Resources Top 5: Is this a ‘tier 1 gold mine in the making’?

Pic: Via Getty

- BMG Resources up again after announcing thick, high-grade gold hits yesterday

- How big will Predictive Discovery’s 3.65Moz ‘Bankan’ project get?

- Receipt of government approvals paves the way for a major exploration program at Lithium Energy’s ‘Solaroz’ lithium brine project

Here are the biggest small cap resources winners in early trade, Wednesday, April 27.

BMG RESOURCES (ASX:BMG)

The WA explorer has surged again in support of yesterday’s big share price gain.

The catalyst? Thick, high-grade gold in drilling at ‘Capital’ — part of the ‘Abercromby’ project — including a highlight 31m at 6.18g/t gold.

This was part of a broader 77m intersection grading ~3g/t from 116m.

Other notable hits included:

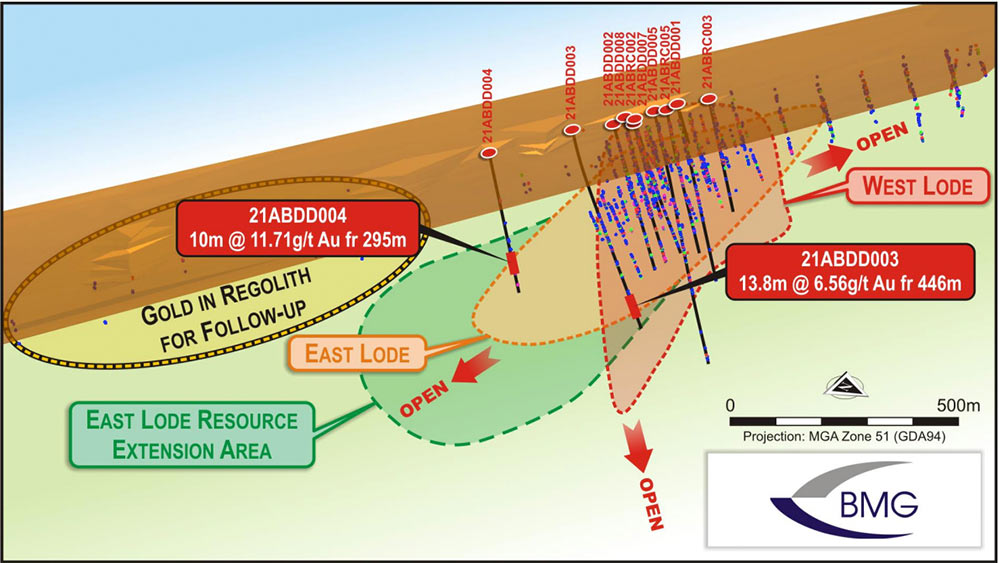

- 10m @ 11.71g/t Au from 295m, and

- 8m @ 6.56g/t Au from 446m

That 10m, ~11.7g/t hit was 250m south of known mineralisation (see pic below).

So far, drilling has more than doubled the mineralised envelope at Capital to 550m long and 520m deep.

The deposit remains open in multiple directions.

Results from early stage ‘aircore’ drilling, testing new areas to the south of Capital, are expected shortly. Follow-up drilling to find the edges of the Capital deposit could kick off next month.

Abercromby is on the Wiluna Greenstone Belt, one of WA’s most important gold producing regions. The project area neighbours notable discoveries like Northern Star’s (ASX:NST) 10Moz ‘Jundee’ and Bellevue Gold’s (ASX:BGL) namesake high grade project (2.2Moz at 11.3g/t).

$15m market cap BMG is down 15% year-to-date. It had $3.1m in the bank at the end of December.

PREDICTIVE DISCOVERY (ASX:PDI)

How big will Bankan get?

New drilling results from the 3.65Moz-and-growing ‘Bankan’ discovery in Guinea include a highlight 41.5m at 5.2 grams per tonne (g/t) gold from 598m depth.

The hits included in today’s announcement targeted areas below the current deeper high-grade core at NE Bankan, which remains ‘open’ at depth and along strike.

These deeper hits have prompted PDI to plan further extensional drilling, to be incorporated in the drill program in the current quarter.

The current and planned drilling will underpin an updated resource, expected to be completed in the September 2022 quarter.

“These new results demonstrate the consistency of grade and mineralisation which evidently continues significantly beyond the bottom of the NE Bankan pit shell, further underpinning Predictive’s view that Bankan is potentially a Tier 1 gold mine in the making,” managing director Andrew Pardey says.

“Predictive is now entering a new phase of its exploration with a greatly expanded drilling program and the improved geological understanding that flows from it.

“These prospects are expected to add significantly to the Bankan project’s mineral resource inventory.”

The $288m market cap stock is down 20% year-to-date, but up +2,200% since making the discovery at Bankan in 2020.

LITHIUM ENERGY (ASX:LEL)

Th receipt of government approvals paves the way for a major exploration program at the flagship ‘Solaroz’ lithium brine project in Argentina.

All eight Solaroz concessions (totalling 12,000ha) have now received EIA approvals.

Geophysics and drilling will kick off from May over all concessions to delineate a maiden JORC Mineral Resource – a must-have for all ASX listed explorers and miners.

“In our view, there is no better address in the world to be exploring for lithium than the prolific lithium triangle, and our ground is directly adjacent to or principally surrounded by two of the largest lithium discoveries globally owned by Allkem (ASX:AKE) and Lithium Americas,” LEL says.

LEL believes Solaroz lies over the same lithium rich aquifer within the Olaroz Salar from which Allkem has been extracting and processing lithium-rich brine for sale as lithium carbonate since 2015, and from which Lithium Americas plans to draw upon for its neighbouring Cauchari-Olaroz development project.

“Lithium Energy proposes to test the proposition that the aquifer which supplies the lithium-rich brine being extracted by Allkem extends under the company’s Solaroz concessions,” it says.

“This will be tested by geophysical work and drilling with a view to fast-tracking production of lithium carbonate dependent upon these works being successfully concluded.”

Arrangements with local geophysics and drilling contractors is now being finalised, LEL says.

The $50m market cap stock is up 15% year-to-date. It had $7.1m in the bank at the end of March.

CULLEN RESOURCES (ASX:CUL)

Some big gold hits at the ‘Mt Eureka’ JV (75% Rox Resources ASX:RXL, 25% Cullen Resources) gave CUL a meaningful bump in early trade.

Highlight intercepts included 13m at 6.81g/t gold from just 45m.

It was part of a large drilling program completed in December 2021 to test high priority targets across Rox’s fully owned and JV areas at the ‘Mt Fisher-Mt Eureka’ project area.

Importantly, drilling intersected significant gold mineralisation at all target areas, RXL says.

“The extensive nature and continuity of the gold mineralisation throughout the project area indicates the greenstone belt has strong potential for major new gold discoveries,” it says.

Follow up drilling is planned.

CUL is currently drilling its wholly owned ‘Wongan Hills’ project near Perth, targeting big volcanic-hosted massive sulphide (VHMS) and nickel-copper-PGE discoveries.

The $7m market cap stock is flat year-to-date. It had $1.4m in the bank at the end of December.

ALBION RESOURCES (ASX:ALB)

(Up on no news)

ALB’s main projects include ‘Lennard Shelf’ (zinc, lead) and ‘Leinster’ (nickel, copper, gold), both in WA.

Recent drilling at Leinster hit “several broad intersections of nickeliferous ultramafic rocks”, with a peak result of 24m @ 0.31% Ni from 16m, including 8m @ 0.50% Ni from 20m.

The next phase of work at the Lennard Shelf will begin shortly, the company said earlier this month.

The $6m market cap minnow – which listed on the ASX April last year — is down 20% year-to-date. It had ~$3m in the bank at the end of December.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.