Resources Top 5: Juniors in the spotlight across a gang of commodities as ASX shoots

Pic: Getty Images.

- Nimy’s massive sulphides at Mons piques investor interest

- Waratah leaps with Spur gold hits

- Cazaly can’t wait to get drilling at Carb Lake

Here are the biggest small cap resources winners in morning trade, Wednesday, August 14. Prices accurate at time of writing.

The ASX soared in early trade today, as corporate regulator ASIC was suing the exchange for alleged misleading statements about its core trading system. And while most stocks are up, there’s a few that are right up the charts across a range of resources commodities…

Nimy Resources (ASX:NIM)

Massive sulphides (volcanic massive sulphide, or VMS) deposits are all the rage as they tend to contain a high content of various precious metals and NIM has hit into a 10m interval of them from its first RC drill hole at its Mons VMS project – which it expected it would.

Mons is in the Forrestania nickel belt west of Kalgoorlie where IGO’s (ASX:IGO) nickel operations are located.

It raised just over $1m for exploration that’s currently running its finger over a previous 5m @ 0.73% nickel, 0.53% copper, 0.06 % cobalt and 0.55g/t PGE’s from 102m anomaly it discovered at the Masson prospect – and has a diamond drill ready to spin to drill beneath the two RC pre-collars it just completed.

“The initial drill hole testing of recent electromagnetic surveys completed at our Mons project has successfully intersected the top of the anomaly where we anticipated,” NIM exec director Luke Hampson says.

“We await assay results from this intersection of the highest EM response recorded at Masson at 10,000 siemens.”

Siemens are a gauge of conductivity by which electromagnetic surveys measure metals in the ground – and 10,000 is quite high.

Investors perhaps think the confirmation of mineralisation is pretty good, too, as shares have rise 15.5% today to trade at 6.7c.

Waratah Minerals (ASX:WTM)

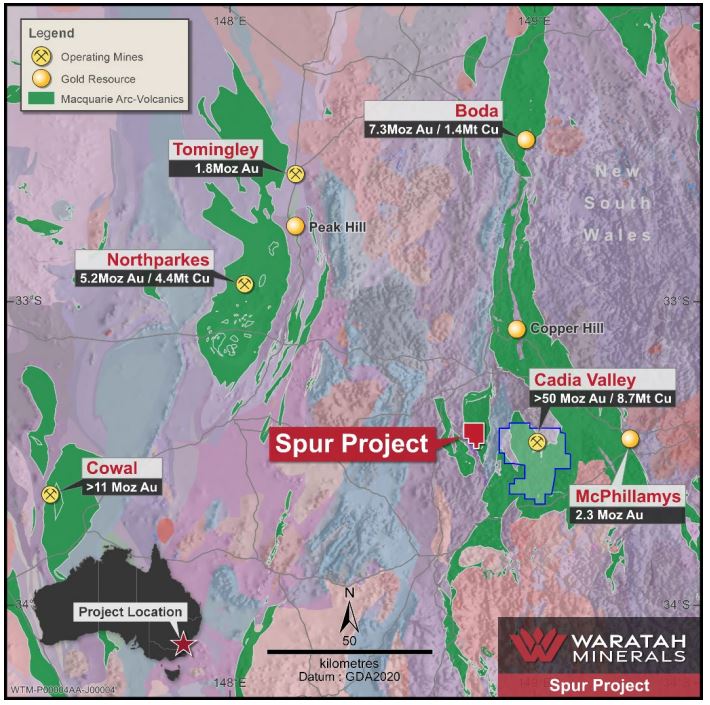

One of WTM’s substantial holders, Farjoy, has increased its stake in the junior from 5.08% to 7.49%, injecting almost $1.5m – as a maiden RC drilling campaign continues at the Spur project.

It put in $232,000 as part of a $5m placement that WTM is using to accelerate drilling at its Spur gold-copper project – and has just thrown in another $1.2m-odd purchase for 4 million shares.

It’s been a good month for the stock price so far, with results from another six holes from the current drill program consistently hitting shallow, high-grade gold mineralisation – up to 9.33g/t Au with 0.38% Cu.

Spur is in the prolific Lachlan Ford Belt in NSW, just 5km from where Newmont’s giant >50Moz gold and 9.5Mt copper Cadia Valley operation sits.

“Spur continues to deliver exceptional drilling results, the results from hole seven are pivotal, demonstrating a dramatic increase in grades downdip and an association with copper as predicted by our epithermal-porphyry exploration mode,” WTM MD Peter Duerden says.

As drilling continues, WTM shares have risen >400% from 9.2c on June 11 and are up 12% on today’s trade, swapping for 37c a share.

Cazaly Resources (ASX:CAZ)

(Up on no news)

Shares in CAZ tanked last week after announcing a delay to kicking off drilling at its Carb Lake niobium-REE project in northwest Ontario, due to a comms spat with the local community around the project that was announced a week ago.

It could be that the issue has been resolved based on trade today, with the $7.8m market-capped junior receiving decent volumes and is one of the better-performing ressies on the ASX today.

Drilling permits were approved in August for Carb Lake, and the explorer is chomping at the bit to start spinning down hole across a large >3km in diameter mineralised carbonatite system.

Why? Because it hasn’t been drilled-tested since the 1960s, with only four holes drilled – yet still showed a whopping 7.1% niobium hit in one of them.

Shares in CAZ rose 18.8% to 1.9c during today’s trade at the time of writing.

Latin Resources (ASX:LRS)

(Up on no news)

LRS has had its first significant bounce in the share market in a couple of months due to depressed lithium prices as it transitions from explorer to developer of its flagship Salinas hard rock Li project in Brazil.

It could be on the expectation of an upcoming resource estimate for its recent Planalto lithium discovery, where drilling popped up high-grade hits of up to 2.5% Li2O at shallow depths.

The $300m market-capped ressie wants to complement the find to its 70Mt @ 1.25% Li2O Colina resource just 1.5km away as it sets itself up to become the next major producer in Brazil’s Minas Gerais State, where >$C1 billion TSX-listed Sigma Lithium kicked off operations at its Grota Do Cirilo spodumene mine last year.

Resource proving continues at Planalto and its maiden MRE is due out in the September quarter.

Shares in LRS have been heavily traded today and are up 13.6% to 12.5c at time of writing.

Estrella Resources (ASX:ESR)

After discovering high-grade manganese in Timor Leste back in April, almost-a-penny-stock ESR has taken samples from all over the tenure and initial pXRF analysis (a preliminary determination of grades from rock chips in the field) showed up to 64% manganese (Mn).

And while further lab analysis confirmed up to 56.9% Mn at the Lalena prospect, that’s still a pretty high number.

More field samples then showed up to 64% Mn near Lalena at the new Sica prospect, spurring the explorer’s decision to now increase the landholding, as it’s identified supergene manganese mineralisation that extends between the two prospects.

It’s applied for additional exploration licenses to the west that will increase its tenure up to 698.1km2 and plans to boost its field team to expedite exploration efforts.

Shares in the minnow were up 20% to 0.6c in early trade.

At Stockhead we tell it like it is. While Latin Resources is a Stockhead advertiser at the time of writing, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.