Resources Top 5: Hotter-than-hot Liontown sees promise in early-stage lithium projects

Pic: Via Getty

- Liontown to farm into Olympia Metals’ early stage Mulline and Mulwarrie lithium projects

- OD6 Metals achieves “very high” magnet REE recoveries up to 96% from flagship Splinter Rock project

- Potential silver bull run has punters eyeing stocks like Boab, which is advancing ‘Sorby Hills’ project toward 2023 development decision

Here are the biggest small cap resources winners in early trade, Monday April 3.

OLYMPIO METALS (ASX:OLY)

Hotter-than-hot project developer Liontown (ASX:LTR) will farm into OLY’s early stage Mulline and Mulwarrie lithium projects in the eastern goldfields of WA.

It’s fairly low cost for LTR as far as earn in deals go, with the $5.6bn stock able to earn a 51% interest in the projects by spending just $400,000.

OLY can then elect to form a JV and share exploration costs, but if it doesn’t LTR can accrue anther 39% by spending $1m within three years.

First LTR will fund a soil/rock sampling program over the next four months to make an initial assessment before deciding to proceed with the deal.

“We are very pleased to partner with Liontown, a well led company that has significant lithium discovery and development experience,” OLY managing director Sean Delaney says.

“With Liontown’s Kathleen Valley mine under construction, they recognise the importance of the discovery of further lithium deposits.”

In the same province as Red Dirt’s (ASX:RDT) ~13Mt Mt Ida lithium project, Mulwarrie and Mulline contain several pegmatites that demonstrate the right geology but that have not been fully tested, Delaney says.

“Importantly, Olympio retains significant exposure to discovery success with the ability to contribute to funding and remain at 49% once Liontown has completed the Stage 1 farm in.”

Former pot stock OLY re-listed as a WA gold, nickel, rare earths and lithium explorer in May last year after raising $6m at 20c per share.

Th $8m capped stock is up 30% year-to-date. It had $3.5m in the bank at the end of December.

OD6 METALS (ASX:OD6)

Understanding clay REE deposits and their economic viability is a difficult business.

They are a lot lower grade than their hard rock counterparts, but supposedly cheaper to process.

But because dominant producer China continues to hold IP close to its proverbial chest many ASX explorers are figuring it out as they go along.

One thing we probably know is this: for a clay REE project to be economic, it needs to contain a decent proportion of ionic and a secondary mineral phases.

REEs hosted in ionic clays can be quickly and cheaply desorbed with a salt solution at ~pH4. Secondary phases need a bit more acid, which is more expensive, but probably doable.

This is where metallurgical test work comes into play. OD6 now says it has achieved “very high” magnet REE recoveries up to 96% from its flagship ‘Splinter Rock’ project using a simple hydrochloric acid leach.

Importantly, the company says the impressive leach response observed suggests reductions in acid strength are possible.

“These metallurgical results, undertaken by a specialist team at ANSTO, are a watershed moment for OD6,” managing director Brett Hazelden says.

“Results provide comfort that high recoveries can be achieved utilising a simple hydrochloric acid leach.

“Testing has spotlighted the potential for additional process optimisation through lowering acid strengths, increasing leach times and removal of coarse grain clay material.”

Best results came from clay basins at distance from the source granites, Hazelden says.

“Our immediate focus is to conduct targeted infill drilling in these clay basins and proceed with further optimisation testwork, bringing us closer to our near-term goal of declaring a significant, high-quality maiden JORC Mineral Resource Estimate.”

The $15.6m capped stock is down 13% year-to-date. It had $5.8m in the bank at the end of December.

BOAB METALS (ASX:BML)

Silver bulls are awakening from their slumber as gold’s poor cousin – up ~16% over the past month — threatens a breakout.

It has punters running the ruler over silver exposed stocks like BML, which is advancing its ‘Sorby Hills’ lead-silver open pit project in the WA Kimberley region towards development.

Sorby Hills is Australia’s largest undeveloped, near-surface lead-silver deposit with resources of 52Moz silver and 1.5Mt lead.

A recent DFS – the most advanced of the economic studies – envisaged annual production of 67,000t lead and 2.2Moz silver in concentrate over an initial 8.5-year mine life.

BML estimates average annual earnings before tax of $119m, and it would cost $245m to build.

With offtake negotiations nearing completion, a final investment decision is targeted for Q3 this year.

The $44m capped stock is down $16m year-to-date. It had $7.1m in the bank at the end of December, and is engaging with Australia Government financing agencies and commercial banks for project financing.

AURORA ENERGY METALS (ASX:1AE)

(Up on no news)

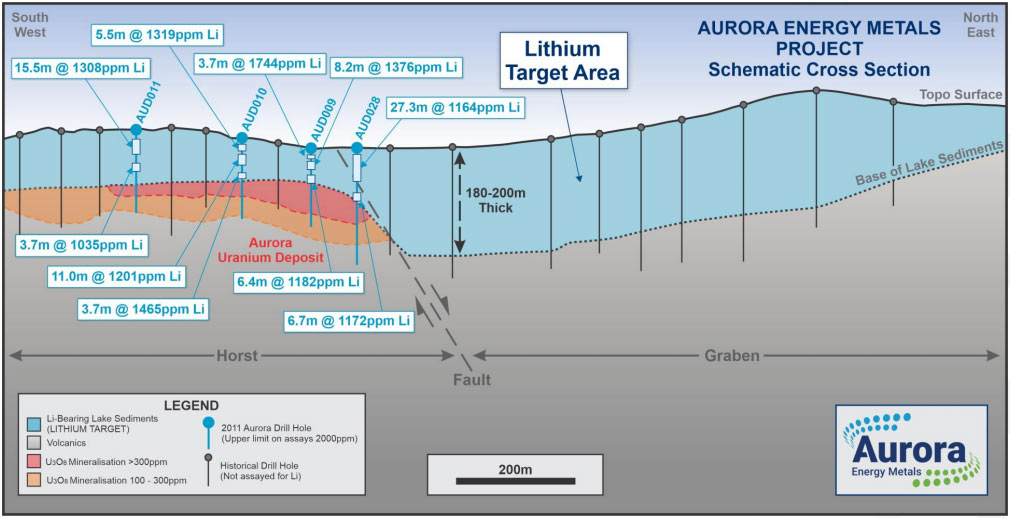

1AE’s namesake project in the US has one of the country’s largest uranium deposits — 104.3Mt @ 214ppm U3O8 for 50.6Mlb U3O8 – but also contains lithium in the sediments overlying and surrounding the uranium resource.

Bonus.

There is potential here to define and develop the two separate resources “providing commodity diversification and economies of scale”, 1AE says.

More drilling, assay results and met test work will culminate in a scoping/pre feasibility study on the uranium deposit sometime this year.

A maiden lithium resource is targeted for release in the first half of 2023.

The $14m capped stock is down 40% on its May 2022 listing price of 20c per share. It had $2.1m in the bank at the end of December.

AVENIRA (ASX:AEV)

(up on no news)

AEV briefly surged last year after announcing ambitious plans for a two-pronged move into selling ore from its ‘Wonarah’ phosphate project in the NT and lithium iron phosphate (LFP) battery cathode production.

In September, AEV inked a non-binding deal with LFP battery manufacturer Aleees and the NT government to build a battery cathode manufacturing plant in Darwin, leveraging Avenira’s flagship 67Mt Wonarah phosphate project.

An early-stage scoping study on LFP plant development released early March received a lukewarm response from investors.

It envisaged either a one train (10,000tpa) or three train (30,000tpa) cathode plant, costing $180m and $527m to build, respectively.

The $30m capped stock is down 15% year-to-date. It had $1.5m in the bank at the end of December.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.