Resources Top 5: Legendary explorer Mark Bennett has the thumbs-up to chase the next Fosterville

Mark Bennett is looking for a repeat of the Fosterville gold mine. Pic: Tracielouise/E+ via Getty Images

- Legendary mine finder Mark Bennett poised to drill for the next Fosterville after Vic Government go ahead

- Great Western sees Winu and Havieron potential in former Rio copper targets

- Sold off Strandline, Pantoro rise on production updates

Here are the biggest resources winners in early trade, Thursday October 5.

S2 Resources (ASX:S2R)

Mark Bennett’s famed history of discoveries in gold and nickel has made his firm S2 Resources a closely watched explorer since its spin out in the deal that sold Sirius and its famous Nova nickel and copper discovery to IGO (ASX:IGO) eight years ago.

Since then the company led by the rock kicker behind not only Nova but also the legendarily named Thunderbox gold mine (now operated by soon to be Australia’s biggest gold miner Northern Star Resources (ASX:NST)) has tested some interesting prospects in WA’s Goldfields and Scandinavia without making a breakthrough.

But its transformative pick-up of right to apply for the Greater Fosterville exploration licence in Victorian gold rush territory near Bendigo in October 2021 was a new dawn for the explorer.

It’s up near 10% on a dour day for mining stocks and for good reason.

That licence — EL7795 and previously known in deliriously bureaucratic terms as Block 4 of the Victorian Government’s North Central Victoria Gold ground release — has now been granted.

In more romantic terms the lease presents among the best opportunities of any explorer to make a discovery that follows up Kirkland Lake (and now Agnico-Eagle’s) Swan Zone find at the Fosterville gold mine back in 2016.

Swan Zone turned Fosterville into Australia’s top performing and cheapest producing gold mine, its reserve initially pulling a virtually unheard of grade of nearly 50g/t.

That’s more than 1.5 ounces to the tonne — around $4500 of gold in every tonne of ore pulled up at current prices. Most underground mines nowadays would be considered high grade at over 5g/t.

It goes without saying that Agnico would have loved EL7795, the prized portion of the ground release, abutting and surrounding the Fosterville Mine. The Canadian giant earned the right to apply for other licences in the release — and back in the Kirkland Lake days it did a bit of work there which S2 will be able to build off from before the old tenement expired — but S2’s exploration plans proved more attractive for the Victorian Government.

Covering some 394km2, it extends for a massive 55km north to south, with S2 planning to spend a minimum amount of $10.4m over the first five-year term of the licence.

A minimum $2.1m has to be spent in the first two years. Diamond drilling sites have already been identified along roadsides, with heritage clearance already obtained from the Dja Dja Wurrung traditional owners and drilling approval from the City of Greater Bendigo Council.

A contractor is expected to begin drilling in around three weeks.

“The granting of EL7795 is a significant moment for S2. It is the most strategic of the four blocks released around Fosterville, and it is the first to be granted,” S2 exec chair Bennett said.

“I would like to thank the Dja Dja Wurrung and Taungurung people, and the staff of the Victorian Earth Resources Regulator for their goodwill, guidance and diligence in this process.”

S2 Resources (ASX:S2R) share price today

Great Western Exploration (ASX:GTE)

“Giant” and “potentially transformational” are two buzz-phrases sure to catch the eye of any investors looking for direction on where to chuck some money in the hunt for tasty copper and gold prospects.

Using the words “Winu” and “Havieron” doesn’t hurt either, those being the two most significant new copper finds in Western Australia since Sandfire Resources (ASX:SFR) made its massive DeGrussa discovery all the way back in 2009.

Winu and Havieron are squarely locked up in the dark corners of global majors Rio Tinto (ASX:RIO) and (soon to be) Newmont respectively.

So if an explorer with a tiny market cap is able to cotton on to something similar it will likely be the only way for investors to make 10-bagger gains on a similar find, bearing in mind AIM-listed Havieron minority owner Greatland Gold is looking long and hard at an ASX listing.

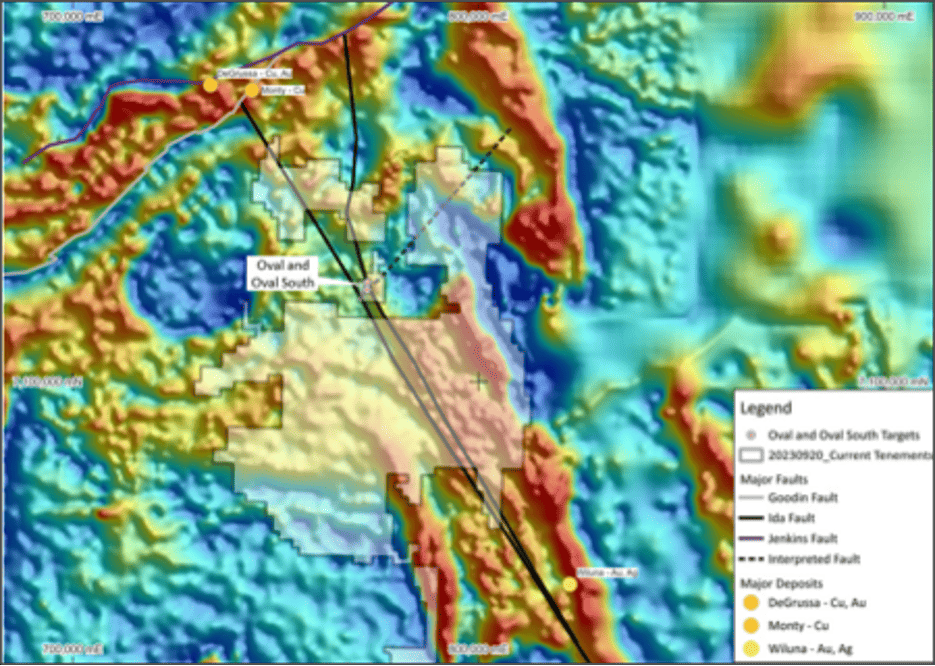

Great Western Exploration says a geological review of its Yerrida North project has turned up just those sorts of copper-gold intrusive targets at Oval and Oval South, calling them “extremely compelling”.

Interestingly, the ground was subject to a farm-in with Sandfire, which spent $4.5m on the turf from 2017 on. But DeGrussa is now closed and Sandfire has shifted its focus overseas to the MATSA Complex in Spain and Motheo in Botswana’s emerging Kalahari copper belt.

GTE took on 100% ownership in August, but has a bevy of exploration data compiled by Sandfire to launch off.

Located in close proximity to Sandfire’s DeGrussa and Monty deposits — which held a combined 766,000t Cu and 588,000oz Au — Oval and Oval South boast co-incident gravity, EM and magnetic anomalism suggesting a deep instrusive structure that could provide a host of mineralised fluids and are located proximal to the Ida Fault, which has been proven to be a fertile conduit for metal rich mantle fluids.

The size of the potential prize? Winu contains some 2.88Mt Cu and 7.88Moz Au, while Havieron is more gold dominant — 2.9Moz against 140,000t Cu.

Ironically, GTE is chasing something Rio could never find. It completed an airborne EM survey in the 1990s and drilled a hole that ended at 232m at a black shale with up to 10% pyrite — a sulphide mineral often referred to as ‘fool’s gold’.

But surveys with stronger penetration since have suggested the most promising conductive sources remain to be tested. One can only imagine.

Great Western Exploration (ASX:GTE) share price today

Legacy Iron Ore (ASX:LCY)

One of the most confusing stocks on the ASX, Legacy Iron Ore is bankrolled by India’s state-owned iron ore giant NMDC.

Its initial focus was trying to turn the Mt Bevan project in WA’s remote and infrastructure constrained Yilgarn into a major exporter of magnetite concentrate for the Indian steel market in partnership with fellow junior Hawthorn Resources (ASX:HAW).

That returned to the agenda last year when Gina Rinehart and Hancock Prospecting dropped in to begin a study on producing and exporting magnetite from Legacy and Hawthorn’s tenements.

The deal has since transformed into a ploy for Rinehart to explore the same ground for lithium, chasing prospects similar to Delta Lithium’s (ASX:DLI) nearby Mt Ida spodumene deposit, with the intention of supplying it to India.

In the meantime, Legacy’s management has kept itself busy by developing some relatively inconsequential gold assets, announcing the start of mining at its Mount Celia project and Blue Peter pit on Monday.

The ore will be processed by Norton Goldfields — the local branch of Chinese gold and lithium giant Zijin — at its Paddington plant around 35km north of Kalgoorlie.

On Monday Legacy reminded us it’s in the Laverton Tectonic Zone, home to around 20Moz of gold resources.

Mt Celia contains around 312,600oz of those, 64,500oz at 2.07g/t in the Blue Peter deposit and 231,800oz at 1.26g/t at Kangaroo Bore with the balance from Margot Find.

Meanwhile, it’s kicked off 300m of RC drilling across the Yilgangi and Patricia North tenements today, news which has the heavily diluted $100 million market capped player around 12% higher today at 1.9c.

Legacy Iron Ore (ASX:LCY) share price today

Strandline Resources (ASX:STA)

Mineral sands producer Strandline has weathered a tough 12 months, falling almost 80% over the past year.

Despite hitting commercial production in November last year, it’s been a long path to hit steady state production.

Strandline generated around $4m in operating cash in FY23, but saw ~$2.5m in operating losses in the June quarter, subsequently raising almost $40m to strengthen its balance sheet in August.

In recent times it has seen the resignation of long-time managing director Luke Graham, replaced by CEO Jozsef Patarica, formerly the CEO of the Grande Cote operations for Mineral Deposits Limited in Senegal and part of the team which developed the Fosterville gold mine in Victoria.

While its wet concentration plant has produced heavy mineral concentrate since November, the focus has been on getting its mineral separation plant in action to deliver premium grade zircon and rutile products.

The $137 million stock has rebounded over 10% today after doing just that, announcing its first shipment of 15,000t of zircon in concentrate is scheduled for this month.

A second shipment of titanium ore chloride ilmenite of 5000t is also scheduled after a 6000t load was waved off at the Port of Geraldton in late August.

Coburn’s MSP is now churning out ilmenite, standard grade zircon and ZIC from heavy mineral concentrate, while HMC production was also up 15% quarter on quarter in September to 30,133t.

“The team is making significant progress in delivering our improvement initiatives, which are improving both productivity and product quality,” Patarica said.

“The recent WCP modification work has resulted in a significant improvement in separation efficiency into the valuable critical minerals – a great example of what the team has been able to achieve.

“Our focus remains on maximising revenue from the products being produced while continuing to optimise the MSP to produce premium grade zircon and rutile. The achievement of our first ZIC sale marks a key milestone in this process as we work to optimise the operation at the same time as increasing volumes.”

A DFS in 2020 showed Strandline planned to deliver average annual production of 34,000t of premium zircon, 54,000t of zircon concentrate, 110,000t of ilmenite and 24,000t of rutile annually from Coburn, with a mine life of up to 37 years.

Strandline Resources (ASX:STA) share price today

Pantoro (ASX:PNR)

In a similar vein, heavily sold gold miner Pantoro saw a bump as it announced a 27% increase in production at the Norseman gold project to 13,168oz, up from 10,345oz in the June quarter.

5352oz were produced in September, a rate in the order of ~65,000ozpa on higher feeed grades lifting for the first time this year above 2g/t.

Production rates remain well shy of the 108,000ozpa proposed in a DFS in October 2020.

MD Paul Cmrlec, who engineered a merger with JV partner Tulla Resources this year, said in Pantoro’s annual report a skills shortage seen across the WA mining industry and mechanical failures at the 1Mtpa Norseman processing plant, now operating at full capacity, had been behind ramp up problems.

“Unfortunately, a number of operational issues within the project have hindered the ramp up to full production,” he said in the report.

“The majority of delays have been related in some way to the acute skills shortage being experienced across the industry with suppliers and contractors often late in supplying goods and services, and high personnel turnover rates impacting productivity, particularly within the open pit mines.

“In addition, a number of unexpected mechanical failures within the processing plant and underground infrastructure have been seen in equipment which was manufactured during COVID-19 impacted periods.

“Major components such as crushers, the mill gear box and the mill motor have failed and been changed out within the first year of operation as a result.

“Conditions appear to be improving, and the majority of issues encountered during the period have been addressed. The processing plant is operating at name plate capacity, and mine grades are improving as the higher grade ore block at depth are being accessed.”

Pantoro (ASX:PNR) share price today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.