Resources Top 5: Green candles for gold and lithium to wrap up the week

Pic: Getty Images

- White Energy soars on drilling start near Olympic Dam

- Tolu Minerals up 40% in a week as maiden drilling continues at 503,000oz Tolukuma gold project

- Gold Mountain discovers two big lithium zones at Salinas II project

Here are the biggest small cap resources winners in morning trade, Friday, August 23. Prices accurate at time of writing.

White Energy (ASX:WEC)

(Up on yesterday’s news)

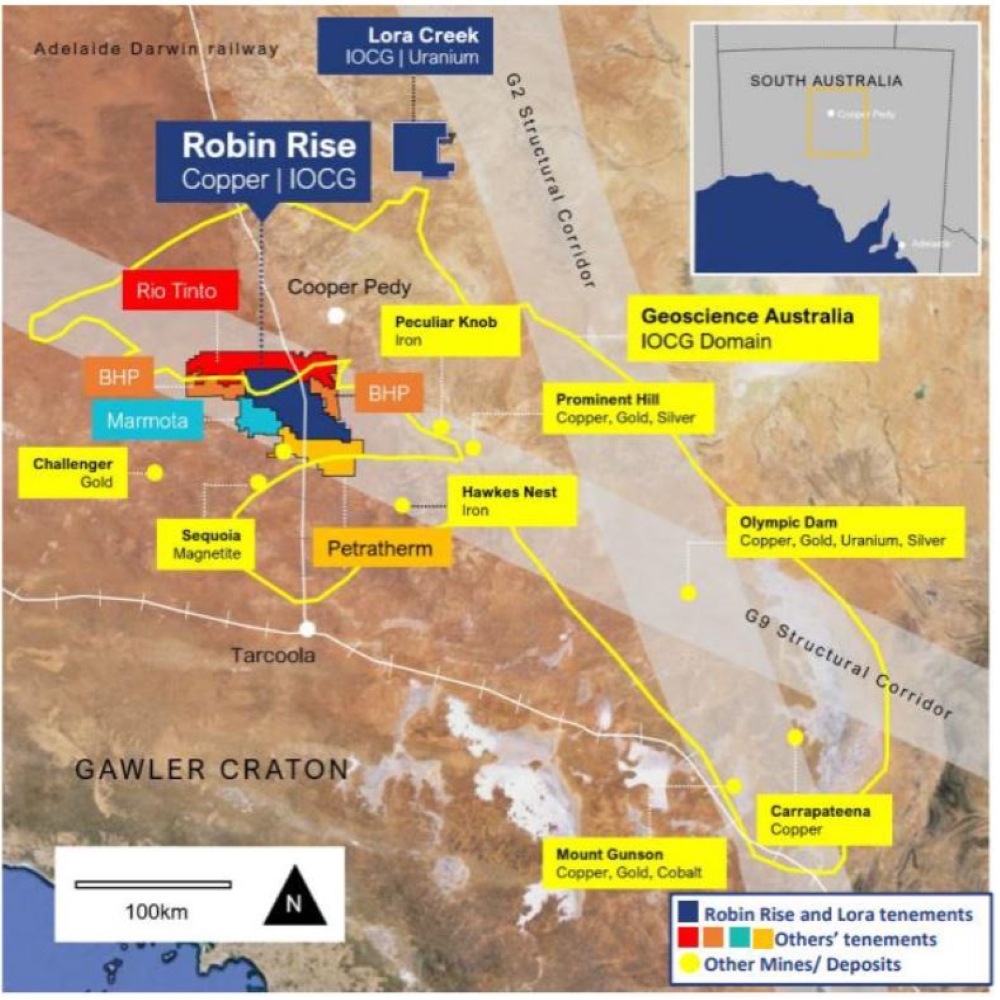

WEC received approvals to kick off drilling its highly prospective Coronation gold-copper prospect at the Robin Rise project, which lies in the prolific Olympic Dam G9 mining corridor in South Australia.

The drilling campaign will focus on the EL6566 tenement, nestled between BHP’s (ASX:BHP) Prominent Hill and Barton Gold’s (ASX:BGD) Challenger mines, and is targeting significant gold, copper and light rare earth anomalies consistent with iron oxide copper gold (IOCG) mineralisation.

There are some anomalous molybdenum hits from previous drilling in 2009 to investigate there, too. The subtle, main IOCG anomaly is up to 1.5km-long x 300-600m-wide, with some satellite anomalies about 500-750m away.

The explorer says four to five holes are planned to test a combination of structural, geochemical and geophysical targets located within the Olympic Dam G9 structural corridor and Geoscience Australia IOCG domain.

Shares in the junior were up a whopping 60% in early trade to 4.8c.

Gold Mountain (ASX:GMN)

(Up on yesterday’s news)

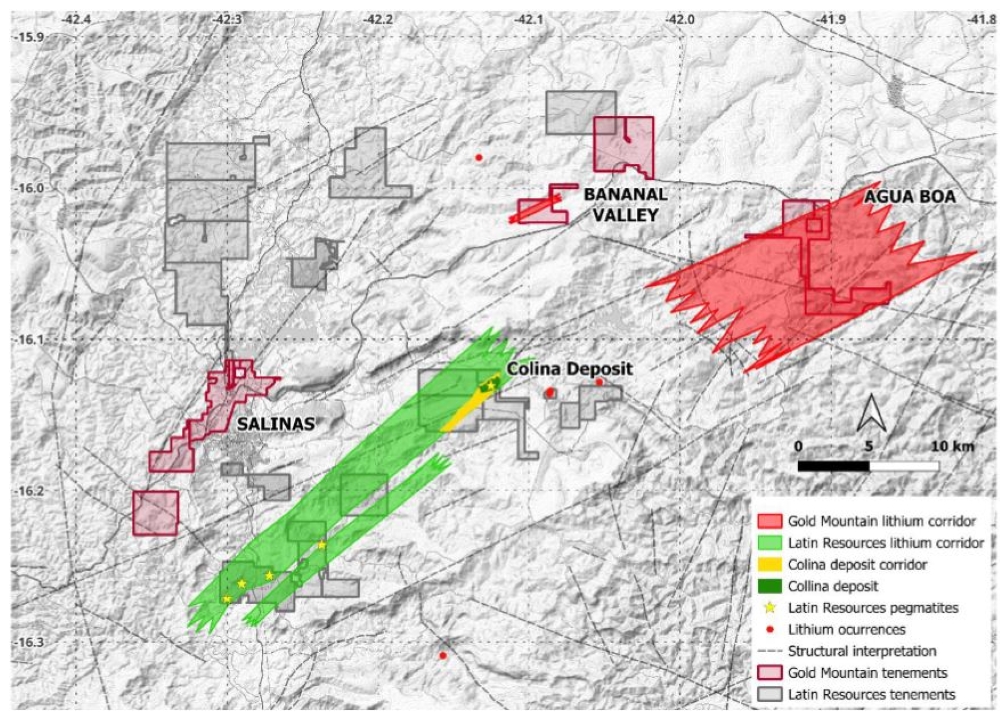

Up to 667ppm lithium has been discovered at GMN’s Agua Boa and Bananal Valley tenements in the Salinas II project in Brazil, along the same regional structural strike as Latin Resources’ (ASX:LRS) Colina deposit.

The lithium anomalies now extend across a 5km x 2km stretch at Bananal Valley and a 6km x 3km stretch at Agua Boa.

Follow-up exploration is planned for next month to map the anomalies and delineate targets for a drill campaign.

The explorer also recently showed promising results from its Itagi prospect in the Down Under project area earlier this month, with sediment samples showing significant potential for rare earth element (REE) deposits.

The highest readings reached 305 ppm TREO, and there are indications of very high-grade mineralisation for REEs, niobium, uranium and scandium.

Shares in the minnow are up 33.3% today, trading at 0.4c.

Tolu Minerals (ASX:TOK)

(Up on no news)

Shares in TOK are up 40% this week without any action announced to the market.

Last we heard, maiden drilling is ongoing at the Taula gold prospect, part of the Tolukuma gold-silver mine in Papua New Guinea it’s restarting.

The explorer IPO’d in November last year, raising some $17.3m for the development and expansion of the project and again $8.8m in April this year.

Tolukuma was first discovered by global mining major Newmont in 1986 and developed in 1995 to exploit high-grade epithermal gold/silver zones within a large structural zone.

The mine operated until 2015 and produced ~1Moz gold at an average recovered grade of an impressive 14g/t gold, peaking at 21.3 g/t and averaging about 50 g/t silver in the form of a gold/silver doré.

Funds are going to site and equipment refurbishment, commissioning of bulk sampling, drilling and expansion of the current 503,000oz gold and 1.95Moz silver resource.

The junior has completed refurbishing a 28-person camp and equipment and long-lead items are being brought in as drilling continues.

Shares in TOK are up 11% today to trade decently above the 50c IPO price at 80c.

James Bay Minerals (ASX:JBY)

(Up on no news)

Late last month JBY announced a start to fieldwork across hundreds of identified lithium-caesium-tantalum (LCT) pegmatite targets at its Joule and and Aqua properties, part of its La Grande project in Quebec, Canada.

The properties reside in the La Grande sub-province, along trend from Patriot Battery Metals’ (ASX:PMT) massive Shaakichiuwaanaan (formerly dubbed Corvette) Li2O deposit and the hope is to crop up with a number of drill-ready targets.

Aqua itself covers 144km2 with regional faults, which host the La Grande Greenstones, traversing the property from east to west and elevated Li2O readings 700m northeast of Fin Resources’ White Bear discovery.

Results could be out soon and interest in the junior has increased its share price 18% today, trading at 13c.

Recharge Metals (ASX:REC)

(Up on no news)

Last we heard of REC it had produced a new copper mineralisation model at its Brandy Hill South project in WA, where previous drilling intersected up to 1.02% copper.

Exploration data supports evidence of a porphyry copper system at Brandy Hill South, which is well preserved compared to similar deposits in WA, says the junior.

Copper mineralisation defined over a strike length of 500m and remains open along strike and at depth.

Contractors have been engaged to complete an IP survey and relogging of previous drilling is being undertaken as part of a recommended work program.

Shares in the explorer have jumped almost 21% today to trade at 3.5c.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.