Resources Top 5: Heavy lifting on garnet offtake sales potential; Macro Metals continues rise

Pic via Getty Images

- Heavy Minerals lifts off thanks to potential offtake garnet sales deal

- Macro Metals continues its climb from yesterday after prominent investors join board

- ADG, MKG and VMS also make the top ressie grade this morning with solid gains

Here are some of the biggest resources winners in early trade, Thursday March 7.

Heavy Minerals (ASX:HVY)

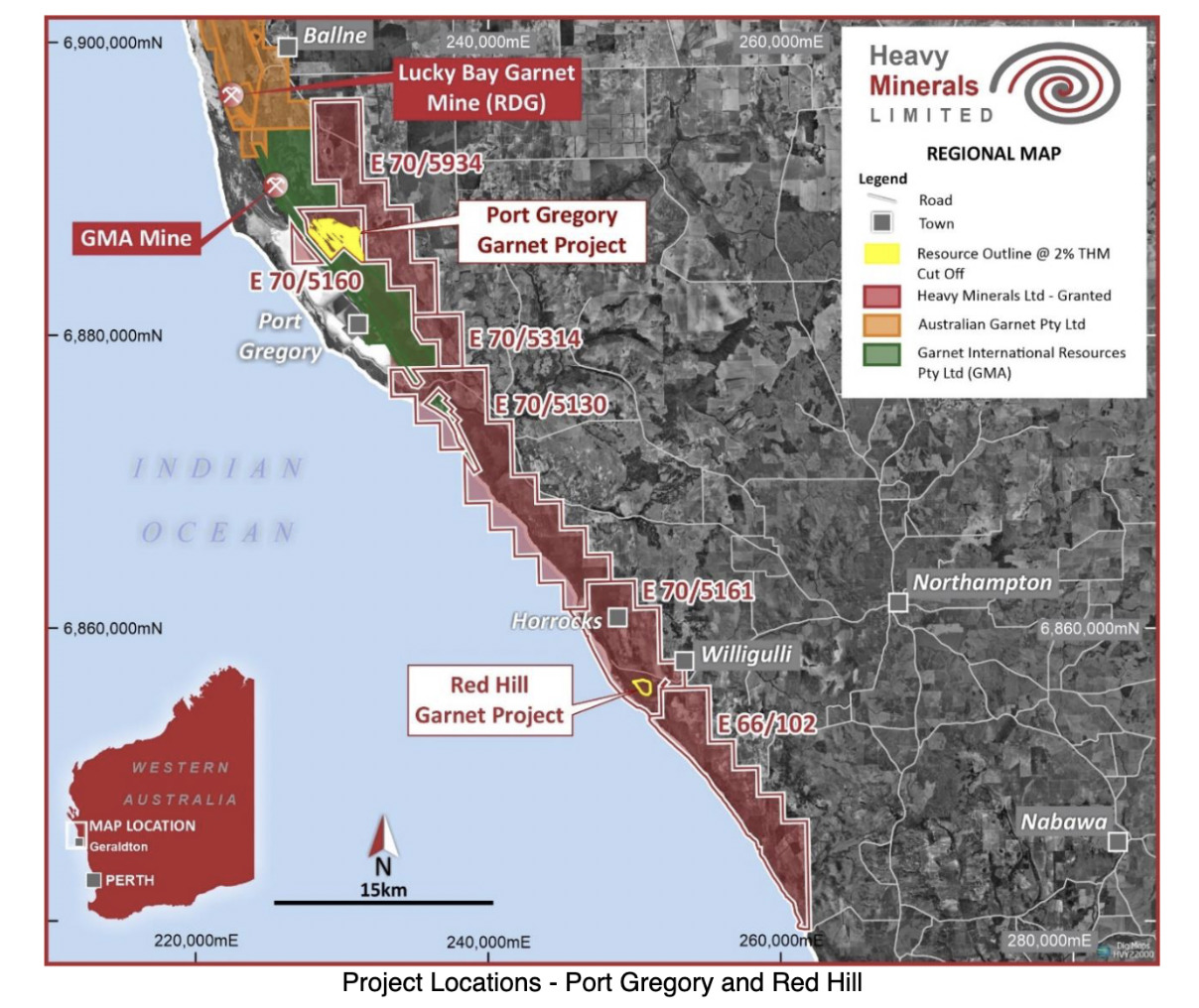

Garnets. That’s what Heavy Minerals is largely into, at Port Gregory in WA… along with the Inhambane Mineral Sands project in Mozambique.

Garnets are used for industrial blast-cleaning, polishing, filtration and water jet cutting, among other things, including the earrings I once bought for a girlfriend back in the mid ’90s, when low-carat garnet earrings were all I could afford*.

The HVY stock is barnstorming this morning, with a near 30% gain after the company announced it’s inked a non-binding Memorandum of Understanding (MOU) for the future sales of a minimum of 15,000tpa of garnet to be produced at its Port Gregory Project for an initial three-year period with with Abrasive Blasting Service & Supplies (ABSS).

HVY says the offtake will account for ~10% of the company’s annual future garnet production at the project and will be sold into the Australian and New Zealand sand-blasting and water jet-cutting markets by ABSS.

Although the agreement is non-binding for now, HVY chairman Adam Schofield is suitably pleased, commenting “that it demonstrates ABSS’s desire to lock in future supply of high-quality Almandine garnet in an industry sector they know and understand well, and within which they are well placed to manage the domestic distribution of Heavy’s garnet products.”

“This is also a significant step on the way to the development of the company’s Port Gregory Project,” he added.

HVY share price

* Hmm… the missus’ birthday is coming up.

Macro Metals (ASX:M4M)

Iron ore junior and lithium explorer Macro Metals is still trading higher off yesterday’s boardroom appointments that include two highly successful, high-profile small caps mining investors – Tolga Kumova and Evan Cranston.

M4M is currently up 50% over the past 24 hours and 100% over the past week and month.

The company has announced the appointment of a “highly regarded board with the dedicated focus of developing Macro’s Pilbara iron ore portfolio”.

The incoming board (or nominees) have subscribed for $1.22m out of the total placement of $1.35m “as a reflection of their commitment towards capturing shareholder value and delivering upon their strategy”.

Board members include: Simon Rushton – MD (co-founder and inaugural MD of Hedland Mining, a Port Hedland iron ore junior); along with, notably, famous small cap investors Tolga Komova and Evan Cranston as non-exec directors.

We're pleased to announce the appointment of a highly regarded board with the dedicated focus of developing @MacroMetals #Pilbara #IronOre portfolio.

Read more here: https://t.co/DmPyEuYXjk

$M4M #ASXnews pic.twitter.com/CgdYZT7E7b

— MacroMetals (@MacroMetals) March 6, 2024

Macro Metals – you might remember it as Kogi Iron pre-2023 – has entered into a tenement acquisition agreement to acquire a total of six exploration licence applications from Mining Equities for a cash reimbursement amount of $54,420 and a 2% royalty on all minerals sold from each project.

Those projects include:

• the W5 Iron Ore Project located in midwest WA, 5km along strike from Fenix Resources’ (ASX:FEX) Iron Ridge Mine.

• the Deepdale Iron Ore Project, adjacent to Rio Tinto’s Robe Valley iron ore operations and CZR Resources’ (ASX:CZR) Robe Mesa Project in the West Pilbara.

• as well as the Bellary Springs, and Turner iron ore projects

Macro Metals is also currently doing its due diligence on its potential 85% acquisition of the Aurora Energy Metals Project (lithium) in the US.

M4M share price

Adelong Gold (ASX:ADG)

Gold/base metals and lithium junior Adelong is double digits to the good today. And on decent volume, too.

Why? It’s a capital funding boost, announced yesterday.

Essentially, the company is raising up to $1.6 million to progress the Adelong gold mine and further its Brazilian lithium exploration.

Adelong has received firm commitments from professional and sophisticated investors to raise $1.1 million (before costs) through a share placement, subject to shareholder approval.

The Company will also offer eligible shareholders opportunity to participate under a SPP on the same terms as the placement to raise up to an additional $500,000.

🔔 $ADG.ax $ADG Adelong Gold to raise up to $1.6 million to progress the Adelong Gold and Brazilian Lithium projects 🔗 https://t.co/byq8MNVNbV#gold #lithium #criticalminerals #preciousmetals #EnergyTransition #Brazil #mining #exploration #goldmining #MiningStocks… pic.twitter.com/6NPWApq4D7

— Adelong Gold (ASX:ADG) (@Adelong_Gold) March 5, 2024

Adelong Gold’s MD Ian Holland noted:

“The funds raised from this placement and the SPP will be utilised to continue assessing production pathways for the existing Adelong gold mine. In addition, following recent changes in management and the acquisition of licenses for lithium exploration in Brazil, we are now well-positioned to pursue these exciting opportunities.”

Holland was recently appointed to the managing directorial role, having most recently been the MD of Navarre Minerals (ASX:NML). He was responsible for acquiring the Mt Carlton Mine and Cush Creek project and transitioning that company from explorer to producer.

ADG share price

Mako Gold (ASX:MKG)

Junior goldie Mako has been moving up nicely this week based on news from its Napié project in Côte d’Ivoire.

The stock is up about 15% so far this week and 60% YTD.

Two parallel artisanal mining sites named ‘Double Zone’ at Tchaga North within the Napié project have got Mako Gold’s top brass excited enough for a boots on ground visit. It’s a target where high-grade rock chip samples have returned up to 22.46g/t.

Ongoing rock chip sampling program at the target area has pulled up another high-grade round of results – with the best of recent gold hits showing up to 79.5g/t last month.

Further rock chip sampling results at Double Zone has now expanded the drill target to 250m in strike length.

The very latest high-grade rock chip results include 22.46g/t Au, 16.78g/t Au, 12.85 Au, and 4.86g/t Au, which complement other recently announced results of 44.73g/t Au, and 6.29g/t Au.

Mako’s MD, Peter Ledwidge imparted the following thoughts:

“The newly named ‘Double Zone’ which is aptly named for the two parallel artisanal mining sites with associated east-west quartz veining, has expanded significantly.

“The consistent high-grade rock chip results at Double Zone along with its increasing strike length and width potential makes this a compelling high-priority drill target.”

MKG share price

Venture Minerals (ASX:VMS)

Minerals explorer/developer Venture is focused on rare earths in WA and tin-tungsten in Tasmania. Why’s it’s share price double digit rising at the time of writing?

A nice little tax boost from the ATO, thanks very much.

The company has announced the you beaut taxation office is coughing up $1.05 million for it under the R&D Tax Incentive Program for the financial year ended 30 June 2023.

Drinks all round.

The refund comes from R&D expenditure on metallurgical testwork and studies at the Mount Lindsay tin-tungsten Project in Tasmania during the previous financial year.

Tungsten – is there anything it can’t do?

Drinks all round then? Actually, the company says the cash will allow it to continue to fast-track resource drilling and metallurgical testwork at a new, high-grade, Jupiter Clay Hosted Rare Earths discovery in Western Australia.

“In addition, Venture will continue to work on R&D activities and advance the Curtin University metallurgical testwork on the Mount Lindsay tin-rich borates,” added Venture.

VMS share price

At Stockhead we tell it like it is. While Mako Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.