Resources Top 5: Green shoots for hard rock lithium

ASX lithium hunters are on the rise through their hard rock projects. Pic: Getty Images

- Arcadium Lithium rockets on Rio takeover news

- Nimy rises on Masson discovery

- Kali expands JV with SQM, incorporating newly acquired Pilbara tenements

Here are the biggest small cap resources winners in morning trade, Monday, October 7. Prices accurate at time of writing.

Arcadium Lithium (ASX:LTM)

LTM shares have caught a rocket on the back of confirmation by Rio Tinto (ASX:RIO) that the company has made an approach to acquire Arcadium – one of the few producers to have rolled out direct lithium extraction at its El Fenix site on Argentina’s Hombre Muerto Salar.

Murmurs about a potential takeover have been circling around the traps since a report in The Australian’s Dataroom column highlighted Arcadium and Albemarle as possible takeover targets for Rio. The latter has a number of early-stage lithium projects but is said to be keen on the takeover of a big producer now that valuations have come down from insane 2023 highs.

Rio is testing a form of its own DLE technology at the Rincon brine project, where a US$335 million pilot project with a 3000tpa LCE capacity is set to be completed this year.

Arcadium has been trying to convince investors it can deliver on expansion plans, which have been dialled back in the face of the lithium price crisis, with expectations that it will lift production capacity from 5,000tpa today to 170,000tpa LCE by 2028.

Buying existing production could help Rio short-circuit its entry into a sector the mining behemoth remains keen on long-term.

The now US$3.31bn market-capped not-so-junior is trading up a hefty 44% at $6.02 a share.

Nimy Resources (ASX:NIM)

NIM, one of the small-cap stand-outs last month, saw its stock price rise 106% on the back of the identification of massive sulphides at its Mons nickel project in WA.

Mons is at the northern end of the renowned Forrestania nickel belt, host to the world-class nickel endowment at the Southern end with numerous other high-grade nickel deposits extending north.

With an ever-growing pipeline of targets, NIM has intersected high-grade copper, nickel, cobalt and PGE mineralisation within broad intervals at Masson – confirming the prospect as a ‘significant discovery’.

Results include 13m at 0.62% copper, 0.36% nickel, 0.04% cobalt, 0.25g/t PGE and 2.30g/t silver from 126m.

All three holes returned grades at greater than 1% copper, signifying a dynamic system that is part of a much larger mafic intrusion.

“Planning is underway to test further extensions to the Masson mineralisation including testing of coincident high magnetics and EM anomalies along the 3.1km northern strike that begins with the Masson discovery,” NIM exec director Luke Hampson says.

NIM shares are up >23% to trade at 7.3c.

Kali Metals (ASX:KM1)

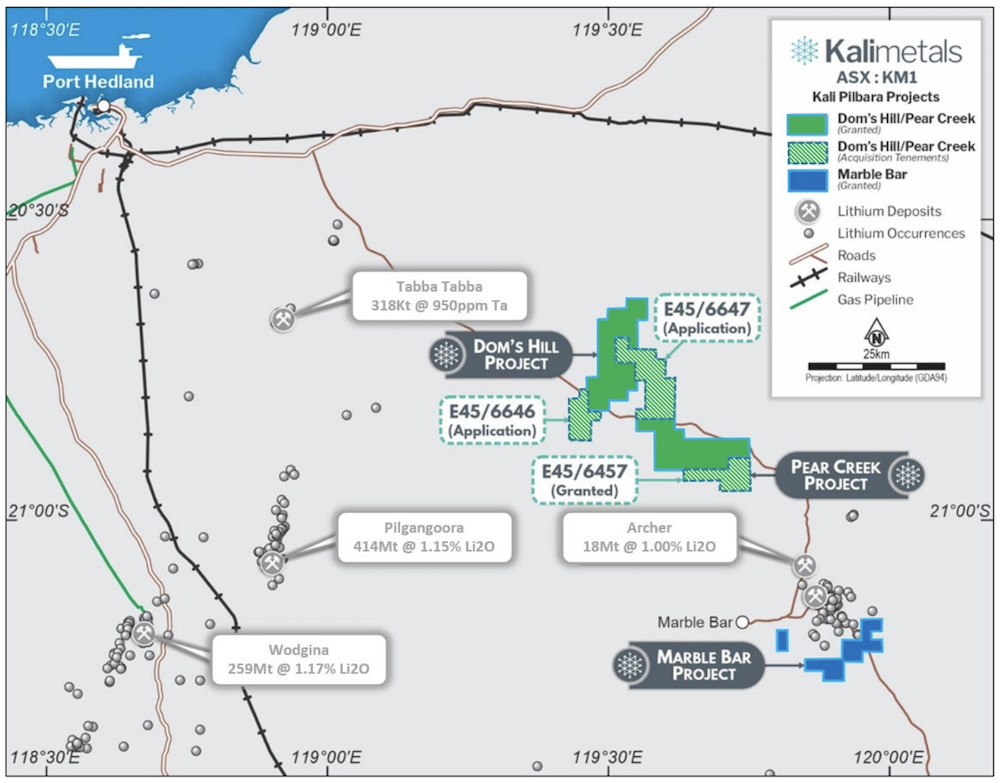

Kali Metals has expanded its JV with Chilean lithium giant SQM, adding two new tenements: DOM’s Hill and Pear Creek.

Kali is acquiring the new DOM’s Hill tenements from major shareholder Kalamazoo Resources (ASX:KZR) for a cash consideration of $100,000, while the Peak Creek tenement is being snapped up from KZR for just $20,000.

Under the updated JV terms, SQM is to spend $500,000 on exploration by 15 December 2025 to retain its 30% interest in Kali’s DOM’s Hill and Pear Creek tenements and increased its exploration commitment of $1m, now a $4.25m spend by 15 December 2026 to earn 50% interest.

KM1’s landholding is along trend of some major lithium depoiits, including Pilbara Minerals’ (ASX:PLS) 414Mt Pilgangoora and Golden Mile Resources (ASX:G88) 18Mt Archer discovery.

KM1 was one of the first IPO’s of 2024, listing onto the bourse in January after raising $15m at 25c a share as a spinoff of KZR’s lithium assets.

Shares in the junior are up 33% on the news to trade at 16c.

Piedmont Lithium (ASX:PLL)

(Up on no news)

In February, the lithium producer cut its workforce by 27% as a reflection of drastically lower lithium prices to save operational costs across its North American Lithium (NAL) JV with Sayona Mining (ASX:SYA).

This didn’t stop PLL working across its NAL and Ghana lithium projects, expanding NAL’s mineral resource by 39% to 87.9Mt at 1.13% Li2O in late August and receiving an environmental permit for its Ewoyaa lithium project with JV partner Atlantic Lithium (ASX:A11).

More news is expected from the global lithium developer in the coming weeks.

Shares in PLL are up 14.8% today to trade at 16.5c.

G11 Resources

(Up on recent news)

G11 recently completed three follow-up RC and DD drill holes targeting EM conductance plates modelled from previous DHEM surveys at its Wilandra copper prospect to assess copper-rich shoots along 4km of mineralised strike.

A total of 326m of pre-collar RC and 573.8m of diamond tails have been drilled over three holes, with sulphide-rich zones intersected in all three.

Exploration continues as copper spot prices continue to rise this year.

READ MORE: Australian copper enters new era where grade is king

G11 is up 17.65% to trade at 2c a share at time of writing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.