Resources Top 5: It’s a good day for… Africa-focused coal companies?

Got coals stocks? In Africa? Picture: Getty Images

- South African coal explorer MC Mining soars without any ASX release

- Intra Energy Corp announces shift from Tanzania coal to Mozambique gold

- Nexus Minerals shares respond to high-grade mineralisation at WA gold project

Here’s your top ASX small cap resources winners in morning trade Thursday, November 5.

The top moving resources stock on the ASX in morning trading is MC Mining (ASX:MCM), up a stonking 55 per cent to 21c.

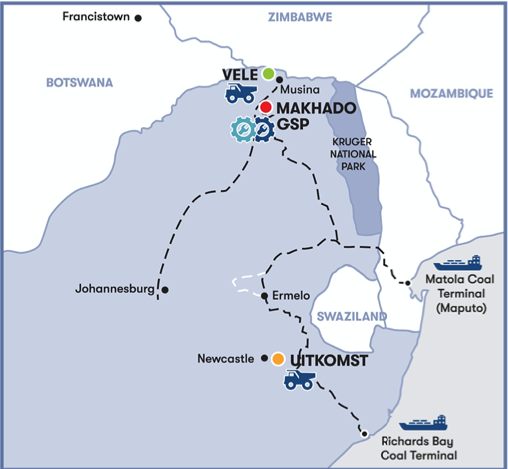

The Johannesburg, London and Sydney listed coal explorer has coking coal and thermal coal projects in South Africa.

MC Mining is in talks with potential funders to develop its flagship Makhado hard coking coal project, but the company has yet to announce any deals to the ASX.

A funding deal with Columbia Skies Holdings, a private company belonging to South African industrialist Pitso Madibo, failed to get off the ground in October.

The industrialist was due to subscribe to 7.8 million MC Mining shares, but this did not happen, said the company in an October release.

The company’s Uitkomst colliery in South Africa produced 137,000 tonnes of coking and thermal coal in the September quarter.

ASX share price for MC Mining (ASX:MCM)

Intra Energy Corp moves away from Tanzania coal business

Coal-to-gold company Intra Energy Corporation (ASX:IEC) caught wind in its sails Thursday, rising 30 per cent to 1.3c, without posting any update.

The Africa-focused company said days earlier it was going to reposition itself as a gold company as its Tanzania-based coal business was not doing too well.

“As the gold development now has assumed greater importance to IEC, the board has decided to position IEC as a gold developer, producer, refiner and trader and move away from coal altogether,” said the company in its September quarter update.

IEC’s 70 per cent-owned Tancoal mine is the dominant supplier to end users in Tanzania, Kenya, Rwanda and Uganda, and is the largest coal mine in Tanzania and east Africa with sales of 169,000 tonnes in the September quarter.

IEC is shifting its focus to its Minas Do Lurio gold resource in Mozambique for which it wishes to raise $US2.5m in a share placement.

ASX share price for Intra Energy Corporation (ASX:IEC)

Nexus Minerals hits high-grade mineralisation

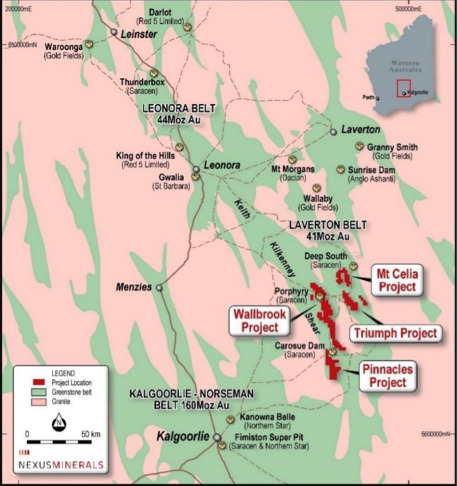

WA gold explorer Nexus Minerals (ASX:NXM) had a good morning, leaping 28 per cent to 16c, three days after it released a report on its proposed Pinnacles open-cut mine.

The company said in an update Monday that drilling had revealed high-grade mineralisation at the base of the proposed open pit at its Pinnacles project.

“The low capital cost of the development significantly de-risks the project metrics and accelerates the project time line,” managing director, Andy Tudor, said in the update.

Hits included 7m at 6.25 grams per tonne (g/t) from 54m, and 9m at 9.5 g/t from 70m, as it moves towards a feasibility study.

ASX share price for Nexus Minerals (ASX:NXM)

European Metals Holdings advances Czech Republic lithium-tin project

Shares rose 28 per cent in European Metals Holdings (ASX:EMH) to 50c without any company update, although its September quarter update last week contained some suggestions for investors.

The company continues to move ahead with its lithium-tin project in the Czech Republic

European Metals Holdings has appointed a leading Germany-based mining and resources-focused investment house to be its adviser in Europe.

The company is also pursuing a listing on the Czech Republic’s stock market in Prague.

ASX share price for European Metals Holdings (ASX:EMH)

Vanadium Resources climbs as scoping study confirms project

Vanadium Resources (ASX:VR8) increased 16 per cent to 2.8c per share without any fresh news since its September quarter report last week.

A scoping study has confirmed the viability of production pentoxide from its Steelpoortdrift vanadium project.

ASX share price for Vanadium Resources (ASX:VR8)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.