Resources Top 5: Lightning could strike twice in West Arunta as Encounter drills high grade niobium next door to WA1

Encounter's Green is over the fence from WA1's Luni. Pic: Getty Images

- Encounter may have found the extension of WA1’s Luni at its Aileron niobium project

- Could Alliance Nickel be WA’s great hope for the battery metal?

- Petratherm, Narryer and QEM up on no news

Your standout small cap resources stocks for Thursday, November 21.

ENCOUNTER RESOURCES (ASX:ENR)

There could be legs yet in the West Arunta niobium narrative, with Will Robinson’s Encounter Resources claiming to have hit high-grade niobium in the continuity of the high-grade system at WA1 Resources’ (ASX:WA1) Luni discovery in the remote WA exploration frontier.

Luni has delivered an enormous 6000% gain for early backers of WA1, making it a $1 billion company and delivering its geos the coveted AMEC Explorer of the Year Award for 2024, with the 200Mt at 1% Nb2O5 (niobium pentoxide) resource regarded as the largest discovery of its kind in 70 years.

Does lightning strike twice? Encounter has certainly lit up the eyes of investors with its Green discovery to the south-west of Luni, with the first assays from four RC holes drilled at the prospect delivering thick, high-grade results.

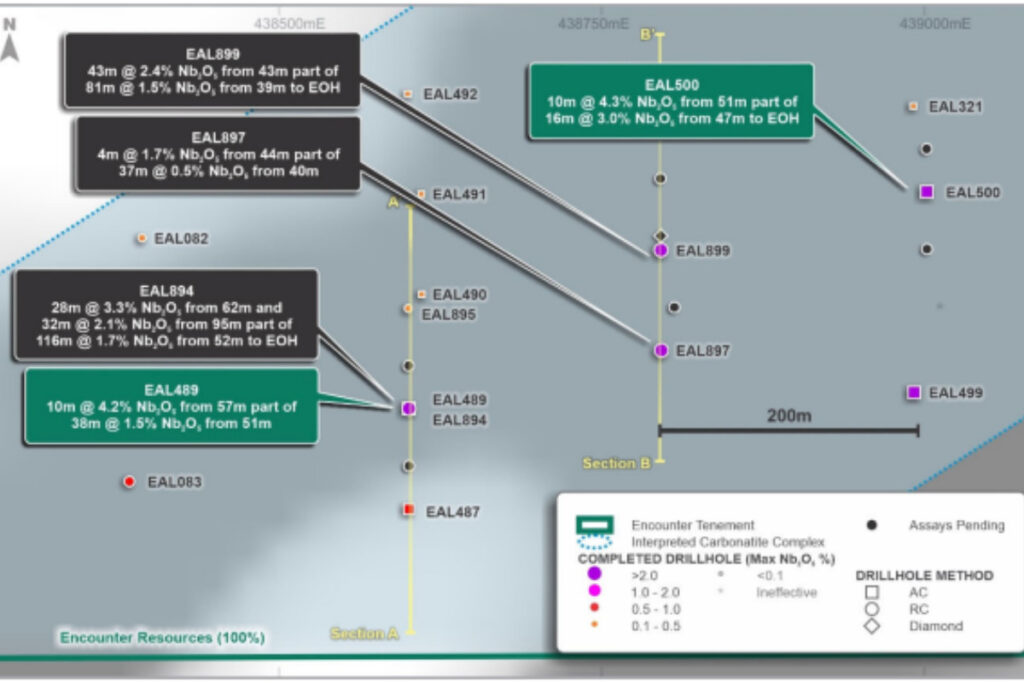

They include 116m at 1.7% Nb2O5 from 52m to the end of hole, including 28m at 3.3% Nb2O5 from 62m and 32m at 2.1% Nb2O5 from 95m in hole EAL894, a hit Encounter has claimed as the highest grade by thickness RC intercept from the whole West Arunta province.

Another similarly impressive strike in hole EAL899 intercepted 81m at 1.5% Nb2O5 from 39m, including 43m at 2.4% Nb2O5 from 43m.

“Green is a large, mineralised carbonatite (+3km long) containing multiple zones of shallow, high-grade niobium mineralisation identified with aircore drilling. The first RC holes completed at the western side of Green demonstrate some of the best, depth-extensive niobium mineralisation in the West Arunta,” Encounter’s exec chair Robinson said.

“A further 30 RC drill holes have been completed at Green, through the better mineralised zones defined by aircore drilling, and we look forward to providing further assay results in the months ahead.”

Part of the Aileron project, another six RC holes have been completed into this apparently high-grade part of the Green prospect, with results due in early 2025. They’ll be closely watched.

Diamond drilling has also bee undertaken adjacent to this area for initial mineralogy and metallurgy, with scanning, sighter beneficiation and flotation tests due for completion in the first half of 2025.

ALLIANCE NICKEL (ASX:AXN)

In a year of despair and depression for Australian nickel stocks, Alliance Nickel has eked out a somewhat surprising 7.5% YTD gain, pushed into the green today after a 16% rise on the back of a definitive feasibility study at its NiWest nickel and cobalt laterite project in the Northern Goldfields.

Located close to Murrin Murrin, a Glencore operation that now counts as one of just two still producing in WA’s once bustling nickel scene, the junior has placed a $1.65 billion capex bill – up 31% since a July 2022 PFS – on developing a heap leach operation that will deliver annual production of 19,500t of nickel and 1500t of cobalt over its first 27 years in operation at all-in sustaining costs of US$4.95/lb.

That’s lowest quartile, should the minnow be able to raise the capital, a serious question given the state of the current nickel market.

NiWest has major project status from Canberra and boasts a JORC ore reserve of 84.7Mt at 0.94% nickel and o.06% cobalt.

But both nickel and cobalt prices are hanging low, nickel sent into oversupply by a rapid acceleration in production from Indonesia and cobalt stuffed full of material from copper mines in the DRC.

That rapid supply growth has halted momentum from rising EV battery demand and sent most of Australia’s nickel mines, including BHP’s 80,000tpa Nickel West division, into care and maintenance.

Alliance has set an H2 2025 timeline for a final investment decision. An equity selldown that would divest up to 50% of the project seems a likely pathway if first production by late 2027 is to be achievable. Debt would include export credit agency financing.

If it can be brought to fruition, the project would deliver $6.1 billion in post-tax free cash flow at long term LME nickel prices of US$20,216/t, with a premium for nickel sulphate taking it to US$22,325/t, and cobalt prices of US$32,556/t.

They’re not there at the moment. The LME three-month nickel contract was trading at US$15,906/t at last observation, with cobalt at US$24,300/t.

If there is a silver lining for Australian nickel laterite projects like NiWest and Ardea Resources’ (ASX:ARL), it’s the support that strategic investors have for them, notably from Europe, the USA, Japan and Korea.

Euro carmaker Stellantis is an 11.5% shareholder in AXN and has a five-year take or pay offtake for 40% of output over the first five years of production. AXN is also in discussions with Korean tech giant Samsung.

The potential to develop assets like these could be influenced by policy as well. US lawmakers have been reticent to allow Indonesian nickel, viewed as a proxy for Chinese interests, to be used in equipment that would qualify for Inflation Reduction Act tax credits. How that evolves in a Trump presidency remains to be seen.

PETRATHERM (ASX:PTR)

(Up on no news)

Petratherm shares surged over 50% in early trade as the explorer held its AGM, having seen its stock price close to double over the past five trading days.

That’s owed in part to some lab results on Tuesday from the Muckanippie project in SA, where PTR confirmed high titanium content in heavy mineral sands from shallow depths in historic drilling.

READ: Resources Top 5: Petratherm heats up with high value titanium metals at Rosewood

Those assays from holes initially collected by the SA mines department, were described by chairman Derek Carter along with surface samples that returned grades upwards of 30% TiO2 as “outstanding”.

“With additional capital raised, we quickly commenced follow-up activities with a 100 hole air-core drilling program,” Carter said in his address to this morning’s general meeting.

“We eagerly await results which are expected next month. We also collected composite samples of the historic drill holes from the Rosewood Prospect area that are stored at the South Australian Core Library and completed an initial trial heavy mineral sand separation test. As announced on Tuesday, the initial results are striking and far beyond our expectations.

“Make no mistake that this is a very important discovery, not only for Petratherm but also for South Australia and indeed, Australia. To discover one such deposit is rare – to discover two (the Petratherm team was heavily involved in Minotaur’s discovery of Prominent Hill) is bordering on unique!”

Petratherm is also hunting iron oxide copper-gold targets in the style of BHP’s Prominent Hill at its Woomera and Mabel Creek projects.

“At the Woomera project, we completed a detailed gravity survey earlier in the year that identified five high-priority IOCG targets. In particular, the Bernard Hill gravity anomaly is of interest,” Carter said. “The modelled density is comparable to that measured in known IOCG deposits such as Prominent Hill, Carrapateena and Oak Dam.”

QEM (ASX:QEM)

(Up on no news)

Another AGM (though not the one the whole market is focused on today with MinRes’ Chris Ellison currently facing the muzak from investors), QEM came through its Wednesday meeting of shareholders unscathed, with all resolutions passing without notice.

That is, sans one to issue performance rights to Tony Pearson, a non-exec director who resigned “following the recent completion of the Julia Creek Project Scoping Study and capital raising”.

That scoping study placed a post-tax NPV8 and IRR of $1.1bn and 16.3% respectively on the development of the flagship Julia Creek asset, which would produce 10,571t of vanadium pentoxide at a purity of 99.5% and 313 million litres of transport fuel annually over the life of the mine.

The August study estimated the project would cost $791 million to build and take five years to payback, but it would deliver revenue of $11.5bn for vanadium sales and $10.1bn for fuel sales over its 30 year life.

FID for the vanadium resource is due in Q1 2028 with production expected in 2029-30.

NARRYER METALS (ASX:NYM)

(Up on no news)

Richard Bevan-led Narryer was one of the top performers yesterday, surging on the release of high grade scandium and rare earths results from the Rocky Gully project in WA’s Great Southern region.

It marks the latest in a long line of clay rare earths discoveries in WA and Australia more generally, a style of deposit better known in China and Brazil.

But Narryer’s calling card is that the early results from Rocky Gully appear to be high in grade, with results in parts of up to 1.8% TREO resembling the proportions seen in deeper, tougher hard rock deposits.

There’s plenty of questions to be answered. There’s no guarantee those high grades will be repeated (and those highlight grades resemble only a fraction of a wider, lower grade intercept) while the key issue around clay rare earths is whether they can be processed with cheap and environmentally safe reagents.

Metallurgical testing is essential there. NYM also holds a tenement at Petratherm’s hot Muckanippie, where PTR can earn up to an 80% equity interest.

READ: Resources Top 5: Runs on the board for rare earths explorer Narryer

At Stockhead, we tell it like it is. While Petratherm and QEM are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.