Resources Top 5: Latitude 66 stands out after selling non-core copper-gold interest

Latitude 66 was a standout on Wednesday. Not unlike Aussie Rhiannan Iffland (plunging aside) at the Red Bull Cliff Diving World Series in Italy at the weekend. Pic: Getty Images

- Latitude 66 has unlocked value from an interest in a non-core Australian asset

- T92 is acquiring the largest undeveloped tungsten-tin-molybdenum deposit in NSW

- DSO approval has been received by HOR for its Horseshoe Lights copper project in WA

Your standout small cap resources stocks for Wednesday, July 2, 2025

Latitude 66 (ASX:LAT)

A standout performer among ASX small caps on Wednesday was Latitude 66, which increased 91.31% to a daily top of 4.4c after selling its 17.5% non-core interest in the Greater Duchess copper-gold joint venture in northwest Queensland.

The non-binding term sheet with Argonaut Partners and Neon Space provides upfront cash consideration of $2 million payable upon completion and a potential contingent consideration payment of either:

- A$4m cash (or equivalent value in ASX-listed shares, based on the 30-day VWAP prior to signing of any sale agreement) if, within 90 days of this announcement, any party acquires 100% of the JV; or

- If the purchaser divests the acquired interest within 90 days to a third party who does not acquire 100% of the JV, 50% of any proceeds above A$4m received by the purchase for such divestment.

LAT has provided formal written notice to JV partner Carnaby Resources offering the sale of the interest on terms and conditions no less favourable to the terms under the non-binding term sheet.

The right of first refusal by Carnaby, which released a scoping study for the project about 70km southeast of Mount Isa in May 2024, must be exercised within 30 days.

LAT has also entered into an unsecured loan agreement with Argonaut Partners for $750,000 as part of the sale arrangement.

“The Greater Duchess joint venture is a non-core asset and the sale transaction announced today is in line with our strategy to unlock value from our Australian assets,” Latitude 66’s managing director Grant Coyle said.

“We are grateful for the support from Argonaut in this transaction, as well as their ongoing support, as we progress the company’s assets in order to realise value for shareholders.

“This transaction is well timed to provide Lat66 with near-term, non-dilutive funding that will enable the company to continue advancing its Finnish and Western Australian projects.”

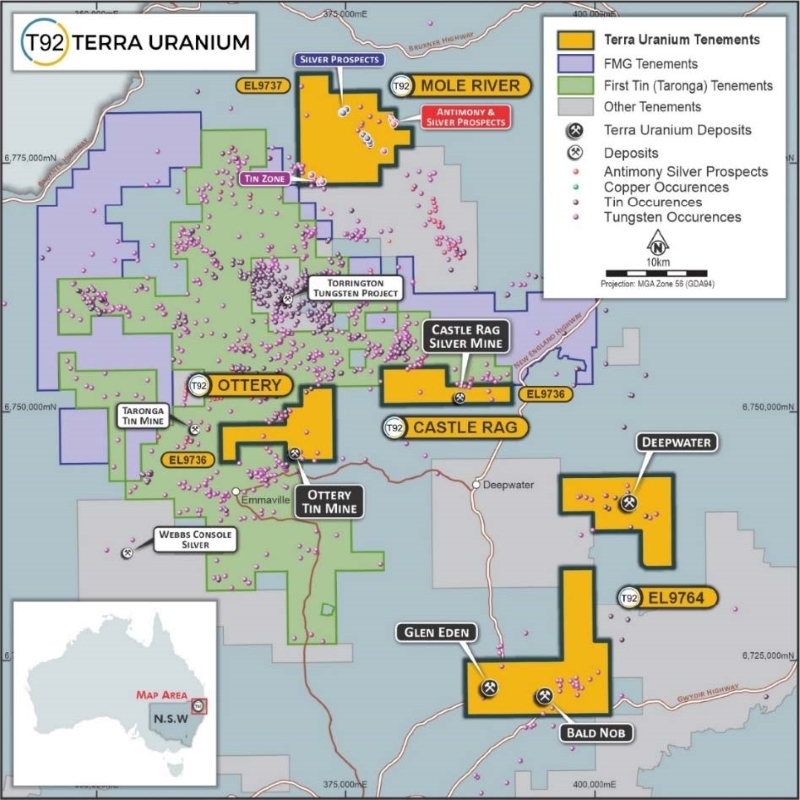

Terra Uranium (ASX:T92)

A bid to acquire the largest undeveloped tungsten-tin-molybdenum deposit in NSW has seen Terra Uranium move up 55.2% to a daily high of 4.5c before closing at 3.8c.

Acquiring Dundee Resources and its tenement that hosts the Glen Eden, Bald Nob and Deepwater tin, tungsten, molybdenum, silver and base metals projects will see T92 enter the NSW critical metals hotspot of the New England region in the state’s northeast.

Glen Eden tungsten-molybdenum project is the largest undeveloped tungsten project in NSW and is 50km by sealed road from the developing critical minerals mines at Taronga (First Tin AIM:1SN) and Hillgrove (Larvotto Resources ASX: LRV).

The timing couldn’t be better with tungsten prices at 12-year highs, recently surpassing $450USD/MTU.

Due to its high melting point, hardness and density, demand has significantly increased on the back of applications across military, aerospace and electrodes.

Diamond drilling by previous explorers to 385m depth returned encouraging molybdenum, tin and tungsten results with mineralisation strong at the end of holes. Results include:

- 282m at 0.11% MoS2, 0.02% SnO2 and 0.08% WO3 for 0.28% WO3 equivalent from 7m; and

- 235m at 0.10% MoS2, 0.03% SnO2 and 0.06% WO3 for 0.25% WO3eq from 15m.

There was also significant bismuth with the molybdenum with an average of 150ppm.

There is a conceptual exploration target to 150m depth of 20 to 30Mt at 0.05 to 0.08% WO3, 0.02 to 0.04% SnO2 and 0.06 to 0.10% MoS2.

The company will drill the exploration target to meet JORC resource standard as soon as site access is available and this is expected to take 4 to 6 months minimum.

“T92 is delighted to have taken the opportunity to acquire the largest undeveloped tin-tungsten-molybdenum deposit in NSW,” Terra Uranium chairman Andrew Vigar said.

“This is an exciting addition to the nearby Ottery tin deposit and we will be looking to develop these together.“

T92 has also received firm commitments from a number of sophisticated investors and funds to raise $865,000 in a placement at 3c per share.

Horseshoe Metals (ASX:HOR)

After securing DSO approval for its Horseshoe Lights copper project in WA and paving the way for personnel to mobilise on site this month ahead of start-up operations, Horseshoe Metals hit a two-year high of 3c, a lift of 42.9% on the previous close.

DSO mining approval from the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS), will facilitate early cash flow from sales of existing high-grade copper stockpiles.

The company is continuing discussions with potential offtake partners underpinned by expectations of robust demand for the DSO material, positioning it for further early-stage cash flow in the coming months.

Alongside the DSO start up, HOR is finalising additional exploration and drilling programs at Horseshoe Lights with activities scheduled to begin this quarter.

HOR executive director Kate Stoney said securing this approval was a critical value catalyst for the company and meant it could capitalise on favourable copper prices.

She said approval marked the first step in bringing the project back into production with DSO operations to be followed by small and large-scale oxide heap/vat leach and cementation.

Pursuit Minerals (ASX:PUR)

Pursuit Minerals, which is focused on delivering ultra-pure lithium from its Rio Grande project in Argentina for future battery demand, has had a strong week, rising 87% to 7.1c.

Rather than being fixated on depressed lithium prices, PUR managing director Aaron Revelle told Stockhead it was intent on serving future supply needs, particularly for premium products.

In this regard, Rio Grande has demonstrated it can deliver 99.5% lithium carbonate, putting the asset in the tier offtakers are chasing.

He said Chinese buyers, who dominated global lithium demand, were hunting for lithium chloride to refine into battery-grade material of 99.5% purity or better, which is where Pursuit separated itself from the pack.

By remaining active even with prices at a low ebb, he said Pursuit was ensuring Rio Grande was ready to feed a high-quality product into the global market.

Pursuit is transitioning to the next phase of development and commercialisation at the asset, after dispatching lithium carbonate samples to multiple prospective offtake and strategic partners earlier this month.

Energy World Corporation (ASX:EWC)

Energy World Corporation reached a four-year high of 9.7c, more than double the close on July 1, a day when shares also soared after steps were made to secure funding critical to EWC’s future development and growth.

These include a proposed change to its capital structure and a number of board changes.

EWC, which has a strategy to deliver critical energy solutions for the Philippines and Indonesia, is planning a subscription deal with Energy World International and Slipform Engineering Group, in relation to the US$432 million plus accrued interest owed under a Debt Repayment and Investment Agreement.

If approved by shareholders, this will see the conversion of shares in exchange for the full repayment of all debt under the DRIA.

Board changes include the resignation of Brian Allen as managing director and chair. Alan Jowell has been appointed interim chair until a permanent chair can be appointed and Edward McCartin has been appointed CEO.

Allen will continue to work for EWC for up to six months to enable a smooth transition for the new CEO and will remain as a director.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Horseshoe Metals and Pursuit Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.