerstone a $20.8m funding package, which will also include Northern Star itself and former FMG (ASX:FMG) chief exec Neville Power.

One of Argonaut’s potential junior takeover targets for 2021, WA-based Genesis unveiled a visible gold intercept of 5m at 60.7 grams per tonne (g/t) from 265m at its 1.6Moz Ulysses project in May.

The $20m will be used to grow the project through aggressive exploration, advance ongoing feasibility studies, and pursue other strategic opportunities as they emerge.

Finlayson is set to join the explorer as managing director mid next year, while Power and highly experienced corporate lawyer Michael Bowen will sit on the board as non-exec directors.

That’s some serious firepower.

“Raleigh is a highly successful gold miner with an exceptional track record of creating value for shareholders, growing Saracen from a junior explorer and developer into a $6 billion company at the time of its merger with Northern Star,” GMD chairman Tommy McKeith says.

“With Raleigh working alongside Neville, whose vast experience and achievements are widely acknowledged across the Australian business spectrum, and Michael, who is one of Perth’s most highly regarded corporate lawyers, Genesis will have an enviable team in the Boardroom.

“The combination of their experience and the funding package will position Genesis to maximise the opportunities at the Ulysses project as well as consider value-enhancing strategic acquisitions.”

The $380m market cap stock is up 137% year-to-date.

PEPINNINI MINERALS (ASX:PNN)

The company says blending brines from its ‘Rincon’ and ‘Incahuasi’ salares in Argentina creates a lithium concentration of 8,500 mg/kg — a level 14 times that of Incahuasi brine and seven times that of Rincon brine.

Nearby lithium producer Orecobre (ASX:ORE) concentrates to 7,000 mg/kg, Pepinnini says.

Is it magic? No, science. Probably.

“The blending of brine with a high concentration of sulphate from the Salar del Rincon with the brine of high concentration of calcium from the Salar de Incahuasi avoids the precipitation of lithium sulphate and reduces the calcium content,” PNN says.

“By using this difference between the brines, it is possible to obtain a higher concentration of lithium in the brine at a lower cost.”

The $20m market cap stock is up just 25% year-to-date.

LAKE RESOURCES (ASX:LKE)

While Lake Resources’ flagship Kachi project already ranks amongst the top 10 global lithium brine resources worldwide, it’s not-so-secret weapon is Lilac Solutions’ innovative direct-extraction technique, which produces cheap, high quality, environmentally friendly lithium.

The trifecta.

Under the new agreement, Lilac Solutions will contribute tech, engineering teams, and an on-site demonstration plant to earn a maximum 25% in the advanced project.

Lilac, after earning its interest in Kachi, will be expected to fund ~US$50 million, equivalent to its pro rata share of future development costs — aligning innovation, funding, development, and production.

This deal follows the recent successful sourcing of an Expression of Interest from the Export Credit Agency of the United Kingdom to provide project finance for the first stage of the Kachi Project.

This Expression of Interest will cover ~70% of the total finance required to expand production to 50,000 tpa of high purity lithium carbonate equivalent.

The $642m market cap stock is up 630% year-to-date.

(Up on no news)

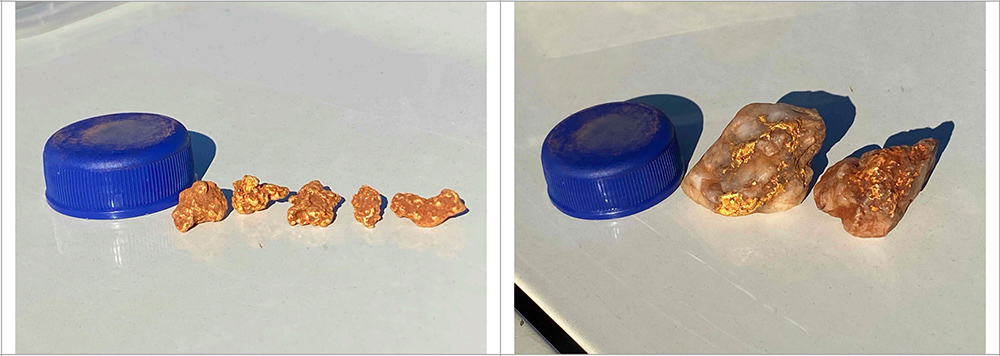

This recently listed gold and base metals explorer completed an early-stage target-finding program at the ‘Melita’ gold-copper-lead-zinc project in the WA goldfields last week.

These targets will be prioritised for initial aircore (shallow) drilling, the company says.

This is a gold rich area, with prospectors regularly picking up nuggs like this off the surface:

A 5 hole maiden drilling program was also completed early September at the historical ‘Rock of Ages’ project near Laverton. Assay results are anticipated in 4 to 5 weeks.

SKY METALS (ASX:SKY)

The perfect time to make a tin discovery, with prices at record highs.

Drilling at the ‘3KEL’ target, part of the ‘Doradilla’ tin-polymetallic project in NSW, has discovered wide, high-grade, primary zone tin-copper over 1km.

Highlights include:

- 32m @ 0.42% tin from 66m, including 9m @ 0.99% tin & 0.31% copper from 81m

- 37m @ 0.31% tin from 91m, including 1m @ 4.23% tin & 0.20% copper from 121m, and:

- 4m @ 1.10% tin & 0.21% copper from 135m

The high-grade stuff is open for +2km along strike, and at depth.

Diamond drilling will kick off soon to follow up these results.

“SKY considers these results very significant and indicate a very large primary tin-copper system over at least 2km of strike,” SKY exploration manager Oliver Davies says.

“With very limited drilling, and mineralisation open along strike and depth, the 3KEL system has potential to evolve into a very large tin-copper deposit.”

The $30m market cap stock is down 50% year-to-date.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.