Resources Top 5: Kula Gold moves closer to restoring Mt Palmer’s golden past

Visible gold has KGD excited at Mt Palmer. Pic: Getty Images

- KGD observes gold in diamond core from Mt Palmer project in WA

- AVM about to begin exploration at newly acquired Guadalupe y Calvo gold-silver project in Mexico

- A 35,000m program of infill and grade control drilling continues at WGR’s Gold Duke project in WA

Your standout small cap resources stocks for Friday, September 19, 2025

Kula Gold (ASX:KGD)

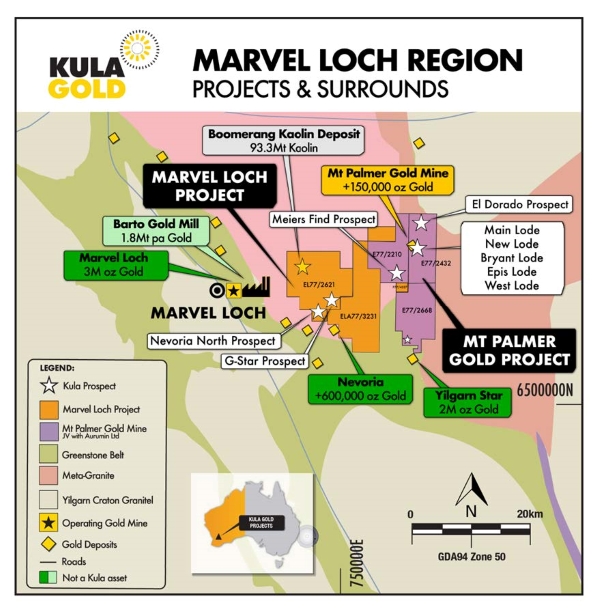

The Mt Palmer gold project in the Southern Cross gold fields of WA is moving closer to reliving its high-grade past with Kula Gold intersecting visible gold and sulphides in diamond drilling.

Diamond hole 25MPDD001, the first in the company’s current drilling campaign, was completed to 54m and hit multiple quartz reefs with native gold and trace sulphides showing in five intersections at depths between 31m and 36m.

While assays are awaited Kula Gold (ASX:KGD) said the early signs were encouraging and investors have applauded the indications with the company reaching 2.7c, a high of almost three years and an increase of 80% on the previous close.

KGD has sent the drill core to the lab for assay to determine the true grade of the hits.

Mt Palmer mine produced more than 150,000oz of gold at 15.9g/t in the period from 1934 to 1944. It is north of the Nevoria Gold Mine (+600,000 oz) and east of the circa 3Moz Marvel Loch Gold Mine.

The mine closed in part due to WWII when the miners left to join the war and it never re-opened.

Detailed structural analysis continues to define the location/plunge extensions of the rich mineralised zones of gold mined historically, and the new drilling is expected to significantly add to the analysis.

Given the abrupt end to mining in 1944, the opportunity for other undiscovered orebodies is a high probability as demonstrated by recent high-grade shallow gold results, which include:

- Epis Lode – 18m at 4.4g/t Au from 0m, including 2m at 31.3g/t from 15m; and

- New Lode – 6m at 36.g/t Au from 17m, including 2m at 53g/t from 18m.

KGD’s diamond core HQ3 drill program is targeting numerous shallow gold prospects including coring near these results.

The program will take about 10 days but more holes may be added.

Kula’s managing director Ric Dawson said: “Whilst we cautiously await the assays from diamond hole 25MPDD001 we are pleased to report the strong visual indications of mineralisation at the Mt Palmer Gold Project.”

A larger RC rig is scheduled to commence on completion of the diamond program to test deeper extensions and targets.

Advance Metals (ASX:AVM)

(Up on no news)

With exploration about to begin on the newly acquired Guadalupe y Calvo (GyC) gold-silver project in Mexico, Advance Metals (ASX:AVM) moved up 67% to 9c, a high of almost two years, and responded to a price query from the ASX.

The company recently announced the acquisition of a 100% interest in the high-grade GyC project in Chihuahua state from Canadian Miner Endeavour Silver Corp.

This is expected to significantly expand Advance’s precious metals portfolio.

Advance’s technical team has moved quickly to review the exploration upside of the project, identify numerous areas for potential expansion of the existing resources and also potential new discoveries.

This work has included inspecting on-ground access conditions, existing mine workings and existing (and potential new) drill sites in aid of the submission process for requisite government approvals for drilling.

An initial drilling program is being developed with extensions to known resources associated with the Rosario and Nankin veins expected to be the highest priority.

A review of the existing drilling has highlighted significant upside potential in the relatively-poorly drilled northwestern portion of the Rosario vein, which appears to have been offset somewhat by the La Bufa Fault.

The mineralisation in this area remains completely open along strike and at depth and will be a priority target for further extensions.

AVM has also identified significant regional discovery potential at El Chapito to the south and San Carlos to the north, with previous mapping highlighting kilometres of prospective veining.

These areas, which have been subject to very little exploration and drilling, will be a priority target for further potential extensions.

The company has held positive initial discussions with representatives of the local community and further engagement will be undertaken as activities ramp up.

GyC hosts a non-JORC, foreign estimate of 9.50Mt at 2.7g/t gold-equivalent (AuEq), containing 816,000oz AuEq or 60.6Moz silver equivalent.

Advance expects to begin the process of upgrading the foreign estimate to a new JORC resource in the coming weeks.

Western Gold Resources (ASX:WGR)

As 35,000m of infill and grade control drilling continues at the Gold Duke project near Wiluna in WA, Western Gold Resources (ASX:WGR) has climbed one-third to 16c, a three-year high.

More than 16,000m of the program has been completed to date and the company has received initial raw data from the first 20 holes with results to be released after the data is interpreted and validated.

The entire drilling program across the stage 1 pits – Emu, Eagle, Golden Monarch and Gold King – is expected to be completed within eight weeks.

This pre-production drilling is designed to de-risk operations and enhance mine scheduling flexibility, effectively eliminating the need for grade control during production.

It will strengthen WGR’s low-cost, high efficiency production strategy ahead of a final investment decision and supports plans for a late Q4 2025 mining start.

The company is also advancing a review of the updated scoping study, which is in the final stage prior to its approval and release.

Focus Minerals (ASX:FML)

It may have taken a few years but the turnaround for Focus Minerals (ASX:FML) has been strong since 2013 when it closed all three gold mines it was operating and sacked 200 people after the gold price tanked.

Restarting the Coolgardie gold project in 2023 and gold prices at or near records have seen the market cap exceed $150m and in the past 12 months the price has lifted from 13c to $1.06.

Today the company, in which Chinese gold major Shandong holds around 63%, has increased one third to $1.06.

Most of the company’s efforts are directed towards the Coolgardie Gold Operations on the outskirts of Coolgardie township in WA’s Goldfields region.

The focus is on optimising mining and processing operations, whilst developing the Bonnie Vale underground mine with stoping scheduled to begin in October.

During June the company achieved a record month of gold production with 3,874 ounces poured at the Three Mile Hill processing plant.

C29 Metals (ASX:C29)

Exiting Kazakhstan and focusing on Australia, particularly the Mayfield copper-gold project in Queensland, has been positive for C29 Metals (ASX:C29), which has risen by one-quarter to a daily high of 3c and has doubled since September 9.

Detailed planning is underway at Mayfield to enable further exploration while the company is considering new opportunities with a particular focus on later stage copper and gold exploration projects.

During the June quarter C29 was notified of a three-year extension to the exploration licence for Mayfield following a detailed submission to the Queensland Department of Natural Resources and Mines, Manufacturing and Regional and Rural Development in December 2024.

The company’s exploration manager and chief geoscientist has reviewed the Mayfield project and is undertaking detailed planning for the next stage of exploration.

“We are forward focused on the prospective Mayfield Copper & Gold Project and in considering new opportunities with a focus on copper and gold,” C29 managing director Shannon Green said in the June quarterly.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Western Gold Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.