Resources Top 5: Licence to drill? Almost. Ionic Rare Earths makes progress in Uganda

"Do you expect me to drill?" (Pic via Getty Images)

- Ionic Rare Earths up on mining licence progress for the Makuutu project in Uganda

- Tesoro Gold is still surging on yesterday’s Drone Hill gold-hit news

- Balkan is spinning the drills again after a brief break at its Gorge lithium project in Ontario

Here are the biggest resources winners in early trade, Friday October 20.

Ionic Rare Earths (ASX:IXR)

Ionic Rare Earths is up on solid news regarding a mining licence application approval (for granting) for the major Makuutu mining project in Uganda.

It’s a project that’s regarded as one of the most advanced ionic-clay-hosted heavy rare earths projects globally available as a source for new supply chains emerging across Europe, the US, and Asia.

The company’s aim is to become a miner, refiner and recycler of sustainable and traceable magnet and heavy rare earths needed to develop net-zero carbon technologies.

Makuutu’s basket contains 71% magnet and heavy rare earths content.

The project, 60% owned by Ionic Rare Earths, is set to become the country’s pre-eminent mine after the Ugandan Directorate of Geological Survey and Mines (DGSM) approved the IXR’s large-scale Mining Licence Application TN03834 – “approved it for granting”, that is.

There’s still some process, including fees and land access verifications, that need to take place before a formal issue of mining licence.

The company notes that this approval comes after “a recent show of support for the project from The Hon Dr Ruth Nankabirwa Ssentamu, the Ugandan government Minister for Energy and Mineral Development, who spoke highly of the Project at the Africa Down Under Mining Conference in early September.”

🚀 We're pleased to announce that the Company, via Rwenzori Rare Metals, has received advice from the Ugandan Directorate of Geological Survey and Mines that the Large-Scale #Mining License has been Approved for Granting🌍📜

ASX🔗https://t.co/lDtOOAZMjc$IXR #rareearthelements pic.twitter.com/c3dh54IqIU

— Ionic Rare Earths Limited (@IONIC_RE) October 19, 2023

The approval also comes after Ionic Rare Earths announced this week it had completed its Phase 5 infill drill program at Makuutu.

Results are pending on that and are expected to boost confidence and scale of the company’s updated Mineral Resource Estimate (MRE).

Additionally, land-access agreements, as well as construction at Makuutu’s demonstration plant, are progressing well, which you can read more about here.

IXR share price

Tesoro Gold (ASX:TSO)

(Up on yesterday’s news)

Take a look at Tesoro, it’s yesterday’s hero. And it’s still puffing out a heroic chest today, as it turns out – currently leading the ressie stocks gains on the ASX again.

We said most of it yesterday, but just to recap then, with some slight rejiggery…

Tesoro Gold, a small Australian goldie with a Chile-focused precious metals exploration bent, is sporting a +23% glow on the local bourse at the time of writing.

It’s up after announcing on October 19 a “new large gold anomaly defined at Drone Hill” – never been drilled before, innit.

It’s an area slightly west of the company’s Ternera gold deposit, which is part of its El Zorro project in Chile.

The company reports that the anomaly has wide outcropping intersections of up to 47m, including:

47m at 1.40g/t Au (with 9m at 4.66g/t Au); 15m at 0.53g/t Au; 3m at 1.88g/t Au; 2m at 5.21g/t Au; and 3m at 2.11g/t Au.

The surface mineralisation is confirmed to extend at least 750m west and 380m south of the Ternera deposit.

Tesoro’s managing director Zeff Reeves said:

“These results place the spotlight on Drone Hill as another high-priority prospective gold target for Tesoro. The geology of the area is analogous to the existing Ternera Gold Deposit and is located only 750m west of Ternera.

“We now have confirmation that surface gold mineralisation extends significantly south and west of our deposit, with the continuous nature of the surface gold mineralisation highlighting the opportunity for large-scale resource growth.”

TSO share price

Balkan Mining and Minerals (ASX:BMM)

Balkan Mining and Minerals is back spinning the drill bits at its flagship Gorge Lithium Project located in Ontario, Canada after a “brief hiatus to observe the hunting activities of the region’s First Nations people”.

The company reports it’s specifically focusing on the Nelson & Koshman pegmatite occurrences. and its drill contractor is focused on increasing productivity. Better than decreasing it, probably. A possible year-round drilling campaign looks to be on the cards.

Drilling recommences at Gorge Lithium Project

📰https://t.co/IUSyQwKulC$BMM $BMM.ax #ASX #Mining #Lithium pic.twitter.com/DUCnrRa9k1

— Balkan Mining & Minerals (@BalkanMining) October 17, 2023

Before it was interrupted, the company had completed one diamond hole, which intersected visual spodumene in shallow pegmatite hosted mineralisation.

Balkan has now recommenced drilling and completed hole P-23-002, moving on to the rest of its scheduled programming.

Balkan Mining and Minerals managing director Ross Cotton enthused:

“The early indications from the program have whet our appetite for what we hope will be a highly successful drilling campaign.”

BMM share price

Focus Minerals (ASX:FML)

(Up on no news)

It might have a rather unfortunate Gen-Z acronym going on as its ticker, but Focus My Life Minerals (FML) is having a very decent time of things share-price wise so far today.

Why, exactly, it’s currently surging up 20%, is indeed the question. The answer doesn’t appear to be easy to source just at this present time.

We can tell you this at least, the Perth-based, Chinese-backed goldie recently refired its Three Mile Hill plant near Coolgardie, and delivered an MRE for the Bonnie Vale prospect, part of the Coolgardie gold project, which covers 121km2 of highly prospective tenements.

That Bonnie Vale MRE update from late September included the following highlights:

• Underground Indicated Mineral Resource ounces increased by 40% with 4.6% improvement in grade.

• Total underground Indicated andInferred Mineral Resource ounces increased by 16%.

• Overall Indicated and Inferred Mineral Resource ounces including potentially open pitable and historic tails increased by 40%.

FML share price

Alchemy Resources (ASX:ALY)

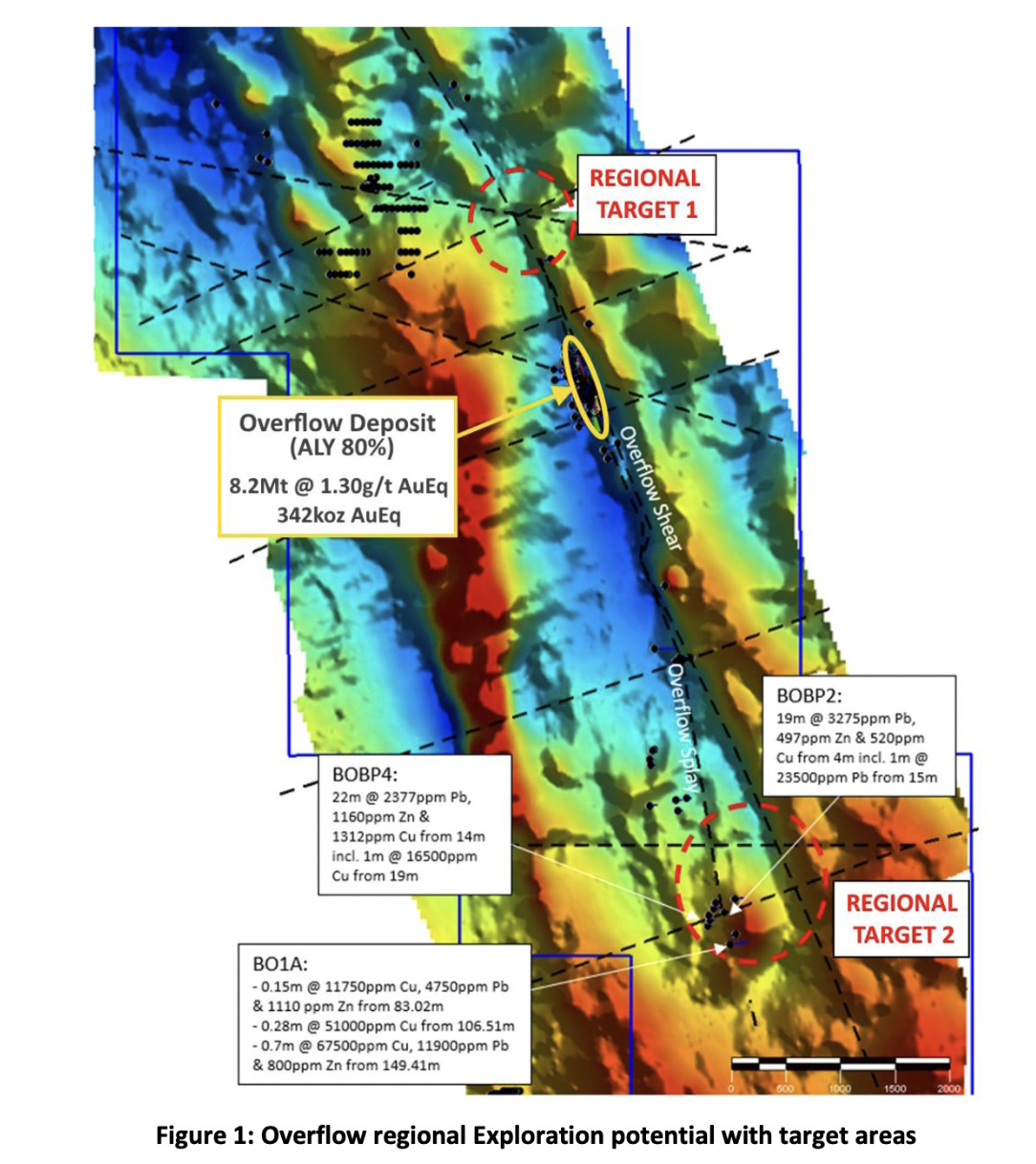

Small gold and battery metals hunter Alchemy is up nicely today after revealing a maiden Mineral Resource Estimate (MRE) for the Overflow deposit a the 80% owned Lachlan gold project in New South Wales.

The estimate, prepared and verified by external consultants, comes in at a JORC-compliant 342koz at 1.30g/t AuEq (Inferred, 0.7g/t AuEq cut-off) from surface.

The company notes that the mineralisation remains open along strike and at depth, and that numerous advanced targets are yet to be assessed. Those include the high-grade Yellow Mountain Prospect 20km to the south, with all areas having little to no modern exploration.

Overflow is “strategically located within trucking distance of neighbouring resources, mines and processing infrastructure with the closest operating mills located less than 40km by road,” added Alchemy in its ASX release this morning.

ALY share price

At Stockhead we tell it like it is. While Ionic Rare Earths is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.