Resources Top 5: How many $40m market cap explorers hold +$22m in cash and shares? Not many

Pic: Getty.

- Cashed up Sunstone well placed to explore new ‘Espiritu’ gold-silver discovery in Ecuador

- Explorer Elementos surges on record tin prices

- Aston continues to run after hitting visible gold earlier in the week

Here are the biggest small cap resources winners in morning trade, Friday, March 12.

~$40m market cap Sunstone has its hands full.

In December, drilling at the ‘Espiritu’ gold-silver target – part of the Bramaderos project in Ecuador — hit 1.1m at 1069g/t silver, 0.2g/t gold, 5.5% zinc and 1.3% lead “in one of multiple lodes”.

The explorer announced more “bonanza” drilling results in late January.

“We are very encouraged by the results coming from Espiritu,” says Sunstone managing director Malcolm Norris.

“The key take-aways here are that the system has the potential to deliver bonanza grades and it is likely to have significant scale based on the surface sampling and mapping to date.

“… with on-going drilling Espiritu could present an early development opportunity while the search for large porphyry gold-copper systems continues at Brama, Limon and other targets.”

Sunstone is also cashed up with $3.3m in the bank and a shareholding in Stockholm-listed Copperstone Resources worth ~$18.7m on February 19.

(Up on no news)

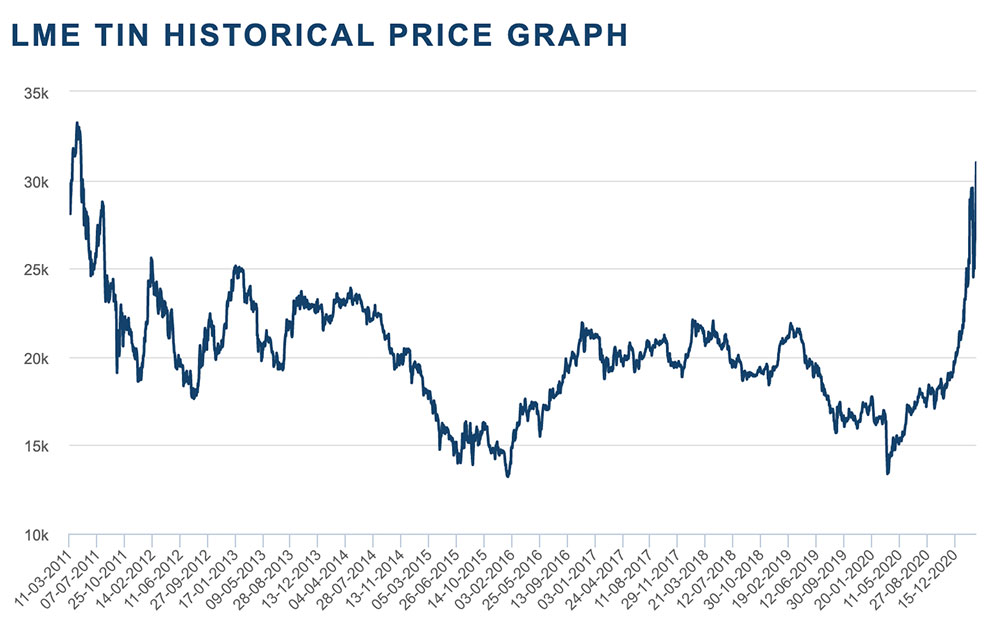

Tin prices are going mental:

Supply is extremely tight worldwide, resulting in a tin cash price near 10-year highs, according to Fastmarkets.

Tin explorer Elementos is hunting for additional tin resources at the Cleveland project in Tasmania while a major drilling campaign continues at its Oropesa project in Spain.

A program to drill test some untouched anomalies at Cleveland is now being prepared for approval by Mineral Resources Tasmania, the company said early March.

The stock is up 500 per cent over the past 12 months.

(Up on no news)

Aston soared earlier this week after hitting visible gold in drilling at the Edleston project in Canada, where +$10.8m had already been spent on drilling and geophysics by previous owners.

These aforementioned explorers hit grades like 5.3m at 81.39g/t gold, 110m from surface, but could never put it all together.

Aston is hoping to find what they missed. The ~$50m market cap stock is now up ~40 per cent over the past three days.

(Up on no news)

In February, Traka hit “open ended high-grade gold mineralisation” at the old ‘Maori Queen’ and ‘Sirdar Mines’, part of the Mt Cattlin project in WA.

The highlight drilling results were 1m at 28.2 g/t gold (Maori Queen) and 9m at 9g/t (Sirdar). Encouraging stuff.

At the time of the announcement drilling was still underway and Traka was awaiting assay results for other completed drilling – which should be released very soon.

(Up on no news)

Shree’s Nelson Bay River iron ore project produced a direct shipping product until being placed on care and maintenance in June 2014 due to plummeting prices for the steel-making ingredient.

Iron ore is back. Now Shree just has to work its way through a quagmire of approvals to start mining again.

“The company hopes to be in a position in 2021 to consider a formal decision for recommencement of the mine,” Shree announced vaguely on March 3.

The explorer is also ‘boots on the ground’ at a few early stage projects in the popular Lachlan Fold Belt of NSW.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.