Resources Top 5: Gold-silver discovery emerges for Godolphin near home of Australia’s first gold rush

Godolphin Resources' growing Lewis Ponds project is in an area of NSW that hosted Australia’s first gold rush. Pic: Getty Images

- Updated resource for GRL’s Lewis Ponds project totals 470,000oz gold and 21Moz silver

- GCM has moved into the manufacturing of VHD graphite blocks of various shapes and sizes

- Stage 2 Mining Licence Expansion application for Kangankunde REE project approved

Your standout small cap resources stocks for Tuesday, August 12, 2025

Godolphin Resources (ASX:GRL)

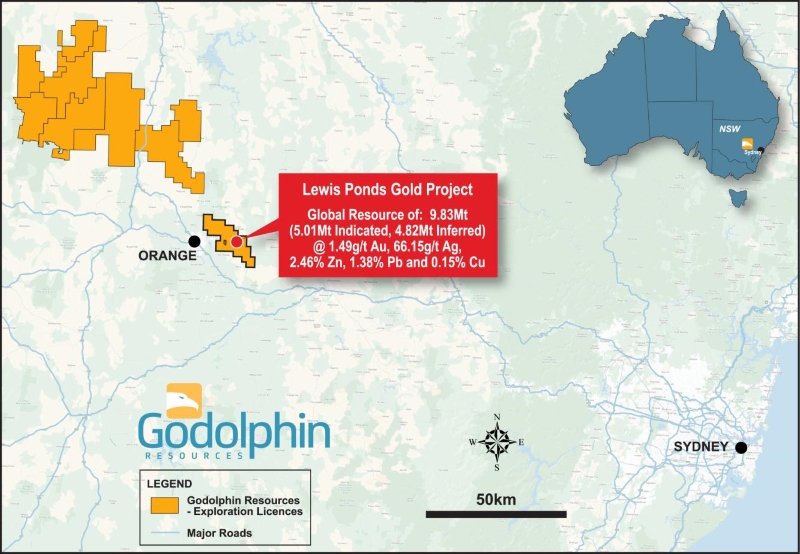

The Lewis Ponds project of Godolphin Resources is emerging as another significant gold discovery, with silver and base metals to boot, in an area that hosted Australia’s first payable gold discovery in April 1851.

The project is upstream from Ophir, where that discovery sparked Australia’s first gold rush, and around 15km east of Orange in the Lachlan Fold Belt where significant discoveries are still being made.

Newmont’s +50Moz gold and 9.5Mt copper Cadia Valley Operations is south of Orange and east of the Spur project of Waratah Minerals which has been a market favourite since releasing broad high-grade gold results on August 4.

Godolphin reached a five-month high of 1.6c, a 46% increase on the previous close, after revealing a resource upgrade from Lewis Ponds described by the company as “transformational”.

The updated resource totalling 470,000oz gold and 21Moz silver along with 41,000t of zinc, 15,000t of copper and 136,000t of lead confirms Lewis Ponds as a large, high-grade gold and silver deposit.

There was a 58% increase in tonnage, 18% increase in gold and 31% increase in silver with the resource standing at 9.83Mt at 1.49g/t Au, 66.15g/t Ag, 2.46% Zn, 1.38% Pb and 0.15% Cu.

Importantly for future development, 5.01Mt are in the higher confidence indicated category.

Image: Godolphin

Alongside updating the MRE, a pit optimisation study was completed with a view to constrain the resource and demonstrate the potential for upper parts of the deposit to be mined economically by open pit methods.

The open pit resource is 2.88Mt at 0.52g/t Au and 41.22g/t Ag for 48,000oz gold and 3.8Moz silver with 1.85Mt, or 64%, in the indicated category.

A scoping level mining study is underway using this data, which is expected to further illustrate the potential for near-term development opportunities.

Godolphin is continuing metallurgical testwork aimed at improving gold and silver recovery while additional drilling is planned to underpin further MRE growth.

“These results have considerably exceeded our expectations and highlight the exceptional potential for the Lewis Ponds project,” MD Jeneta Owens said.

“This is a major increase from our previous MRE, an exceptional milestone for Godolphin and provides a very strong foundation for the initial scoping mining study.”

Green Critical Minerals (ASX:GCM)

One of the most active small cap stocks was Green Critical Minerals with more than 131m shares changing hands valued at more than $4.4m while the price jumped 17.74% to 3.65c, a high of almost five years.

This came after GCM advised that it had moved into the manufacturing of very high density (VHD) graphite blocks of various shapes and sizes after commissioning of Module 1 at the VHD production plant.

VHD blocks are a high-performance graphite material developed by GCM and characterised by thermal and electrical properties achieved through a production process that’s faster and more cost-effective than traditional methods.

These blocks are designed for various applications requiring efficient heat management, including data centres, semiconductors and advanced electronics.

Blocks up to 60×100×60 mm have been produced at the plant, which is ramping up production and sustaining high product quality.

Production of larger blocks – up to 160 mm thick and 200 mm long – is in progress, which GCM said demonstrated improved process maturity and alignment with customer specs.

In preparation for commercial sampling and prototyping, GCM is building a diverse inventory of sample stocks with first-time sample shipments to prospective customers in North America.

A variety of product sizes and geometries are being manufactured, with blocks tailored for thermal management applications including heat sinks and cold plates.

Production capacity has also been further strengthened through the addition of two new furnaces, increasing throughput.

GCM managing director Clinton Booth said with the VHD production plant now operational, the company was shifting from initial rollout into active commercial execution, focused on fulfilling demand, scaling output and maintaining quality.

“Importantly, we’re not creating a solution for a future market, we’re delivering high-performance thermal products into an existing, high-demand sector that is actively searching for better, more cost-effective materials,” he said.

“What sets us apart is our ability to move now. Our multi-channel distribution strategy, which includes partnerships with online retailers, means we’re not waiting for major orders to begin selling, we can expedite access to a global market fast.”

Lindian Resources (ASX:LIN)

Approval of the Stage 2 Mining Licence Expansion application for Kangankunde rare earths project provides strong endorsement from the Malawian government and regulatory certainty, materially de-risking the expansion development pathway, according to Lindian Resources.

As a result, Lindian reached a 12-month high of 18.5c, a lift of 37.04% on the previous close.

The approval from the Mining and Minerals Regulatory Authority (MMRA) Board increases the licensed area from 900 to 2,500 hectares.

“The upgrade of our Stage 2 expansion area from an exploration licence to a mining licence allows Lindian to work in parallel on our larger Stage 2 expansion whilst using the learnings from the development of our Stage 1 production facility to ensure we optimise our processing flow sheets and recoveries,” chairman Robert Martin said.

“This will also allow Lindian to capitalise on our ability to be the next rare earth producer to market and to capture a larger market share.

“The company continues to field additional inbound enquiries and is working on multiple pathways for further strategic offtake and funding agreements.”

Green Technology Metals (ASX:GT1)

After being granted two 21-year mining leases by the Ontario Ministry of Mines in Canada for the Seymour lithium project, Green Technology Metals increased 17.65% to 4c.

This significant regulatory milestone means there are now three granted leases fully encompassing the proposed mine and infrastructure area, marking a critical step in de-risking Seymour’s pathway to development.

The company has spent the last four years committed to permitting and development work, including ongoing engagement with indigenous communities.

Since acquiring the asset in 2021, GT1 has undertaken comprehensive environmental assessment work, including a recent owl and fisheries study and has completed season-specific baseline studies.

Ongoing environmental monitoring continues to inform project planning and ensure potential impacts are identified and responsibly managed.

GT1 anticipates concluding the provincial environmental assessment in the upcoming quarter, marking another milestone in the project’s permitting timeline.

It says the accomplishment takes Seymour closer to a financial investment decision, subject to remaining permits and approvals.

Southern Hemisphere Mining (ASX:SUH)

Buoyed by FMR Resources (ASX:FMR) completing technical due diligence and proceeding to earn up to a 60% interest in the southern portion of the Llahuin Copper-Gold Project in Chile, Southern Hemisphere Mining improved 38% to 4c.

FMR is now part of a joint venture with SUH covering four selected concessions in the southern part of Llahuin, including the large Southern Porphyry copper-gold target.

“We are delighted to welcome FMR to the Llahuin Copper-Gold Project and look forward to joint exploration success across the Southern Porphyry zone,” SUH chairman Mark Stowell said

“This strategic JV validates our long-held view of the district’s latent potential, and with drilling planned for Q4 2025, our shareholders are well-positioned to benefit from upcoming catalysts in this emerging major copper story.”

FMR has also completed a $2.2m placement in connection with the transaction, with respected resource investor Mark Creasy joining the register as a substantial shareholder.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Green Critical Minerals and Green Technology Metals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.