Resources Top 5: JBY and MGA grab limelight for lithium, but never mind that… G6M has tungsten

Pic via Getty Images

- James Bay Minerals and Metalsgrove Mining are bringing the lithium gains love for investors today

- Meanwhile, Group 6 Metals has breezed past them with a larger intraday pump, thanks to its Tassie tungsten update

- MGU and GML also having a positive start to their Wednesdays

Here are some of the biggest resources winners in early trade, Wednesday June 5.

James Bay Minerals (ASX:JBY)

Canadian-focused lithium exploration junior James Bay Minerals’ share price is wading in decent double-digit gains so far today.

And that’d be because fieldwork has begun across numerous high-priority lithium-caesium-tantalum (LCT) pegmatite targets at the company’s Joule property in Quebec, Canada, as it kicks off a 2024 summer field program.

The program will see JBY explore a significant number of LCT and rare earths targets at Joule, while the company is also exploring partnerships to further acecelerate development across its Quebec properties.

JBY’s La Grande project packages in particular, are very close to Winsome Resources’ (ASX:WR1) Cancet and Patriot Battery Metals’ (ASX:PMT) high-profile Corvette lithium projects.

The Joule property itself spans 163km2 hectares along the Robert-Bourassa reservoir which features a prominent ~24km deformation zone running east to west, with deformation widths up to 1.5km in the northeastern part of the property.

James Bay’s executive director, Andrew Dornan said:

“In late 2023, despite having just a couple of months before snowfall, our fieldwork was directed towards the Aero Property, thanks to its convenient access directly off the Trans-Taiga highway.

“Now that the Canadian winter has passed, we’re shifting gears with our sights set on the exciting Joule Property.

“The rare earth targets identified through the radiometric surveys show significant promise, and the team is looking forward to delving deeper into these zones to unlock their full potential while also exploring the numerous priority lithium-pegmatite targets identified across the property.”

Read more > here.

MetalsGrove Mining (ASX:MGA)

Another lithium-hunting junior, MGA has made another strong move today, which it’s been doing a bit just lately.

Today’s share-price bumping news centres around MGA’s Zimbabwe lithium hunt.

Mapping and sampling results are in from the company’s initial exploration program, which have helped define several pegmatites (although caveated: “with less detailed geological observations”).

A total of 104 rock samples were collected, prepared, and submitted to a lab in South Africa – nine samples from the ‘Beatrice’ target and 95 from the Arcturas region.

The Arcturas region samples recorded lithium values at “trace levels or below detection limits”, while the nine samples collected at Beatrice showed encouraging lithium grades, with values up to 1.44% Li2O.

The company notes, though, that only one of those latter samples was collected within its tenements.

Nevertheless, MGA is planning further imminent exploration work on these projects.

ICYMI: Zimbabwe #Lithium Projects – Mapping and Sampling Results Received from Initial Exploration Program

-Geological mapping consisted of defining several pegmatites although with less detailed geological observations.

More: https://t.co/ikZsYWFA6U $MGA $MGA.ax pic.twitter.com/MgO1LZRitY— MetalsGrove (@metalsgrove) June 3, 2024

Magnum Mining (ASX:MGU)

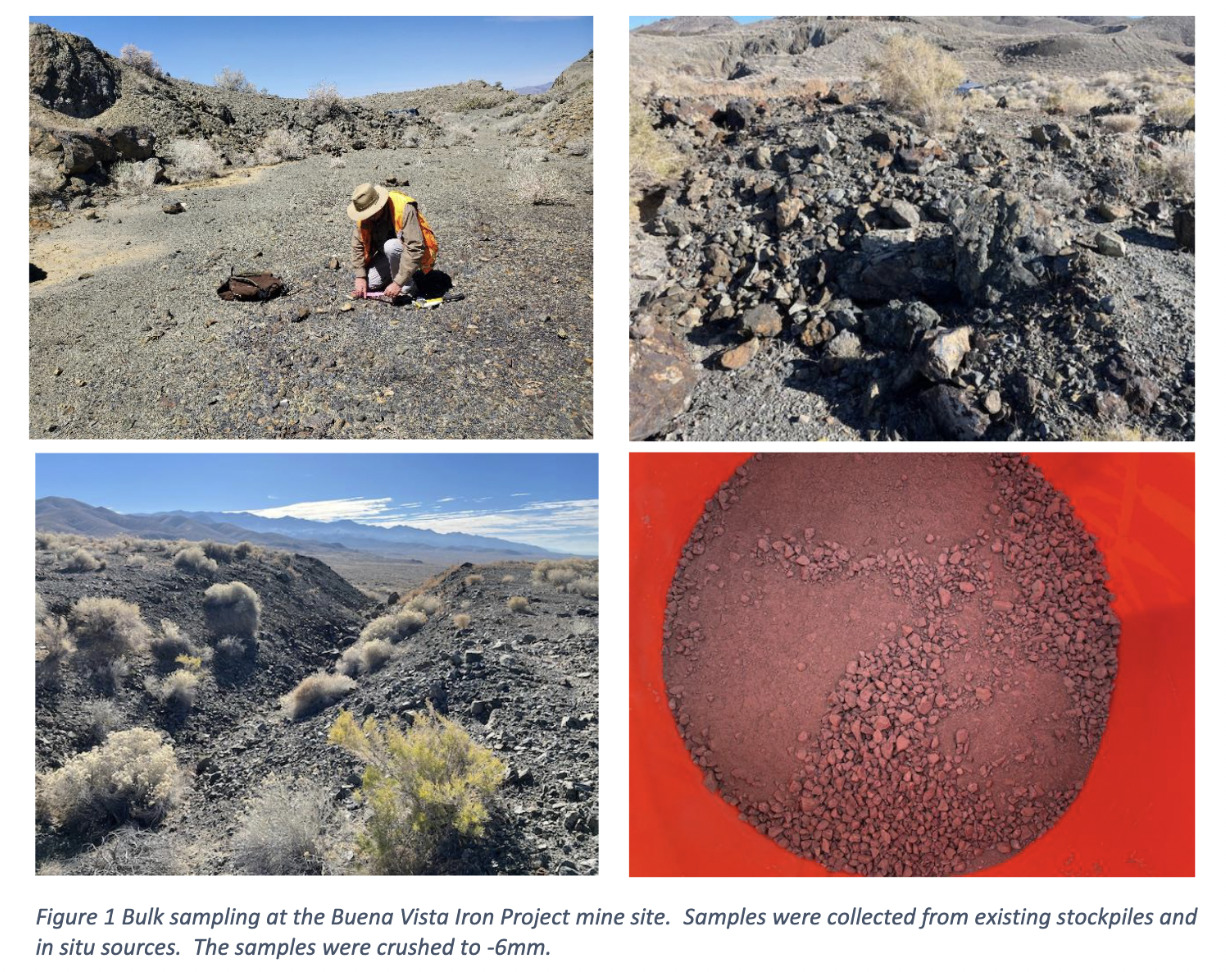

Iron ore and magnetite junior Magnum is a notable ASX ressie performer today after announcing some encouraging metallurgical test work.

Those fresh results indicate a high grade 68.3% iron grade magnetite concentrate is readily achievable just through simple, low cost grinding at the company’s Buena Vista iron project in Nevada.

A crucial part of the testing, notes the company, is that the grinding has achieved the low silica and aluminium levels it was after – below 3%, which is a target needed to meet Direct Reduction Iron grade requirements.

It means that industry standard grade of iron “fines” are achievable with the coarse grind size. And that’s very much a win.

What next? Flotation test work is underway with the aim of achieveing higher iron grades, and Magnum also says that a bulk magnetite concentrate will be produced for supply to key potential customers for their in-house testing.

Group 6 Metals (ASX:G6M)

Let’s talk tungsten. And it’s about time, too. It is the world’s toughest metal after all, and it gets too much tough love. Probably.

In any case, Group 6 Metals is right into this extremely hard, stupendously dense and fantastically heat-resistant stuff, with its focus lying on its 100%-owned Dolphin Tungsten Mine (DTM) project on King Island in Tasmania.

The company has provided an update on operations at the site this morning.

High grade ore from the C-lens (a form of geologic deposit) has now been exposed in the Dolphin open cut pit.

And the company notes that mining at the open pit has exceeded forecast volumes for ore tonnes and metric tonne units of WO3 (tungsten oxide) recovered up until the end of April, when compared to the geological model.

This comes at a good time for tungsten in the global market, too, with the commodity strengthening on “strategic supply concerns”.

Clarifying that further, G6M noted that “the past 6 weeks has seen an increase in the ammonium paratungstate (APT) CIF Rotterdam price of approximately 12%, with current prices quoted as U$335 – 360 per mtu (10 kg of WO3). This sharp increase in price has been attributed to the tightening of Chinese domestic supply driving prices in China higher and increased activity by Chinese buyers in Western markets.”

APT is considered the most important raw material for all other tungsten products.

#G6M Dolphin Mine operational activities update: https://t.co/LLLZEddw5J

✅ High grade C-Lens exposed in open cut pit

✅ Tungsten market strengthens on supply concerns

✅ Ore sorting test work delivers encouraging results

✅ Advancing agreement to integrate renewable energy pic.twitter.com/TZJZlj2aYS— Group 6 Metals Limited (@Group6Metals) June 5, 2024

Group 6 Metals MD and CEO Keith McKnight said:

“Chinese APT prices, quoted on FOB delivered basis, are now higher than European prices quoted CIF Rotterdam. This is an unusual development in the tungsten market which points to tightening domestic supply in China and more activity by Chinese buyers in Western markets.

“Chinese import of tungsten concentrates almost doubled in the first calendar quarter of 2024 and the expectation is that this trend will continue into the second half of the year.”

Regarding G6M’s latest news, McKnight added:

“Over the past six months, our geology and mining teams have excelled at maximising ore recovery. This means we’ve collected more valuable tungsten ore than forecast while working the outer areas of the Dolphin open pit.

“While this has caused a temporary delay in the mining sequence, the extra effort has resulted in a detailed understanding of the mine’s geology, giving us a lot of confidence in our mine forecast.”

Gateway Mining (ASX:GML)

(Up on no news)

Gateway Mining is a WA-focused mineral exploration junior targeting a large-scale, quality gold resource at its Montague gold project in the North Murchison gold fields.

It notes it provides exposure to an “under-explored land package within a Tier-1 gold exploration location with an existing 526,000oz of mineral resources”.

There’s no news to speak of today (yet) that might provide a reason for GML’s impressive 37% intraday burst.

Here’s some of the company’s latest news, though – a boardroom shuffle…

Gateway Mining has decided to refresh its board, with former managing director Peter Langworthy rejoining the team after stepping down in 2021 | Coverage by @MiningNewsNethttps://t.co/v00gfeEtf6#GML #gold #exploration #WA

— Gateway Mining Ltd (@gateway_mining) May 31, 2024

At Stockhead we tell it like it is. While James Bay Minerals is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.