Resources Top 5: Kula bags on Cobra strike, fellow lithium hunter Oceana also looks swell

Pic: dikkyoesin1, RooM/ Via Getty Images

- Take a look at KGD, it’s yesterday’s hero. And today’s.

- Lithium stocks are surging, as shareholders of OCN and TYX, among others, will tell you

- Also having a beaut day on the bourse so far, for non battery-metal reasons; ADN and BTR

Here are the biggest resources winners in early trade, Thursday November 16.

Kula Gold (ASX:KGD)

(Up on yesterday’s news)

This goldie/ white goldie’s shareholders believe in yesterday… and today.

KGD is leading the ressie sick gainz pack so far today, thanks to the news we (okay, and other outlets, probably) delivered on Wednesday regarding drilling of an expanded target area at the Cobra lithium project in southwest WA, which is due to kick off next week.

We’ve got full details of that in our special report from yesterday, here. But, in brief with bullets:

- Drilling to start next week at Kula Gold’s 3km long, 500m wide Cobra lithium prospect

- $650,000 to be raised for a maiden drill program

- Company also optioned more ground to expand wider Kirup lithium project by 48km2

- Kirup tenements are adjacent to Greenbushes, the world’s biggest lithium mine

And here’s one of our most excellent camera-facing journos, Ashtyn Hiron, speaking about it all with Kula Gold’s MD Ric Dawson.

⛏️ Kula Gold Managing Director Ric Dawson speaks to @StockheadAU re: drilling at $KGD's Cobra #Lithium Prospect.

🗣 "We’ve done all the groundwork & now it’s up to the RC rig to give us some results that hopefully will be spodumene at depth”

⚙️ https://t.co/PcfV8u6JGg$KGD.ax pic.twitter.com/NUvMBFeJhR

— Kula Gold Limited (@KulaGold) November 15, 2023

KGD share price

Oceana Lithium (ASX:OCN)

Swelling up today, in a good way, we also have Oceana – another peggie explorer on the hunt near and far – including in Australia, Brazil and Canada.

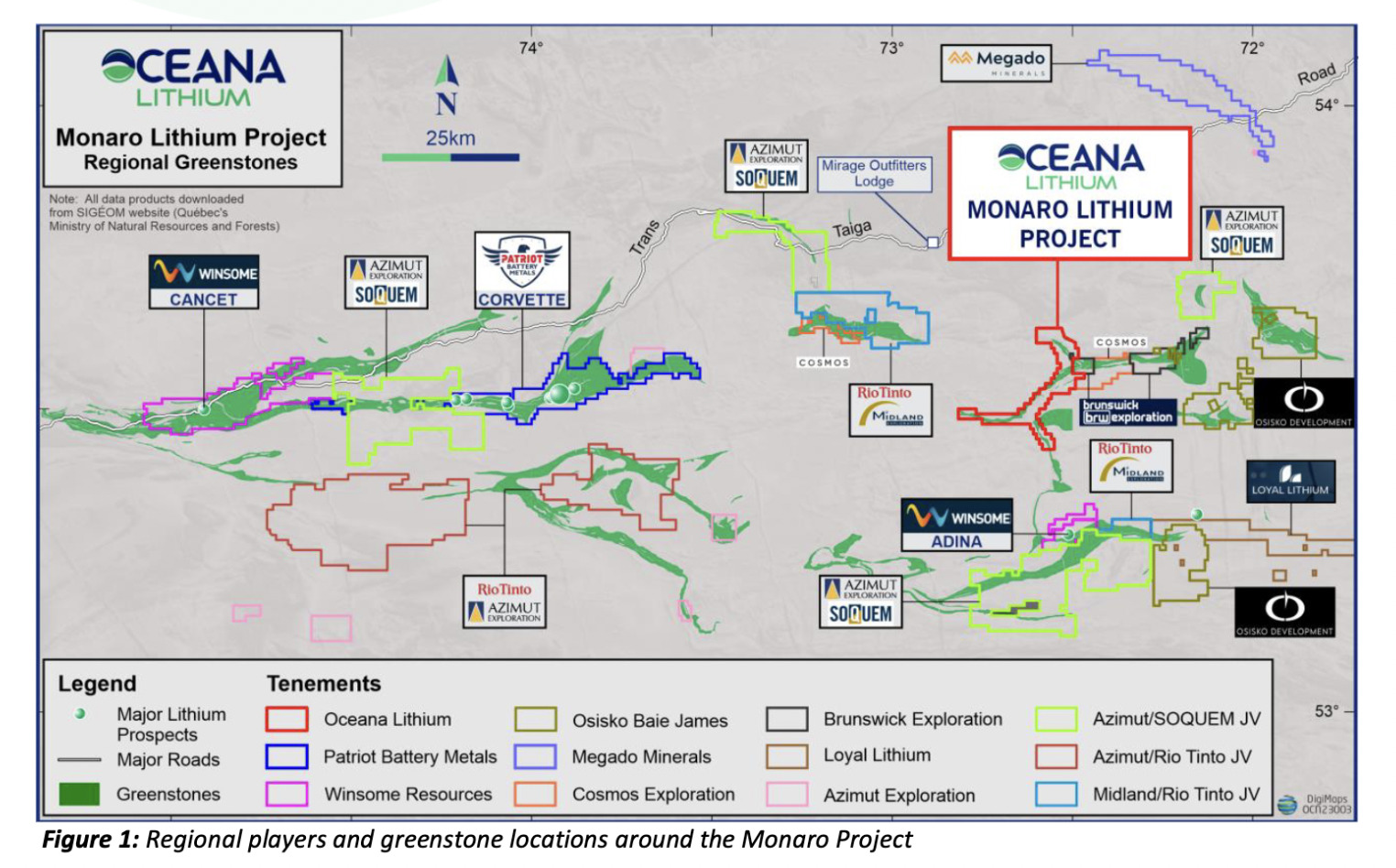

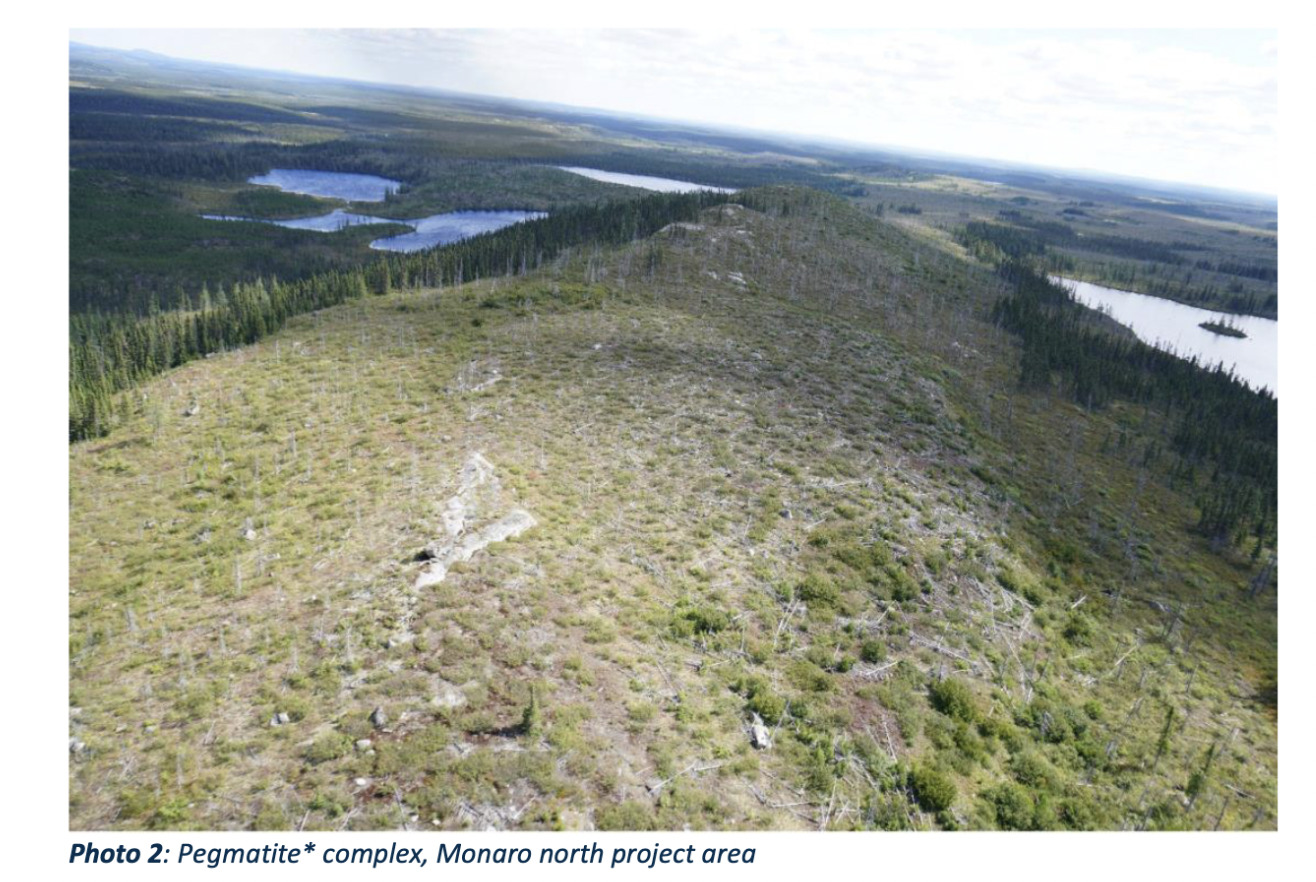

It’s on the move today, thanks to identification of high-priority lithium targets at its Monaro project in that hottest of lithium hotspots – James Bay, Canada.

OCN reports the first phase of field exploration work has now wrapped up at the site, and it’s left with an option to acquire a 100% interest in the project.

Monaro has 207 mineral claims covering an area of 104km2 along the western portion of the Duhesme Lake metavolcanic-sedimentary greenstone belt, which can be traced about 40km along strike and 4-5km across – see below.

The company says that “elevated levels of Rubidium (Rb) and low Potassium (K)to Rubidium ratios coincident with favourable geology and magnetic signatures have delineated several high-priority lithium targets for further investigation”.

Some 175 rock samples are being assessed with results expected in December.

OCN share price

Andromeda Metals (ASX:ADN)

Look, let’s take a short break from banging on about lithium, shall we?

Here’s Andromeda Metals, also pushing its way up the bourse today, courtesy of its kaolin-hunting efforts, among other news.

If you didn’t know, kaolin is clay used in the premium ceramic industry, as well as having some tech, medicine, cosmetic, and even food additive and toothpaste industry applications. In short, the stuff is useful.

The company has just announced its JORC-code-aligned inaugural Mineral Resource Estimate (MRE) for the Chairlift kaolin deposit in South Australia.

The company notes a combined Inferred Resource of 53.5 million tonnes (Mt) of kaolin at the deposit, neighbouring Andromeda’s flagship kaolin project Great White to Chairlift’s north-west.

Bob Katsiouleris, Andromeda’s CEO and MD, said:

“The Chairlift Deposit adds to the number of high quality resources now surrounding The Great White Project, further cementing the global significance of the region for high quality kaolin products.

“These resources significantly expand the potential market opportunities for Andromeda in the high-end porcelain ceramics and low-carbon concrete markets, further supporting the long-term benefits and future expansion opportunities of the planned development of The Great White Project.”

ADN share price

Brightstar Resources (ASX:BTR)

In a further diversion from lithium, let’s briefly talk Brightstar, because it’s shining on the bourse today, too.

And that’s thanks to a maiden mineral resource heads up for the Link Zone deposit within the broader Menzies gold project, which is near the town of Menzies about 130km north of Kalgoorlie.

Brightstar’s estimate: +21k oz at 1.1g/t Au from shallow, near surface material.

The company says Link Zone has potential for early-stage mining “to generate operational working capital to organically fund exploration and development activities”, adding:

“The MRE displays favourable ore body characteristics of near surface stacked lodes, oxidised material, likely low strip mining and is still open at depth and along strike at all three deposits within the Link Zone.:

Brightstar’s MD Alex Rovira said: In addition to completing the necessary approvals, permitting and mine planning, Brightstar are also assessing whether Link Zone can be extracted under a mining joint venture similar to the current Selkirk mining JV.”

BTR share price

Tyranna Resources (ASX:TYX)

Right, back to regular programming – lithium. Kidding. Sort of.

We noted recently that critical minerals explorer TYX had the drills spinning with some success at its Muvero prospect within the Namibe lithium project in Angola.

Today, the stock is double-digits well up on a fair bit more spodumene-bearing pegmatite-poking action at the promising African site.

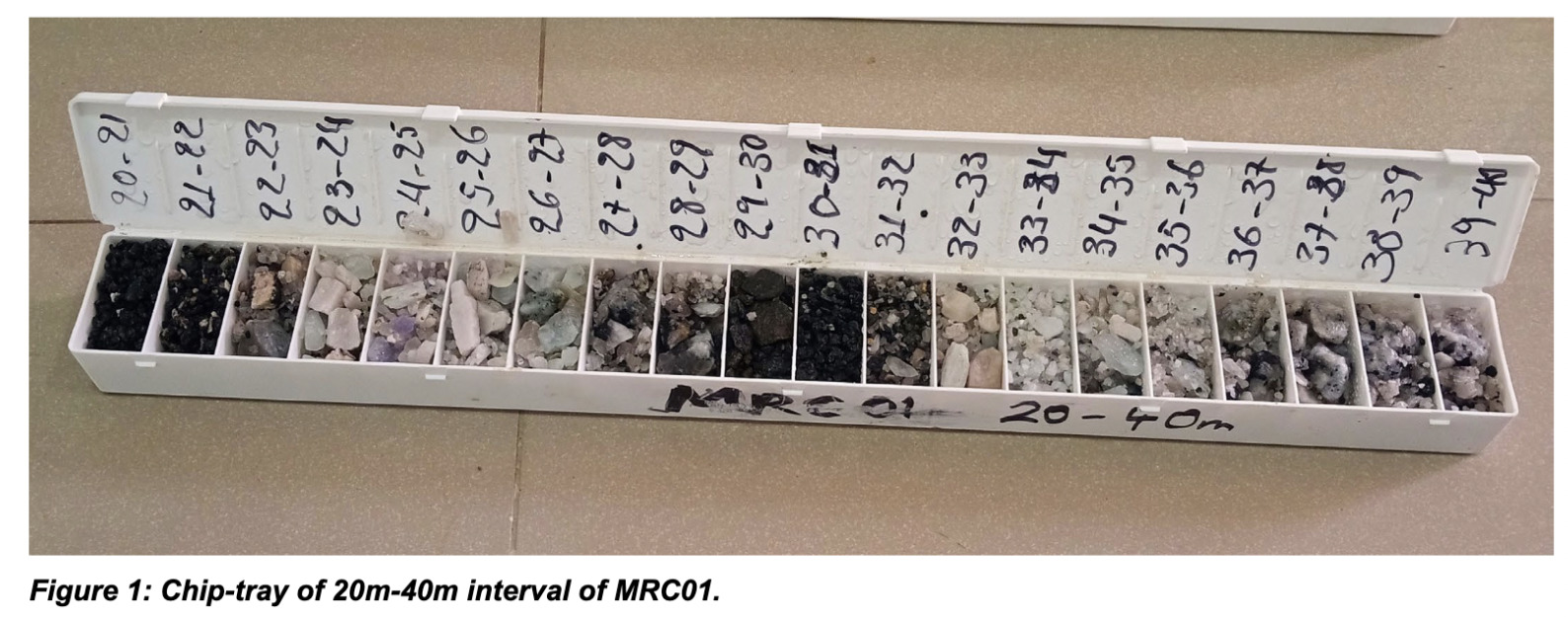

So far, drill-holes MRC01 to MRC10 have been completed, for a total of 1,650m.

Spoddy goodness has been spotted in drill-cuttings from seven of said 10 holes.

The company is encouraged by this, natch, and says it’s set to increase its drilling ops from 6,000m to 8,000m or more and continue through 2024, as well as keeping up its drilling at other prospects.

Someone at Tyranna tipped out their kid’s Lego collection and filled it with some juicy, spod-bearing rock samples. Here’s a pic:

Tyranna’s technical director, Peter Spitalny, said:

“The continuing intersection of spodumene-bearing pegmatites reinforces the potential of the Muvero prospect to contain a substantial amount of spodumene…

“And we are optimistic that as drilling continues and extends into 2024 this will prove to be the case!” he emphasised.

TYX share price

At Stockhead we tell it like it is. While Kula Gold and Oceana Lithium are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.