Resources Top 5: Led by LPM, lithium hunters charge up the ASX this morning

Pic via Getty Images

- Lithium Plus Minerals finds impressive 127m mineralised pegmatites in NT

- Odessa and New Age up on peggie news in WA, while Rubix goes hard in James Bay

- And in non-lithium news, Killi hits high-grade copper’n’gold in Queensland

Here are the biggest small cap resources winners in early trade, Thursday September 7.

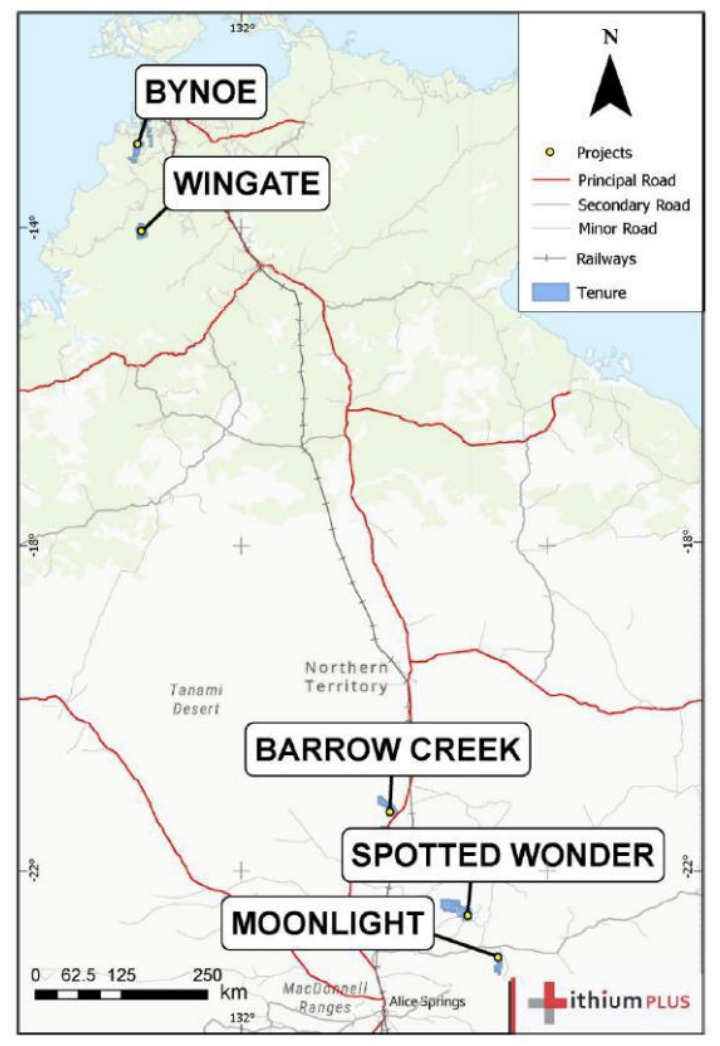

Lithium Plus Minerals (ASX:LPM)

This pure-play lithium hunter’s share price has bolted out the gates this morning, up more than 60% at the time of writing.

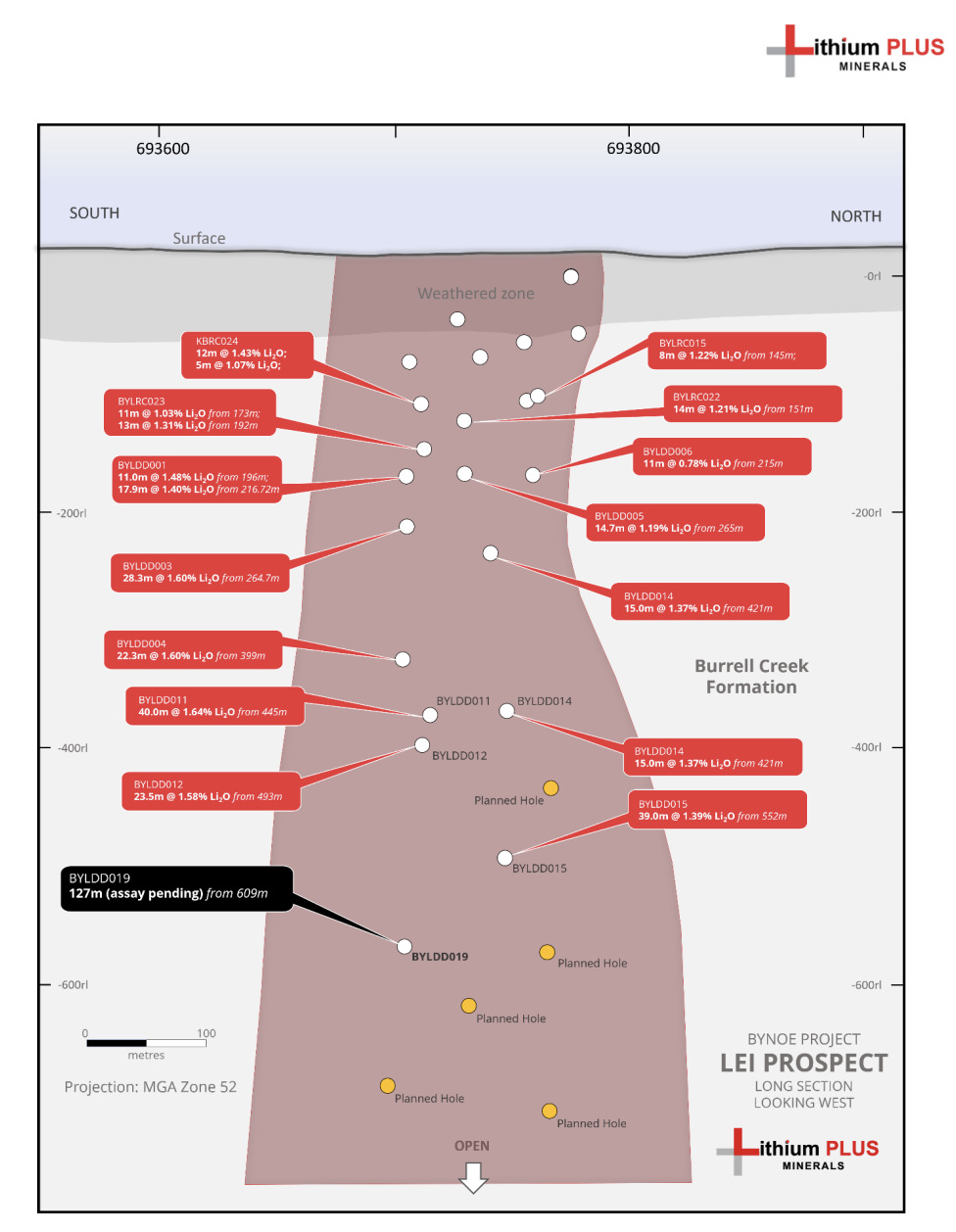

It’s confirmed the discovery of a head-turning 127m-thick lithium pegmatite intersection (from 609m with a true width of ~60m) at its Lei prospect, part of the Bynoe project in the NT.

The company reports the intersection came after the recommencement of infill and extensional drilling in August, with the fast-tracking of seven drillholes, and assays are now pending.

It’s a big find for LPM – among the biggest drilling intersections found to date at the Bynoe project.

LPM exec chair Dr Bin Guo is certainly excited about it all, and noted the “large spodumene crystals of consistent distribution throughout the core sample”.

“Importantly, it indicates that the primary Lei pegmatite thickens with depth, expanding laterally and vertically whilst maintaining significant grade,” he added, also clarifying that a maiden lithium resource is due before the start of 2024.

LPM share price

Odessa Minerals (ASX:ODE)

In July, this minerals minnow confirmed the presence of extensive pegmatites in the Robinson Bore and Eastern lithium anomalies at its Yinnetharra project at Lockier Range in the Gascoyne region of WA.

The exploration gem also detailed further lithium and REE exploration plans at that time, and the appointment of a new exploration manager and geoscience services team.

Well, today, guess what? It’s stock price is pumping after announcing >46,000m strike-length of pegmatites mapped to date by geology crews at the project, with the field programme ~50% complete.

That includes more than 16,500m in strike-length of pegmatites mapped at Robinsons Bore alone, which lies adjacent to Minerals 260’s (ASX:MI6) Aston lithium project.

Odessa confirms that over 46,000 meters of #Pegmatites have been mapped at the Lockier Range project.

View: https://t.co/Nt9EKvGnLj#Lithium #Gascoyne @DavidLenigas pic.twitter.com/OdHF87tjUw

— Odessa Minerals (@OdessaMinerals) September 6, 2023

Odessa exec director David Lenigas says exploration efforts on the ground at Lockier Range are now in full swing.

“The abundance of pegmatite outcrop in the areas of highly anomalous lithium geochemistry is highly encouraging and this work is designed to generate drill-ready LCT pegmatite targets.”

ODE share price

New Age Exploration (ASX:NAE)

Diversified minerals and metals minnow NAE is currently on a daily 20%+ mission on the back of news regarding its high-priority lithium targets in the central Pilbara region of WA.

The company reports that a second phase of UltraFine+ Geochemical soil sampling is underway at its extensive gold-lithium projects in the region – to infill and extend high priority LCT (lithium, caesium, tantalum) pegmatite targets in the in the lead up to drilling.

The program aims to refine the high priority targets and assess the extent of the known anomalous zones.

Additionally, New Age announces it’s appointed Greg Hudson as its Chief Geological Consultant.

Hudson was previously General Manager of Geology with Neometals (ASX:NMT) from 2018 to 2023. In that time, NMT divested the Mt Marion lithium mine and spun out Widgie Nickel (ASX:WIN).

🔔 $NAE.ax $NAE Exploration Advances on High Priority Lithium Targets, Central Pilbara Projects, WA 🔗 https://t.co/aVSzU8lxBy

NAE Executive Director, Joshua Wellisch commented:

“The appointment of Greg Hudson as Chief Geological Consultant is a very exciting time for the… pic.twitter.com/Ep6H1o00gT

— New Age Exploration Ltd (ASX:NAE) (@NAE_Exploration) September 6, 2023

NAE share price

Killi Resources (ASX:KLI)

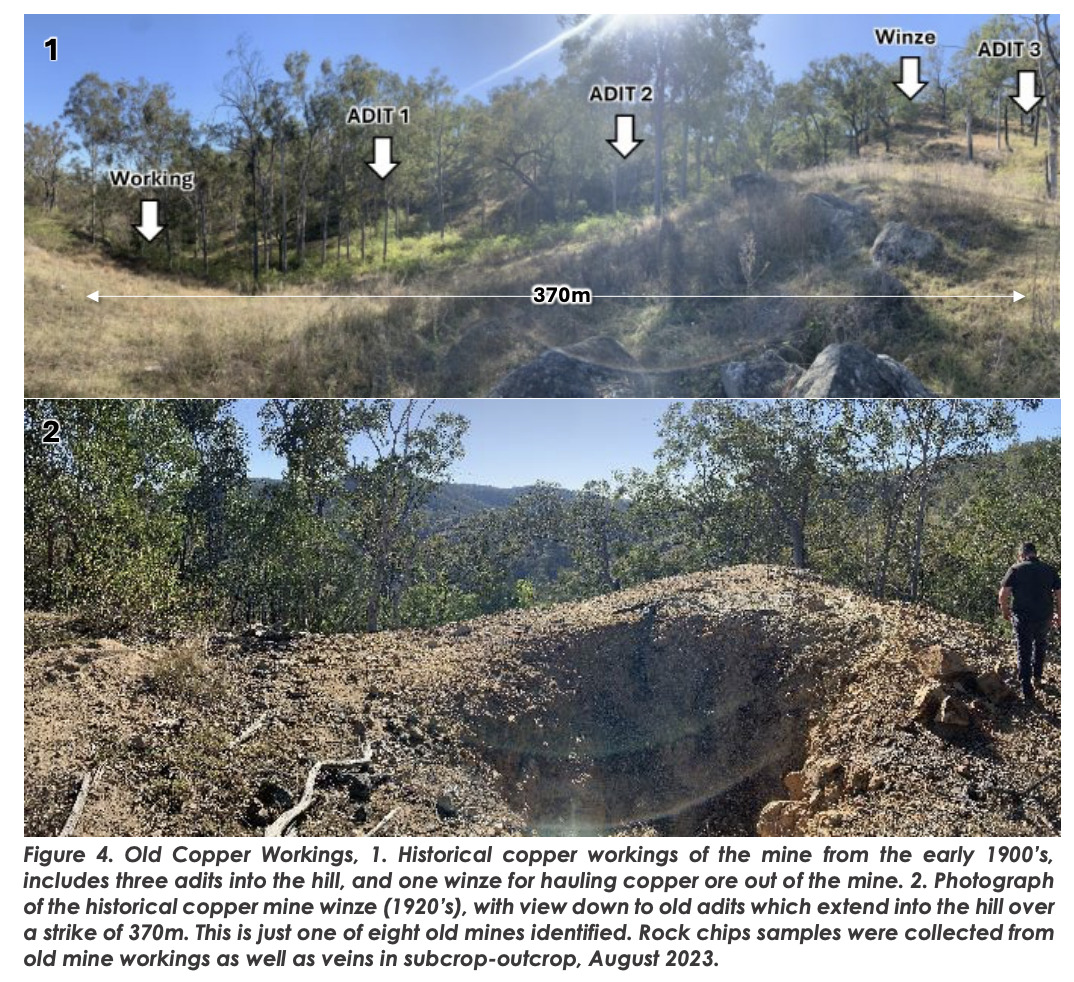

Gold, copper and rare earths explorer Killi Resources is killing it this morning, busting up the ASX on news of high-grade hits of up to 7.2% Cu and 12.4g/t Au at surface from rock chip samples from its Baloo prospect.

Baloo is a 5.5km long by 2.5km wide copper-gold-silver corridor located within the company’s 100% owned Mt Rawdon West project in Queensland.

It’s the first field program completed by Killi at the recently granted project, and these results are a pretty bloody good start, to say the least.

The company notes that copper mineralisation at surface commonly occurs as bornite across the corridor, which is a strong indicator mineral for proximity to intrusive-porphyry copper-gold systems.

Copper and gold mining at the prospect has a long history, dating back to the early 1900s, when operations previously wound up. This is the first exploration operation held since that time.

Killi CEO Kathryn Cutler says the location of multiple old workings from the early 1900’s, had been recorded by the Queensland Government, “however the commodity and mining specifics have not”.

“The scale of the historical workings from the turn of the last century demonstrates there is a significant potential here for an economic copper-gold discovery.”

KLI share price

Rubix Resources (ASX:RB6)

Rubix, a lithium-hunting junior going hard for the battery metal in Canada’s James Bay hotspot, is rising on an update regarding its Ceiling project.

The company reports it commissioned expert geological consultancy group PGN Geoscience, to conduct a hyperspectral mapping study targeting lithium prospectivity at the site.

And the survey says? Ding, ding, ding… Encouraging.

The hyperspectral mapping data apparently supports a strong case for lithium minerals prospectivity (specifically spodumene) and prospective lithologies (pegmatites) of the Wemindji Greenstone Belt and the Ceiling lithium project within.

The results have shown good coincidence with large pegmatitic outcrop interpretations previously reported by Rubix (up to 345 of them). Follow-up field work and rock chip testing will now be required to verify the results.

Rubix’s Ceiling project, by the way, has previously surged on a good old nearology narrative. It’s right near the much bigger ($9bn capped) player Allkem (ASX:AKE) and its impressive lithium exploits, including a recent massive resource upgrade, in the same region.

We are pleased to announce today that Hyperspectral mapping using Sentinel-2 data supports the lithium prospectivity of the Wemindji Greenstone Belt & the Ceiling Lithium Project: https://t.co/MXolBjxCyX #RB6

Fieldwork is due to commence shortly. pic.twitter.com/OaTlwrGbMP

— Rubix Resources (@RB6_ASX) September 7, 2023

RB6 share price

At Stockhead we tell it like it is. While New Age Exploration is a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.