Resources Top 5: Iron ore junior tells Twiggy and Gina to take a look, more lithium M&A and McGowan to chair Frontier

"Twiggy, Twiggy, I promise I'm not a telemarketer". Pic: Getty Images

- Australian Critical Minerals shoots on iron ore rock chip samples in the Pilbara, calls out Twiggy and Gina

- Lithium M&A captures the imagination

- Frontier jumps on ex-WA Premier Mark McGowan’s chair appointment

Here are the biggest small cap resources winners in morning trade, Monday, August 19. Prices accurate at time of writing.

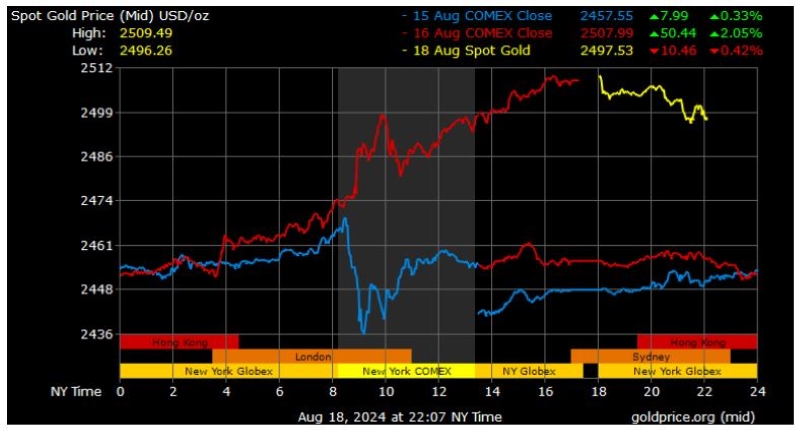

Gold broke through the significant US$2500/oz barrier for the first time on Friday and stocks with exposure to the commodity have replied in turn, with increases across the board. Other stocks have risen on project milestones across iron ore, lithium and renewables.

READ MORE: Gold hits US$2,500k for first time

Australian Critical Minerals (ASX:ACM)

This explorer has sounded the horn, virtually calling on iron ore big wigs Andrew Forrest and Gina Rinehart to take a look after uncovering economic grades in Pilbara rock chips.

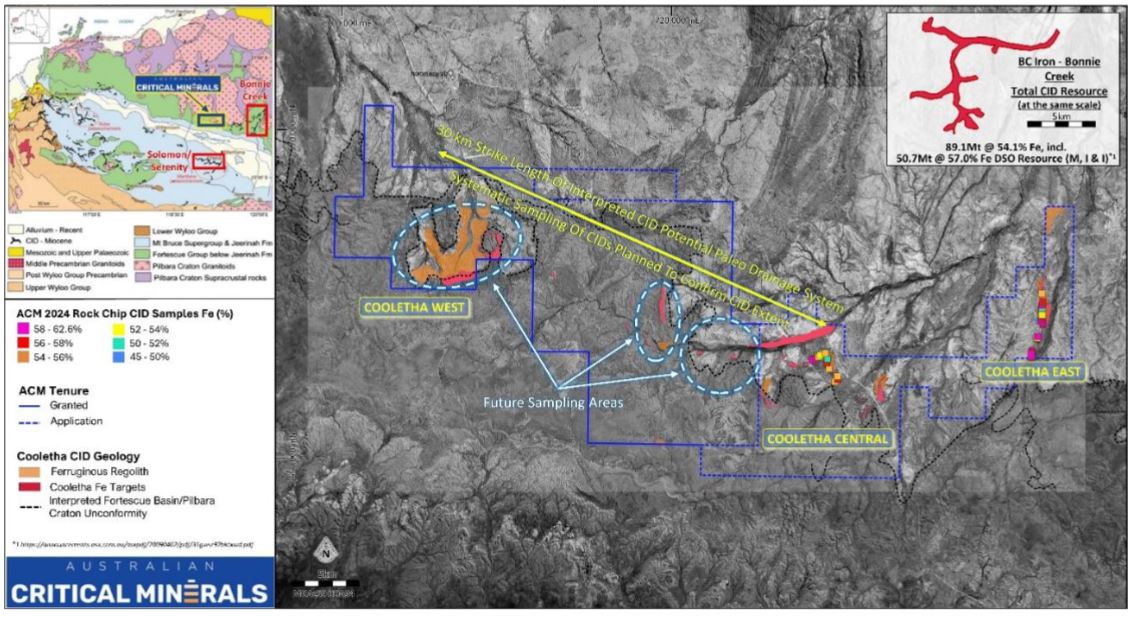

ACM followed up on a hunch it might just have some decent iron ore prospectivity at its Pilbara iron exploration programs, with mapping and sampling conducted in June highlighting its Cooletha and Shaw projects.

It looks like the explorer might be onto something. 46 rock chips have been assayed, returning up to 61.3% Fe at a 55.5% Fe average at Shaw and up to 62.6% Fe at a 54.9% average at Cooletha.

The results have interpreted Shaw has 9km of confirmed banded iron formations and the company intends to carry out systematic sampling of the extensive BIF horizons.

And Cooletha contains an identified 42km stretch of combined channel iron deposits, where ACM is considering grid sampling on the CID outcrops and scree slopes to further uncover its prospectivity.

Channel iron deposits are lucrative, significant sources of iron ore in WA’s Pilbara, where projects such as BHP (ASX:BHP) and Rio Tinto (ASX:RIO) mammoth Yandicoogina deposits and the latter’s Robe are in operation.

ACM reckons other surrounding neighbours might come knocking soon.

“The impressive results returned from our Shaw and Cooletha projects in the Pilbara are an early but important step in realising the value proposition offered by our iron ore portfolio,” ACM MD Dean de Largie says.

“It has been our belief that the iron ore product at Shaw and Cooletha is of a quality that could be of interest to our surrounding neighbours, Fortescue (ASX:FMG) and Gina Rinehart’s Roy Hill operation.

“In addition to these potentially commercial Fe grades, we are pleased to note that the samples have a particularly low phosphorous concentration with an average 0.08% Phosphorous in the Cooletha samples.

“Based on these very respectable Fe results we have commenced a large sampling program of approximately 800 rock samples across the significant CIDs at Cooletha and the significant BIFs at Shaw.”

Shares in ACM have ticked up an impressive 31.9% on the back of the news to trade at 9.5c.

Charger Metals (ASX:CHR)

Charger metals is up 19% after revealing it had knocked back Core Lithium (ASX:CXO) on a $6.5 million bid for the lithium explorer.

The big prize here is the Bynoe project, which would bulk up Core’s control of the lithium field in the NT, near its Finniss lithium operations.

It hasn’t been the happiest time for Core, which was forced to halt mining and now processing at Finniss just months after starting up after hard rock lithium prices took a major dive late last year.

They’ve virtually quartered in a year. But that means small cap valuations are also more attractive.

Core, which has entered a trading halt to explain its side of the story, reportedly lobbed a non-binding all-share offer which valued Charger at 8.4c.

Charger’s intention was to trade on the Bynoe project solely, a strategic process it says is ongoing. The explorer turned heads last year after it drafted Rio Tinto (ASX:RIO) in as a JV and earn-in partner to farm into its lithium ground in the Lake Johnston region of WA.

Its Adrian Griffin and Aidan Platel-led board’s view of the change of control proposal from Core though is what it does not do the job.

“The view of the CHR Board is that the terms currently provided in the Core NBIO do not fully reflect the Company’s value and prospects. The Charger Board remains open to continuing engagement with Core should it wish to do so, with the view to pursuing the best outcome for Charger shareholders,” the company said.

“Charger also intends to continue dialogue with other parties with which it is already engaged. These discussions involve a range of potential alternative outcomes for advancing and maximising the value of the Company and its projects. The Charger Board intends to evaluate each of the options on their merits.

“However, there is no guarantee that any of the current or future discussions that the Company may engage in with third party industry participants will necessarily give rise to any transaction or proposition unless the Charger Board concludes it to be in the best interests of the Company and its shareholders.”

It comes as ‘counter-cyclical’ M&A becomes a major focus with spodumene prices under US$800/t, down from over US$3000/t a year ago. Pilbara Minerals (ASX:PLS) blew that horn with its agreed $560 million all-scrip takeover of Latin Resources (ASX:LRS) announced last week.

At 8.4c for each CHR share, the Core offer translates to a 23% premium to Friday’s closing price and a 35% premium to the 5-day VWAP.

Bynoe is a 70:30 JV with Lithium Australia (ASX:LIT) and near CXO’s 48.2Mt at 1.26 Li2O Finniss project.

Frontier Energy (ASX:FHE)

In a boon for hydrogen-focused FHE, ex-WA Premier Mark McGowan has signed onto the board as non-exec chair to help drive the development of its Waroona renewables project in WA.

Stage One of the Waroona will construct a 120MWdc (megawatts of direct current) solar facility with an integrated 4.5 hour duration, 80MW/360MWh lithium-ion phosphate (LFP) battery that will supply clean electricity into the South West Interconnected System.

“Frontier’s Waroona project stands out as a significant asset in Western Australia’s transition, at a time when energy security is paramount, and the state continues to experience new demand records,” McGowan says.

“I look forward to working closely with the company to ensure this strategy is realised for the benefit of shareholders, key stakeholders and all West Australians.”

McGowan famously once boasted an approval rating of 91%, becoming Australia’s most popular political leader thanks to his hardline stance on border closures during the Covid-19 pandemic.

FHE last week received certified reserve capacity approval, that guarantees payments for five years totalling up to $27 million annually once in operation to provide capacity support for WA’s energy grid.

Shares in the junior jumped ~10% today, trading at 51c at time of writing.

Atlantic Lithium (ASX:A11)

(Up on no news)

A11 is on the rise with an expected resource estimate update for its 36.8Mt @ 1.24% Li2O Ewoyaa lithium project in West Africa’s Ghana.

It recently hit permitting milestones, including leasing and environmental requirements being processed and is waiting on the country’s parliament to ratify the documents next month.

“It is expected that the Mining Lease will be ratified in the current parliamentary sitting or in the next parliamentary session, expected to commence in October. We are prepared for all eventualities and will adapt plans as events unfold,” A11 exec chair Neil Herbert says. “We are prepared for all eventualities and will adapt plans as events unfold.

“We continue to make strong progress through permitting hurdles, with the recent submission of the draft Environment Impact Statement and subsequent completion of the second and final EPA public hearing in respect of the project; both representing major events on the road to production.”

A11 received US$5m worth of funding from Ghana’s sovereign wealth fund MIIF for the development of the project and has binding agreement for a further US$27.9m to acquire a 6% contributing interest in the company’s Ghana portfolio.

Shares in the $180m market-capped explorer are up 11.8% today, trading at 28.5c.

Prodigy Gold (ASX:PRX)

Another drilling campaign is about to kick off at PRX’ Tanami North gold project after releasing an MRE in June that stamped its Hyperion deposit with 8.64Mt @ 1.5g/t gold for 407,000oz – a pretty big increase from the previous 4.4Mt at 2.2g/t for 314,000oz.

Track restoration and drill pad preparation is underway to facilitate a 13-hole RC drilling campaign for 1300m at Hyperion and a 5-hole one at the Brokenwood prospect nearby, where hits of upto 8.1g/t gold have been discovered.

Shares in PRX have lifted 25% on the news, and the gold price, swapping for 3c a share at time of writing.

At Stockhead we tell it like it is. While Frontier Energy and Charger Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.