Resources Top 5: Lindian partners with REE major Iluka for Kangankunde

A partnership between Lindian and Iluka is a win-win for the companies as well as for Australia and Malawi. Pic: Getty Images

- Partnership for Kangankunde REE project funding and offtake

- High-grade niobium is emerging as a significant contributor to the Kameelburg project

- Exceptional rock chip sampling results have been returned from Central Otavi project

Your standout small cap resources stocks for Wednesday, August 6, 2025

Lindian Resources (ASX:LIN)

A strategic partnership has strengthened the standing of the Kangankunde project as one of the world’s most attractive and advanced rare earth projects and represents a win-win for partners Lindian Resources (ASX:LIN) and Iluka Resources (ASX:ILU) as well as for Malawi and Australia.

The partnership incorporates a binding loan term sheet of US$20 million (~$32m) and full-form offtake agreement with Iluka and has seen Lindian reach 15c, a 59.6% improvement on the previous close with more than 38m shares changing hands.

Iluka will provide a cornerstone US$20m Construction Term Loan Facility over a five-year tenor while the 15-year strategic partnership will provide Iluka with offtake of 90,000 tonnes (6,000tpa) of rare earth monazite concentrate from Lindian’s Kangankunde project until a total of 9,600dmt of contained neodymium and praseodymium has been delivered.

The concentrate will feed Iluka’s fully integrated Eneabba Rare Earths Refinery Facility in Western Australia, which is partly funded by the Australian government.

Iluka will also be granted a right of first refusal (ROFR) for the phase 2 Kangankunde production expansion for up to a further 375,000 tonnes (25,000tpa for 15 years), subject to Iluka providing a 50% debt funding offer for the expansion capital cost and agreeing to Lindian’s revised commercial terms (such as pricing mechanisms).

This provides a strong foundation for additional growth and aligns with establishing WA as a strategic hub for the downstream processing of third-party rare-earth feedstocks.

The binding strategic partnership with Iluka provides a credible pathway forward for the development of Kangankunde, whilst delivering long-term contracted revenue.

Kangankunde will produce a premium monazite concentrate over a long initial Life of Mine (LoM) of 45 years, based on JORC ore reserves.

“This is a pivotal milestone for Lindian and is a major step towards accelerating the development of Lindian’s globally significant Kangankunde rare earths project in Malawi,” Lindian executive chairman Robert Martin said.

“These agreements will provide a multi-decade source of feed for Iluka’s Eneabba refinery facility in Western Australia, backed by the Australian government. The floor price protection, no financial ratio covenants and offtake-linked terms are fit-for-purpose for the company, ensuring the long-term interests of shareholders are enhanced.”

Aldoro Resources (ASX:ARN)

The world-class rare earth element credentials of the Kameelburg project in Namibia continue to be enhanced by Aldoro Resources with high-grade niobium emerging as a significant contributor.

Assays have extended known REE and niobium mineralisation to ~1100m along a NW-SE orientation and demonstrate continuity and scale.

Diamond holes DD005B and DD008A encountered significant mineralisation throughout the entire drill core with the former extending the mineralised zone by 400m.

Hole DD005B was drilled to a depth of 399m and intersected a combined 102.8m zone of REE dominant mineralisation grading 2% total rare earth oxides, 0.18% niobium pentoxide and 203ppm molybdenum in the upper layer and 206.6m at 0.76% TREO, 0.43% Nb2O5 and 52ppm Mo in the lower niobium dominant layer. This included a top result of 4.14% Nb2O5.

Hole DD008A returned 200.5m at 1.64% TREO, 0.177% Nb2O5 and 349ppm Mo in the upper layer and 75.6m at 0.61% TREO, 0.165% Nb2O5 and 233ppm Mo in the lower layer.

Results will be included in an updated resource estimate that Aldoro Resources expects to release later in August.

This is likely to be a significant improvement to the maiden resource of almost 280Mt at 2.45% TREO equivalent announced earlier this week.

“Diamond holes DD005B & DD008A continue to demonstrate the continuity and scale of the Kameelburg deposit, and we are comfortable these two holes will add significant tonnage and grade to the updated mineral resource estimate encompassing all holes drilled in the phase I program,” chairperson Quinn Li said.

“In addition, the high-grade niobium mineralisation intersected by DD005B provides further support of our internal model that the occurrence of a deeper high-grade zone of mineralisation to the west of the carbonatite represents an exciting area that warrants further exploration when our larger diamond rigs arrive in September.”

Once Kameelburg drilling is completed, ARN will mobilise the rig to drill the Omuronga Carbonatite.

Golden Deeps (ASX:GED)

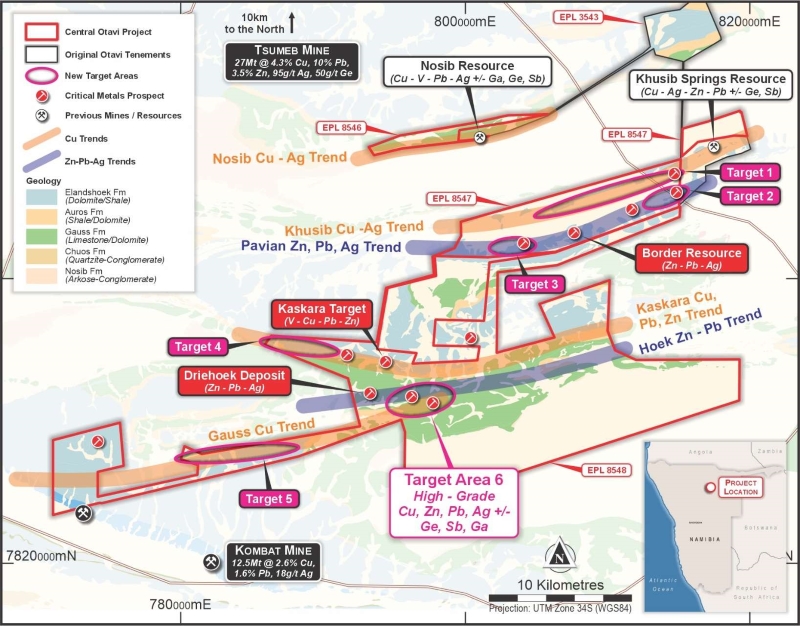

Exceptional rock chip sampling results for copper, zinc, silver and lead with high-grade germanium and highly anomalous antimony from the Central Otavi project in Namibia saw Golden Deeps hit 2.9c, an increase of 32% on the previous close.

Grades of up to 38.3% Cu, 35.4% Zn; 2,473 g/t Ag and 97 g/t Ge were returned from sampling of strongly mineralised gossans (oxidised sulphide) and sulphide occurrences within a 1km x 800m area.

Trenching and channel sampling of the key gossan and sulphide outcrops is underway in conjunction with further soil and rock chip sampling in extensions of this large system.

Geophysical programs, including IP surveys, will be carried out to detect Cu, Zn, Pb, Ag sulphide targets within the gossan corridors, to be followed by drill testing as soon as possible.

“The identification of these outcropping oxidised sulphide gossans – and the spectacular grades of copper, zinc, silver and lead, with high-grade germanium and highly anomalous antimony, over such a widespread area – clearly demonstrates the potential for substantial, high-grade mineralised sulphide discoveries in multiple zones,” Golden Deeps CEO Jon Dugdale said.

Albion Resources (ASX:ALB)

Albion Resources has kicked off the second phase of its RC drilling program at the Yandal West Project in the highly-prospective Yandal Greenstone Belt of Western Australia.

The new program will cover around 1700m and target multiple high-priority gold prospects.

These include the Collavilla Historical Workings target where outcropping shallow mineralised quartz veins have delivered high-grade historical results.

This new drilling aims to step out from there, toward the greenstone contact.

Another target is Collavilla East, which contains a chargeability anomaly extending to around 300m deep near known mineralisation.

At Barwidgee Central target drilling will follow up on historic intercepts, testing mineralisation and anomalous surface geochemistry and geophysical targets.

Also on the drilling schedule are targets across the broader Ives Find area and the May Queen prospect.

Waratah Minerals (ASX:WTM)

The word is out about the gold potential of Waratah Minerals Spur project southwest of Orange in NSW and in proximity to the massive Cadia Valley gold and copper operations of Newmont with shares rising for a third consecutive day.

The $107m company hit a new four-year high of 60c, an increase of 14c or 30.5% on the July 5 close and double the close of 30c on Friday, August 1.

These increases were sparked by drilling results released on July 4 that have enhanced confidence in the project’s potential to host a large-scale, high-grade epithermal gold system with plenty of upside along the rapidly emerging Spur Gold Corridor.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Aldoro Resources, Albion Resources and Waratah Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.