Resources Top 5: It’s an antimony frenzy as ASX juniors can’t stop, won’t stop the gains

Mining

Mining

Here are the biggest small cap resources winners in morning trade, Wednesday, August 26. Prices accurate at time of writing.

Production out of China has incrementally dropped across the past few years and prices of antimony have now shot through the roof – trading at around US$24,500/t – a fair bump from 2020 when prices were as low as the still economical US$6000/t.

Why? Because China has imposed export restrictions on the material, sending supply chains into a frenzy.

READ MORE: Blinkers Off: Every ASX junior with a horse in the West’s antimony race

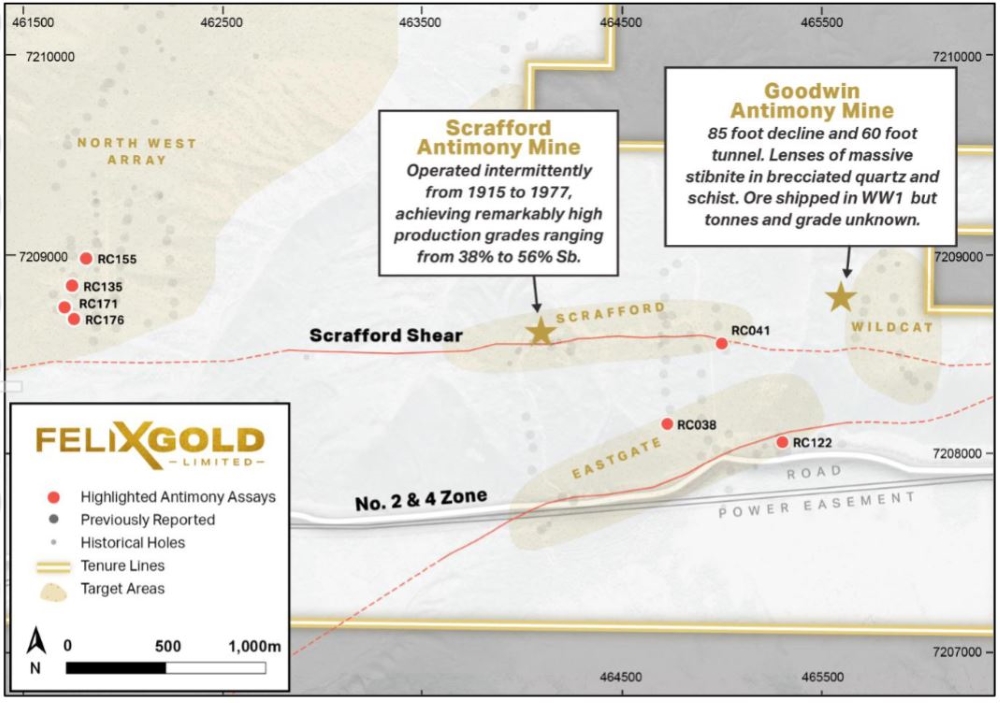

Antimony (Sb) is kicking off. Hard. The latest to shoot almost 100% on early trade is FXG, announcing hits of up to 28% antimony discovered by reassaying gold samples from 2022 and 2023, and historical 58% production grades from the Scrafford mine within its tenements.

FXG is now assessing its standalone antimony production potential at the Treasure Creek gold project in Alaska.

Treasure Creek is within the world-class Fairbanks Gold District, where historical gold production exceeds 16Moz and where historical antimony production at the Scrafford mine included those stellar grades.

The project contains a 30.8Mt inferred resource for 831,000oz gold, encompassing its NW Array and Grant Mine deposits, yet it’s FXG’s antimony endowment that could be the real kicker to accelerate the project’s development.

“The historical success of using a straightforward gravity separation method at Scrafford, even with older tailings, suggests that a relatively simple and cost-effective processing plant could be implemented for future operations,” the company says.

“This minimises capital expenditure and technical risks associated with more complex processing techniques.”

“Unlike lower-grade antimony often associated with larger gold systems, the high-grade antimony at Treasure Creek – exemplified by the Scrafford Antimony Mine, with historical production grades up to 58% Sb – it presents a unique opportunity for stand-alone antimony production,” exec director Joe Webb added.

Shares in the now $21m gold-antimony explorer have soared a whopping 96% with $1.6m in volume traded so far to swap for 9.7c at time of writing.

SS1 has jumped through the roof after releasing a 45% upgrade to its Maverick Springs project in Nevada to a world-class 423Moz silver equivalent resource.

Demand for the shiny metal is surging on the back of growth in industrial uses, primarily in solar PV cells, leading to spot prices increasing 23% since the start of the year to almost US$30/oz.

A comprehensive review of existing drill data and remodelling of the resource led to the upgrade with the inclusion of the entire mineralised domain at the project, which is deemed to have reasonable prospects for eventual economic extraction.

“Achieving the status of the largest pure silver resource on the ASX is a significant milestone in Sun Silver’s short history,” SS1 exec director Gerard O’Donovan said.

“Expanding our resource base was crucial, particularly given that the previous report was calculated based on market pricing of US$21.50 silver and US$1850 gold.”

Gold and silver resources often contain antimony credits – some more than others – and SS1, as it turns out, did some pXRF analysis on its tenure recently which returned up to 1459ppm Sb.

The explorer is continuing to investigate its antimony endowment and, considering the size of its silver deposit, it might just have quite a sizeable amount of credits of the material to further increase Maverick Springs’ economic development studies.

Shares in the junior are up almost 16% today to trade at 6.6c.

(Up on no news)

NAG is shouting about its own antimony discovery at its 3.6g/t, 153,000oz gold equivalent Nagambie gold mine in central Victoria, which contains a 4.3%, 17,840t Sb resource, which it updated in May.

The explorer points to Australia’s Mandalay Resources-owned Costerfield mine, which has only about a 1100-1500t resource – a small comparison with Nagambie.

NAG’s focus is to significantly grow the resource and it said at the end of July that it’s “confident a recommended follow-up drill program of depth and extensional drill will achieve this objective, given the four lode systems intercepted to date are open at depth and along strike”.

“The Board and the CEO continue to work hard to put the company in a position to take the next steps to build on the exciting gold and antimony discovery,” the company noted.

Shares were up 17% at time of writing and up 177% for the month to trade at 2.7c.

Desktop studies are underway at the Hillgrove South prospect at the explorer’s Halls Peak project in NSW.

CRR is aiming to define high-priority targets that may be an extension of Larvotto Resources’ (ASX:LRV) Hillgrove deposit 6km away, which currently hosts a 7.264Mt at 1.3% Sb for 93kt of contained antimony.

The project is along the major Chandler fault, which runs between Halls Peak and Hillgrove in the New England Fold Belt in NSW.

“Strategically located next to the historically productive Hillgrove project, this initiative places us in a prime position within the highly promising New England Fold Belt,” non-exec director Nigel Broomham says.

The minnow is up 33% to trade at 1.2c per share.

High grades of hematite iron ore of up to 64.9% Fe have been identified in the southern extent of M4M’s Goldsworthy East project in WA.

That comes on the back of a rejection of BHP (ASX:BHP) objection to to the exploration license application and the Warden’s Court of WA has recommended that it be granted.

A program of works is now waiting to be submitted so maiden drilling can get underway, which it expects to happen by November this year.

The Goldsworthy open pit, which is less than 2km to the west of M4M’s tenements, produced 55Mt at 63.5% Fe between 1965 and 1982.

Shares in the iron ore explorer have jumped 20% on the news, trading at 2.9c.

At Stockhead we tell it like it is. While Felix Gold and Sun Silver are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.